Vietnam Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Vietnam Agribusiness Market Overview:

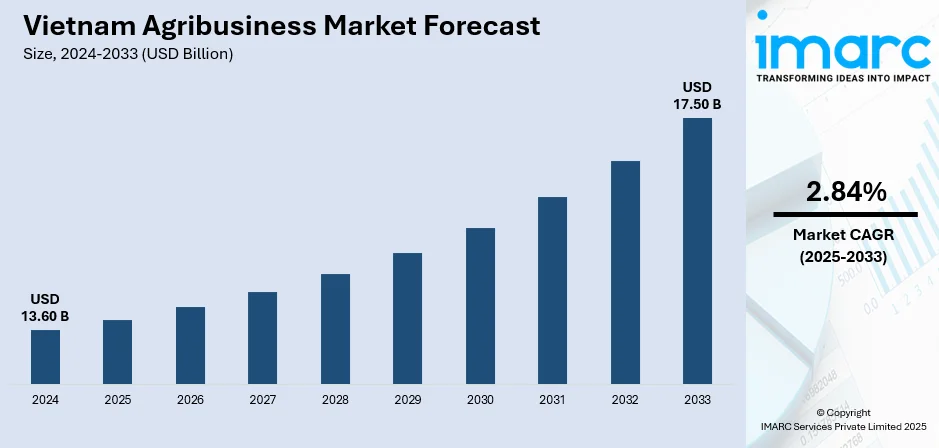

The Vietnam agribusiness market size reached USD 13.60 Billion in 2024. The market is projected to reach USD 17.50 Billion by 2033, exhibiting a growth rate (CAGR) of 2.84% during 2025-2033. Consistent international orders are motivating farmers to broaden cultivation areas, adopt modern farming techniques, and improve post-harvest processing to meet export standards. Besides this, people are shifting towards convenient and longer-shelf-life products like canned fruits and frozen seafood, thus contributing to the expansion of the Vietnam agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.60 Billion |

| Market Forecast in 2033 | USD 17.50 Billion |

| Market Growth Rate 2025-2033 | 2.84% |

Vietnam Agribusiness Market Trends:

Growing exports of rice and seafood

Strong export demand for rice and seafood is ensuring a steady revenue stream and boosting Vietnam’s global trade position. Vietnam's seafood exports saw an impressive rebound during the first quarter of 2025, achieving a total value of 2.45 Billion USD, representing a 26% increase compared to Q1 2024, as reported by the Vietnam Association of Seafood Exporters and Producers (VASEP). Vietnam is one of the world’s leading rice exporters, with high-quality fragrant and glutinous rice varieties in demand across Asia, Africa, and the Middle East. Consistent international orders are encouraging farmers to expand cultivation areas, adopt modern farming techniques, and improve post-harvest processing to meet export standards. Similarly, seafood, particularly shrimp, pangasius, and tuna, enjoys strong demand in markets like the US, EU, and Japan, fueling growth in aquaculture and fisheries. Export requirements are motivating producers to invest in sustainable farming practices and cold chain logistics, ensuring compliance with food safety regulations. The stable foreign market is also attracting private and foreign investment in storage, packaging, and transport infrastructure. Rising export earnings from rice and seafood are contributing significantly to rural incomes, leading more communities to engage in these sectors. Furthermore, government trade agreements and reduced tariffs are enhancing market access, making Vietnam’s agribusiness more competitive globally.

To get more information on this market, Request Sample

Rising demand for processed and packaged products

Increasing demand for processed and packaged products is impelling the Vietnam agribusiness market growth by encouraging greater value addition and diversification in the food sector. As urbanization activities are accelerating, Vietnamese consumers are shifting towards convenient, ready-to-eat (RTE), and longer-shelf-life products, such as canned fruits, instant noodles, packaged rice, and frozen seafood. As per the IMARC Group, the Vietnam convenience food market size is set to exhibit a growth rate (CAGR) of 4.7% during 2025-2033. This trend is supported by changing lifestyles, with busier schedules leading to a preference for easy-to-prepare foods. In turn, agribusinesses are investing in modern processing facilities, advanced packaging technologies, and improved cold chain infrastructure to maintain product quality and meet safety standards. Additionally, government policies promoting food processing industries and foreign investments are further accelerating the sector growth. Increasing popularity of branded packaged goods is also encouraging innovations in flavors, nutrition, and eco-friendly packaging. By moving up the value chain from raw products to processed offerings, Vietnam’s agribusiness is strengthening its competitiveness, meeting both domestic and global demand, and ensuring more sustainable economic returns for the agricultural sector.

Vietnam Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

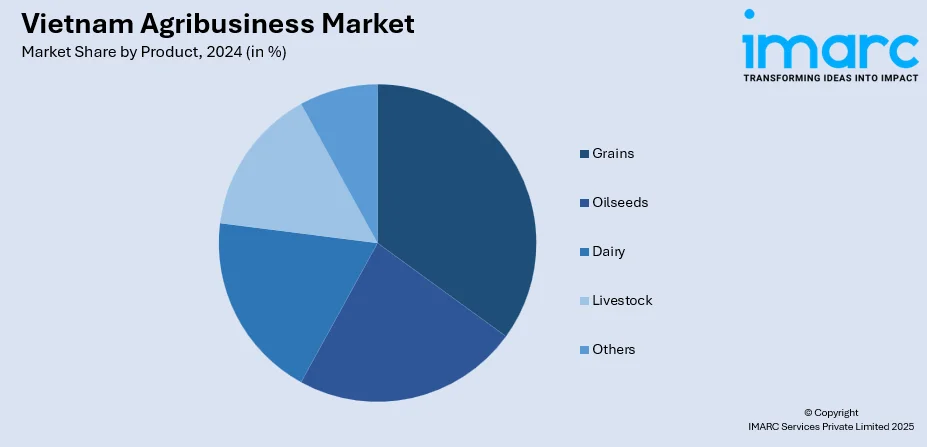

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Agribusiness Market News:

- In August 2025, the US Soybean Export Council celebrated thirty years of collaboration between US Soy and Vietnam, marked by milestones, including a Memorandum of Understanding (MoU) and a significant conference. The events underscored the significance of their partnership in bolstering Vietnam’s food, feed, and livestock industries. At the conference, ‘USSEC 30th Anniversary in Vietnam: Sustainable Solutions with US Soy,’ leaders in agribusiness, government representatives, and sustainability supporters from Southeast Asia highlighted common objectives in climate-smart agriculture and responsible sourcing.

- In June 2025, Vietnam was set to finalize agreements with the United States for the purchase of over USD 2 Billion in agricultural goods. The declaration was made as a delegation from the Ministry of Agriculture and Environment, headed by Minister Do Duc Duy, visited the United States. The latest agreements involved buying soybean meal, corn, wheat, dried soybeans, and dried distillers grains (DDGS).

Vietnam Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam agribusiness market on the basis of product?

- What is the breakup of the Vietnam agribusiness market on the basis of region?

- What are the various stages in the value chain of the Vietnam agribusiness market?

- What are the key driving factors and challenges in the Vietnam agribusiness market?

- What is the structure of the Vietnam agribusiness market and who are the key players?

- What is the degree of competition in the Vietnam agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)