Vietnam Almond Milk Market Size, Share, Trends and Forecast by Type, Category, Packaging Type, Application, Distribution Channel, and Region, 2026-2034

Vietnam Almond Milk Market Summary:

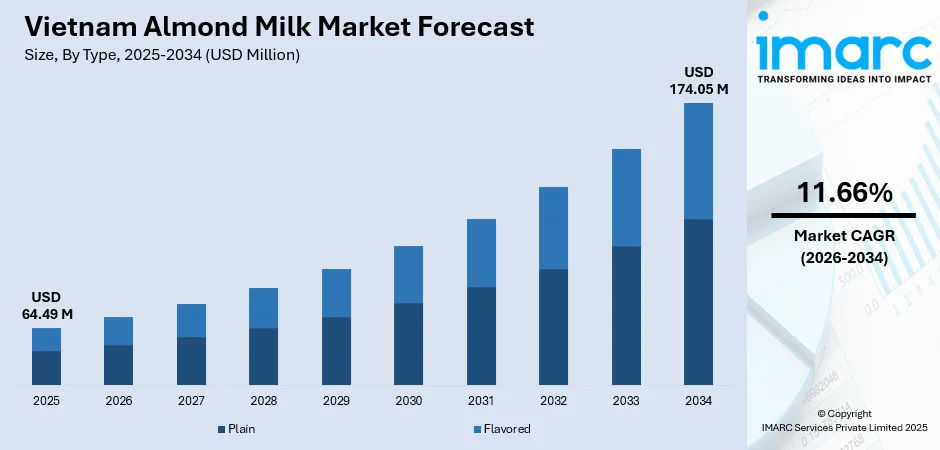

The Vietnam almond milk market size was valued at USD 64.49 Million in 2025 and is projected to reach USD 174.05 Million by 2034, growing at a compound annual growth rate of 11.66% from 2026-2034.

The market is propelled by rising health consciousness among Vietnamese consumers, increasing prevalence of lactose intolerance, and growing adoption of plant-based diets. Demand is being further accelerated by the growing middle-class population with increased spending means, the impact of Western eating trends, and the construction of robust retail infrastructure. Additionally, innovative product launches by major domestic manufacturers and the proliferation of e-commerce platforms are strengthening the Vietnam almond milk market share.

Key Takeaways and Insights:

- By Type: Flavored almond milk dominates the market with a share of 56.23% in 2025, driven by consumer demand for taste variety and enhanced flavor profiles including vanilla and chocolate options.

- By Category: Organic leads the market with a share of 64.64% in 2025, reflecting strong consumer preference for natural, clean-label products with no artificial additives.

- By Packaging Type: Carton represents the largest segment with a market share of 57.55% in 2025, owing to its convenience, extended shelf life, and eco-friendly recyclable properties.

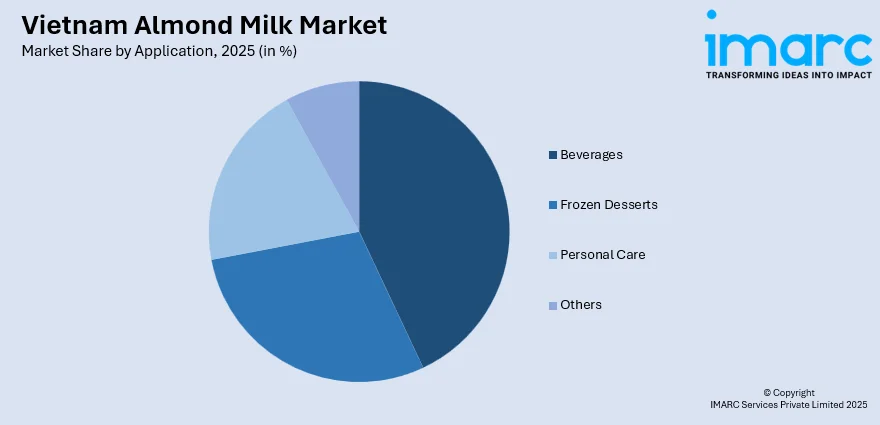

- By Application: Beverages holds the largest share at 40.82% in 2025, fueled by increasing consumption of almond milk as a standalone drink and in coffee-based beverages.

- By Distribution Channel: Hypermarkets and supermarkets lead with a share of 42.86% in 2025, providing wide product visibility and consumer accessibility across urban centers.

- Key Players: The Vietnam almond milk market exhibits moderate fragmentation with domestic giants leading through extensive distribution networks and innovative product lines. International players also maintain presence through imports and partnerships with local distributors.

To get more information on this market Request Sample

Vietnam's almond milk market is experiencing robust expansion as consumer preferences shift toward healthier, plant-based alternatives. Rising urbanization, particularly in major economic hubs like Ho Chi Minh City and Hanoi, is driving demand for convenient, nutritious beverage options. The market is also supported by increasing awareness of lactose intolerance, which affects a significant portion of the Asian population. For instance, Vinamilk launched its plant-based milk line featuring almond, walnut, and pea protein, becoming Vietnam's first dairy company to offer plant-based milk with 9g of protein per serving, demonstrating the industry's commitment to innovation and meeting evolving consumer demands.

Vietnam Almond Milk Market Trends:

Rising Demand for Organic and Clean-Label Products

Vietnamese consumers are increasingly prioritizing organic and clean-label almond milk products free from artificial preservatives and additives. This trend reflects heightened health awareness and willingness to pay premium prices for perceived health benefits. The organic segment's dominance at 64.64% market share underscores this preference. In July 2024, Vinamilk's Vietnam Beverage Factory achieved Carbon Neutral certification under the international PAS 2060:2014 standard from the British Standards Institute (BSI), neutralizing 3,410 tons of CO2 emissions through green energy adoption and sustainable practices.

Expansion of Flavored Variants and Product Innovation

Product innovation through diverse flavor offerings is reshaping market dynamics, with manufacturers introducing vanilla, chocolate, and locally-inspired flavor profiles to attract broader consumer segments. Vinamilk has responded by launching its nine-seed blend plant-based milk combining almond, walnut, oat, soybean, and various beans, earning recognition at the World Dairy Innovation Awards 2025 for best packaging design of its plant-based yogurt line. Some of the major products included the Vinamilk Optimum, Green Farm's product line, and Plant-Based Milk.

Integration with Coffee Culture and Foodservice

Vietnam's vibrant coffee culture is creating significant opportunities for almond milk adoption in cafes and foodservice establishments. As specialty coffee consumption grows, almond milk is increasingly offered as a dairy alternative in urban coffee chains. Dairy substitutes are being actively added to menus in the growing food service sector, which includes cafes and restaurants. Major international coffee chains operating in Vietnam now feature almond milk options, driving mainstream acceptance and expanding the addressable market for premium plant-based beverages.

Market Outlook 2026-2034:

The market for almond milk in Vietnam is expected to develop steadily through 2033 due to positive demographic trends, rising disposable incomes, and changing customer preferences for healthier lifestyles. The government's focus on digital economy development and retail infrastructure expansion will enhance product accessibility across urban and rural markets. E-commerce adoption, which has surged in Tier 2/3 cities, presents significant distribution opportunities. As per the IMARC Group, the Vietnam e-commerce market is expected to reach USD 239.3 Billion by 2033, exhibiting a growth rate (CAGR) of 26.20% during 2025-2033. The market generated a revenue of USD 64.49 Million in 2025 and is projected to reach a revenue of USD 174.05 Million by 2034, growing at a compound annual growth rate of 11.66% from 2026-2034.

Vietnam Almond Milk Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Flavored | 56.23% |

| Category | Organic | 64.64% |

| Packaging Type | Carton | 57.55% |

| Application | Beverages | 40.82% |

| Distribution Channel | Hypermarkets and Supermarkets | 42.86% |

Type Insights:

- Plain

- Flavored

Flavored almond milk dominates the Vietnam market with a 56.23% share of total market revenue in 2025.

The flavored almond milk segment's dominance is driven by Vietnamese consumer preference for taste variety and enhanced sensory experiences. Popular flavors include vanilla, chocolate, and locally-inspired options that appeal to diverse age groups from children to adults. The segment benefits from product innovation by major manufacturers who continuously introduce new flavor profiles to capture market attention. Vinamilk's plant-based milk line featuring nine different seed and nut ingredients demonstrates the industry's commitment to offering diverse flavor combinations that satisfy evolving consumer palates.

Additionally, flavored variants often contain fortified nutrients including vitamins and minerals, positioning them as nutritious alternatives to traditional dairy milk. This dual benefit of taste and nutrition particularly resonates with health-conscious urban consumers who seek convenient yet healthy beverage options. The segment also benefits from strong marketing campaigns by leading brands emphasizing both flavor enjoyment and nutritional value, further cementing flavored almond milk's position as the preferred choice among Vietnamese consumers.

Category Insights:

- Organic

- Conventional

Organic almond milk leads the Vietnam market with a commanding 64.64% market share in 2025.

The organic segment's market leadership reflects the strong consumer trend toward clean-label and natural products in Vietnam. Rising health consciousness and concerns about food safety have prompted Vietnamese consumers to prioritize organic certifications when making purchasing decisions. The segment benefits from perceived health advantages including absence of pesticides, artificial additives, and genetically modified ingredients. Major players have capitalized on this trend by launching dedicated organic product lines with prominent organic certifications prominently displayed on packaging.

The willingness of Vietnamese middle-class consumers to pay premium prices for organic products has enabled manufacturers to maintain healthy profit margins while investing in quality sourcing. Vinamilk's Green Farm initiative, which demonstrates the quality nature can bring to food, dairy and nutrition, focuses on sustainable farming practices, exemplifies the industry's commitment to organic and environmentally responsible production. The organic segment is further supported by growing retail shelf space dedicated to organic products in supermarkets and hypermarkets across urban centers.

Packaging Type Insights:

- Carton

- Glass

- Others

Carton packaging holds the largest share at 57.55% of the Vietnam almond milk market in 2025.

Carton packaging dominates due to its practical advantages including extended shelf life through aseptic packaging technology, lightweight portability, and cost-effectiveness. The format is particularly well-suited for Vietnam's developing cold chain infrastructure, as UHT-processed almond milk in cartons can be stored without refrigeration until opening. Major manufacturers have standardized carton packaging for their mainstream product lines, leveraging partnerships with global packaging suppliers to ensure quality and consistency.

Environmental sustainability considerations also favor carton packaging, as it is widely perceived as more eco-friendly compared to plastic alternatives. Vietnamese consumers, particularly in urban areas, increasingly consider environmental impact in their purchasing decisions. International Dairy Products JSC (IDP) recently launched dairy products in SIG XSlimBloc carton packs, demonstrating the industry's continued investment in innovative carton packaging solutions. The format's convenience for on-the-go consumption further reinforces its market leadership position.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Beverages

- Frozen Desserts

- Personal Care

- Others

Beverages represents the largest application segment with a 40.82% market share in 2025.

The beverages segment leads due to almond milk's primary consumption as a ready-to-drink dairy alternative. Vietnamese consumers increasingly incorporate almond milk into their daily beverage routines, consuming it as standalone drinks, breakfast accompaniments, and coffee additives. The segment benefits from Vietnam's vibrant coffee culture, where specialty coffee shops increasingly offer almond milk as a premium dairy-free option. Urban consumers particularly favor almond milk-based beverages for their perceived health benefits and smooth taste profile.

The food service industry's expansion, including restaurants, cafes, and quick-service chains, has accelerated beverage segment growth by normalizing plant-based milk consumption. Starbucks and other international coffee chains operating in Vietnam feature almond milk options, driving mainstream consumer adoption. Additionally, domestic beverage brands have launched ready-to-drink almond milk products in convenient single-serve formats, capturing the on-the-go consumption occasion and expanding the segment's addressable market across diverse consumer demographics.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Stores

- Others

Hypermarkets and supermarkets account for the highest revenue share at 42.86% in 2025.

Hypermarkets and supermarkets dominate distribution due to their extensive product assortment, competitive pricing, and convenient one-stop shopping experience. The channel benefits from Vietnam's rapidly expanding modern retail infrastructure, with major chains including VinMart, Big C, AEON, and Lotte Mart continuously expanding their store networks across urban and suburban areas. In 2024, Saigon Co.op, the operator of the Co.opmart supermarket chain, the second-largest supermarket system in Vietnam, also wants to build an additional 154 new retail sites throughout the country with sales estimated to climb by 4-6 per cent this year, enhancing product accessibility nationwide.

These retail formats provide manufacturers with prominent shelf placement and promotional opportunities to drive consumer awareness and trial. The channel's strength in the dairy and dairy alternatives category stems from established consumer shopping habits and trust in product quality assurance. Modern trade retailers have increasingly dedicated shelf space to plant-based alternatives, positioning almond milk products alongside traditional dairy to capture substitution demand. The channel's continued expansion into Tier 2 and Tier 3 cities is expected to drive further market penetration.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, anchored by Hanoi, represents a significant market for almond milk characterized by value-conscious consumers who prioritize product research before purchasing. Northern Vietnamese consumers demonstrate preference for trusted brands offering long-term value, with traditional shopping methods remaining prevalent alongside growing e-commerce adoption among younger urban populations.

Central Vietnam presents emerging opportunities for almond milk market expansion, with growing urbanization in cities like Da Nang driving modern retail development. The region exhibits a balance between traditional consumption patterns and evolving health-conscious preferences, with local distributors playing crucial roles in product accessibility across diverse geographical terrains.

Southern Vietnam, led by Ho Chi Minh City, represents the largest and most dynamic regional market for almond milk. The region benefits from higher disposable incomes, cosmopolitan lifestyles, and strong preference for premium international and health-focused products. Southern consumers demonstrate higher e-commerce adoption and openness to new product trial, making it the primary market for premium almond milk variants.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Almond Milk Market Growing?

Rising Health Consciousness and Lactose Intolerance Awareness

Growing awareness of health and nutrition among Vietnamese consumers is a primary driver of almond milk market growth. Consumers increasingly recognize the nutritional benefits of almond milk, including its low calorie content, absence of cholesterol, and presence of vitamins E, A, and D. The prevalence of lactose intolerance among Asian populations, including Vietnam, further drives demand for dairy alternatives. According to Statista, Vietnamese consumers are increasingly shifting toward plant-based milk alternatives including almond milk due to rising health awareness and concerns about dairy allergies. The trend is particularly pronounced among urban populations who have greater access to health information through digital platforms and social media, driving sustained demand for nutritious plant-based alternatives.

Expanding Middle Class and Rising Disposable Incomes

Vietnam's expanding middle class with rising disposable incomes is enabling consumers to afford premium plant-based products including almond milk. Vietnam's GDP per capita is forecast to moderate to 5.8% in 2025 due to increased trade policy uncertainty before a modest rebound to 6.1 percent in 2026, according to World Bank projections. This economic growth translates directly into increased spending on health-oriented food and beverages, with consumers willing to pay premium prices for perceived quality and health benefits. The improving income levels allow consumers to explore and afford premium dairy alternative products, presenting lucrative opportunities for almond milk manufacturers targeting the value-conscious yet quality-seeking consumer segment.

Retail Infrastructure Expansion and E-commerce Growth

The rapid expansion of modern retail infrastructure and e-commerce platforms is significantly enhancing almond milk accessibility across Vietnam. Modern retail formats including supermarkets, hypermarkets, and convenience stores are proliferating in both urban and suburban areas, providing wider product distribution reach. Major e-commerce platforms, along with social commerce channels like TikTok Shop, are enabling consumers nationwide to access almond milk products conveniently. Vietnam Post's launch of nongsan.buudien.vn in December 2024, Vietnam's first dedicated e-commerce platform for agricultural products, further demonstrates the digital infrastructure development supporting market growth.

Market Restraints:

What Challenges the Vietnam Almond Milk Market is Facing?

Higher Price Points Compared to Traditional Dairy

The products of almond milk are sold at a premium price compared to the conventional milk of dairy origin, hence limiting their adoption in the price-sensitive consumer segments. The imported ingredients of almonds and their special processing requirements drive up the cost. This price difference creates certain challenges for market penetration into rural areas and other consumer categories with low incomes, which accord a greater priority to affordability than to health-related attributes.

Limited Domestic Almond Production and Import Dependency

There is almost no domestic cultivation of almonds in Vietnam, which highly relies on imported raw materials from mainly the United States. Such import dependence exposes the manufacturers to currency changes, shipping delays, and supply chain disruptions. This global supply chain situation, coupled with growing transportation costs, has affected the import cost and lead times, forcing producers to revise pricing strategies and look for substitute ingredient sources.

Competition from Other Plant-Based Milk Alternatives

Almond milk also faces extreme competition from other plant-based alternatives that have already gained a foothold in Vietnam, such as soy milk, oat milk, and coconut milk. Soy milk benefits from traditional consumption patterns and lower production costs, while the popularity of oat milk is growing globally. This competitive landscape thus makes the plant-based dairy market more fragmented and may challenge the possibility of almond milk gaining dominant market share.

Competitive Landscape:

The Vietnam almond milk market is highly competitive and is a battleground within the broader dairy alternatives sector. Competition is primarily led by dominant domestic dairy powerhouses who leverage existing robust distribution and high consumer trust to launch extensive nut milk lines. These local giants focus on product diversification, including flavored and fortified almond options. They face rising challenges from both regional players with strong supply chains and international brands introducing premium imported almond milks. International players compete on specialized niche products, such as organic or baristas blends, while utilizing e-commerce for targeted urban reach. The main competitive strategies revolve around taste, packaging innovation, and price sensitivity due to high import costs for raw almonds.

Recent Developments:

- June 2025: Vinamilk announced it has become Southeast Asia's first dairy producer to adopt Tetra Pak's wholesome soy grinding technology for its plant-based milk production. This advanced technology enhances soy nutrition while reducing waste, aligning with Vinamilk's sustainability goals. The innovation allows manufacturers to reduce water consumption by up to 20% and improve overall production efficiency.

- May 2025: TH Binh Duong Clean Food Company, a subsidiary of TH Group, announced plans to develop a mega VND 6.07 Trillion (USD 234 Million) factory in Song Than 3 Industrial Park, Binh Duong Province. The plant will span approximately 100,000 square meters and produce dairy products, yogurt, ice cream, and non-alcoholic beverages. The project will be implemented in four phases from 2027 to 2037, with total production capacity reaching 852,351 tons annually when fully operational. This expansion strengthens TH True Milk's position in the Southern Vietnam market, where nut milk and plant-based alternatives continue to gain traction.

Vietnam Almond Milk Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plain, Flavored |

| Categories Covered | Organic, Conventional |

| Packaging Types Covered | Carton, Glass, Others |

| Applications Covered | Beverages, Frozen Desserts, Personal Care, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam almond milk market size was valued at USD 64.49 Million in 2025.

The Vietnam almond milk market is expected to grow at a compound annual growth rate of 11.66% from 2026-2034 to reach USD 174.05 Million by 2034.

Flavored almond milk dominates with a 56.23% market share in 2024, driven by consumer demand for taste variety including vanilla and chocolate options that appeal to diverse age groups while providing fortified nutritional benefits.

Key factors driving the Vietnam almond milk market include rising health consciousness, increasing lactose intolerance awareness, expanding middle-class population with higher disposable incomes, retail infrastructure growth, and e-commerce platform proliferation enabling wider product accessibility.

Major challenges include higher price points compared to traditional dairy limiting mass-market adoption, import dependency on almond ingredients creating supply chain vulnerabilities, and intense competition from established plant-based alternatives including soy and oat milk.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)