US Paneer Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

US Paneer Market Overview:

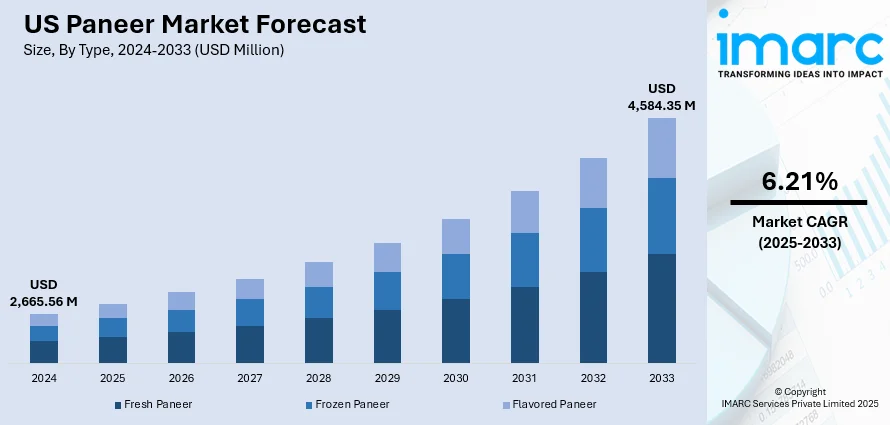

The US paneer market size reached USD 2,665.56 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,584.35 Million by 2033, exhibiting a growth rate (CAGR) of 6.21% during 2025-2033. Rising demand for Indian cuisine, expanding South Asian diaspora, increasing availability in retail chains, product innovation in flavored and organic variants, and growing awareness of protein-rich vegetarian options are some of the factors contributing to the US paneer market share. Foodservice partnerships and online delivery are also boosting visibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,665.56 Million |

| Market Forecast in 2033 | USD 4,584.35 Million |

| Market Growth Rate 2025-2033 | 6.21% |

US Paneer Market Trends:

Premium and Planet-Friendly Cheese in Focus

The US paneer category is shifting toward products that emphasize both quality and responsible packaging. Imported specialty varieties with a mild flavor profile are gaining traction, as consumer interest grows in cheeses that feel artisanal yet easy to use. Convenience is being prioritized through innovations like resealable films and reduced-plastic containers. These packaging upgrades appeal to shoppers seeking less waste without compromising on shelf life or ease of handling. Altogether, it points to stronger expectations for paneer products that meet high standards for taste, practicality, and sustainability, especially among urban and younger demographics accustomed to clean labels and functional packaging. Growth is now coming not just from flavor, but from the full product experience, from fridge to table. These factors are intensifying the US paneer market growth. For example, in June 2024, Président, part of Lactalis USA, showcased its specialty cheese range at the 2024 Summer Fancy Foods Show in New York. Highlights included the US debut of Leerdammer, a mild, nutty Gouda-style cheese from Holland, arriving this fall. Also introduced was new eco-friendly packaging for Président Feta 8 oz. chunks, using less plastic and a resealable film. These innovations target growing consumer demand for quality, convenience, and sustainability in dairy.

To get more information on this market, Request Sample

Organic Blocks Driving Ingredient-Conscious Choices

There's growing interest in paneer-style dairy options that offer both versatility and clean labels. New block formats, especially those that align with organic standards, are appealing to consumers who want more control in the kitchen, whether for slicing, shredding, or melting. These launches reflect a stronger preference for ingredient transparency, where shoppers look for familiar, minimal formulations without artificial additives. This shift is reinforcing the organic segment’s position in the US paneer market, where consumers are increasingly selective, seeking quality and function without trade-offs. Products that balance traditional dairy appeal with modern expectations around labeling and flexibility are carving out a more prominent role in everyday cooking and snacking habits. For example, in March 2025, Organic Valley launched its first organic American Cheese Blocks in Original and Fiesta flavors. Made with the same recipe as its award-winning slices, the 11-ounce blocks offer flexibility for slicing, shredding, or melting. The cooperative aims to meet demand for organic, clean-label dairy options with recognizable ingredients. This launch strengthens the organic segment in the US paneer, aligning with broader consumer shifts toward transparency and ingredient simplicity.

US Paneer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Fresh Paneer

- Frozen Paneer

- Flavored Paneer

The report has provided a detailed breakup and analysis of the market based on the type. This includes fresh paneer, frozen paneer, and flavored paneer.

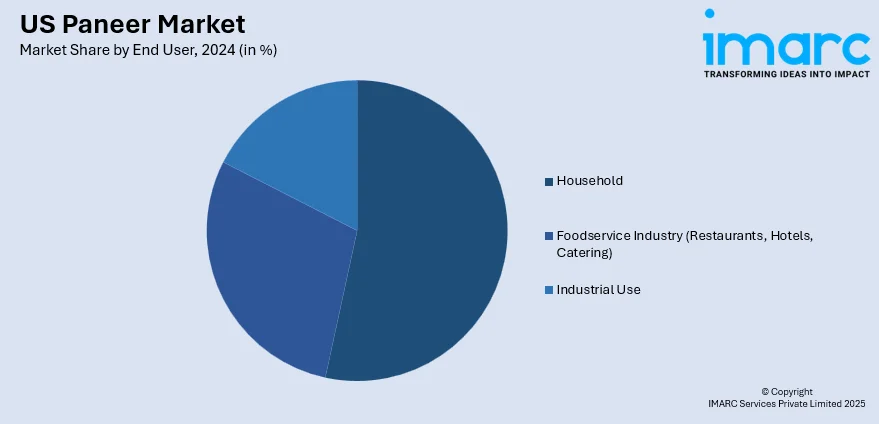

End User Insights:

- Household

- Foodservice Industry (Restaurants, Hotels, Catering)

- Industrial Use

The report has provided a detailed breakup and analysis of the market based on the end user. This includes household, foodservice industry (restaurants, hotels, catering), and industrial use.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Paneer Market News:

- In March 2025, Arla Foods Ingredients partnered with South Dakota-based Valley Queen to produce Nutrilac ProteinBoost, a whey protein concentrate used in high-protein dairy products. Production will begin in winter 2025/2026 at Valley Queen’s Milbank facility. Known for its high-quality cheese output, the company processes over 1.36 Billion kg of milk annually. This move supports rising demand for protein-rich dairy in the US, including applications relevant to paneer manufacturing.

US Paneer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fresh Paneer, Frozen Paneer, Flavored Paneer |

| End Users Covered | Household, Foodservice Industry (Restaurants, Hotels, Catering), Industrial Use |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US paneer market performed so far and how will it perform in the coming years?

- What is the breakup of the US paneer market on the basis of type?

- What is the breakup of the US paneer market on the basis of end user?

- What is the breakup of the US paneer market on the basis of distribution channel?

- What is the breakup of the US paneer market on the basis of region?

- What are the various stages in the value chain of the US paneer market?

- What are the key driving factors and challenges in the US paneer market?

- What is the structure of the US paneer market and who are the key players?

- What is the degree of competition in the US paneer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US paneer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US paneer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US paneer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)