Vietnam Aluminium Market Size, Share, Trends and Forecast by Processing Type, End Use Industry, and Region, 2025-2033

Vietnam Aluminium Market Size and Share:

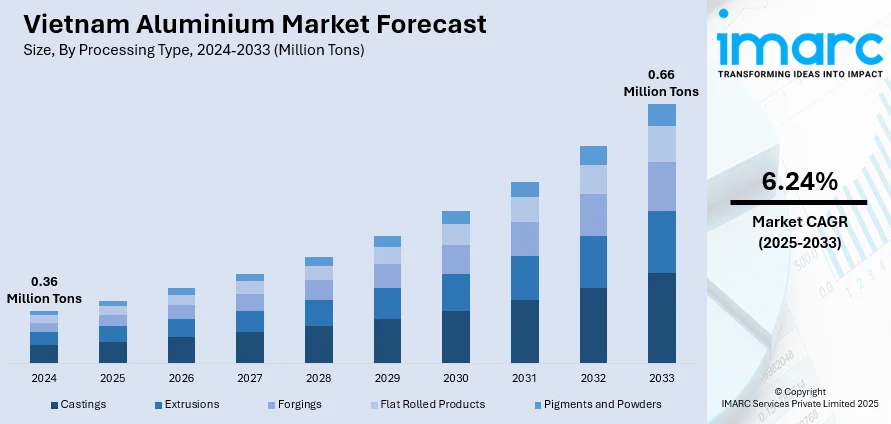

The Vietnam aluminium market size reached 0.36 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 0.66 Million Tons by 2033, exhibiting a CAGR of 6.24% during 2025-2033. The market is expanding rapidly, driven by industrial growth, infrastructure development, and increased foreign investment. Rising demand from construction, renewable energy, and manufacturing sectors fuels production and innovation. Government support and trade agreements enhance competitiveness, contributing to a steady rise in the Vietnam aluminium market share regionally and globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.36 Million Tons |

| Market Forecast in 2033 | 0.66 Million Tons |

| Market Growth Rate 2025-2033 | 6.24% |

The rapid expansion of Vietnam’s manufacturing sector, particularly in electronics, automotive components, and machinery, is a key driver for aluminium demand. As foreign direct investment (FDI) continues to flow into industrial zones, especially under the China+1 strategy, the requirement for lightweight, durable materials such as aluminium has increased significantly. Government-backed infrastructure projects, including transportation networks and smart city initiatives, further augment aluminium consumption across construction and electrical applications. Additionally, Vietnam’s trade agreements—such as the EVFTA and CPTPP—have incentivized local aluminium producers to modernize operations and improve product quality, fostering industry competitiveness and increasing domestic and export-oriented aluminium production to meet evolving international standards.

To get more information on this market, Request Sample

The growing emphasis on energy efficiency and sustainability across Vietnam’s industrial policies is driving demand for aluminium due to its recyclability and lower lifecycle energy costs. Industries are increasingly adopting aluminium to comply with emerging environmental regulations and green certification requirements, particularly in construction and packaging. For instance, in October 2024, at the 2nd National Congress in Hanoi, Vietnam’s Aluminium Profile Association unveiled a five-year roadmap (2024–2029) to strengthen the sector. The industry has doubled output to 1.3 million tonnes annually. Key goals include improving trade defence, legal compliance, and international competitiveness. The Association is working closely with Vietnam’s Trade Defense Department to address anti-dumping issues and support sustainable, ethical growth in the aluminium profile segment. Moreover, the rise of renewable energy installations—most notably solar power—has created a robust market for aluminium in panel frames and structural systems. The local government’s support for material innovation and adoption of circular economy practices further incentivizes the use of secondary aluminium, opening new value chains and reducing import dependence. These developments collectively contribute to a more resilient and self-reliant aluminium sector in Vietnam.

Vietnam Aluminium Market Trends:

Construction and Infrastructure Expansion Fueling Aluminium Demand

Vietnam aluminium market growth is driven by the robust expansion of the construction sector. Aluminium is extensively used in window frames, doors, roofing, and cladding due to its strength and lightweight nature. According to the Ministry of Construction, Vietnam's construction industry is projected to grow by approximately 7.8–8.2% in 2025, the highest rate since 2020. Rapid urbanization and large-scale infrastructure projects, including transport networks and smart cities, are significantly increasing the demand for aluminium. This trend is expected to continue as government investments in public infrastructure remain a national priority, creating consistent demand for aluminium-based building materials.

Industrial and Automotive Sector Growth

Vietnam’s aluminium market is being propelled by strong industrial and automotive performance. The Industrial Production Index (IIP) rose by 8.4% year-on-year in 2024, the highest increase in four years, signaling robust manufacturing activity. Simultaneously, aluminium demand is rising in the automotive sector, where it is valued for reducing vehicle weight and improving fuel efficiency. In November 2024, vehicle sales surged by 58% year-on-year, according to the Vietnam Automobile Manufacturers' Association. These sectors are increasingly relying on aluminium for structural and component applications, indicating a shift toward advanced, energy-efficient production standards and contributing to the positive Vietnam aluminium market outlook.

Technological Innovation and Sustainability

Vietnam's aluminium industry is evolving through the integration of Industry 4.0 technologies and a stronger focus on sustainability. Automation and digitalization in production processes are enhancing operational efficiency and reducing costs, supporting the country’s broader ambition to move beyond basic assembly manufacturing. Trade liberalization and government-backed FDI initiatives are enabling easier import of raw materials and boosting aluminium exports. Additionally, the eco-friendly, fully recyclable nature of aluminium aligns with global and local sustainability goals. Increasing adoption of recycling and circular economy practices is not only meeting regulatory expectations but also elevating the Vietnam aluminium market share on the global stage.

Vietnam Aluminium Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam aluminium market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on processing type and end use industry.

Analysis by Processing Type:

- Castings

- Extrusions

- Forgings

- Flat Rolled Products

- Pigments and Powders

Flat rolled products stand as the largest component in 2024, holding around 37.8% of the market. The flat rolled products segment dominates the Vietnam aluminium market due to its extensive applications across key industries such as construction, transportation, packaging, and electronics. These products—comprising sheets, plates, and coils—are essential for roofing, cladding, vehicle bodies, and consumer goods manufacturing, aligning with Vietnam’s rapid industrialization and infrastructure growth. The segment benefits from high strength-to-weight ratios, corrosion resistance, and recyclability, making it ideal for modern engineering and sustainable solutions. Additionally, the rise in foreign direct investment in manufacturing and Vietnam’s participation in global supply chains has fueled demand for high-quality, processed aluminium, further solidifying the dominance of flat rolled products.

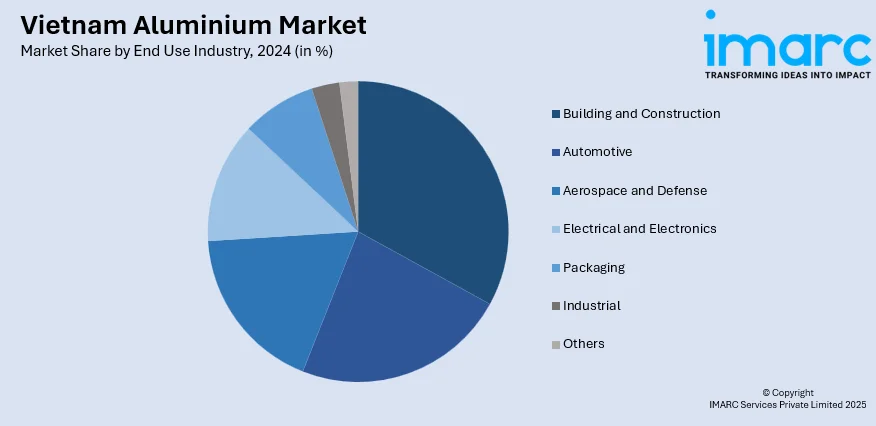

Analysis by End Use Industry:

- Automotive

- Aerospace and Defense

- Building and Construction

- Electrical and Electronics

- Packaging

- Industrial

- Others

Building and construction leads the market with around 43.3% of market share in 2024. The building and construction segment dominates the Vietnam aluminium market due to the country’s rapid urbanization, infrastructure development, and strong economic growth. Aluminium is widely used in this sector for applications such as window frames, doors, curtain walls, roofing, and cladding, owing to its lightweight, durability, and corrosion resistance. Government-backed projects, including housing developments, commercial complexes, and transport infrastructure, are driving large-scale aluminium consumption. Additionally, the push for energy-efficient and sustainable buildings has further increased the adoption of aluminium in modern architectural designs.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share of over 35.5%. The Southern Vietnam segment dominates the Vietnam aluminium market due to its high concentration of industrial zones, export-oriented manufacturing hubs, and major urban centers like Ho Chi Minh City. This region is the country's economic powerhouse, contributing significantly to GDP and attracting substantial foreign direct investment, particularly in construction, automotive, and electronics industries—all key consumers of aluminium. The presence of large infrastructure projects and rapid urban development has driven strong demand for aluminium in buildings, transportation, and packaging. Additionally, Southern Vietnam benefits from well-developed logistics networks and port facilities, facilitating both domestic distribution and international trade of aluminium products.

Competitive Landscape:

The competitive landscape of the Vietnam aluminium market is characterized by a mix of domestic producers and foreign-invested enterprises, creating a dynamic and rapidly evolving environment. Companies compete on product quality, pricing, technological capabilities, and supply chain efficiency. The growing emphasis on high-performance alloys and environmentally sustainable production processes is driving innovation and investment in advanced manufacturing technologies. Strategic partnerships, capacity expansion, and vertical integration are common strategies adopted to strengthen market presence. With rising demand from sectors such as construction, automotive, and electronics, competition is expected to intensify. According to the Vietnam aluminium market forecast, the market will continue to expand steadily, encouraging firms to focus on value-added products and sustainable practices to maintain a competitive edge. For instance, in April 2024, Vietnam’s state-run miner Vinacomin announced plans to invest $7.3 Billion to expand alumina and aluminum production in Dak Nong province, targeting the country’s rising domestic demand. The investment included two bauxite exploration projects and five refining projects, with the goal of boosting alumina output at the Nhan Co complex to 2 million tons annually. Additionally, the Dak Nong complex was set to triple its capacity to produce 2 million tons of alumina and up to 1 million tons of aluminum.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam aluminium market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Ghonor received its third consecutive aluminum edge profile order from a Vietnamese client. Following initial cooperation in November 2024, the May 2025 order emphasized speed and precision. Ghonor upgraded its Vietnam factory with AI scheduling, IoT tracking, and enhanced quality control to ensure timely, high-quality delivery.

- February 2025: Japan’s Marubeni Corporation invested in Vietnamese aluminum recycling firm NM2. As Vietnam leads Southeast Asia in beverage can consumption, Marubeni aims to support low-emission recycled ingot production and advance sustainable resource use aligned with Vietnam’s EPR policy and Marubeni’s green business strategy.

- November 2024: BM Windows received the Asian Export Award for exporting made-in-Vietnam aluminum-glass facades to Canada, Australia, the U.S., and New Zealand. The company met strict international standards, expanded global partnerships, and showcased its innovations at the Zak World of Facades in Toronto in May 2024.

- July 2024: Baosteel Packaging announced plans to build a new aluminium can facility in Long An, Vietnam, with a 525-million-yuan investment. The plant, set to produce 800 million cans annually, aims to strengthen customer support and expand the company’s footprint in the Southeast Asian market.

- July 2024: Hong Kong-based Kam Kiu Aluminium announced a USD 100 Million investment in its first overseas plant in Nam Dinh, Vietnam. Set to open in May 2025, the facility will produce aluminum parts for tech and automotive firms. Local authorities pledged expedited support for project implementation and utilities access.

Vietnam Aluminium Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Processing Types Covered | Castings, Extrusions, Forgings, Flat Rolled Products, Pigments and Powders |

| End Use Industries Covered | Automotive, Aerospace and Defense, Building and Construction, Electrical and Electronics, Packaging, Industrial, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam aluminium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam aluminium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam aluminium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminium market in Vietnam was valued at 0.36 Million Tons in 2024.

The Vietnam aluminium market is projected to exhibit a CAGR of 6.24% during 2025-2033, reaching a volume of 0.66 Million Tons by 2033.

Key drivers in the Vietnam aluminium market include rapid urbanization, strong growth in construction and infrastructure, rising demand from the automotive and electronics sectors, and increased foreign direct investment. Government initiatives, trade liberalization, and the shift toward sustainable, recyclable materials also contribute to expanding aluminium consumption and production capacity.

In 2024, Southern Vietnam dominated the market with a share of 35.5%. This can be attributed to its dense concentration of industrial parks, robust construction activity, and high foreign investment. The region's advanced infrastructure, proximity to major ports, and manufacturing-driven economy significantly increased aluminium consumption across construction, automotive, and export-oriented sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)