US Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2025-2033

US Photonic Integrated Circuit Market Overview:

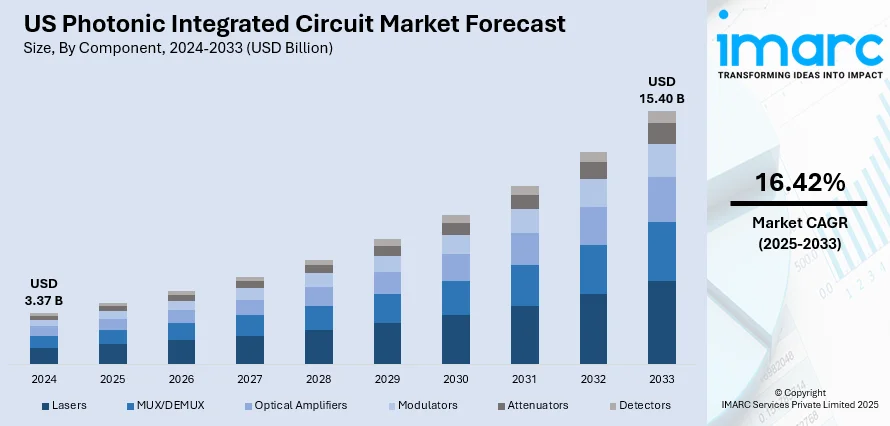

The US photonic integrated circuit market size reached USD 3.37 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.40 Billion by 2033, exhibiting a growth rate (CAGR) of 16.42% during 2025-2033. The market is driven by rising demand for high-speed data transmission, increasing adoption of optical communication technologies, and growing investments in defense and aerospace sectors. Technological advancements in silicon photonics and government support for innovation further boost market expansion. The expansion of data centers and telecom infrastructure also accelerates the US photonic integrated circuit market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.37 Billion |

| Market Forecast in 2033 | USD 15.40 Billion |

| Market Growth Rate 2025-2033 | 16.42% |

US Photonic Integrated Circuit Market Trends:

Defense and Aerospace Applications

Defense and aerospace sectors in the US are increasingly adopting photonic integrated circuits due to their advantages in size, weight, and power consumption. PICs enhance system reliability and performance for applications such as LIDAR, sensing, and secure communications. Government initiatives and funding programs are promoting R&D efforts to develop rugged and high-performance PICs suited for harsh environments. This strategic focus propels advancements in specialized PICs, strengthening the US photonic integrated circuit market growth by expanding the technology's use beyond commercial telecommunications into critical defense applications. For instance, in August 2025, Quantum Computing Inc. (QCi) secured a contract from NIST to design and fabricate thin-film lithium niobate (TFLN) photonic integrated circuits (PICs), marking its first direct U.S. government contract for TFLN foundry services. The project emphasizes low-loss waveguides and high-performance components. QCi also received a commercial chip order from a major Fortune 500 defense contractor. This milestone strengthens QCi’s position as a trusted U.S. supplier of advanced photonic technologies for high-security applications in quantum computing and national defense.

To get more information on this market, Request Sample

Expansion of Data Centers and Telecom Infrastructure

The rapid expansion of data centers and telecom infrastructure in the US fuels demand for photonic integrated circuits to support faster and more efficient optical communication. PICs play a crucial role in enabling higher bandwidth, lower latency, and reduced energy consumption in network equipment. Investments by major tech firms to upgrade infrastructure with PIC-enabled solutions are significant. The deployment of 5G and emerging 6G networks further drives the integration of photonic components to meet escalating data traffic. This growing infrastructure investment is a key factor supporting the US photonic integrated circuit market growth. For instance, in April 2025, Coherent Corp. launched its new 2x400G-FR4 Lite silicon photonics transceiver, designed for AI-driven data centers and Ethernet networks. This energy-efficient module offers a 500-meter reach, reduced power consumption, and a compact design using integrated silicon photonics. It complements Coherent’s existing 800G-DR8 solution with better fiber efficiency. The transceiver eliminates the need for thermoelectric coolers and suits high-volume deployments.

US Photonic Integrated Circuit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, raw material, integration, and application.

Component Insights:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

The report has provided a detailed breakup and analysis of the market based on the component. This includes lasers, MUX/DEMUX, optical amplifiers, modulators, attenuators, and detectors.

Raw Material Insights:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes indium phosphide (InP), gallium arsenide (GaAs), lithium niobate (LiNbO3), silicon, and silica-on-silicon.

Integration Insights:

- Monolithic Integration

- Hybrid Integration

- Module Integration

The report has provided a detailed breakup and analysis of the market based on the integration. This includes monolithic integration, hybrid integration, and module integration.

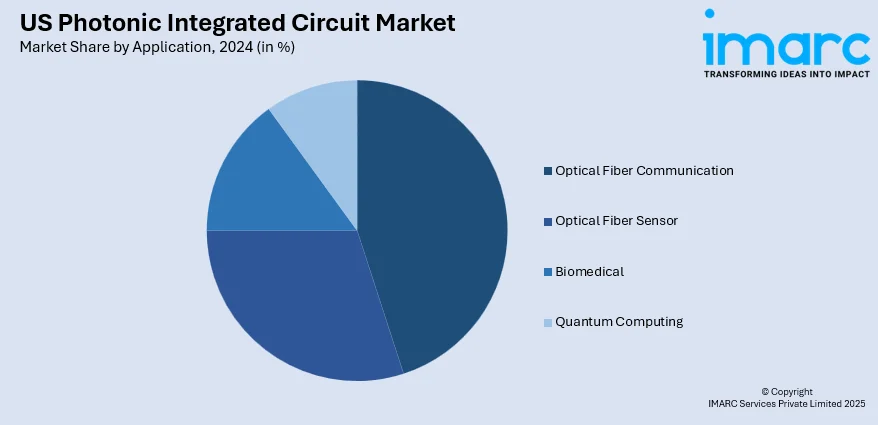

Application Insights:

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes optical fiber communication, optical fiber sensor, biomedical, and quantum computing.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Photonic Integrated Circuit Market News:

- In August 2025, Xanadu and DISCO Corporation partnered to advance wafer processing techniques for photonic quantum computing. The collaboration focuses on ultra-low loss photonic integrated chips through enhanced wafer dicing, polishing, and preparation for heterogeneous integration. DISCO’s cutting-edge dicing, grinding, and polishing technologies improve chip performance, reduce optical loss, and streamline manufacturing. This partnership supports Xanadu’s goal of building utility-scale photonic quantum computers by enabling scalable, high-precision photonic packaging crucial for next-gen quantum and photonic applications.

- In March 2025, PhotonDelta and Silicon Catalyst partnered to accelerate early-stage photonic startups globally. Backed by $1.5 Billion, PhotonDelta brings a complete photonic chip ecosystem, while Silicon Catalyst offers a semiconductor incubator with 500+ partners. The collaboration provides startups with expert guidance, go-to-market support, and funding. Focused on scaling integrated photonics for applications like data centers, quantum computing, and sensing, this alliance aims to drive innovation and tackle energy challenges, while fostering the next generation of photonic technologies across global markets.

US Photonic Integrated Circuit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US photonic integrated circuit market performed so far and how will it perform in the coming years?

- What is the breakup of the US photonic integrated circuit market on the basis of component?

- What is the breakup of the US photonic integrated circuit market on the basis of raw material?

- What is the breakup of the US photonic integrated circuit market on the basis of integration?

- What is the breakup of the US photonic integrated circuit market on the basis of application?

- What is the breakup of the US photonic integrated circuit market on the basis of region?

- What are the various stages in the value chain of the US photonic integrated circuit market?

- What are the key driving factors and challenges in the US photonic integrated circuit market?

- What is the structure of the US photonic integrated circuit market and who are the key players?

- What is the degree of competition in the US photonic integrated circuit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US photonic integrated circuit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US photonic integrated circuit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US photonic integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)