Very Light Jet Market Report Size, Share, Trends and Forecast by Aircraft Type, Material, Propulsion, End Use, and Region, 2025-2033

Very Light Jet Market Overview:

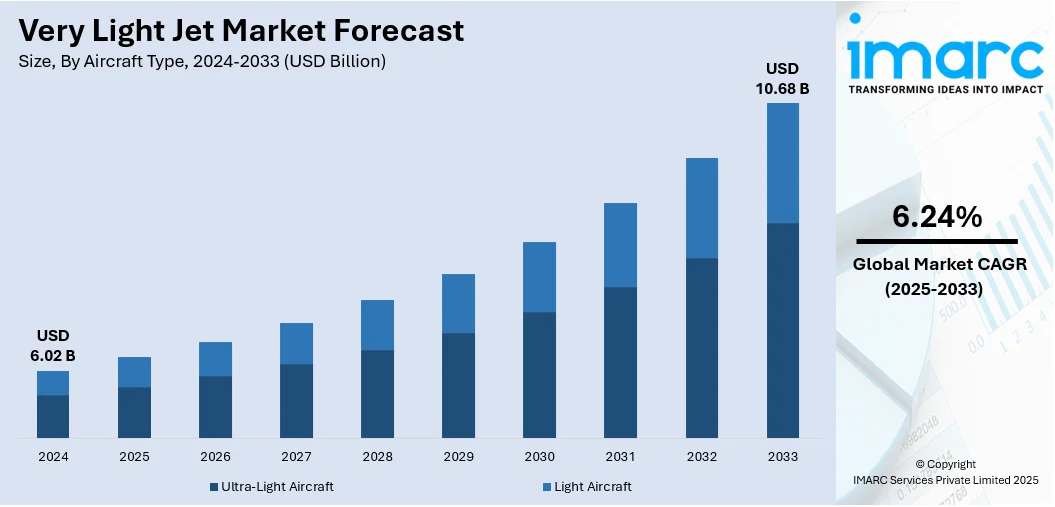

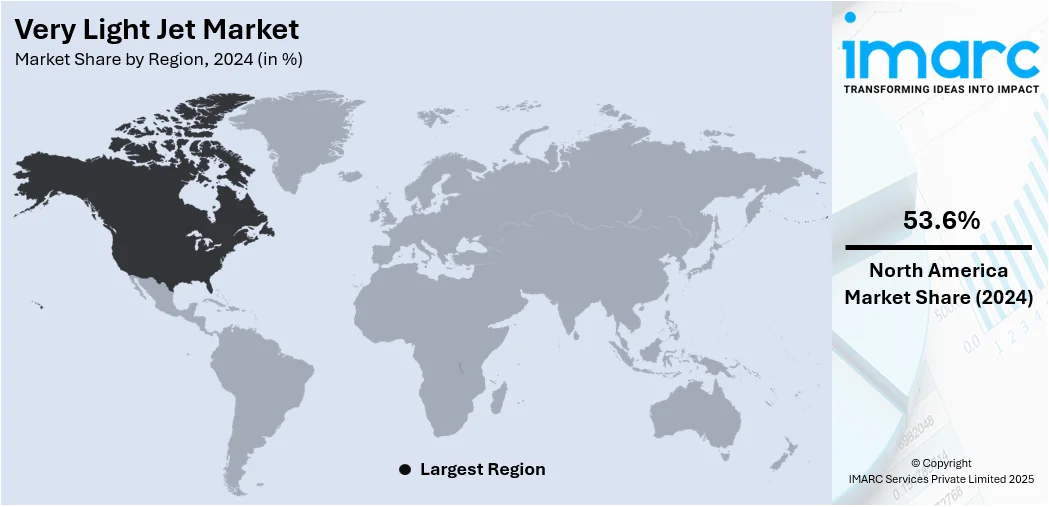

The global very light jet market size was valued at USD 6.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.68 Billion by 2033, exhibiting a CAGR of 6.24% during 2025-2033. North America currently dominates the market, holding a significant market share of around 53.6% in 2024. The market is propelled by the growing need for cost-effective and time-saving air travel solutions, especially from business travelers and private owners who need flexibility and convenience. In addition to that, technology improvements in airplanes are improving performance and lowering operating expenses. Moreover, expansion of on-demand charters and rising usage of air taxis are major drivers augmenting the very light jet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.02 Billion |

|

Market Forecast in 2033

|

USD 10.68 Billion |

| Market Growth Rate (2025-2033) | 6.24% |

The market is majorly driven by rising demand for cost-effective, short-haul business travel and the growing preference for point-to-point connectivity. In addition to this, continual advancements in avionics and lightweight composite materials are reducing operational costs and improving fuel efficiency, making these jets attractive for private owners and charter operators. Also, the surge in air taxi services and the expansion of regional airports are fueling adoption. Notably, InterGlobe Enterprises signed a memorandum of understanding (MoU)with U.S.-based Archer Aviation to launch electric air taxi services in India by 2026, pending regulatory approvals. The partnership plans to introduce up to 200 of Archer’s “Midnight” eVTOL aircraft, each capable of carrying four passengers and a pilot, with operations initially targeting major cities such as Delhi, Mumbai, and Bengaluru. Moreover, increasing interest from corporate travelers seeking flexibility and time savings, along with investments in pilot training programs and fractional ownership models, is further supporting market growth.

To get more information on this market, Request Sample

In the United States, the market expansion is propelled by the robust general aviation infrastructure, increased investments, and the presence of a large network of regional airports. For instance, in July 2024, the Federal Aviation Administration (FAA) announced the seventh allocation of Airport Infrastructure Grants (AIG), awarding USD 289 Million to support 129 airports across 40 states. These funds aim to enhance the safety, capacity, and efficiency of air travel nationwide. One of the emerging very light jet market trends in the region is the rising adoption of air taxis for urban and intercity travel, which is also a significant factor increasing the demand. Furthermore, favorable regulatory frameworks and tax incentives for private aircraft ownership. Also, technological upgrades in navigation and safety systems are encouraging new entrants. Corporate adoption is increasing as companies seek efficient alternatives to commercial flights. Besides this, the presence of leading manufacturers, expanding charter services, and strong economic conditions is driving purchases. Additionally, the push for sustainable aviation solutions enhances the appeal of fuel-efficient very light jets.

Very Light Jet Market Trends:

Growth in the Travel and Tourism Industry

The significant growth of the travel and tourism sector is leading to a growing demand for non-scheduled charter flights. This, in turn, is providing a boost market expansion. As per industry reports, international tourist arrivals grew 5% during the first quarter of 2025 from the same period in 2024, reflecting a strong rebound in global tourism and enhancing demand for personalized aviation services. These aircraft provide direct access to remote destinations and smaller airports, to which commercial airlines frequently find it difficult to travel. With more tourist operators and upscale resorts teaming up with charter airlines, the use of very light jets for personalized travel packages has grown. In addition, growing demand for adventure tourism, high-end vacations, and destination travel among high-income travelers further augments the demand. Moreover, the post-pandemic preference for private travel that minimizes the threat and inconvenience of crowded airports fueled market adoption.

Expansion of Air Taxi and On-Demand Charter Services

The expansion of air taxi networks and on-demand charter services is positively impacting the very light jet market outlook by broadening the reach of private aviation to new customer segments. In January 2024, Supernal LLC, Hyundai Motor Group's advanced air mobility arm, showcased its S‑A2 electric vertical takeoff and landing (eVTOL) concept at CES 2024 in Las Vegas. With capacity for a pilot and four passengers, this launch underscores the market’s shift toward integrating sustainable technologies and urban air mobility concepts with the very light jet segment. The aircraft features eight tilting rotors and a distributed propulsion system, with projected cruise speeds of approximately 120 mph (~193 km/h). Other than this, increased emphasis on urban-to-urban connectivity, with passengers demanding convenient and prompt transportation between cities with few commercial flying possibilities, is compelling the charter operators to expand their fleet. Besides this, technological platforms and mobile apps for booking have also simplified on-demand services, making them popular among business and leisure travelers. The trend is bound to continue as more areas adopt flexible mobility solutions and tailored travel choices.

Increasing Number of High Net Worth (HNW) Individuals

The rise in the number of high net worth individuals is significantly influencing the very light jet market growth. According to reports, the global HNWI population grew by 4.4% year-on-year in 2024, reaching 2,341,378, up from 2,243,300 in 2023. Wealthy individuals are increasingly seeking personalized and time-efficient travel solutions that provide convenience and privacy, making very light jets an attractive option. These aircraft are considered cost-effective compared to larger private jets while still offering luxury, speed, and flexibility. The expanding global base of HNW individuals, particularly in emerging economies, is creating new opportunities for private aviation services, fractional ownership programs, and charter operators. Many buyers are first-time private jet users, and very light jets serve as an entry-level solution for private ownership. This growing demographic is also driving the development of aircraft with advanced avionics, premium interiors, and enhanced fuel efficiency to meet the preferences of affluent travelers who prioritize comfort, exclusivity, and cutting-edge technology.

Very Light Jet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global very light jet market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type, material, propulsion, and end use.

Analysis by Aircraft Type:

- Ultra-Light Aircraft

- Light Aircraft

Light aircraft leads the market with around 61.5% of market share in 2024. They are cost-effective, versatile, and suitable for short-range travel. These aircraft are designed to operate at reduced fuel prices and with less maintenance compared to traditional airplanes; therefore, they are appealing to individual owners, corporate fleets, and air taxis. Their capacity to use small airports and short runways extends reach to areas where large jets cannot penetrate, making them highly market relevant. In corporate aviation, light aircraft offer a compromise between comfort and price, acting as an opening class for individuals and corporations that can afford private flying. They find growing applications in pilot training and fractional programs, further stimulating demand. As technological advancements in lightweight materials and avionics proceed, light aircraft are further cementing themselves as a mainstream segment of the very light jet market, driving its growth and accessibility.

Analysis by Material:

- Aluminum

- Composites

- Others

Composites lead the market with around 39.6% of market share in 2024. Composites are lightweight, high-strength, and corrosion-resistant. These products are important in lowering overall aircraft weight, which straightaway enhances fuel efficiency, range, and payload capacity. Their moldability enables creative aerodynamic designs, leading to increased performance and reduced operating costs. The maintenance-free nature of composites lowers maintenance needs, and this is an important consideration for operators wishing to achieve cost-effectiveness. Additionally, their resistance to harsh weather conditions increases safety and reliability. As environmental issues escalate, composites play their part in sustainability by facilitating improved fuel efficiency and hybrid or electric drive technology advancements. As technology continues to evolve, the application of composites in fuselage structures, wings, and interior parts continues to increase, cementing their role as a material of choice in the production of new very light jets.

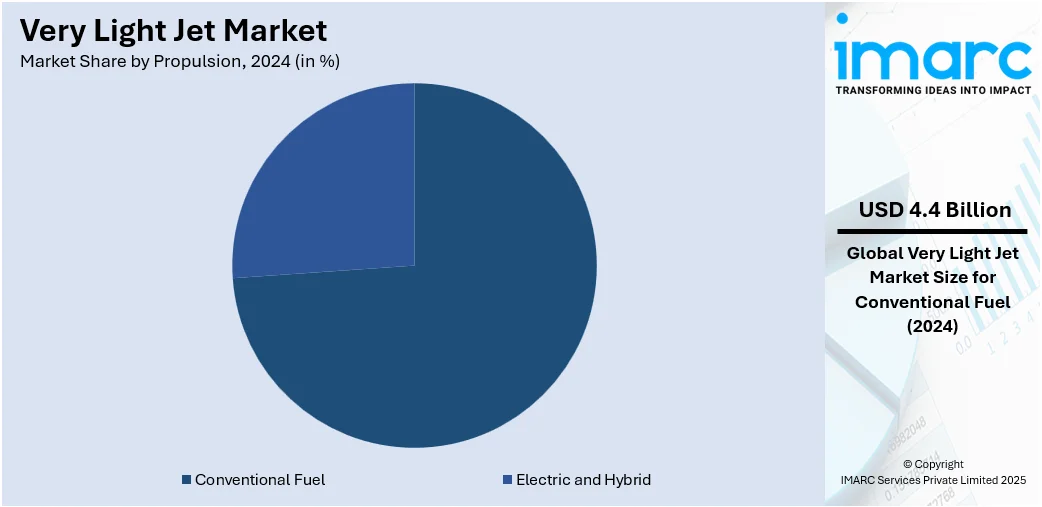

Analysis by Propulsion:

- Electric and Hybrid

- Conventional Fuel

Conventional fuel leads the market with around 73.6% of market share in 2024. This segment is known for its established reliability, existing infrastructure, and compatibility with existing engine technologies. Conventional aviation fuel-powered jets provide greater energy density than alternative fuels, which guarantee longer range and better performance, essential for business and personal travel. The global access to refueling stations facilitates smooth operations, and conventional fuel propulsion proves to be an economical option for operators and owners of fleets. It is also cost-effective in maintenance and operational stability, as conventional fuel engines have a proven history of operation and safety. Although there is increasing interest in sustainable aviation fuels and hybrid systems, conventional fuel remains dominant, as it accommodates the high speed, power, and range requirements of very light jet consumers.

Analysis by End Use:

- Civil and Commercial

- Military

Civil and commercial applications dominate the market as these aircraft are widely used for private flights, business flights, air taxis, and pilot training. Their relative affordability and lower operating costs render them an attractive option for small and medium-sized companies looking for flexible and time-saving travel options. Charter and air taxi operators also prefer very light jets as they offer economical means of short to medium-range travel, serving cities that are not well connected with commercial airlines. Furthermore, flight schools and aviation schools are increasingly incorporating these jets to train advanced pilots owing to their state-of-the-art avionics and handling ease. The increasing need for customized and call-for-service air travel continues to enhance the significance of civil and commercial end use within this market.

Military use of very light jets, though scaled down compared to civil and commercial sectors, is significant for special operations. These jets are used in most training exercises involving pilots, liaison missions, surveillance, and light transport. These jets are agile, cost-friendly to operate, and could take off from shorter runways; they are ideal for quick-response tasks and regional operations. Very light jets are also being used for low-cost training programs to enable air forces to train pilots on large and sophisticated aircraft. A few of the models are specialized towards surveillance or intelligence operations because of their speed and capability to use lower altitudes. While defense agencies seek cost-effective solutions that still do the job, the military segment still accounts for a solid share in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 53.6%. The market in the region is propelled by its robust aviation infrastructure, high demand for business and private air travel, and major manufacturers and suppliers within the region. The market is supported by a well-developed network of airports, where many small airports are available for very light jet operations. Much of the demand is led by corporate executives, entrepreneurs, and private owners who look for convenient and time-efficient travel solutions. Also, the demand in the United States for air taxi operations and fractional ownership programs further supports the market expansion. In addition, North America's regulatory environment facilitates design and manufacturing innovation, promoting development in fuel efficiency and avionics. Benefiting from an established customer base and growing interest in personal aviation, North America remains at the forefront in propelling the overall growth of the market.

Key Regional Takeaways:

United States Very Light Jet Market Analysis

In 2024, the United States holds a substantial share of around 90.70% of the very light jet share in North America. The market in the United States is witnessing robust growth driven by the increasing popularity of private aviation for short-haul regional travel. A surge in point-to-point connectivity needs across underserved airports is prompting a rise in VLJ operations. The proliferation of on-demand air mobility services and the rise in fractional ownership programs are further encouraging market penetration. Technological advancements in avionics and lightweight materials enhance operational efficiency, making VLJs an appealing option for individual and business travelers alike. Moreover, a growing segment of high-net-worth individuals and small business owners is increasing the demand for cost-effective private air travel alternatives. As per industry reports, over the past decade, the United States has witnessed remarkable growth in wealth accumulation, marked by a 78% increase in the number of millionaires between 2014 and 2024. The trend toward decentralized business operations is also increasing the frequency of travel to remote locations, where VLJs serve as practical solutions. Additionally, favorable regulatory support for general aviation and investments in secondary airport infrastructure facilitates the growth of regional air mobility solutions. With rising interest in eco-conscious aviation, manufacturers are also exploring hybrid propulsion systems, positioning the market for sustainable innovation.

Europe Very Light Jet Market Analysis

In Europe, the market is experiencing steady expansion, supported by rising demand for personalized and time-efficient travel options among business professionals. The region’s dense network of smaller airports and intercity routes makes VLJs a suitable choice for intra-European flights. According to an industry report, Europe recorded a 4.9% rise in international tourist arrivals in Q1 2025 compared to the same period last year, supporting broader air travel demand and secondary airport usage. Increased interest in low-emission, short-haul aviation is encouraging the adoption of fuel-efficient aircraft models tailored for urban-to-regional mobility. Moreover, the trend of agile corporate travel, combined with stricter time management needs, is favoring compact and faster jet solutions. The growing presence of luxury air mobility services is also contributing to market appeal, particularly for niche travelers seeking premium experiences without the cost of larger jets. The shift toward digital booking platforms is simplifying access to VLJ charters, expanding user engagement across younger and tech-savvy demographics.

Asia Pacific Very Light Jet Market Analysis

The market in the Asia Pacific is progressing steadily, driven by the expansion of regional air connectivity and demand for efficient intra-country travel. Industry reports indicate that India’s airport network expanded from 74 airports in 2014 to 159 in 2024, more than doubling in a decade, creating new avenues for VLJ utilization across regional corridors. The rise of affluent middle-class populations with an interest in private aviation is fueling market momentum. In fast-developing economies, VLJs are increasingly viewed as tools for business scalability, allowing executives to access multiple locations within limited timeframes. Additionally, infrastructure developments such as the emergence of new regional airports are creating favorable conditions for VLJ deployments. The preference for short-distance, low-capacity aircraft aligns well with regional travel requirements, especially across archipelagos and remote industrial hubs. The integration of digital scheduling and flight management systems is further easing operational complexities, making VLJs more accessible to first-time users.

Latin America Very Light Jet Market Analysis

The very light jet market in Latin America is gaining traction amid growing demand for flexible transportation across remote and underserved areas. According to an industry report, travel and tourism sector in Brazil is projected to exceed USD 167 Billion in contribution by 2025, underlining the region’s expanding air mobility landscape. Economic diversification efforts in various sectors are increasing executive travel to regions where traditional aviation infrastructure is limited. VLJs offer a practical mobility solution with minimal runway requirements, making them ideal for smaller airfields. Local entrepreneurs' interest in private aviation, cross-border business use, air charter services, and leasing models is boosting adoption. VLJs offer cost-effective alternatives to commercial aviation, particularly in the region's uneven transport infrastructure.

Middle East and Africa Very Light Jet Market Analysis

The very light jet market in the Middle East and Africa is developing steadily, fueled by growing inter-regional business travel and increased interest in decentralized aviation services. A recent report highlights that the MENA business travel sector reached USD 18.1 Billion in 2024 and is expected to grow at 6.1% year-over-year into 2025, surpassing the global average, an encouraging sign for business-oriented aviation. The rising presence of mobile professionals and consultants is prompting demand for nimble and time-efficient aircraft capable of reaching secondary destinations. Infrastructure improvements in regional airports and private terminals are making VLJ operations more feasible across remote and semi-urban zones. Additionally, the rising awareness of air mobility as a strategic productivity tool is drawing attention to VLJs for short-hop connectivity. With an increasing emphasis on rapid, point-to-point executive travel, the market is finding relevance among a new segment of cost-conscious private flyers.

Competitive Landscape:

The market is characterized by innovation in design, reduced operating costs, and increasing demand for personal and business travel over short to mid-range distances. Competition revolves around performance efficiency, cabin comfort, and advanced avionics integration. In addition to this, manufacturers are focusing on jets with better fuel economy, lower emissions, and reduced noise levels to meet environmental standards. Furthermore, the market is also shaped by the growth of air taxi services and private charters, which rely on cost-effective yet high-performance aircraft. Price sensitivity and maintenance requirements play a significant role in shaping buyer preferences. According to the very light jet market forecast, the market is set to expand steadily due to rising interest from small fleet operators and individual buyers seeking affordable entry into private aviation. Apart from this, advances in lightweight materials, hybrid propulsion concepts, and digital cockpit technologies are expected to enhance market differentiation. Also, the competition is intense among key players with the increased adoption among private owners, fractional ownership programs, and regional connectivity initiatives across developed and emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the very light jet market with detailed profiles of all major companies, including:

- Bombardier Inc.

- Cirrus Design Corporation (Aviation Industry Corporation of China)

- Diamond Aircraft Industries (Wanfeng Aviation Industry Co. Ltd.)

- Embraer S.A.

- Honda Aircraft Company (Honda Motor Company)

- Nextant Aerospace

- Pilatus Aircraft Ltd

- Stratos Aircraft Inc.

- Textron Aviation Inc

Latest News and Developments:

- July 2025: OneFlight International introduced a limited promotion offering jet cards at up to 50% below average rates across three categories, light, super-midsize, and heavy jets. The light jet card costs USD 110,000 for 20 hours. The promotion followed a 63.4% revenue surge and over 100% growth in member accounts year-to-date.

- June 2025: X-1 Jets unveiled a summer-exclusive JetCard for U.S. citizens flying in Europe, featuring Phenom 300 light jets. Offered in 6.25, 12.5, and 25-hour tiers, it enables flexible, blackout-free travel with seven days’ notice. Concierge-backed services emphasized seamless luxury travel across European destinations from May to September 2025.

- February 2025: British firm AERALIS created AERALIS France to deliver flexible light jet systems across Europe. The move supported civil certification through EASA and future Anglo-French defense collaboration. This step allows private operators to adopt affordable “Aircraft-as-a-Service” models, minimizing government investment and preparing for the replacement of aging European light jet fleets.

- January 2025: Honda Aircraft inaugurated its Echelon advanced systems integration test facility in Greensboro, North Carolina. The ASITF, built using wind tunnel-informed aerodynamic models, facilitated early-stage testing of flight systems, controls, and electronics. The initiative aimed to mature the Echelon design, reduce development costs, and accelerate readiness for flight testing.

Very Light Jet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Aircraft Types Covered | Ultra-Light Aircraft, Light Aircraft |

| Materials Covered | Aluminum, Composites, Others |

| Propulsions Covered | Electric and Hybrid, Conventional Fuel |

| End Uses Covered | Civil and Commercial, Military |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bombardier Inc., Cirrus Design Corporation (Aviation Industry Corporation of China), Diamond Aircraft Industries (Wanfeng Aviation Industry Co. Ltd.), Embraer S.A., Honda Aircraft Company (Honda Motor Company), Nextant Aerospace, Pilatus Aircraft Ltd, Stratos Aircraft Inc. and Textron Aviation Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the very light jet market from 2019-2033.

- The very light jet market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the very light jet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The very light jet market was valued at USD 6.02 Billion in 2024.

The very light jet market is projected to exhibit a CAGR of 6.24% during 2025-2033, reaching a value of USD 10.68 Billion by 2033.

The market is driven by factors such as increased demand for private air travel, growing disposable incomes, and advancements in aviation technology that make these jets more affordable and efficient. Additionally, the expanding number of small and medium-sized businesses requiring efficient travel solutions contributes significantly to the market's growth.

North America currently dominates the very light jet market with a market share of around 53.6%. The dominance is fueled by the region’s high concentration of wealthy individuals and businesses that prioritize private travel for its convenience and flexibility. Additionally, the well-established aviation infrastructure and favorable regulatory environment further support this market leadership.

Some of the major players in the very light jet market include Bombardier Inc., Cirrus Design Corporation (Aviation Industry Corporation of China), Diamond Aircraft Industries (Wanfeng Aviation Industry Co. Ltd.), Embraer S.A., Honda Aircraft Company (Honda Motor Company), Nextant Aerospace, Pilatus Aircraft Ltd, Stratos Aircraft Inc. and Textron Aviation Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)