US Secondary Wood Products Market Size, Share, Trends and Forecast by Type, 2026-2034

US Secondary Wood Products Market Summary:

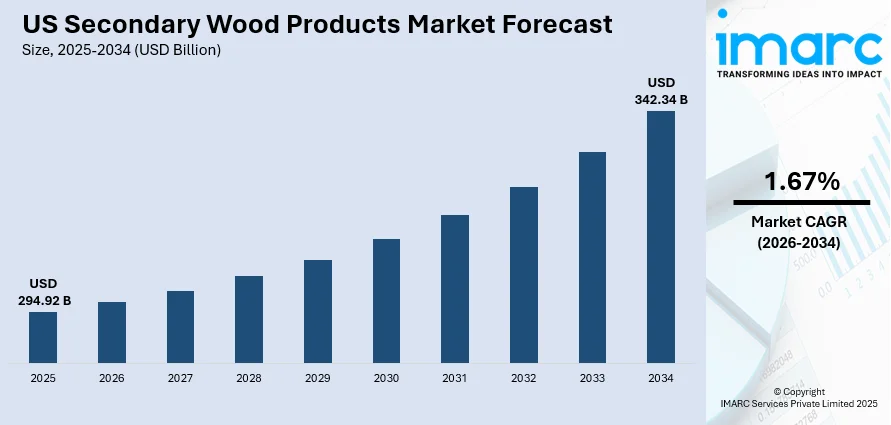

The US secondary wood products market size was valued at USD 294.92 Billion in 2025 and is projected to reach USD 342.34 Billion by 2034, growing at a compound annual growth rate of 1.67% from 2026-2034.

The US secondary wood products market encompasses a diverse range of manufactured goods derived from primary timber materials, including furniture, engineered wood panels, and paper-based products. The market benefits from the nation's mature manufacturing infrastructure, strong construction activity, and growing consumer preference for sustainable wood products. Robust residential and commercial construction spending, combined with increasing demand for eco-friendly furnishings, continues to drive market expansion across all segments.

Key Takeaways and Insights:

-

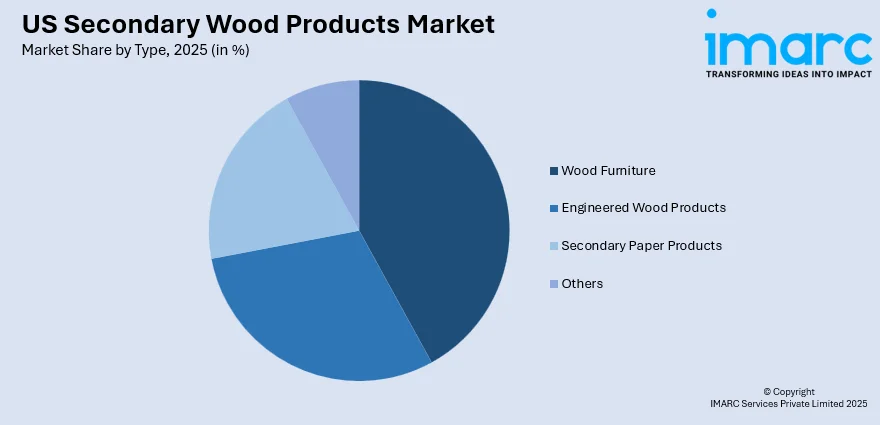

By Type: Wood furniture dominates the market with a share of 42% in 2025, driven by strong consumer demand for residential furnishings and the expanding real estate sector supporting home improvement activities.

-

Key Players: The US secondary wood products market exhibits a moderately fragmented competitive structure, with established domestic manufacturers competing alongside international suppliers across various product categories. Major industry participants focus on sustainable sourcing practices, manufacturing efficiency, and product innovation to maintain competitive positioning in the evolving marketplace.

To get more information on this market Request Sample

The US secondary wood products industry represents a critical segment of the nation's manufacturing economy, supported by extensive forestry resources and advanced processing capabilities. According to the National Association of Home Builders, total housing reached 1.36 Million Units, with single-family home building increasing by 6.5% at the end of 2024, directly fueling the demand for wood furniture, cabinetry, and engineered wood products used in residential applications. The market is further strengthened by the growing emphasis on sustainable materials, with the Sustainable Furnishings Council reporting that sales of FSC-certified wood furniture increased in 2023, reflecting stronger eco-conscious purchasing behavior among American consumers.

US Secondary Wood Products Market Trends:

Rising Demand for Sustainable and Eco-Friendly Wood Products

American consumers are increasingly prioritizing environmentally responsible furniture and wood products, driving manufacturers to adopt sustainable forestry practices and eco-friendly production methods. The growing environmental consciousness is reshaping purchasing decisions across the market. Companies have earned recognition on the 2025 Wood Furniture Scorecard for sourcing certified sustainable wood from responsibly managed Appalachian forests, demonstrating the industry's strong commitment to environmental stewardship and responsible resource management.

Growing Adoption of Engineered Wood in Construction Applications

Engineered wood products are experiencing increased adoption in residential and commercial construction due to their superior dimensional stability, cost-effectiveness, and sustainable characteristics. These products offer enhanced structural performance while meeting growing environmental standards across the building industry. In November 2024, Weyerhaeuser Company announced plans to invest approximately USD 500 million to build a new TimberStrand facility near Monticello and Warren, Arkansas, significantly expanding engineered wood products capacity in the US.

E-commerce Expansion and Digital Transformation in Furniture Retail

The digital transformation of furniture retail continues to reshape consumer purchasing patterns, with online platforms offering expanded product selection and convenient shopping experiences. This shift has accelerated market accessibility and broadened consumer reach across diverse demographics. Manufacturers are actively investing in digital visualization tools, augmented reality applications, and direct-to-consumer platforms to enhance customer engagement, improve product discovery, and streamline the purchasing journey for modern consumers.

Market Outlook 2026-2034:

The US secondary wood products market is positioned for steady growth through 2033, supported by persistent housing shortages, renovation activities, and evolving consumer preferences for sustainable materials. According to the Congressional Budget Office, housing starts are projected to average 1.6 million per year over the next decade, driven by pent-up demand and demographic factors. In July 2024, Ashley Furniture Industries announced an USD 80 Million expansion plan for its manufacturing facilities in Lee County, Mississippi, expected to create approximately 500 new jobs by end of 2025, demonstrating industry confidence in sustained market demand. The market generated a revenue of USD 294.92 Billion in 2025 and is projected to reach a revenue of USD 342.34 Billion by 2034, growing at a compound annual growth rate of 1.67% from 2026-2034.

US Secondary Wood Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Wood Furniture |

42% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Wood Furniture

- Office Furniture

- Household & Institution

- Wooden Kitchen, Cabinets and Countertops

- Other Furniture

- Engineered Wood Products

- Plywood

- OSB

- Particle Board

- Other Engineered Woods

- Secondary Paper Products

- Paper Products

- Paperboard Containers

- Others

The wood furniture dominates with a market share of 42% of the total US secondary wood products market in 2025.

The wood furniture leads the US secondary wood products market, driven by strong consumer demand across residential and commercial applications. American households demonstrate consistent preference for wooden furniture due to its durability, aesthetic appeal, and timeless design characteristics. The US wooden furniture market is reflecting sustained growth in home furnishing expenditure. The residential segment accounts for substantial market share, supported by rising homeownership rates and renovation activities.

Sustainability has emerged as a critical differentiator in the wood furniture segment, with consumers increasingly seeking products made from responsibly sourced materials. The segment benefits from a robust domestic manufacturing base, with companies offering high-quality, customizable wood furniture using sustainably sourced materials. The Lacey Act enforcement continues to push manufacturers toward sustainable production practices, ensuring wood products are legally and responsibly sourced while meeting growing environmental standards.

Market Dynamics:

Growth Drivers:

Why is the US Secondary Wood Products Market Growing?

Sustained Residential Construction and Home Improvement Activities

The US housing market continues to generate substantial demand for secondary wood products through new construction and renovation projects across the country. The growing need for compact and multi-functional furniture to maximize space utilization in smaller apartments and urban dwellings further supports market expansion. Rising renovation activities among existing homeowners contribute significantly to sustained product demand. The persistent housing shortage, estimated at over 7.1 million rental homes according to the official government report, creates sustained replacement demand for wood products across all categories.

Growing Consumer Preference for Sustainable and Eco-Friendly Materials

Environmental consciousness among American consumers is driving significant demand for sustainably produced wood products across all market segments, reshaping industry practices and manufacturing standards. The furniture industry has responded with increased adoption of FSC-certified materials, recycled content, and environmentally responsible manufacturing processes that minimize ecological impact. Companies are investing in supply chain transparency, deploying blockchain-based tracing systems that allow buyers to confirm the origin of wood, upholstery, and finishes, building consumer trust and enhancing market differentiation among environmentally conscious buyers seeking verified sustainable products.

Expansion of E-Commerce and Evolving Retail Distribution Channels

The rapid growth of online retail has transformed furniture distribution and consumer access to wood products, expanding market reach and sales opportunities. The United States e-commerce market continues to demonstrate strong growth, with the IMARC Group projecting to reach USD 2,099.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.46% during 2025-2033. Digital platforms enable consumers to access wider product selections, compare prices across retailers, and purchase custom furniture configurations conveniently. Direct-to-consumer brands have gained market traction by offering repair parts, buy-back guarantees, and efficient flat-packed shipping, catering to environmentally conscious consumers seeking quality wood furniture.

Market Restraints:

What Challenges the US Secondary Wood Products Market is Facing?

Rising Raw Material Costs and Supply Chain Volatility

Fluctuations in timber prices and supply chain disruptions create significant cost pressures for secondary wood product manufacturers. Log costs for plywood mills have surged considerably, compressing margins despite relatively stable panel pricing. Tariff-related uncertainties and transportation costs continue to affect raw material procurement and manufacturing economics across the industry, challenging profitability for producers.

Elevated Interest Rates Impacting Housing and Furniture Demand

High mortgage rates and financing costs constrain housing market activity and consumer spending on home furnishings, dampening demand for wood products. The housing market has experienced notable declines in total starts compared to previous years, reflecting ongoing affordability challenges. Consumer confidence regarding job security and economic conditions represents persistent headwinds to discretionary furniture purchases.

Competition from Alternative Materials and Imported Products

Secondary wood products face increasing competition from plastic, metal, and composite alternatives that offer lower costs and specific performance advantages. Import competition, particularly from Asian manufacturers, continues to challenge domestic producers on price while raising quality and sustainability concerns. The industry must balance cost competitiveness with maintaining quality standards and sustainable sourcing practices.

Competitive Landscape:

The US secondary wood products market exhibits a moderately fragmented competitive structure, characterized by the presence of large integrated manufacturers, specialized producers, and numerous regional players across product segments. Competition intensifies around factors including product quality, sustainable sourcing credentials, manufacturing efficiency, and distribution capabilities. Leading companies are actively investing in automation, sustainable forestry certifications, and digital transformation to maintain competitive positioning. Strategic mergers, capacity expansions, and product innovation continue to reshape market dynamics, with industry participants focusing on operational efficiency and environmental compliance to address evolving market requirements.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Companies Covered | Ashley Furniture Industries, Steelcase, HNI Corporation, Herman Miller, Weyerhaeuser Company, Universal Forest Products, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The US secondary wood products market size was valued at USD 294.92 Billion in 2025.

The US secondary wood products market is expected to grow at a compound annual growth rate of 1.67% from 2026-2034 to reach USD 342.34 Billion by 2034.

Wood furniture dominated the market with a 42% share in 2025, driven by strong consumer demand for residential furnishings, rising homeownership rates, and growing preference for sustainable, high-quality wooden furniture in American households.

Key factors driving the US secondary wood products market include sustained residential construction activity, growing consumer preference for sustainable and eco-friendly wood products, expansion of e-commerce distribution channels, and increasing adoption of engineered wood in building applications.

Major challenges include rising raw material and lumber costs, supply chain volatility, elevated interest rates impacting housing affordability and furniture demand, competition from alternative materials, and import pressure from lower-cost international manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)