Vibration Monitoring Market Report by Component (Hardware, Software, Services), System Type (Embedded Systems, Vibration Analyzers, Vibration Meters), Monitoring Process (Online, Portable), End Use Industry (Energy and Power, Metals and Mining, Oil and Gas, Automotive, Food and Beverages, and Others), and Region 2025-2033

Vibration Monitoring Market Size:

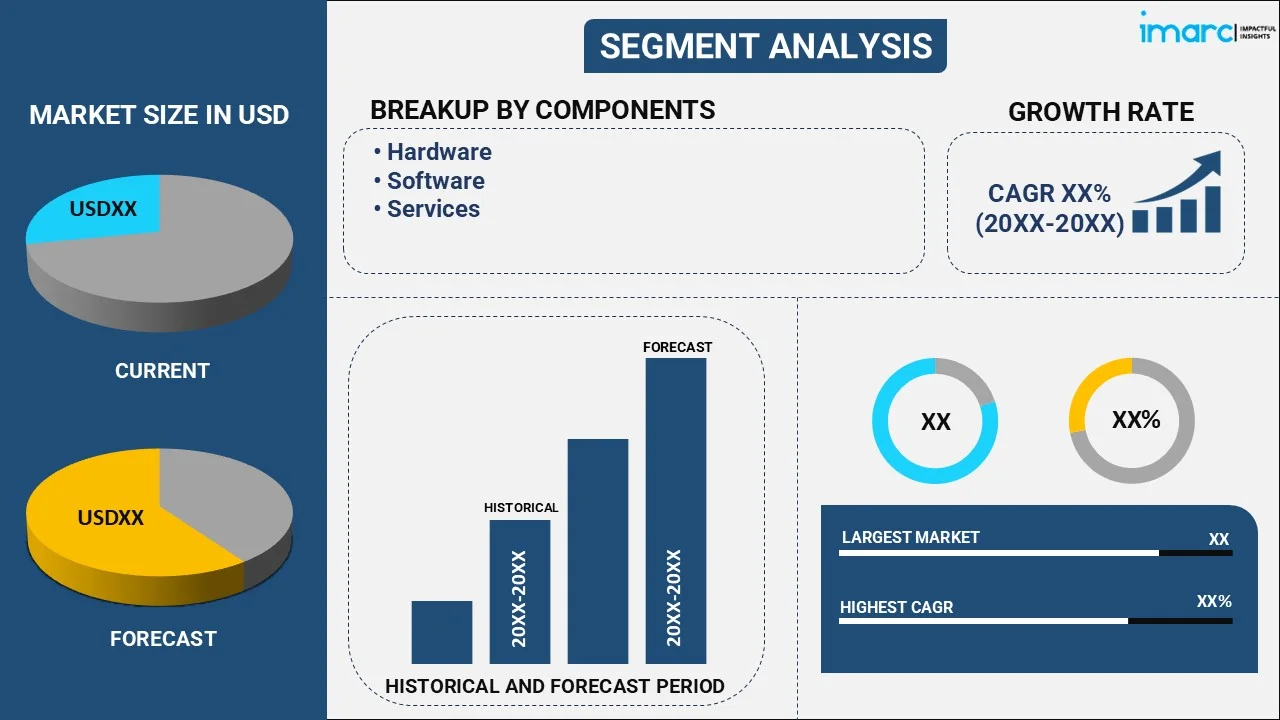

The global vibration monitoring market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market growth is primarily influenced by increasing concerns regarding safety across various industries and amplifying adoption of vibration monitoring to identify potential issues. In addition, the escalating popularity of predictive maintenance is also significantly contributing to the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.7 Billion |

|

Market Forecast in 2033

|

USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

Vibration monitoring is a critical process that is widely utilized in various industries to detect and analyze the vibrations of machinery and equipment. It is employed to spot possible issues before they result in serious harm or failure, which would need costly downtime and repairs. In order to measure the vibrations of machines and equipment, vibration monitoring requires sensors. These sensors are affixed to the machinery being observed, and they gather information on the vibrations' frequency, amplitude, and direction. Additionally, it uses a variety of sensors, such as piezoelectric accelerometers, velocity transducers, and proximity probes. The choice of a sensor relies on the application and the type of equipment being monitored. Each form of sensor has specific benefits and drawbacks. The vibration data is processed and analyzed by specialized software after it has been collected by the sensors. The software transforms the raw vibration data into informative data, such as frequency analysis, time waveforms, and vibration spectra. Moreover, the software is capable of carrying out numerous analyses, including frequency-domain, time-domain, and statistical analyses.

Vibration Monitoring Market Trends:

Increased Adoption of Predictive Maintenance

According to the vibration monitoring market forecast, magnifying adoption of predictive maintenance in key sectors, such as energy, manufacturing, and automotive, is anticipated to dominantly contribute to the expansion of product applications. Vibration monitoring systems assist in identifying equipment anomalies early, preventing costly downtime and elevating machinery lifespan. Moreover, various companies are heavily investing in such technologies to improve operational efficacy and lower the costs of maintenance. As key sectors emphasize on reducing unplanned breakdowns, the need for advanced vibration monitoring solutions is projected to fuel, mainly driven by the demand for enhanced credibility and safety in complex processes and machinery. As per industry reports, the global market value for predictive maintenance solutions is projected to exceed USD 8 billion in 2024.

Advancements in Wireless Vibration Monitoring Technologies

Technological advancements in wireless vibration monitoring systems are substantially steering the global market. Such systems offer real-time data and remote supervision abilities, making them highly effective for sectors with difficult-to-access equipment. Wireless sensors lower installation costs and provide better flexibility, enabling enterprises to inspect equipment without the need for comprehensive cabling. In addition, this trend is rapidly gaining momentum in industries such as manufacturing, oil and gas, and power generation, where operational efficacy and cost-efficiency are key aspects. Furthermore, the magnifying adoption of wireless technologies is improving the overall efficacy of vibration monitoring systems. In November 2023, Worldsensing launched the Vibration Meter, a new wireless sensor designed to measure vibration using a tri-axial accelerometer. This product offers excellent battery life, an enhanced communication range, and a more competitive price point.

Integration of IoT and AI in Vibration Monitoring

The incorporation of artificial intelligence (AI) and the Internet of Things (IoT) in vibration monitoring systems is a crucial trend in the market. IoT-enabled devices acquire real-time data from machines, while AI algorithms evaluate the data to forecast equipment failures and upgrade performance. This combination allows for improved diagnostics and automated maintenance decisions, enhancing the precision and efficacy of vibration monitoring. In addition, sectors such as transportation, manufacturing, and energy are rapidly adopting IoT and AI-powered solutions to improve equipment credibility, lower operational risks, and bolster productivity, resultantly fueling the vibration monitoring market demand. For instance, in April 2023, POLYN Technology launched VibroSense, an innovative small AI chip solution for vibration monitoring sensor nodes, effectively reducing power consumption and offering low latency.

Vibration Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, system type, monitoring process and end use industry.

Breakup by Component:

- Hardware

- Software

- Services

Hardware accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

Breakup by System Type:

- Embedded Systems

- Vibration Analyzers

- Vibration Meters

Embedded Systems holds the largest share of the industry

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes embedded systems, vibration analyzers, and vibration meters. According to the report, embedded systems accounted for the largest market share.

Breakup by Monitoring Process:

- Online

- Portable

Online represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the monitoring process. This includes online and portable. According to the report, online represented the largest segment.

Breakup by End Use Industry:

- Energy and Power

- Metals and Mining

- Oil and Gas

- Automotive

- Food and Beverages

- Others

Oil and Gas exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes energy and power, metals and mining, oil and gas, automotive, food and beverages, and others. According to the report, oil and gas accounted for the largest market share.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest vibration monitoring market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for vibration monitoring. Some of the factors driving North America vibration monitoring market included rapid industrialization, favorable government regulations and continual technological advancements, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global vibration monitoring market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Analog Devices Inc.

- Emerson Electric Company

- Erbessd Instruments Technologies Inc.

- General Electric Company

- Honeywell International Inc.

- Istec International

- Meggit SA

- National Instruments

- Parker-Hannifin Corp.

- Petasense Inc.

- Rockwell Automation Inc.

- Schaeffler AG

- SPM Instrument AB

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Vibration Monitoring Market News:

- In April 2024, The Timken Company, a prominent industrial motion products manufacturer, launched a new wireless sensor and vibration monitoring solution to detect any major fault preemptively. The system uses mesh technology to transmit data to a gateway receiver, which can be connected via WiFi or Ethernet. Users retain control of their data on-premise, ensuring security, and can monitor performance through a dashboard. This solution is designed for easy setup and is intended to enhance operational efficiency and reliability.

- In November 2023, Banner Engineering, an industrial automation company, launched a new product line focused on vibration monitoring for industrial automation, enabling predictive maintenance and reducing downtime. The system includes an Asset Monitoring Gateway that connects with up to 40 wireless sensors to gather real-time vibration data from equipment, ensuring efficient operation and minimizing unplanned downtime.

Vibration Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| System Types Covered | Embedded Systems, Vibration Analyzers, Vibration Meters |

| Monitoring Processes Covered | Online, Portable |

| End Use Industries Covered | Energy and Power, Metals and Mining, Oil and Gas, Automotive, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Emerson Electric Company, Erbessd Instruments Technologies Inc., General Electric Company, Honeywell International Inc., Istec International, Meggit SA, National Instruments, Parker-Hannifin Corp., Petasense Inc., Rockwell Automation Inc., Schaeffler AG, SPM Instrument AB |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vibration monitoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vibration monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vibration monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global vibration monitoring market was valued at USD 1.7 Billion in 2024.

We expect the global vibration monitoring market to exhibit a CAGR of 5.6% during 2025-2033.

The rising adoption of vibration monitoring technique, as it aids in enhancing the lifespan of a machine, providing real-time reaction to the change of health conditions, supporting remote conditioning monitoring, etc., is primarily driving the global vibration monitoring market.

The sudden outbreak of the C004FVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for vibration monitoring.

Based on the component, the global vibration monitoring market has been divided into hardware, software, and services. Among these, hardware currently exhibits a clear dominance in the market.

Based on the system type, the global vibration monitoring market can be categorized into embedded systems, vibration analyzers, and vibration meters. Currently, embedded systems account for the majority of the global market share.

Based on the monitoring process, the global vibration monitoring market has been segregated into online and portable, where online currently exhibits a clear dominance in the market.

Based on the end use industry, the global vibration monitoring market can be bifurcated into energy and power, metals and mining, oil and gas, automotive, food and beverages, and others. Currently, oil and gas holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global vibration monitoring market include Analog Devices Inc., Emerson Electric Company, Erbessd Instruments Technologies Inc., General Electric Company, Honeywell International Inc., Istec International, Meggit SA, National Instruments, Parker-Hannifin Corp., Petasense Inc., Rockwell Automation Inc., Schaeffler AG, and SPM Instrument AB.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)