UV Tapes Market Size, Share, Trends and Forecast by Product, Application, and Region 2025-2033

UV Tapes Market 2024, Size and Trends:

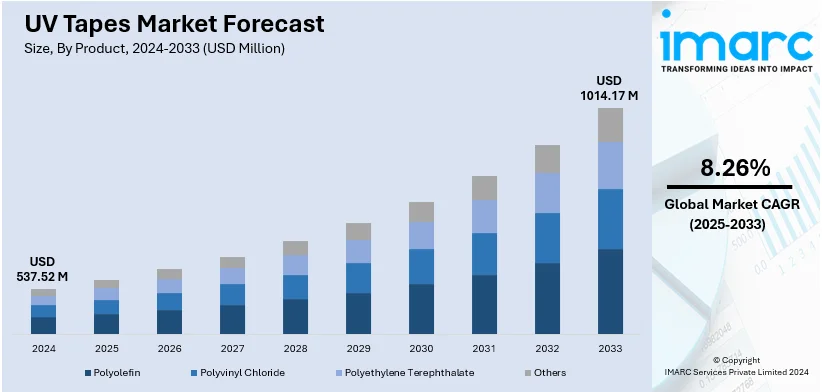

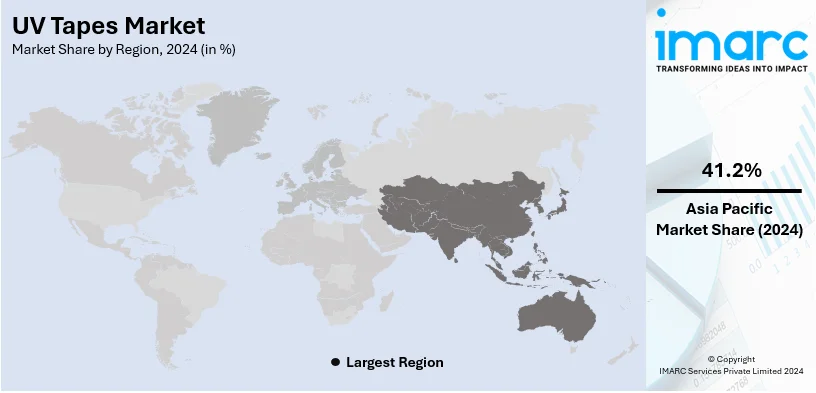

The global UV Tapes market size was valued at USD 537.52 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1014.17 Million by 2033, exhibiting a CAGR of 8.26% during 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 41.2% in 2024. The UV tapes market share is growing due to increasing applications in semiconductor manufacturing, rising adoption in electronics assembly, ongoing advancements in adhesive technologies, and expanding demand for precision-based microelectronics packaging solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 537.52 Million |

|

Market Forecast in 2033

|

USD 1014.17 Million |

| Market Growth Rate (2025-2033) | 8.26% |

The integration of advanced electronics for safety, connectivity, and autonomous driving technologies into the automotive industry has greatly impacted the UV tapes market growth. UV tapes are used in manufacturing electronic components like sensors and printed circuit boards (PCBs) in modern vehicles. Furthermore, the acceleration of vehicle electrification and the increasing popularity of electric and hybrid models have further heightened the demand for reliable adhesives that can endure varied environmental conditions. The market for electric vehicles (EVs) is expanding rapidly in the United States with a growth rate of 27.5% annually. It is also estimated that this market will reach US$ 386.5 billion in the country by 2032. This rise in EV usage has raised demand for UV tapes in the automotive industry.

The United States stands out as a key UV tapes market disruptor with a share of 70.5% in North America. It is driven by the widespread popularity of flexible display among US consumers. As major technology firms concentrate on producing cutting-edge devices to suit customer demand, the US market for flexible and foldable screens is expanding considerably. Due to increased production of organic light-emitting diode (OLED) and active-matrix organic light-emitting diode (AMOLED) panels, the US display industry is expected to grow at a compound annual rate of 2.9% between 2024 and 2032. UV tapes are essential for guaranteeing flawless handling and lamination of thin screens in various devices. Three out of five US individuals who own smartphones are interested in getting a foldable smartphone for their next purchase (59%), indicating the significant trend toward foldable smartphones and the increasing significance of UV tapes in production processes.

UV Tapes Market Trends:

Increasing Demand from the Electronics and Semiconductor Industry

The UV tape market share is majorly driven by the semiconductor and electronics industries. The worldwide semiconductor industry was reported to be worth USD 694.0 billion in 2024 and is forecasted to reach USD 1,221.2 billion in 2033, with a compound annual growth rate (CAGR) of 6.48%. This significant increase highlights the growing need for UV tapes, which are crucial for procedures like chip packing and wafer dicing. This need is further increased by the widespread use of consumer electronics, such as smartphones and Internet of Things (IoT) devices, spurred by the world's rapid urbanization. The UK government estimates that 56.3 million people, or 82.9% of the country's total population, resided in cities in 2019, which increased the demand for efficient UV tapes for electrical and semiconductor components.

Booming Construction and Renewable Energy Industries

The burgeoning construction industry is stimulating the UV tapes market demand for pipes, windows, open joint facades, and sealing around doors. According to Invest India, in 2023, the outlay for PM Awas Yojana is being enhanced by 66% to over USD 9.36 billion. This has created an increasing demand for UV tapes in the Indian infrastructure sector. Apart from this, these tapes are used for protective and adhesive purposes in solar panel manufacturing and glass lamination. The global push towards renewable energy sources, including solar energy, has increased the need for durable and weather-resistant materials. Almost 17 million more European homes were powered by solar in the year 2023, because of a 40% growth in solar installations from 2022. In comparison to the 40 GW of solar installed in 2022, the year 2023 brought 55.9 GW of new solar capacity across the European Union (EU). UV tapes are valued in these installations for their ability to withstand extreme environmental conditions, ensuring the longevity and performance of solar modules.

Rising Adoption in the Medical and Healthcare Sector

The medical industry's demand for UV tapes is growing due to their application in producing advanced medical devices and equipment. UV tapes are employed for precise bonding and protection during the manufacturing of diagnostic instruments, implantable devices, and surgical tools. The rising expenditure in the healthcare care across the globe is also fueling the use of UV tapes for various purposes. For instance, the Indian healthcare sector is witnessing unprecedented growth, with private equity and venture capital (VC) investments surpassing US$ 1 billion in the initial five months of the year 2024, marking a 220% increase from 2023. UV tapes’ biocompatibility and residue-free removal make them ideal for sensitive applications. Technological advancements in medical equipment and the global focus on improving healthcare infrastructure also drive the market growth, as UV tapes ensure manufacturing accuracy and efficiency.

UV Tapes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global UV tapes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Polyolefin

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Others

As per the latest UV tapes market outlook, polyolefin stand as the largest product in 2024, holding around 59.4% of the market. It is driven by its superior properties and widespread applicability across industries. Polyolefin UV tapes are favored for their excellent adhesion, temperature resistance, and ability to provide residue-free removal, making them ideal for delicate processes such as semiconductor wafer dicing and display lamination. These tapes are highly durable and compatible with various substrates, enhancing their use in industries such as electronics, automotive, and medical devices. Its cost-effectiveness and high performance in precision-driven applications is boosting its demand. The increasing adoption of polyolefin UV tapes in the production of advanced electronic components and solar panels also underscores its critical role in supporting technological advancements and sustainable manufacturing practices.

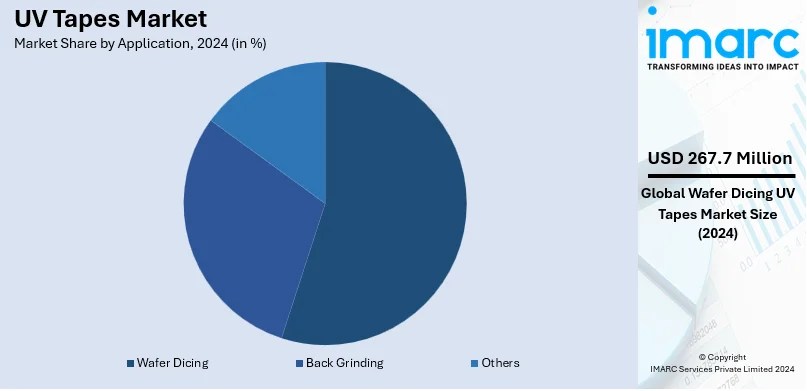

Analysis by Application:

- Wafer Dicing

- Back Grinding

- Others

Based on the recent UV tapes market forecast, wafer dicing leads the market with around 49.8% of market share in 2024. The dominance of wafer dicing is fueled by the expanding need for semiconductors in the industrial, automotive, and electronics industries. In order to ensure accurate cutting and safeguard sensitive semiconductor wafers during manufacture, UV tapes are essential to the wafer dicing process. The growth of semiconductor production, specifically in the US and Asia-Pacific regions, has led to this segment's substantial market demand. Moreover, reliable UV tapes that offer clean removal and reduce wafer damage are important due to the growth of sophisticated electronics, including fifth-generation (5G) devices, the Internet of Things (IoT) applications, and high-performance computing.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 41.2%. Asia-Pacific leads the UV tapes market, with the highest regional share due to its increasing electronics and semiconductor industries. Taiwan, South Korea, Japan, and China are among the world's leading semiconductor manufacturers. Moreover, the demand for high-end UV tapes in applications such as wafer dicing and display manufacturing has also risen with the widespread adoption of cutting-edge technologies like 5G, IoT, and artificial intelligence (AI). Also, the automobile industry in the region is growing rapidly, particularly in China and India, thus pushing the usage of UV tapes in electronic components. Furthermore, the Asia-Pacific region boasts the largest as well as the fastest-growing market globally for UV tapes on account of favorable government initiatives such as the South Korean semiconductor investment program and China's Made in China 2025.

Key Regional Takeaways:

North America UV Tapes Market Analysis

The market for UV tapes in North America is expanding steadily due to developments in the electronics and semiconductor sectors. With the help of government programs like the CHIPS Act, which provided significant funding to boost domestic semiconductor fabrication, the United States in particular has made a significant contribution. Moreover, the need for UV tapes in wafer dicing and chip packing processes has increased as a result of the construction of new fabrication facilities. The region's robust automotive industry, which emphasizes advanced driver-assistance systems (ADAS) and electric vehicles (EVs), is also encouraging the use of UV tapes in the assembly of electrical components. The significance of UV tapes in North America is further highlighted by the growing healthcare sector and the increase in the manufacturing of minimally invasive (MI) medical devices. This market segment benefits from the region’s emphasis on high-quality, precision-driven manufacturing processes, ensuring a consistent demand for innovative UV tape solutions.

United States UV Tapes Market Analysis

United States accounted for the largest share of UV tapes in North America with over 70.5%. The UV tapes market in the United States is gaining momentum due to specific and evolving factors. UV tapes have become highly in demand among semiconductor and electronics manufacturers because of the relentless miniaturization and an increase in the complexity of electronic components. As businesses move to increase the precision of their wafer dicing and chip assembly processes, there has been a growing need for temporary bonding solutions that are reliable and residue-free. Besides this, as the industries keep giving more importance to producing light-weight and small-sized products like wearables and IoT-enabled devices, the market is observing high utilization of UV tapes in flexible printed circuit boards (PCBs). The producers of solar panels are also using UV tapes highly as they have good resistance against UV rays and adhesive power due to the growing nation focus on renewable energy. Furthermore, automotive companies are exploring UV tapes in electronic assemblies as they are intensifying their efforts in integrating advanced electronic systems in electric and autonomous vehicles. The healthcare industry is also adopting UV tapes in microelectronics for medical devices, driven by the ongoing push for innovations in diagnostic and therapeutic equipment. According to the American Medical Association, health spending in the U.S. increased by 4.1% in 2022 to USD 4.5 Trillion or USD 13,493 per capita. Collectively, these industry-specific developments are fuelling the adoption of UV tapes in the United States, underpinned by a strong emphasis on high-performance materials and innovative manufacturing practices.

Asia Pacific UV Tapes Market Analysis

The demand for UV tapes in the Asia-Pacific region is being driven by continued developments in semiconductor packaging and assembly processes, notably in electronics manufacturing powerhouses such as China, Japan, and South Korea. UV tapes are increasingly being used by manufacturers because of their ability to precisely die-cut and temporarily attach materials, which are crucial for creating high-density electronic components. The creation of flexible displays is also booming in the electronics industry, where UV tapes are frequently used to manage fragile substrates during processing. India's electronic domestic output grew from USD 49 billion in 2017 to USD 101 billion in 2023, according to Invest India. Additionally, the solar energy sector is consistently incorporating UV tapes into the construction of photovoltaic modules because of their exceptional resilience and resilience to UV radiation, which enhances module efficiency and lifespan. The automotive sector, experiencing a shift towards electric vehicles, is increasingly requiring UV tapes for chip protection and other electronic applications in vehicles. Additionally, companies are actively leveraging government incentives and policies that support electronics manufacturing in emerging economies like India and Vietnam, fuelling the regional production of UV tapes. Amid rising environmental concerns, manufacturers are continuously innovating to develop eco-friendly UV tapes, addressing stringent sustainability regulations across the region. These developments are collectively enhancing the adoption of UV tapes across diverse industries, further propelling market growth.

Europe UV Tapes Market Analysis

The demand for UV tapes in Europe is majorly driven by the increasing adoption of high-tech manufacturing technologies in electronics and semiconductor industries. Manufacturers are looking forward to precision and efficiency, and therefore, UV tapes are increasingly used for the superior adhesive properties during delicate processes like dicing and back grinding of semiconductor wafers. For renewable energy, UV tapes are highly integrated in manufacturing photovoltaic cells to withstand exposure by strong temperatures and UV during photoprocessing for assembly. The automotive sector's application of UV tapes in electronic packaging and the assembly for the creation of more highly miniaturized components through increased usage in electric and more complex vehicle applications, specifically EVs and ADAS is boosting its market reach in Europe. According to UK government, in 2022, motor vehicles and parts manufacturing added USD 16.91 Billion to the economy, making up 0.6% of the UK's total output. The strong emphasis of the region on sustainability is further driving the use of UV tapes that are in strict compliance with environmental regulations with low VOC emissions and recyclable material use. Moreover, the need for customized tape solutions in medical device manufacturing and other precision applications is constantly being upgraded with the innovative endeavours of the companies. The increasing investment in research and development (R&D) across the region is also enabling advancements in UV tape formulations, catering to specific industrial needs and driving the market forward in niche, high-value applications.

Latin America UV Tapes Market Analysis

The demand for UV tapes in Latin America is currently being driven by their growing application in the electronics and semiconductor industries, where manufacturers are increasingly using them for wafer dicing and back-grinding processes to ensure precision and minimize damage. Companies are actively innovating their production techniques to address the rising need for high-performance materials, particularly as the region's semiconductor market is expanding due to technological advancements and investment in microelectronics. The automotive sector is also adopting UV tapes for various assembly processes, leveraging their strong adhesion and easy removability during production, as vehicle manufacturing in countries like Brazil and Mexico continues to ramp up. According to the International Trade Administration, Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. At the same time, packaging companies are incorporating UV tapes to improve product safety and tamper-proofing, aligning with the increasing regulatory focus on secure and sustainable packaging solutions. Moreover, the solar energy industry is rapidly integrating UV tapes for module manufacturing and installation processes, as Latin American countries pursue renewable energy targets. Manufacturers are focusing on creating UV tapes with improved UV resistance and thermal stability to cater to these dynamic requirements. These developments are collectively fostering the growth of UV tape applications across diverse industrial sectors, reflecting the region's ongoing industrial and technological progression.

Middle East and Africa UV Tapes Market Analysis

The demand for UV tapes in the Middle East and Africa is growing as industries are actively expanding their focus on advanced semiconductor manufacturing and electronic component production. Companies are increasingly adopting UV tapes for their critical role in wafer dicing and die attachment processes, ensuring precision and reduced material damage. Simultaneously, the region's burgeoning solar energy sector is employing UV tapes to enhance the durability and efficiency of photovoltaic cells, addressing the increasing energy needs. According to Statistics South Africa, in 2022, 21 municipalities across 7 provinces supplied solar home systems to 149 919 households. With governments investing heavily in infrastructure and automotive sectors, manufacturers are incorporating UV tapes to ensure reliable bonding and protection in harsh climatic conditions, such as high temperatures and sand exposure. Moreover, the packaging industry in the region is leveraging UV tapes for high-precision lamination and sealing, catering to the expanding e-commerce and food sectors. Local players are also prioritizing the use of UV tapes in electronic displays and flexible printed circuit boards as consumer demand for advanced gadgets rises. Additionally, strict regulations on material performance and environmental sustainability are driving industries to prefer UV tapes, which offer minimal residue and superior environmental compatibility. These trends reflect the dynamic adoption of UV tape technology tailored to the region's unique industrial and environmental needs.

Competitive Landscape:

Based on the emerging UV tapes market trends, key players in the market are actively pursuing strategies to strengthen their market positions and address evolving industry demands. They are investing in research and development (R&D) to innovate and enhance product offerings, focusing on creating UV tapes with superior adhesion, temperature resistance, and eco-friendly materials to meet stringent environmental regulations. Furthermore, collaborations and partnerships are being formed to expand technological capabilities and market reach, enabling companies to cater to a broader customer base. Additionally, these players are exploring mergers and acquisitions to consolidate their market presence and diversify product portfolios, aiming to provide comprehensive solutions across various applications. Apart from this, key players are positioning themselves to effectively meet the growing demand for UV tapes in sectors such as electronics, automotive, and construction, ensuring they remain competitive in a dynamic market landscape.

The report provides a comprehensive analysis of the competitive landscape in the UV tapes market with detailed profiles of all major companies, including:

- AI Technology Inc.

- Chase Corporation

- Denka Company Limited

- Furukawa Electric Co. Ltd.

- LINTEC Corporation

- Loadpoint Ltd

- Minitron Elektronik GmbH

- Mitsui Chemicals

- Nitto Denko Corporation

- Sumitomo Bakelite Co. Ltd.

- Ultron Systems Inc.

Latest News and Developments:

- June 2021: Henkel announced a significant increase in its production capacity for UV acrylic hotmelt pressure-sensitive adhesives (PSAs) in Europe. This expansion aims to address previous capacity constraints and meet the growing demand for UV-curable PSAs across various sectors, including tapes, labels, medical, and graphic films.

- February 2024: Researchers from Kyushu University, in collaboration with Nitto Denko, introduced an innovative UV-sensitive tape designed to simplify the transfer of two-dimensional (2D) materials, such as graphene. This tape alters its adhesion properties when exposed to UV light, enabling the efficient transfer of 2D materials onto various substrates, including silicon, ceramic, glass, and plastic. This advancement holds promise for applications in electronics and medical devices.

- March 2024: Bostik, adhesive solutions by Arkema, has invested in UV acrylic hot melt pressure sensitive adhesive (UV acrylic HMPSA) capabilities, expands the manufacture of UV acrylic HMPSAs within its North American facilities and brings its high-performance portfolio to market.

- October 2024: Labelexpo India 2024 Technology Preview highlighted several exhibitors showcasing products relevant to the UV tape market. H.B. Fuller exhibited a comprehensive range of high-performance pressure-sensitive adhesives (PSAs), including UV acrylic PSAs, tailored for the production of tapes, labels, and protective films.

UV Tapes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polyolefin, Polyvinyl Chloride, Polyethylene Terephthalate, Others |

| Applications Covered | Wafer Dicing, Back Grinding, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AI Technology Inc., Chase Corporation, Denka Company Limited, Furukawa Electric Co. Ltd., LINTEC Corporation, Loadpoint Ltd, Minitron Elektronik GmbH, Mitsui Chemicals, Nitto Denko Corporation, Sumitomo Bakelite Co. Ltd. and Ultron Systems Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UV tapes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global UV tapes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UV tapes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UV tapes market was valued at USD 537.52 Million in 2024.

IMARC estimates the UV tapes market to exhibit a CAGR of 8.26% during 2025-2033.

Key factors driving the global UV tapes market include the growing demand from the electronics and semiconductor industries, rapid advancements in flexible displays, increasing adoption in automotive electronics, rising innovations in adhesive technologies, heightened use in medical devices, and expanding applications in renewable energy and construction sectors.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the UV tapes market include AI Technology Inc., Chase Corporation, Denka Company Limited, Furukawa Electric Co. Ltd., LINTEC Corporation, Loadpoint Ltd, Minitron Elektronik GmbH, Mitsui Chemicals, Nitto Denko Corporation, Sumitomo Bakelite Co. Ltd. and Ultron Systems Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)