Vietnam Access Control Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

Vietnam Access Control Market Overview:

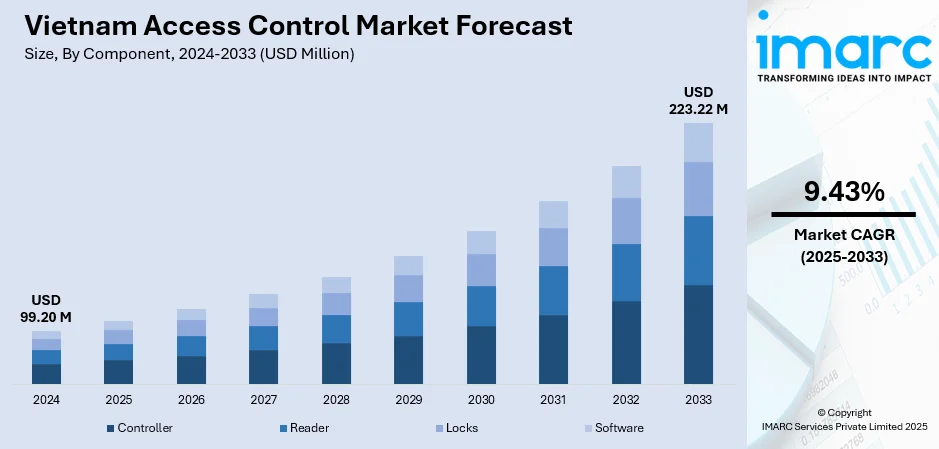

The Vietnam access control market size reached USD 99.20 Million in 2024. The market is projected to reach USD 223.22 Million by 2033, exhibiting a growth rate (CAGR) of 9.43% during 2025-2033. The market is driven by rapid industrial growth and increasing security needs across sectors like manufacturing and energy. The rising adoption of digital technologies, including biometric and cloud-based systems, enhances demand for advanced access solutions. Government initiatives supporting smart infrastructure and data protection further encourage businesses to implement secure access control. Additionally, urbanization and commercial development fuel the need for reliable security measures, collectively boosting the Vietnam access control market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 99.20 Million |

| Market Forecast in 2033 | USD 223.22 Million |

| Market Growth Rate 2025-2033 | 9.43% |

Vietnam Access Control Market Trends:

Industrial Expansion and Infrastructure Development:

Vietnam's increased industrialization and infrastructure expansion are a maa key Vietnam access control market trend. As new factories, transport centers, and energy plants come up, security has taken a priority to avoid theft, sabotage, and accidents. Access control systems are important as they dictate who enters critical locations, allowing only authorized individuals to have access. Future projects require comprehensive security solutions that integrate physical barriers with electronic technologies, including biometric scanners and smart cards. Both business and government sectors are heavily investing in these sophisticated systems to safeguard assets and ensure operational safety. Industrial areas are continuing to grow, and access control becomes mandatory for protecting workers and infrastructure, making it an integral part of Vietnam's developing industrial sector and security policy.

To get more information on this market, Request Sample

Digital Transformation and E-Government Initiatives:

Vietnam’s rapid digital transformation is driving strong demand for advanced access control solutions. As government services and administrative processes move online, secure identification and controlled access to digital platforms have become critical. A key example is the national ID system, which has enrolled over 70 million citizens within two years, highlighting the scale of digital identity adoption. This large-scale rollout necessitates robust authentication methods, including biometric access controls and cloud-based security solutions, to prevent fraud and ensure privacy. By integrating access control with these digital platforms, the government improves service efficiency while protecting sensitive citizen data. This digital shift is fueling growth in both public and private sectors, emphasizing the need for flexible, scalable security systems that enable seamless and secure access to vital infrastructure and services.

Regulatory Compliance and Data Protection Laws:

Vietnam's implementation of tighter data protection legislation is fueling robust Vietnam access control market growth in the access control market. Corporations and government agencies need to safeguard sensitive information from unauthorized access, boosting the need for secure entry systems. The legislation obliges firms to carefully control user permissions and watch out for access points to meet legal requirements. It also focuses on data sovereignty, promoting local data storage and regulation of tighter cross-border data transfers. To support these needs, organizations are embracing advanced technologies such as biometric systems, radio-frequency identification (RFID), and cloud-based access controls. These technologies enable greater security, flexibility, and compliance assistance. This regulatory emphasis is driving the move towards more evolved, trustworthy security infrastructures throughout Vietnam, better guarding confidential data and overall development of the access control market.

Vietnam Access Control Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, and end user.

Component Insights:

- Controller

- Reader

- Locks

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes controller, reader, locks, and software.

Type Insights:

- Card Based

- Contact

- Contactless

- Biometric Based

- Fingerprint

- Face Recognition

- Face Recognition and Fingerprint

- Iris Recognition

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes card based (contact, contactless) and biometric based (fingerprint, face recognition, face recognition and fingerprint, iris recognition, and others).

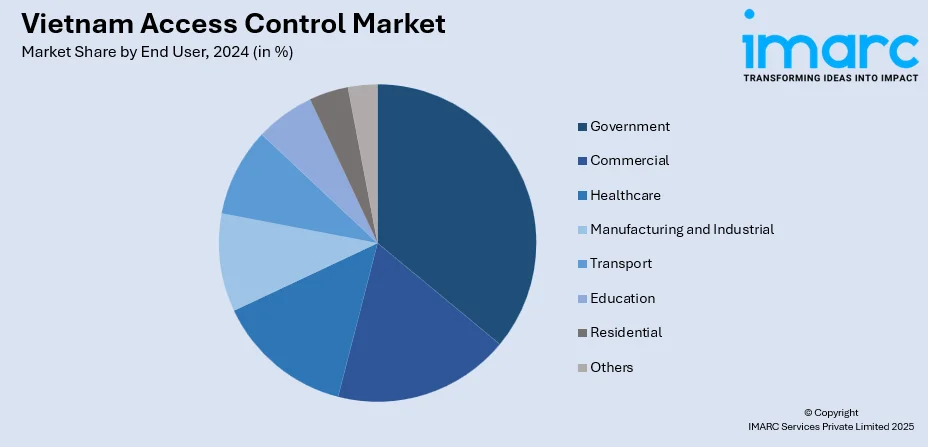

End User Insights:

- Government

- Commercial

- Healthcare

- Manufacturing and Industrial

- Transport

- Education

- Residential

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government, commercial, healthcare, manufacturing and industrial, transport, education, residential, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Access Control Market News:

- In July 2025, Vietnam launched a Level-2 electronic ID (e-ID) system for foreign residents, enabling access to digital services like banking and property registration via the VNeID app. Managed by the Ministry of Public Security, the system requires biometric data and valid residence permits for registration. The initiative aims to simplify administrative processes, with a 50-day registration campaign underway for eligible foreigners, aligning with global digital identity trends and enhancing convenience by digitizing residence cards.

- In July 2025, Vietnam launched NDAChain, its national blockchain platform, to enhance digital data infrastructure by 2026. Developed by the National Data Association, NDAChain provides a secure, transparent verification layer for the National Data Center, protecting critical data from cyber threats. The platform supports government and private sectors by ensuring data integrity and scalability, fueling Vietnam’s digital transformation with a hybrid architecture that combines centralized and decentralized systems.

Vietnam Access control Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Controller, Reader, Locks, Software |

| Types Covered |

|

| End Users Covered | Government, Commercial, Healthcare, Manufacturing and Industrial, Transport, Education, Residential, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam access control market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam access control market on the basis of component?

- What is the breakup of the Vietnam access control market on the basis of type?

- What is the breakup of the Vietnam access control market on the basis of end user?

- What is the breakup of the Vietnam access control market on the basis of region?

- What are the various stages in the value chain of the Vietnam access control market?

- What are the key driving factors and challenges in the Vietnam access control market?

- What is the structure of the Vietnam access control market and who are the key players?

- What is the degree of competition in the Vietnam access control market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam access control market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam access control market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam access control industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)