Vietnam Agricultural Machinery Market Size, Share, Trends and Forecast by Product Type, and Region, 2026-2034

Vietnam Agricultural Machinery Market Summary:

The Vietnam agricultural machinery market size was valued at USD 276.25 Million in 2025 and is projected to reach USD 655.66 Million by 2034, growing at a compound annual growth rate of 10.08% from 2026-2034.

Vietnam's agricultural machinery market is experiencing robust expansion driven by the government's strategic commitment to agricultural modernization and the transition from manual to mechanized farming practices. The declining agricultural labor force, as younger generations migrate to urban centers, has accelerated demand for efficient farm equipment. Rising agricultural export requirements and the consolidation of fragmented farmlands are further propelling investments in tractors, harvesters, and precision farming technologies across the Vietnam agricultural machinery market share.

Key Takeaways and Insights:

-

By Product Type: Tractors dominate the market with a share of 54% in 2025, driven by their versatility across rice, fruit, and industrial crop cultivation, as well as the ongoing transition from two-wheeled to four-wheeled tractors in northern farming regions.

-

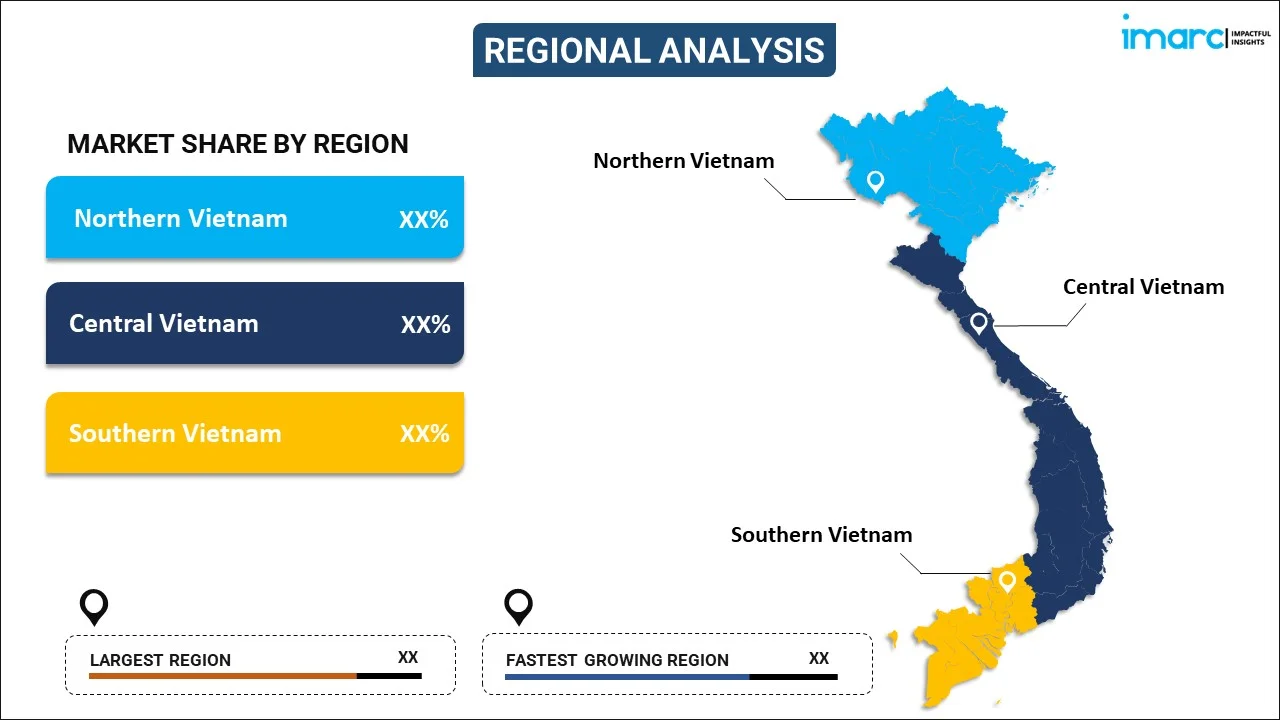

By Region: Northern Vietnam leads the market with a share of 28.6% in 2025, supported by government initiatives promoting mechanization in mountainous regions and the presence of large-scale agricultural cooperatives driving equipment adoption.

-

Key Players: The Vietnam agricultural machinery market exhibits moderate competitive intensity, with established international manufacturers competing alongside domestic producers. Major players maintain their positions through comprehensive dealer networks, integrated financing solutions, and product lines tailored to Vietnam's diverse agricultural requirements. Some of the major players include CLAAS KGaA mbH, Kubota Vietnam Company Limited, Vietnam Engine, and Yanmar Vietnam (Agriculture).

Vietnam's agricultural sector has undergone significant transformation, with mechanization levels reaching over 70% of cultivated land and more than 97% of rice crops now being mechanically harvested. The creation of a dedicated ministry overseeing agriculture and environmental affairs has strengthened policy alignment in support of agricultural modernization. At the same time, international collaborations and technology transfers are helping accelerate the development of domestic manufacturing capabilities. Private sector initiatives focused on building specialized industrial zones for mechanical and agricultural equipment production are contributing to job creation, enhancing local supply chains, and reducing reliance on imported machinery. The integration of smart farming technologies, including GPS-enabled equipment and precision agriculture tools, is reshaping farming practices across the Mekong Delta and Red River Delta regions.

Vietnam Agricultural Machinery Market Trends:

Rapid Adoption of Agricultural Drone Technology

The integration of unmanned aerial vehicles into farming operations is transforming crop management across Vietnam's agricultural landscapes. Agricultural drones are increasingly utilized for precision spraying, crop monitoring, and field mapping, offering labor reductions of up to 75% compared to traditional manual methods. By December 2024, Kien Giang Province alone operated over 690 agricultural drones, demonstrating the technology's widespread acceptance among rice farmers seeking to optimize pesticide application and reduce input costs.

Smart Farming and IoT Integration

Precision agriculture solutions that combine IoT sensors, GPS-guided equipment, and data analytics are increasingly being adopted by Vietnamese farmers aiming to improve productivity while using resources more efficiently. Smart farming machinery allows real-time tracking of soil quality, crop conditions, and irrigation needs, supporting timely and accurate interventions. Government-led smart agriculture programs are encouraging the adoption of these technologies, accelerating the shift toward data-driven farming practices that enhance efficiency, sustainability, and long-term agricultural performance.

Electric and Sustainable Machinery Development

The shift toward environmentally sustainable farming equipment is gaining momentum as Vietnam commits to low-emission agricultural practices. Electric-powered tractors are emerging as viable alternatives to diesel-powered equipment, offering zero emissions and lower operating costs. This trend aligns with the government's one-million-hectare low-emission rice program, which has enrolled extensive areas of farmland in sustainable cultivation practices by 2025, driving demand for machinery that supports reduced chemical inputs and efficient water management.

Market Outlook 2026-2034:

The Vietnam agricultural machinery market is poised for sustained expansion as the country advances its agricultural modernization agenda and strengthens its position as a leading global agricultural exporter. Increasing mechanization adoption across rice, coffee, and fruit cultivation, combined with favorable government policies providing soft loans, tax incentives, and demonstration farm access, will continue driving market growth. The consolidation of fragmented farmlands and the emergence of custom hiring centers are making advanced machinery accessible to smallholder farmers. The market generated a revenue of USD 276.25 Million in 2025 and is projected to reach a revenue of USD 655.66 Million by 2034, growing at a compound annual growth rate of 10.08% from 2026-2034.

Vietnam Agricultural Machinery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Tractors | 54% |

| Region | Northern Vietnam | 28.6% |

Product Type Insights:

To get detailed segment analysis of this market, Request Sample

- Tractors

- Rice Transplanters

- Harvesting Machinery

- Haying and Forage Machinery

- Others

Tractors dominate the Vietnam agricultural machinery market with a 54% share in 2025.

Tractors remain indispensable for Vietnamese farmers, serving critical functions in plowing, tilling, planting, and transportation across rice paddies, coffee plantations, and fruit orchards. The Ministry of Agriculture and Rural Development has set targets to transition from two-wheeled to four-wheeled tractors for rice growing in northern regions by 2030, driving demand for higher-capacity equipment. The integration of advanced technologies such as GPS systems, automated steering, and precision farming features has increased tractor appeal among farmers seeking productivity improvements.

Vietnam’s agricultural machinery market is witnessing rising demand for tractors that surpasses current domestic manufacturing capacity, encouraging greater reliance on imports and local production partnerships. Equipment manufacturers are increasingly collaborating with Vietnamese enterprises to establish assembly and manufacturing facilities, supported by technology transfer arrangements that strengthen local value creation. At the same time, the introduction of intelligent tractors integrated with artificial intelligence and machine learning technologies is transforming farming operations. These advanced machines support higher levels of automation, precision, and efficiency, enabling farmers to optimize productivity while reducing labor intensity and operational costs.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam leads the Vietnam agricultural machinery market with a 28.6% share in 2025.

Northern Vietnam’s agricultural machinery market is driven by ongoing modernization efforts and gradual farm consolidation across key agricultural provinces. Farmers are increasingly adopting mechanized solutions to improve productivity, address labor shortages, and manage larger cultivated areas more efficiently. The shift from traditional farming methods toward mechanized planting, harvesting, and soil preparation is encouraging demand for tractors, harvesters, and precision equipment. Improved rural infrastructure and better access to financing and cooperative models further support machinery adoption in the region.

Climate variability and changing weather patterns in Northern Vietnam are pushing farmers to invest in machinery that supports efficient water management and timely field operations. Mechanized irrigation, land leveling, and precision input application help mitigate climate-related risks and improve yield stability. At the same time, government-led agricultural support programs and extension services promote mechanization to enhance food security and sustainability. This combination of environmental pressures and institutional support is accelerating agricultural machinery uptake across Northern Vietnam.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Agricultural Machinery Market Growing?

Government Agricultural Modernization Initiatives

The Vietnamese government actively promotes agricultural mechanization through comprehensive policy reforms and financial incentives designed to accelerate the adoption of modern farming equipment. Farmers receive soft loans with interest subsidies, tax relief, and access to demonstration farms to encourage investment in advanced machinery. The government has committed to significantly increasing investment in agricultural development, with a strong focus on accelerating mechanization across key crop segments. These efforts aim to modernize farming practices, improve productivity, and enhance efficiency in staple crop cultivation, particularly rice, through wider adoption of advanced agricultural machinery and technologies. The establishment of the Ministry of Agriculture and Environment in February 2025 has enhanced coordination of mechanization programs, while the launch of sustainable development projects, including the one-million-hectare low-emission rice initiative, demonstrates the commitment to technology-driven agricultural transformation.

Declining Agricultural Labor Force and Rising Wage Costs

Vietnam’s agricultural sector is experiencing a steady decline in available labor as younger workers move to urban areas in search of opportunities in industry and services. This shift has created workforce shortages in rural regions, particularly during peak planting and harvesting seasons, while rising labor costs are putting pressure on farm profitability. As the remaining farming population continues to age, mechanization is becoming an increasingly practical solution, driving greater adoption of machinery across rice, fruit, and industrial crop cultivation.

Expanding Agricultural Exports and Productivity Requirements

Vietnam’s expanding role as a major global agricultural exporter is encouraging greater investment in modern machinery to meet international quality, safety, and efficiency requirements. Export-focused producers increasingly rely on advanced equipment that supports precision farming, minimizes post-harvest losses, and complies with strict residue and traceability standards. At the same time, the gradual consolidation of fragmented farmland into larger operational units is improving the economic viability of tractors, harvesters, and mechanized planting systems, enabling farmers to scale production and compete more effectively in global markets.

Market Restraints:

What Challenges the Vietnam Agricultural Machinery Market is Facing?

High Initial Equipment Costs for Smallholder Farmers

The heavy investment costs associated with modern agricultural equipment have been a significant hindrance to small farm businesses in Vietnam, which are the major contributors to agricultural production within the country. The limited use of credit facilities and financing options makes it a daunting task for farmers to invest in modern equipment, and the existing financing structures only finance a percentage of the costs. Consequently, the use of technology such as agricultural drones and precision equipment, which require significant investment, remains a dream for small farm businesses.

Fragmented Land Holdings and Terrain Challenges

Small and fragmented pieces of land in the northern and central parts of the country make it hard to justify the need for wide and powerful machinery. In fact, some of these pieces of land are not suitable for the use of such machinery. This contributes to inefficiency in the use of machinery in Vietnamese agriculture. This is on top of the nature of Vietnamese topography that results in differently sized pieces of land.

Technical Skills Gap and Training Deficiencies

Effective utilization of advanced agricultural machinery requires technical knowledge in both operation and maintenance that many Vietnamese farmers currently lack. Rural farmers, particularly those in remote areas, have limited access to training programs covering modern farming practices and equipment handling. This skills gap leads to underutilization or misuse of machinery, reducing effectiveness and potential productivity benefits despite growing equipment availability.

Competitive Landscape:

The Vietnam agricultural machinery market exhibits moderate competitive concentration, with established international manufacturers and domestic producers competing across diverse product segments and price points. Major global players maintain market leadership through comprehensive product ranges, extensive dealer networks across rice-growing regions, and integrated financing solutions that facilitate farmer adoption. These companies differentiate themselves through product innovation, after-sales service excellence, and technology partnerships with local enterprises. Domestic manufacturers are strengthening their positions through government procurement policies, compatibility with existing equipment fleets, and localized production facilities. Technology transfer agreements between international and Vietnamese companies are accelerating local manufacturing capabilities, while strategic partnerships enable the development of precision agriculture solutions incorporating AI-based diagnostics, telematics, and autonomous features tailored to Vietnamese farming conditions.

Some of the key players include:

- CLAAS KGaA mbH

- Kubota Vietnam Company Limited

- Vietnam Engine

- Yanmar Vietnam (Agriculture)

Recent Developments:

-

February 2025: Truong Hai Group Corporation (THACO) announced a USD 1 billion initiative to establish a 786-hectare industrial park in Binh Duong, focused on mechanical production, including agricultural machinery. This project aims to expand domestic manufacturing capabilities, enhance local supply chains, and support the production of advanced farm equipment, reinforcing THACO’s role in modernizing Vietnam’s agricultural and industrial sectors. This project aims to enhance domestic production capacity, decrease import dependency, and generate 32,000 jobs.

-

December 2024: Yanmar Holdings Co., Ltd. launched the distribution of Solis tractors in Thanh Hoa Province by collaborating with International Tractors Limited, aiming to expand access to modern agricultural equipment and support local farming modernization efforts. The collaboration focuses on Vietnam's dry-field segment, providing access to tractors supported by Yanmar's service network to advance agricultural modernization.

-

June 2024: The 4th International Exhibition on Machinery, Equipment, Supplies, Chemicals, and Agricultural Products in Vietnam (Agri Vietnam 2024) attracted more than 100 exhibitors from 14 countries and territories, showcasing advanced agricultural technologies and fostering international partnerships.

Vietnam Agricultural Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Tractors, Rice Transplanters, Harvesting Machinery, Haying and Forage Machinery, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | CLAAS KGaA mbH, Kubota Vietnam Company Limited, Vietnam Engine, Yanmar Vietnam (Agriculture), etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam agricultural machinery market size was valued at USD 276.25 Million in 2025.

The Vietnam agricultural machinery market is expected to grow at a compound annual growth rate of 10.08% from 2026-2034 to reach USD 655.66 Million by 2034.

Tractors dominated the market with a 54% share in 2025, driven by their versatility across diverse farming operations, including rice cultivation, fruit orchards, and industrial crop production throughout Vietnam's agricultural regions.

Key factors driving the Vietnam agricultural machinery market include government agricultural modernization initiatives with financial incentives, declining agricultural labor force necessitating mechanization, expanding agricultural exports requiring production efficiency, and the adoption of smart farming technologies.

Major challenges include high upfront equipment costs for smallholder farmers with limited credit access, fragmented and small land holdings unsuitable for large machinery, technical skills gaps among rural farmers, uneven terrain challenges, and dependency on imported components and equipment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)