US Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2025-2033

US Online Education Market Overview:

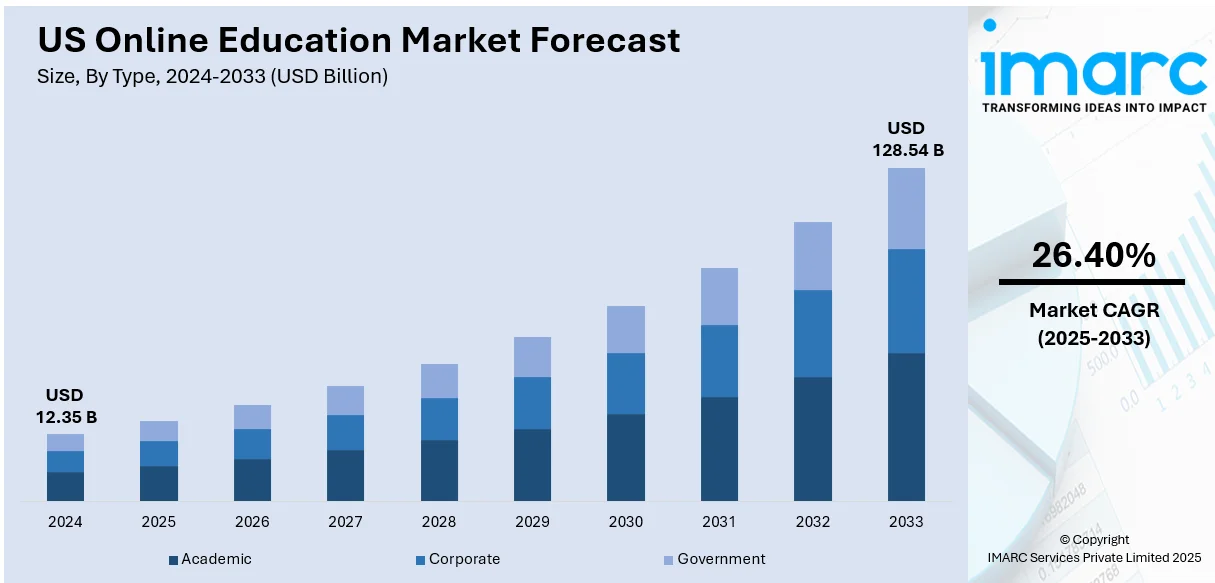

The US online education market size reached USD 12.35 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 128.54 Billion by 2033, exhibiting a growth rate (CAGR) of 26.40% during 2025-2033. The market is driven by increasing demand for flexible, self-paced educational content across professional and academic sectors, responding to the evolving skill requirements of modern industries. Technological advancements, including AI-driven personalization, immersive simulations, and data-enabled learning analytics, are transforming educational delivery standards. Growing collaborations between educational platforms and employers for customized workforce development programs are strengthening market growth, further augmenting the US online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.35 Billion |

| Market Forecast in 2033 | USD 128.54 Billion |

| Market Growth Rate 2025-2033 | 26.40% |

US Online Education Market Trends:

Increasing Demand for Flexible Learning Models

The growing need for flexible learning formats among working professionals, students, and lifelong learners is a major contributor to the expansion of the United States online education market. In 2025, revenue in the U.S. Online Education market is projected to reach USD 99.84 billion, with an ARPU of USD 1.49K and user penetration at 19.5%. By 2029, the number of users is projected to reach 87.6 million. As employment sectors evolve rapidly, individuals seek continuous skill enhancement through digital platforms offering self-paced courses, certifications, and degree programs. Universities and private institutions have expanded their digital offerings to accommodate hybrid and remote learning demands, while massive open online course (MOOC) providers partner with top academic institutions to deliver accredited content. Additionally, corporations increasingly invest in employee upskilling through customized online training programs to remain competitive. Platforms offering specialized courses in fields such as technology, finance, healthcare, and creative industries are gaining substantial traction. The adaptability of these platforms to cater to niche professional needs has elevated their relevance. Growing reliance on personalized, accessible, and flexible digital content is consistently contributing to US online education market growth as education delivery undergoes continued digital transformation.

To get more information on this market, Request Sample

Corporate Collaboration and Workforce Upskilling Initiatives

Corporate collaboration with online education providers is emerging as a powerful driver in shaping the U.S. online education market landscape. Employers across industries are forming strategic partnerships with online platforms to develop customized curricula aligned with their workforce development needs. These programs focus on technical skill enhancement, leadership training, and certification preparation, ensuring employees remain competitive in a dynamic job market. On June 5, 2025, the Accrediting Commission for Schools, Western Association of Schools and Colleges (ACS WASC) and the Virtual Learning Leadership Alliance (VLLA) announced a new partnership to launch a joint accreditation process for online education programs. This collaboration integrates ACS WASC’s accreditation expertise with VLLA’s AccredVEd initiative, creating a unified framework based on the National Standards for Quality Online Programs. The initiative is set to provide greater accountability, consistent quality assurance, and national standards for excellence in virtual learning environments. Remote work trends have amplified the relevance of online learning by allowing employees to seamlessly balance professional responsibilities with skill advancement. Additionally, federal and state-level workforce development programs promote collaboration between academic institutions and employers to bridge skill gaps in critical sectors, including IT, engineering, and healthcare. Startups and established educational providers alike offer modular, stackable credential programs that cater to industry-specific job requirements, enhancing employee employability. With ongoing industry transformations and technological disruptions reshaping the employment landscape, these collaborations are cementing online education’s role as a primary tool for professional advancement.

US Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

The report has provided a detailed breakup and analysis of the market based on the provider. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

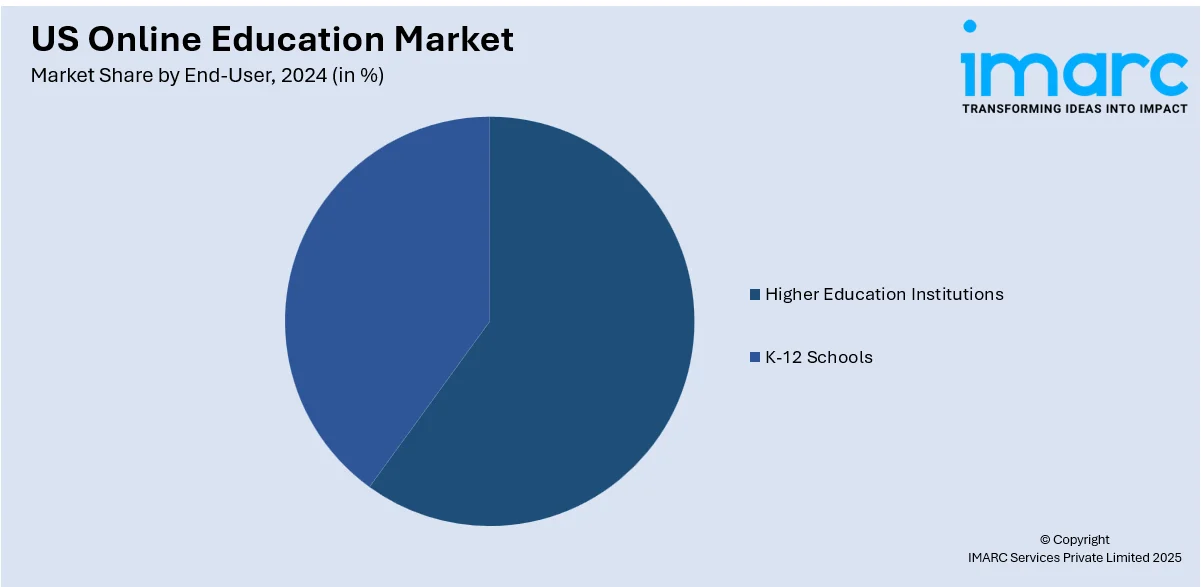

End-User Insights:

- Higher Education Institutions

- K-12 Schools

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes higher education institutions and K-12 schools.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all major regional markets. This includes Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Online Education Market News:

- On March 5, 2024, Accenture announced an agreement to acquire digital education pioneer Udacity to enhance its newly launched Accenture LearnVantage platform. Udacity, with over 230 professionals and a global network of 1,400 experts, specializes in advanced technology courses blending online learning with expert instruction. The acquisition will strengthen Accenture’s efforts to deliver scalable, outcome-driven tech education, especially in cloud, data, and AI skills development.

US Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US online education market performed so far and how will it perform in the coming years?

- What is the breakup of the US online education market on the basis of type?

- What is the breakup of the US online education market on the basis of provider?

- What is the breakup of the US online education market on the basis of technology?

- What is the breakup of the US online education market on the basis of end-user?

- What is the breakup of the US online education market on the basis of region?

- What are the various stages in the value chain of the US online education market?

- What are the key driving factors and challenges in the US online education market?

- What is the structure of the US online education market and who are the key players?

- What is the degree of competition in the US online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)