US Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2025-2033

US Pro AV Market Overview:

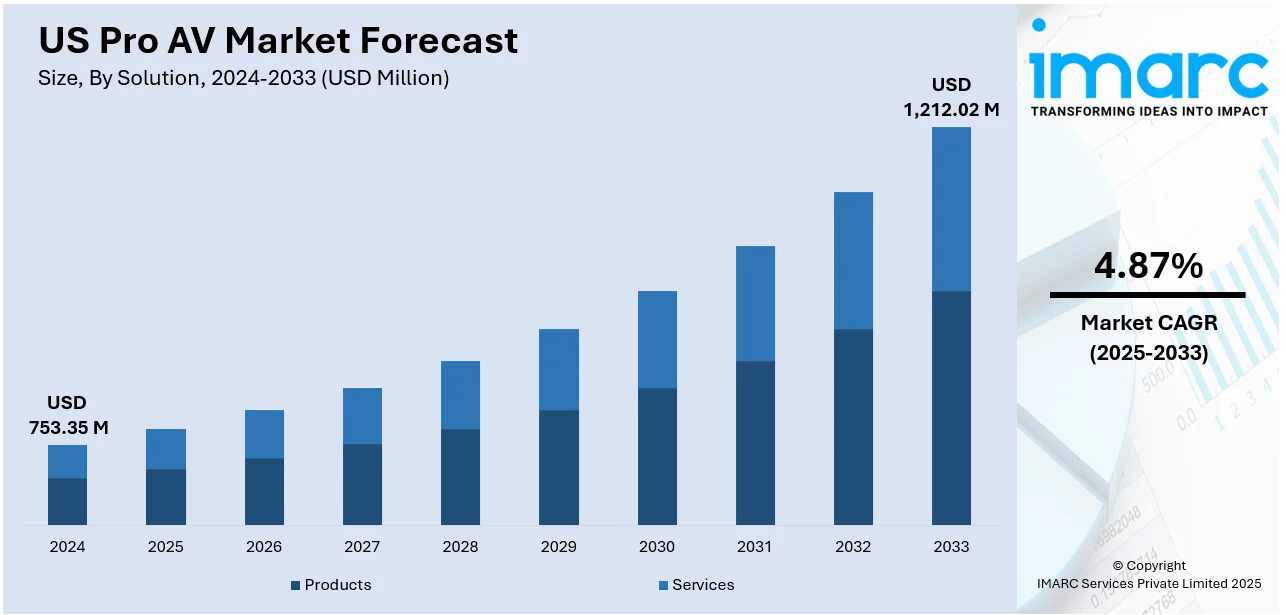

The US Pro AV market size reached USD 753.35 Million in 2024. The market is projected to reach USD 1,212.02 Million by 2033, exhibiting a growth rate (CAGR) of 4.87% during 2025-2033. The market is expanding due to increasing demand for seamless AV-over-IP integration and immersive display systems. Continued investment in interoperable solutions and efficient video wall technologies is supporting US Pro AV market share across commercial venues, education, entertainment, and corporate installations nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 753.35 Million |

| Market Forecast in 2033 | USD 1,212.02 Million |

| Market Growth Rate 2025-2033 | 4.87% |

US Pro AV Market Trends:

Push for Interoperability and Open Standards

The US Pro AV market growth is being steadily shaped by a rising demand for open, interoperable systems that reduce integration complexity and offer more flexibility for end-users. Businesses are no longer willing to rely solely on proprietary ecosystems that limit compatibility. Instead, they are gravitating toward platforms that can work seamlessly across brands and applications. This need for cross-platform collaboration and open cloud adoption is driving innovation at a broader scale. For example, in May 2025, leading AV companies including Sony, Panasonic, Shure, and Legrand launched OpenAV Cloud in the US market. This nonprofit initiative promoted open APIs and interoperability, enabling faster integration and cloud adoption across Pro AV systems, boosting collaboration, innovation, and cross-brand compatibility in the industry. By placing openness at the core of AV deployment, the initiative is addressing long-standing pain points, making it easier for integrators and businesses to create connected AV environments without vendor lock-in. The emphasis on standardized APIs and collaborative development signals a future where the Pro AV ecosystem is more fluid, service-oriented, and scalable. These developments indicate a growing preference in the US for unified, brand-agnostic systems that support faster rollouts and improved lifecycle support across installations.

To get more information on this market, Request Sample

Demand for Scalable Immersive Display Solutions

Visual technology has become central to customer experience in physical spaces, prompting US businesses to invest in scalable, immersive display systems that deliver clarity, impact, and engagement. There’s increasing pressure across commercial and entertainment venues to create memorable, dynamic visual environments that support brand storytelling, real-time communication, and spatial aesthetics. For example, in June 2025, BlueSquare X partnered with Chief at InfoComm to launch integrated video wall solutions for the US Pro AV market. Combining Vision X LED and Vivid X LCD displays with Chief’s mounting systems, the collaboration enhanced installation efficiency and elevated immersive display experiences across commercial sectors. By merging display hardware with custom mounting innovations, the partnership reduced setup complexity and allowed faster project delivery across sectors like hospitality, retail, and corporate spaces. This combination of high-performance visuals with installation-ready infrastructure has opened the door for wider Pro AV adoption, even among clients with limited technical teams. As a result, the US market is seeing broader rollout of video walls and interactive displays, not only in high-end venues but also in mid-sized business environments looking to modernize their presence.

US Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

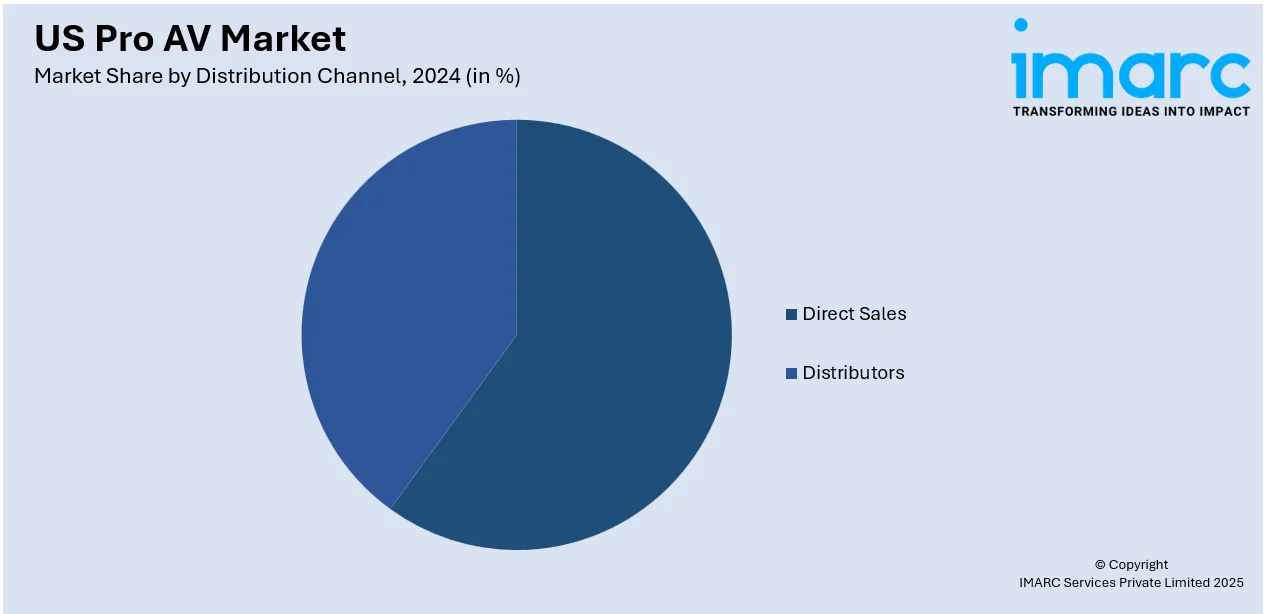

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Pro AV Market News:

- June 2025: NETGEAR expanded its Pro AV managed switch lineup at InfoComm 2025 by unveiling four new M4350 models tailored for broadcast and live event use. These innovations enhanced AV-over-IP deployments, improved network reliability, and reinforced NETGEAR’s position in the US Pro AV industry.

- September 2024: CommScope launched the RUCKUS Pro AV portfolio in the US, featuring Wi-Fi 6/7 access points, ICX switches, and cloud-based management tailored for AV installations. The release advanced IP-based AV networking, improving deployment efficiency and enhancing connectivity for residential and commercial Pro AV projects.

US Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the US Pro AV market on the basis of solution?

- What is the breakup of the US Pro AV market on the basis of distribution channel?

- What is the breakup of the US Pro AV market on the basis of application?

- What is the breakup of the US Pro AV market on the basis of region?

- What are the various stages in the value chain of the US Pro AV market?

- What are the key driving factors and challenges in the US Pro AV market?

- What is the structure of the US Pro AV market and who are the key players?

- What is the degree of competition in the US Pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US Pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US Pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US Pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)