US Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

US Luxury Fashion Market Overview:

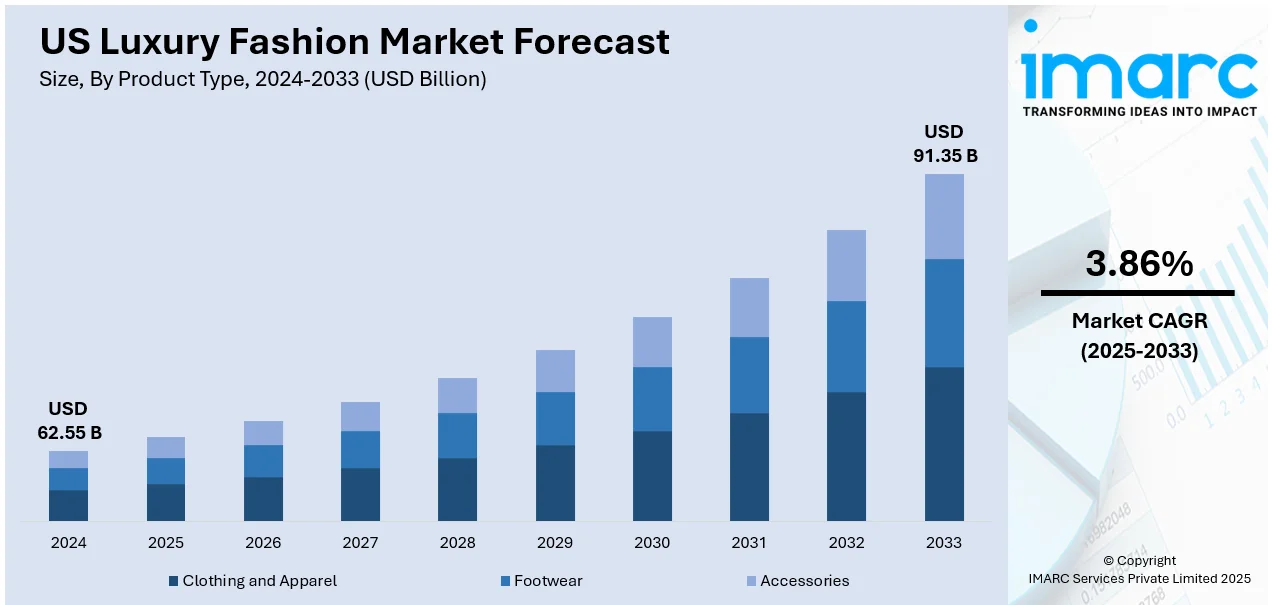

The US luxury fashion market size reached USD 62.55 Billion in 2024. The market is projected to reach USD 91.35 Billion by 2033, exhibiting a growth rate (CAGR) of 3.86% during 2025-2033. The market is fueled by growing demand for exclusive designs, premium quality, and brand heritage that resonate with affluent consumers seeking distinction. Moreover, increasing disposable income among high-net-worth individuals, along with expanding online luxury retail channels, strengthens the sector’s reach and sales potential. Besides, sustainability initiatives and strategic collaborations with influential designers and celebrities further augment the US luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.55 Billion |

| Market Forecast in 2033 | USD 91.35 Billion |

| Market Growth Rate 2025-2033 | 3.86% |

US Luxury Fashion Market Trends:

Digital Integration and Omnichannel Experiences

The luxury fashion brands in the country have intensified their focus on merging digital tools with traditional retail to deliver seamless, personalized experiences. E-commerce no longer serves as a secondary sales channel. It acts as an equal pillar alongside flagship stores and exclusive boutiques. According to industry reports, e-commerce accounted for a record 22.7% of total retail sales in 2024 and grew at a rate of 7.5%, nearly triple the 2.6% growth of overall retail. Furthermore, high-end labels are investing in virtual try-ons, live-streamed fashion shows, and augmented reality features that replicate the sensory appeal of physical shopping. Additionally, social commerce and curated online events help cultivate exclusivity for digital consumers. Also, loyalty programs now integrate digital touchpoints with in-store benefits, creating connected shopping journeys. Apart from this, consumer expectations for convenience have driven brands to refine same-day delivery and high-end concierge services. Moreover, private digital appointments, virtual stylists, and personalized lookbooks strengthen client relationships beyond physical interactions. This trend has also expanded luxury’s reach among younger consumers who prefer mobile-first browsing. As digital platforms evolve, established brands and emerging designers alike must balance innovation with brand heritage to maintain exclusivity and authenticity while meeting rising demand for frictionless luxury retail.

To get more information on this market, Request Sample

Sustainability and Ethical Sourcing

The growing emphasis on sustainability and the demand for transparency from brands is a significant factor positively impacting the US luxury fashion market growth. The traditional notion of luxury defined solely by opulence has evolved toward a more values-driven approach to purchasing. Materials like organic silk, recycled cashmere, and traceable leather are becoming standard among leading labels. In addition to this, certifications, supply chain audits, and blockchain-backed provenance reports reassure discerning clients that their purchases align with ethical standards. Also, the growing regulatory oversight is reshaping the competitive environment for luxury fashion brands in the US, pushing companies to integrate sustainability, worker safety, and transparent sourcing into core business strategies rather than treating them as optional commitments. Several US states are introducing legislation aimed at improving sustainability, transparency, and safety within the fashion industry. Notably, passed into law in 2024, California’s Responsible Textile Recovery Act (SB707) marks a significant milestone as the first extended producer responsibility framework for textiles in the nation, compelling brands to manage post-consumer waste more actively. And 2023 proposed bills in Massachusetts and Washington seek to require fashion companies to disclose environmental and labor impacts. Besides this, limited collections crafted with local artisans preserve traditional skills while shortening supply chains. Sustainability now intersects with design innovation, as brands experiment with novel materials and processes that appeal to luxury buyers who expect responsibility to accompany exclusivity.

US Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

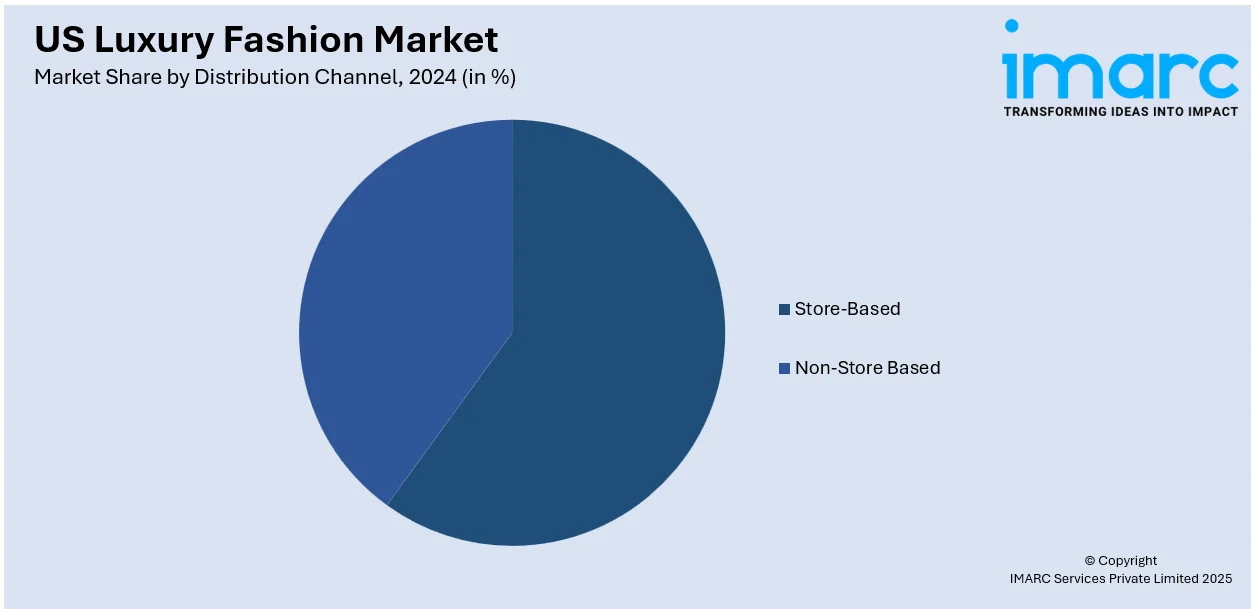

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Luxury Fashion Market News:

- On April 29, 2025, Amazon and Saks Fifth Avenue announced the launch of “Luxury Stores at Amazon,” a curated online storefront offering high-end men’s and women’s apparel, accessories, shoes, beauty products, and handbags. The platform features renowned designers with digital displays inspired by Saks’ flagship windows in New York. This strategic collaboration represents Amazon’s renewed push into the luxury retail space by leveraging Saks’ brand prestige and curated selection, aiming to deliver an elevated and seamless shopping experience for affluent consumers.

- On October 10, 2024, Authentic Brands Group and Saks Global unveiled a new partnership under the name Authentic Luxury Group to reshape the luxury market through global brand expansion and strategic licensing. The platform will develop and scale iconic brands such as Barneys New York, Judith Leiber Couture, Hervé Léger, and Vince across categories, including fashion. This partnership aims to capitalize on both companies’ strengths in brand development and luxury retail to create a diversified, next-generation luxury ecosystem.

US Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the US luxury fashion market on the basis of product type?

- What is the breakup of the US luxury fashion market on the basis of distribution channel?

- What is the breakup of the US luxury fashion market on the basis of end user?

- What is the breakup of the US luxury fashion market on the basis of region?

- What are the various stages in the value chain of the US luxury fashion market?

- What are the key driving factors and challenges in the US luxury fashion market?

- What is the structure of the US luxury fashion market and who are the key players?

- What is the degree of competition in the US luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)