Veterinary Dental Equipment Market Size, Share, Trends and Forecast by Animal Type, Product, End Use, and Region, 2025-2033

Veterinary Dental Equipment Market Size and Share:

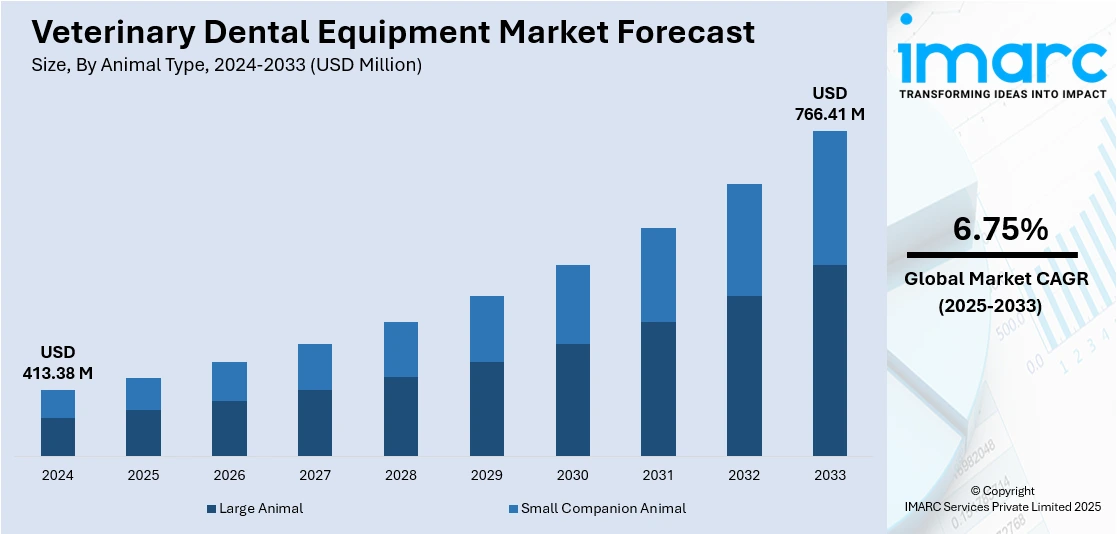

The global veterinary dental equipment market size was valued at USD 413.38 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 766.41 Million by 2033, exhibiting a CAGR of 6.75% during 2025-2033. North America currently dominates the market, holding a significant market share of over 44.1% in 2024. The market is driven by the growing demand for advanced dental procedures in companion animals, coupled with the rising adoption of digital diagnostic tools, and the proliferation of specialty veterinary clinics. Increased pet insurance penetration, rising disposable incomes, and targeted product innovations are enabling clinics to expand their dental service offerings, thereby fueling the market. Advancements in pain management and supportive care technologies are further augmenting the veterinary dental equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 413.38 Million |

|

Market Forecast in 2033

|

USD 766.41 Million |

| Market Growth Rate 2025-2033 | 6.75% |

The global market is primarily driven by the increasing prevalence of dental disorders in companion animals requiring professional intervention. In line with this, the rising penetration of pet insurance covering dental procedures is also providing an impetus to the market. Moreover, the expanding network of veterinary specialty practices offering advanced dental services is also acting as a significant growth-inducing factor for the market. In addition to this, the shift toward early diagnosis and preventive care is resulting in greater adoption of diagnostic dental tools, directly contributing to the veterinary dental equipment market growth. On September 6, 2024, Vimian Group AB announced its acquisition of 100% of iM3 Dental Limited (Ireland) and 80% of iM3 Pty Ltd (Australia) for approximately EUR 84 million (USD 90 million), with a potential earn-out of up to EUR 60 million (USD 64 million) over five years. iM3, a global veterinary dental equipment provider with sales in over 40 countries, reported annual revenues of EUR 35.9 million (USD 38.4 million) and EBITDA of EUR 7.7 million (USD 8.3 million) for the 12 months ending July 2024. This acquisition marks Vimian’s strategic entry into the veterinary dental equipment niche. Besides this, the growing integration of digital technologies, such as intraoral cameras and cloud-based dental records, is creating lucrative opportunities in the market.

The United States stands out as a key regional market, which is primarily driven by the presence of a highly structured pet healthcare system with strong veterinary service penetration. Besides this, the increasing adoption of evidence-based practice protocols and quality standards in animal dentistry is creating lucrative opportunities in the market. On January 11, 2024, Midmark Corporation launched its redesigned Midmark Mobile Dental Delivery System aimed at improving efficiency and safety in veterinary dental procedures. The system includes features such as high- and low-speed LED handpieces, a quieter oil-less compressor, integrated handles, an onboard maintenance checklist, and a compact design that fits under standard countertops, responding directly to feedback from veterinary professionals. The market is further driven by the emphasis on minimally invasive dental surgeries and supportive pain management solutions. Some of the other factors contributing to the market include advanced clinic infrastructure, rapid expansion of urban pet clinics, rising demand for mobile veterinary units, and accelerated innovation from U.S.-based dental equipment manufacturers.

Veterinary Dental Equipment Market Trends:

Rising Pet Ownership and Prevalence of Dental Disorders

The growing number of households with pets is significantly contributing to the demand for veterinary dental equipment. As more individuals integrate companion animals into their families, the need for regular oral healthcare services has increased. This trend is particularly relevant in countries like the United States, where, according to the American Pet Products Association (APPA), 94 million households currently own at least one pet. Such a rise in pet ownership has correlated with a rise in dental disorders, especially periodontal diseases, which are common among cats and dogs aged three years and older. These conditions affect the supporting structures of the teeth and require timely diagnosis and intervention, thereby boosting the need for specialized dental tools and technologies and creating a favorable veterinary dental equipment market outlook.

Preventive Oral Care and Growing Awareness

Another major driver of the veterinary dental equipment market is the heightened awareness among pet owners regarding preventive oral care. Routine evaluations and dental cleaning procedures are being increasingly emphasized by veterinary professionals. According to the Animal Medical Center, preventative cleaning and evaluations are recommended at least every 1–2 years, with follow-up exams typically scheduled within 3–6 months, depending on the animal’s condition. This structured approach to dental care has encouraged higher adoption of dental instruments, imaging tools, and hygiene equipment across veterinary clinics. Educational campaigns and the ready availability of such services have reinforced the importance of maintaining optimal pet oral health.

Supportive Policies, Economic Factors, and Technological Innovation

Supportive government policies and favorable economic dynamics are further accelerating the market's expansion. Several countries are actively implementing initiatives to promote veterinary dental care, making services and equipment more accessible. Additionally, rising disposable incomes have enabled pet owners to invest more in comprehensive health services, including dental care. This has coincided with a notable increase in veterinary practitioners, expanding the overall service capacity. Moreover, sustained research and development efforts have resulted in advanced dental technologies designed specifically for companion animals. As per the veterinary dental equipment market forecast, these next-generation solutions are playing a major role in enhancing procedural efficiency and clinical outcomes, thereby shaping the future trajectory of the market.

Veterinary Dental Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global veterinary dental equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on animal type, product, and end use.

Analysis by Animal Type:

- Large Animal

- Small Companion Animal

Large animal accounts for 64.7% of the market due to the significant dental care requirements in livestock, equines, and other production animals. These animals often experience dental conditions that directly impact productivity, nutrition, and welfare, prompting routine oral evaluations and interventions. Veterinarians specializing in large animal care frequently use advanced dental tools to perform procedures in farm or field settings, necessitating robust and portable equipment. The economic value of large animals in agricultural and equine industries further drives investment in preventive and therapeutic dental services. As awareness grows among livestock owners and equine professionals, the demand for specialized dental equipment increases, contributing substantially to the veterinary dental equipment market's overall growth trajectory.

Analysis by Product:

- Equipment

- Dental X-Ray Systems

- Electrosurgical Units

- Dental Stations

- Dental Lasers

- Powered Units

- Hand Instruments

- Dental Elevators

- Dental Probes

- Extraction Forceps

- Curettes and Scalers

- Retractors

- Dental Luxators

- Others

- Consumables

- Dental Supplies

- Prophy Products

- Others

- Adjuvants

Equipment constitutes the core of veterinary oral care services, making it the primary revenue contributor in the product segment. The category remains dominant due to its critical role in diagnostic, surgical, and preventive procedures. Equipment such as ultrasonic scalers, air-driven dental units, polishing devices, and radiographic systems are essential in both routine cleanings and complex interventions. Increasing demand for minimally invasive and efficient dental treatments is encouraging clinics and hospitals to invest in technologically advanced, ergonomic instruments tailored to various animal species. As innovations in design and functionality continue to improve procedural outcomes, the dental equipment category strengthens its foothold, driving operational efficiency and ultimately supporting veterinary dental equipment market growth.

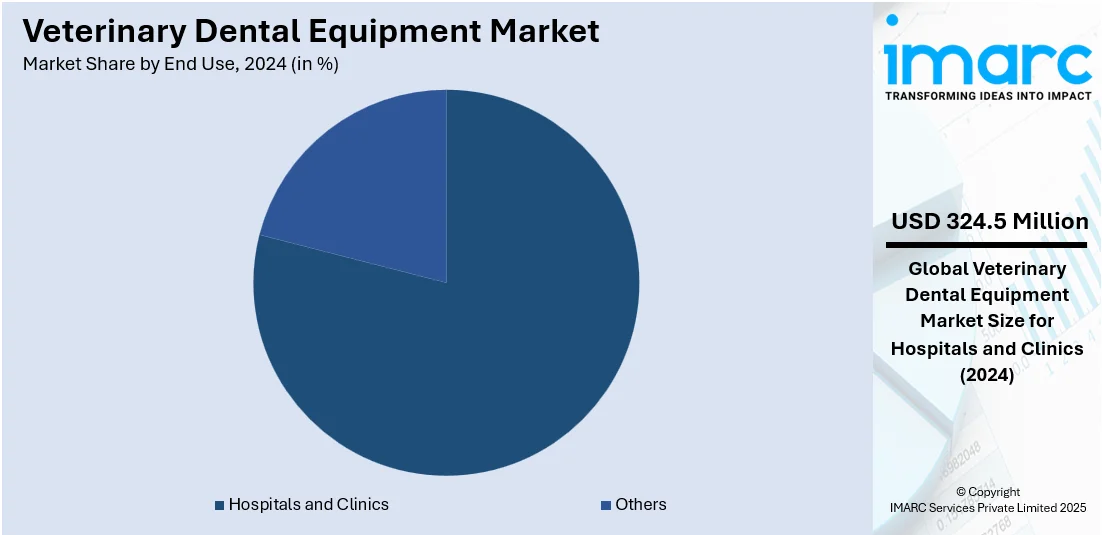

Analysis by End Use:

- Hospitals and Clinics

- Others

Hospitals and clinics represent the dominant segment, holding a 78.5% share in 2024. These facilities are central to the delivery of comprehensive veterinary dental services, offering both preventive care and complex dental surgeries under controlled clinical environments. Equipped with modern diagnostic and therapeutic instruments, hospitals and clinics serve as the primary hubs for dental examinations, cleanings, extractions, and post-operative care. The presence of skilled veterinary professionals and structured treatment protocols ensures higher service quality, encouraging pet owners to rely on institutional care. As more clinics adopt sophisticated dental equipment and broaden their service offerings, they continue to generate significant demand, thereby reinforcing their leading position and propelling overall veterinary dental equipment market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for 44.1% of the global market in 2024. The dominance is attributed to a well-established veterinary healthcare infrastructure, high pet ownership rates, and substantial pet health expenditures. The region also benefits from advanced technological adoption and a strong presence of key market players actively engaged in R&D and distribution. Regulatory support and educational campaigns further enhance awareness regarding animal dental health. Moreover, the growing emphasis on companion animal welfare and the routine inclusion of dental services in veterinary practices contribute to sustained equipment demand. As veterinary standards continue to evolve, North America’s leadership is expected to persist, significantly influencing the market growth globally.

Key Regional Takeaways:

United States Veterinary Dental Equipment Market Analysis

In 2024, the United States accounted for 89.80% of the total market share in North America. The United States market is experiencing steady growth, driven by the increasing prioritization of animal oral health and the expansion of advanced veterinary clinics. The rise in pet adoption across urban households, coupled with a growing emphasis on preventive care, is fostering demand for specialized dental tools. Additionally, continuous innovation in veterinary dental technologies, such as ultrasonic scalers and digital radiography systems, enhances procedural efficiency and accuracy. The market is also benefitting from an increased focus on companion animal wellness programs supported by veterinary associations. According to the American Pet Products Association (APPA), the pet industry shows continued growth and resiliency, with total U.S. pet industry expenditures reaching USD 152 Billion in 2024 and projected sales expected to rise to USD 157 Billion in 2025. This surge in spending reflects a broader willingness among pet owners to invest in advanced healthcare services, including dental care, further driving the adoption of veterinary dental equipment. Veterinarian dental services are integrating into general animal health checkups, expanding market offerings. Training programs, advanced infrastructure, and increased pet healthcare expenditure are boosting dental care adoption, boosting market penetration.

Europe Veterinary Dental Equipment Market Analysis

The market in Europe is advancing due to growing awareness about pet oral hygiene and the widespread availability of dental diagnostics in veterinary settings. A significant contributor to market development is the rising adoption of minimally invasive procedures, particularly for routine dental care and treatment. The World Animal Foundation states that around 13.5 million dogs and 12.5 million cats are kept as pets in the UK alone, highlighting the large companion animal population driving demand for enhanced dental care solutions. The increased demand for mobile veterinary services is further driving the need for portable and compact dental equipment. Additionally, the expansion of educational initiatives on veterinary dentistry is strengthening service capabilities across various veterinary institutions. The market is experiencing growth due to the increasing demand for customized treatment plans, technological integration, and the trend toward routine dental evaluations as part of comprehensive wellness programs.

Asia Pacific Veterinary Dental Equipment Market Analysis

The Asia Pacific market is gaining traction due to increasing investments in veterinary healthcare infrastructure and growing awareness among pet owners about dental hygiene. Urbanization and the rise of nuclear families have contributed to heightened pet humanization, boosting demand for premium veterinary care. In India, the National Animal Disease Control Programme's (NADCP) initiatives, including the goal to eliminate Foot and Mouth Disease by 2030 with over 114.56 Crore vaccines administered by April 2025, are strengthening overall veterinary health systems, indirectly supporting growth in specialized services such as dental care. A notable trend further supporting market expansion is the surge in pet insurance adoption, which is expanding access to specialized dental services. Veterinary clinics are incorporating veterinary dental care into academic curricula, enhancing regional expertise and service capacity, and contributing to the region's expanding market footprint in the veterinary dental equipment sector.

Latin America Veterinary Dental Equipment Market Analysis

In Latin America, the veterinary dental equipment market is witnessing upward momentum, primarily driven by the expansion of veterinary education and training facilities. Reports state that in 2022, there were over 30,000 veterinary establishments, such as clinics and hospitals, in Brazil, highlighting the region’s growing infrastructure. Increasing participation in international veterinary conferences and workshops is promoting knowledge transfer and adoption of modern dental practices. Local veterinary professionals are showing a growing inclination toward advanced dental instrumentation to enhance service quality. Additionally, the proliferation of small animal clinics in urban areas is fueling demand for basic and intermediate dental tools. These evolving dynamics are positioning the region for gradual growth in the veterinary dental equipment segment.

Middle East and Africa Veterinary Dental Equipment Market Analysis

The Middle East and Africa market is gradually expanding, supported by increasing investments in veterinary infrastructure and services. The Wisconsin Economic Development Corporation states that Africa’s veterinary sector is expected to more than double to USD 9.1 Billion by 2025, reflecting significant growth potential in the region. This expansion is further driven by the rising establishment of veterinary teaching hospitals and diagnostic centers, which enhance the availability of specialized care. Increased focus on zoonotic disease prevention has indirectly heightened attention to oral examinations during routine veterinary visits. Awareness campaigns for pet health are urging pet owners to seek dental care services, with specialized equipment adoption expected to continue in the Middle East and Africa.

Competitive Landscape:

Key players in the veterinary dental equipment industry are actively pursuing strategies to drive market growth through innovation, strategic partnerships, and geographic expansion. Companies are heavily investing in research and development to introduce advanced dental tools such as high-speed handpieces, ultrasonic scalers, and portable digital imaging systems tailored for animal care. Additionally, collaborations with veterinary hospitals and academic institutions are enabling product testing, practitioner training, and increased product visibility. Market leaders are also expanding their global distribution networks, targeting high-growth regions with rising pet ownership. Some firms are focusing on offering bundled service packages and subscription-based models for equipment maintenance and upgrades. These efforts are collectively enhancing product accessibility, clinical efficiency, and overall demand for veterinary dental solutions worldwide.

The report provides a comprehensive analysis of the competitive landscape in the veterinary dental equipment market with detailed profiles of all major companies, including:

- Acteon Group Ltd

- Charles Brungart Inc

- Cislak Manufacturing Inc.

- Dentalaire International

- Dispomed ltd

- Henry Schein Inc.

- iM3Vet Pty Ltd.

- Integra LifeSciences Corporation

- J & J Instruments Inc

- MAI Animal Health

- Midmark Corporation

- TECHNIK VETERINARY Ltd.

Latest News and Developments:

- May 2025: ANTECH launched RapidRead Dental, an AI-powered tool delivering 98% accurate veterinary dental radiograph evaluations in about 10 minutes. Built using over 275,000 teeth images, it provides real-time, tooth-by-tooth diagnostics, enhanced workflow efficiency, minimized anesthetic time, and supported better patient outcomes through annotated reports, improving both clinical decisions and client communication.

- May 2025: Mars launched the GREENIES Canine Dental Check, an AI-powered tool that assessed dogs' dental health using smartphone photos. Trained on over 53,000 images, it detects tartar and gum issues within seconds.

- March 2025: Barkle launched a no-brush dental gel for dogs, offering an easy, clinically tested solution to reduce plaque, tartar, and bad breath. Applied by finger cot, the gel uses safe ingredients and aims to make at-home canine oral care more accessible and effective.

- February 2025: Fera Pets launched its first dental supplement, Dental Support, a powdered formula for dogs and cats designed to enhance oral health without brushing. Containing enzymes, botanicals, and postbiotics like Oravestin™ and Bactase Pet™, the product supports cleaner teeth, fresher breath, and gum health by balancing the oral microbiome naturally.

Veterinary Dental Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Large Animal, Small Companion Animal |

| Products Covered |

|

| End Uses Covered | Hospitals and Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acteon Group Ltd, Charles Brungart Inc, Cislak Manufacturing Inc., Dentalaire International, Dispomed ltd, Henry Schein Inc., iM3Vet Pty Ltd., Integra LifeSciences Corporation, J & J Instruments Inc, MAI Animal Health, Midmark Corporation and TECHNIK VETERINARY Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the veterinary dental equipment market from 2019-2033.

- The veterinary dental equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the veterinary dental equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global veterinary dental equipment market size was valued at USD 413.38 Million in 2024.

The veterinary dental equipment market is projected to exhibit a CAGR of 6.75% during 2025-2033, reaching a value of USD 766.41 Million by2033.

The overall market is driven by increasing pet ownership, rising awareness of pet oral health, and the growing prevalence of periodontal diseases in companion animals. Enhanced access to veterinary dental services, favorable government policies, and innovations in next-generation equipment are further accelerating demand for veterinary dental solutions.

North America currently dominates the market, holding a significant market share of over 44.1% in 2024, supported by advanced pet healthcare infrastructure and high spending on companion animal wellness.

Major players in the veterinary dental equipment market include Acteon Group Ltd, Charles Brungart Inc, Cislak Manufacturing Inc., Dentalaire International, Dispomed Ltd, Henry Schein Inc., iM3Vet Pty Ltd., Integra LifeSciences Corporation, J & J Instruments Inc, MAI Animal Health, Midmark Corporation, and TECHNIK VETERINARY Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)