US Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

US Used Cooking Oil Market Overview:

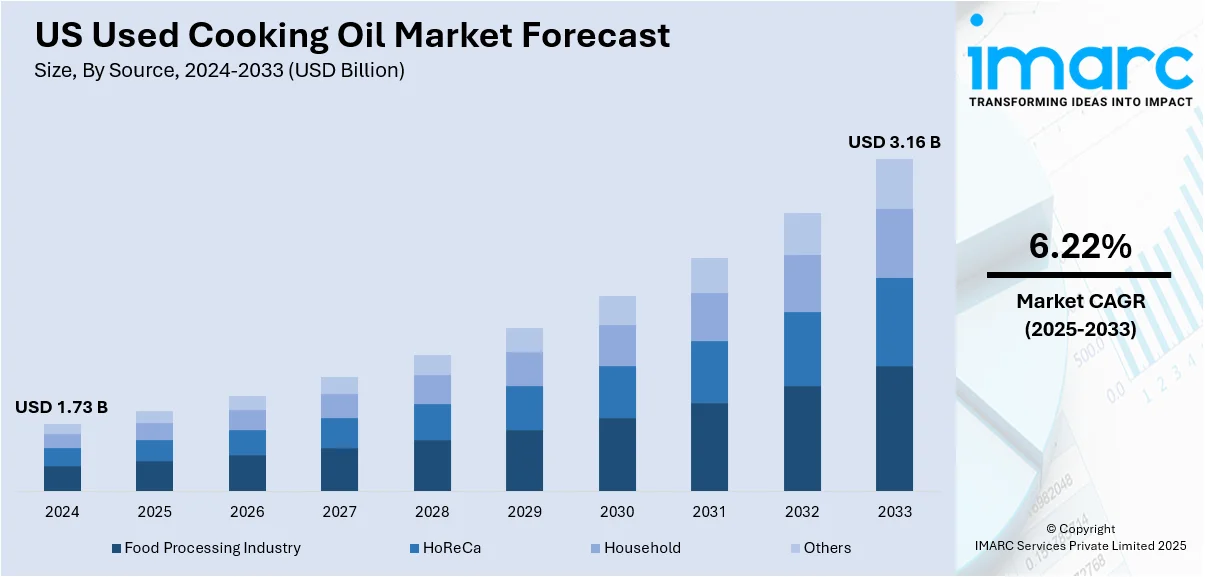

The US used cooking oil market size reached USD 1.73 Billion in 2024. The market is projected to reach USD 3.16 Billion by 2033, exhibiting a growth rate (CAGR) of 6.22% during 2025-2033. The market is experiencing strong growth due to rising biodiesel production. Used cooking oil is employed as a key feedstock for biodiesel, supporting clean energy goals. Besides this, partnerships between restaurants and used cooking oil collection services are becoming more common, ensuring reliable sourcing and helping businesses comply with waste regulations. These developments are strengthening the recycling chain, thereby expanding the US used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2033 | USD 3.16 Billion |

| Market Growth Rate 2025-2033 | 6.22% |

US Used Cooking Oil Market Trends:

Increasing biodiesel manufacturing

Rising biodiesel production is offering a favorable market outlook in the US. According to the information provided on the official website of the US Energy Information Administration, the biodiesel plant manufacturing capacity in the US reached 136 Million barrels per day. As the country is shifting towards cleaner and more sustainable energy sources, biodiesel is emerging as a popular alternative to conventional fossil fuels. Used cooking oil is one of the most cost-effective and environment friendly feedstocks for biodiesel production. With an increasing number of industries and transportation fleets seeking to reduce their carbon footprint, the demand for biodiesel is rapidly rising. This surge has led to higher demand for used cooking oil, which can be efficiently converted into biodiesel through established processing techniques. Moreover, government mandates and incentives promoting renewable fuels are accelerating biodiesel utilization, motivating fuel producers to secure reliable and steady sources of used cooking oil. Biodiesel derived from used cooking oil helps achieve sustainability goals by minimizing greenhouse gas emissions, supporting the broader green energy transition. Overall, increasing need for clean fuels is bolstering the US used cooking oil market growth.

To get more information on this market, Request Sample

Rising applications in foodservice industry

With the increasing number of restaurants, fast food chains, and catering services, the volume of cooking oil consumed and subsequently discarded has grown rapidly. The foodservice sector is generating a consistent and large-scale supply of used oil, which is being actively collected and repurposed for sustainable applications, such as industrial lubricants. As sustainability is becoming a major focus for foodservice providers, many establishments are adopting responsible disposal and recycling practices, further improving the supply chain for used cooking oil. Additionally, partnerships between restaurants and used cooking oil collection services are becoming more common, ensuring reliable sourcing and helping businesses comply with waste regulations. This continuous and expanding stream of used cooking oil from the burgeoning foodservice industry is supporting the market growth, while also contributing to circular economy practices in the US. As per industry reports, the restaurant and foodservice sector in the US is expected to attain USD 1.5 Trillion in sales by 2025, up 4% compared to 2024.

Growing need for animal feed additives

The increasing need for animal feed additives is positively influencing the market in the US. Used cooking oil, when processed and refined, serves as a valuable energy-rich supplement in animal feed, particularly for livestock and poultry. Its inclusion improves feed palatability and provides essential fatty acids, supporting animal health and growth. With increasing concerns about traditional feed ingredient costs and supply fluctuations, manufacturers are turning to used cooking oil as a reliable substitute. Moreover, regulatory acceptance and innovations in feed formulation are encouraging broader adoption of used cooking oil-based additives. This trend aligns with the livestock industry's aim to reduce feed production costs while maintaining nutritional standards. As the demand for economical animal feed solutions is growing, used cooking oil continues to gain traction as a viable component in the feed additive industry. According to the IMARC Group, the United States animal feed market is set to attain USD 164.95 Billion by 2033, exhibiting a CAGR of 3.95% from 2025-2033.

US Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

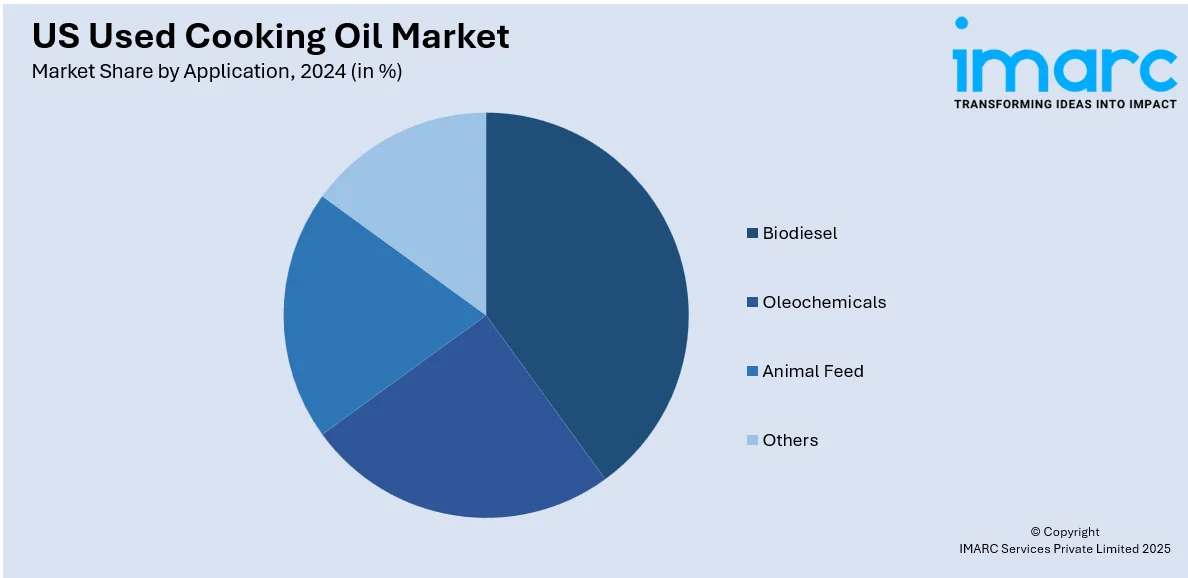

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the US used cooking oil market on the basis of source?

- What is the breakup of the US used cooking oil market on the basis of application?

- What is the breakup of the US used cooking oil market on the basis of region?

- What are the various stages in the value chain of the US used cooking oil market?

- What are the key driving factors and challenges in the US used cooking oil market?

- What is the structure of the US used cooking oil market and who are the key players?

- What is the degree of competition in the US used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)