US Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

US Steel Tubes Market Overview:

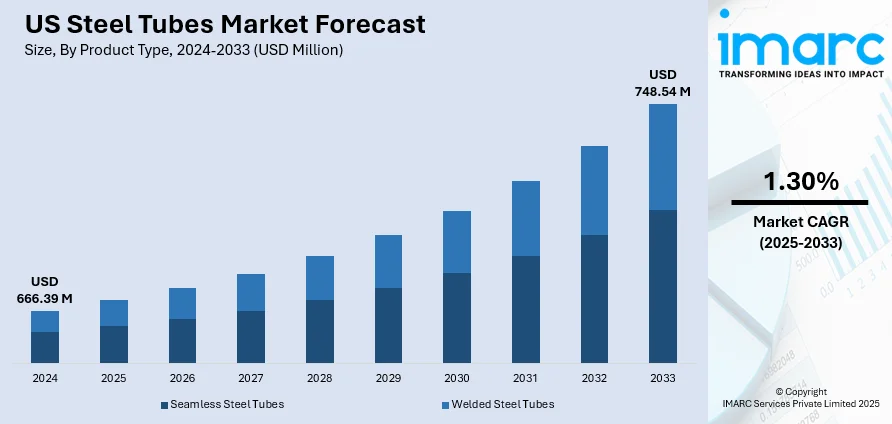

The US steel tubes market size reached USD 666.39 Million in 2024. The market is projected to reach USD 748.54 Million by 2033, exhibiting a growth rate (CAGR) of 1.30% during 2025-2033. The market is advancing steadily, supported by robust demand in infrastructure, construction, energy, and automotive sectors. Leading domestic and international manufacturers are enhancing product performance through advanced materials and fabrication techniques, while also emphasizing customization for various end-use industries. Supply chains are gradually reorienting toward regional sourcing to minimize lead times and improve resilience. Growth is further stimulated by sustainability commitments and regulatory alignment, encouraging the adoption of environmentally responsible production methods. Emerging trends highlight the expanding profile of the US steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 666.39 Million |

| Market Forecast in 2033 | USD 748.54 Million |

| Market Growth Rate 2025-2033 | 1.30% |

US Steel Tubes Market Trends:

Domestic Capacity Adjustment toward Precision

In March 2025, the U.S. imposed enhanced steel tariffs raising duties directly affecting the supply cost of OCTG and other tubular steel imports. This policy shift, reported by official trade bulletins, has prompted domestic mill operators to re-evaluate production focus toward tubes with tighter tolerances and engineered coatings tailored for critical industrial and energy infrastructure projects. With upstream tariff-driven supply constraints, demand for high-spec tubes such as seamless mechanical mining tubes or corrosion-resistant profiles is growing within the established production base. Federal infrastructure initiatives under the Bipartisan Infrastructure Law are further bolstering demand for high-quality tubing suited to long-lasting pipelines, transit systems, and building systems. Rather than expanding basic commodity volume, manufacturers are prioritizing specification compliance, technical finishing, and traceability to navigate the shifting trade environment. This emphasis helps domestic producers maintain pricing stability despite tariff-related cost volatility. All things considered, US steel tubes market growth is increasingly anchored in precision applications rather than sheer production throughput.

To get more information on this market, Request Sample

Export Shift Fueled by Production Trends

In January 2025, weekly US raw steel production stood at million net tons with capacity utilization, indicating modest year‑on‑year growth and a steady foundational feedstock supply for tube makers. That steady throughput underpins domestic downstream alignment with sustained internal demand, allowing tube fabricators to convert raw material into tailored profiles such as structural tubing or mechanical tubes. Simultaneously, the stable production environment supports consistent delivery to export markets though with increasing emphasis on product differentiation rather than bulk commodity exports. Tube exporters are focusing on engineered alloy blends, tighter wall precision, and corrosion-resistant specifications features that help preserve export pricing power even without expanding volume. Buyers overseas now expect traceable technical attributes and certification compliance for critical infrastructure use, reinforcing that differentiation strategy. As tariff policies place pressure on commodity import pipelines, U.S. tube manufacturers are better served by prioritizing quality and specification over broad volume export growth. In summary, this dynamic supports US steel tubes market trends via refined positioning over scale-centric export ambition.

Carbon and Energy Transition Demands Elevate Specialty Tubes

In 2024, the US established approximately 1,600 miles of low‑pressure hydrogen pipeline requiring high‑purity stainless or alloy steel tubes rated for critical applications in carbon capture and clean energy infrastructure. Federal investments under the Bipartisan Infrastructure Law and Inflation Reduction Act specifically allocated significant capital toward hydrogen transport and CCUS pipelines. These developments are driving demand for durable, corrosion-resistant tubes made to stringent tolerances, such as alloy chemical tubing or seamless pressure-grade profiles. Domestic tube producers are adjusting capacity and fabrication lines to meet this emerging technical demand shifting from commodity segments toward energy transition‑focused production. The need for clean‑energy tubing enables domestic value capture and supports long-term relevance amid shifting energy systems. It also reduces reliance on imports for specialized tubing, bolstering internal engineering capability. As this niche demand base grows, domestic manufacturers are better positioned to command premium pricing tied to specification and reliability. Overall, this reflects escalating demand from clean energy infrastructure projects and strategic value orientation in tube fabrication.

US Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

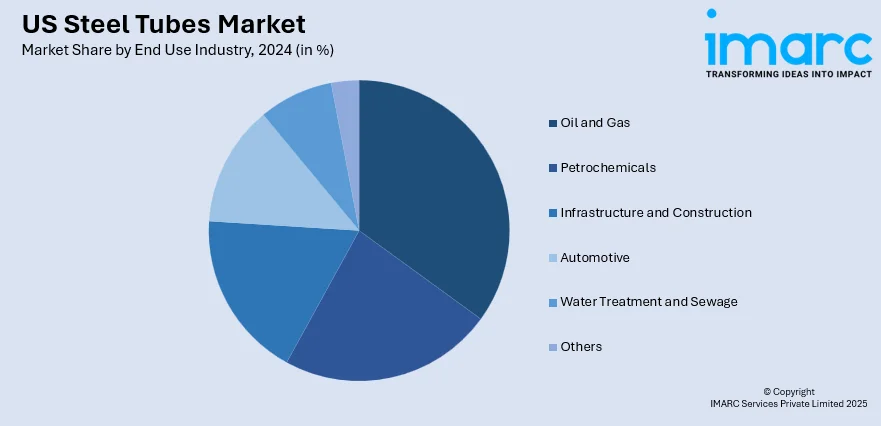

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Steel Tubes Market News:

- June 2025: Nippon Steel has completed its acquisition of US Steel, making the latter a wholly owned U.S. subsidiary while retaining its name and Pittsburgh headquarters. As part of a national security agreement, the US government holds a “golden share” granting veto power over major decisions and the right to appoint board representation. Nippon Steel has pledged substantial investments in US operations over the coming years, with leadership and governance committed to US citizenship to ensure compliance with domestic oversight and political requirements.

US Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the US steel tubes market on the basis of product type?

- What is the breakup of the US steel tubes market on the basis of material type?

- What is the breakup of the US steel tubes market on the basis of end use industry?

- What is the breakup of the US steel tubes market on the basis of region?

- What are the various stages in the value chain of the US steel tubes market?

- What are the key driving factors and challenges in the US steel tubes market?

- What is the structure of the US steel tubes market and who are the key players?

- What is the degree of competition in the US steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)