Vietnam Athletic Footwear Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Vietnam Athletic Footwear Market Size and Share:

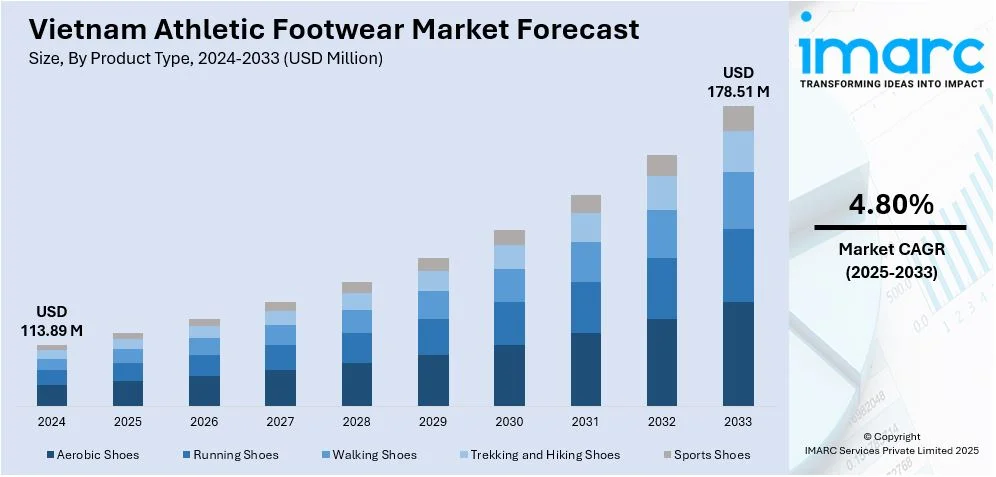

The Vietnam athletic footwear market size was valued at USD 113.89 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 178.51 Million by 2033, exhibiting a CAGR of 4.80% during 2025-2033. Southern Vietnam currently dominates the market, holding a significant market share of around 37.5% in 2024. The market is driven by rising urban youth engagement in fitness, government-backed sports initiatives, and rising demand for performance-oriented footwear. Global brands such as Nike and Adidas continue leveraging Vietnam’s manufacturing edge, while local firms upgrade to meet international quality standards amid increasing e-commerce accessibility. Additionally, social media-fueled brand awareness, coupled with the growing appeal of athleisure and sustainable design, is further augmenting the Vietnam athletic footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.89 Million |

| Market Forecast in 2033 | USD 178.51 Million |

| Market Growth Rate 2025-2033 | 4.80% |

The market is primarily driven by accelerating health consciousness and increasing participation in sports and fitness activities, particularly among urban youth. With growing disposable incomes, consumers are prioritizing quality and performance, favoring brands that offer innovative designs and advanced technologies. Government initiatives and events promoting sports, such as the annual "National Sports Day," further stimulate demand. Vietnam is experiencing a fitness crisis at present, with 82% of boys and 91% of girls aged between 11 and 17 years old being physically inactive. Due to this critical situation, the International Olympic Committee (IOC), the World Health Organization (WHO), and PATH have launched a sport-based health program reaching more than 1 million individuals in five countries. The 'Fit for Future' program has been able to engage over 10,000 students and educate over 200 educators via a mobile app that aims to raise the levels of daily physical activity. This program conforms to the Olympic Agenda 2020+5 and presents significant opportunities for Vietnam's sports footwear industry to grow, especially with youth sports participation continuing to grow. Additionally, the influence of global athletic trends, fueled by social media and international sporting events, has heightened brand awareness. Local manufacturers are also upgrading production capabilities to meet international standards, attracting both domestic and international buyers seeking cost-effective yet high-performance footwear.

In addition, Vietnam’s expanding role as a global manufacturing hub for major athletic brands, leveraging its free trade agreements and competitive labor costs, is also supporting the Vietnam athletic footwear market growth. Companies source heavily from Vietnam, enhancing domestic exposure to global trends. The e-commerce growth has also accelerated market growth, with platforms making athletic footwear more accessible nationwide. Vietnam's e-commerce market, led by Shopee, Lazada, and Tiki, is growing rapidly, with 57% of total purchases made through mobile transactions in Vietnam and cross-border sales growing at a rate 2.3 times higher than domestic e-commerce. Platforms such as TikTok Shop have witnessed a stunning 32-fold jump in purchase-through-search. At the same time, Chinese imports per day have topped USD 63 Million, this is a huge potential for footwear brands as price-sensitive, mobile-loyal consumers pursue variety and instant delivery. With 37% of its sales coming through cross-border purchases and stiff competition from both local giants and foreign players, Vietnam's athletic footwear industry has to move quickly to keep up with its competitive advantage in this fast-changing digital age. Furthermore, the rise of athleisure fashion has blurred the lines between sportswear and casual wear, driving demand for versatile footwear. Sustainability concerns are also shaping the market, with eco-conscious consumers favoring brands that incorporate recycled materials, pushing manufacturers to adopt greener practices.

Vietnam Athletic Footwear Market Trends:

Health-Conscious Consumers Drive Demand for Specialized Footwear

Vietnam’s market is undergoing a rise, largely propelled by the growing emphasis on health and physical well-being. A shift in consumer priorities is evident as rising health awareness stimulates participation in fitness and recreational activities. A recent study among Vietnamese high school students reveals that 23.19% are actively engaged in extracurricular sports, while 28% express a strong enthusiasm for athletic involvement beyond school hours. This indicates a foundational change in lifestyle choices, especially among younger demographics, translating directly into a higher demand for specialized athletic footwear. Consumers are no longer seeking generic shoes but are increasingly choosing performance-optimized products that cater to specific sports needs. As fitness becomes more than a trend, shaping into a cultural norm, the footwear industry is adjusting rapidly, introducing new product lines to cater to runners, gym-goers, and sports enthusiasts. This health-driven momentum is increasing volumes and encouraging brand diversification, further creating a positive Vietnam athletic footwear market outlook.

Major Sports Events Fuel Localized Market Engagement

The staging of international sports events in Vietnam is significantly bolstering local engagement and footwear consumption. In May 2025, the ASEAN Football Federation (AFF) declared that Vietnam would be the host for the ASEAN Women's MSIG Serenity Cup™ 2025. Set to occur in August 2025, the tournament is planned to be held at Viet Tri Stadium and Lach Tray Stadium, featuring high-caliber regional competition with eight teams participating. This announcement underscores Vietnam's rising profile in Southeast Asia's sports scene and reflects the escalating public enthusiasm for live sporting events. The visibility and anticipation surrounding such tournaments fuel interest in athletic gear, especially branded footwear linked to football and other high-impact sports. According to the Vietnam athletic footwear market forecast, retailers and brands are leveraging this spotlight to launch event-themed merchandise, exclusive athlete endorsements, and stadium promotions to stimulate sales. With Vietnam positioned as a regional sports hub, these events serve as a catalyst for short-term sales spikes and long-term brand loyalty within a growing market segment.

Technology and E-Commerce Reshape Consumer Access and Preferences

Technological innovations and e-commerce proliferation are redefining the way consumers in Vietnam interact with athletic footwear. Cutting-edge advancements, including lightweight materials, advanced cushioning, and breathable designs, are now central to product appeal. The integration of smart tech, such as AI-powered training modules, health-monitoring devices, and virtual metaverse-based sports applications, is transforming footwear from mere apparel to performance-enhancing gear. These innovations will be showcased in upcoming exhibitions, affirming their growing importance in consumer decisions. Additionally, the accessibility enabled by e-commerce platforms is a critical growth engine. Online retail channels allow widespread product availability beyond major urban centers, connecting rural and semi-urban consumers with the latest collections. Furthermore, a 2024 report indicates that 72% of Vietnamese consumers now prefer online platforms when purchasing fashion products, including athletic footwear, citing convenience and product variety as key factors. The convergence of performance and fashion, particularly through high-profile athlete collaborations, is attracting tech-savvy shoppers seeking style and function. This transformation is expanding market reach and reshaping consumer expectations, creating demand for versatile, technologically enriched footwear options tailored to both athletic and everyday lifestyles.

Vietnam Athletic Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam athletic footwear market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, distribution channel, and end user.

Analysis by Product Type:

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking and Hiking Shoes

- Sports Shoes

Running shoes stand as the largest component in 2024, fueled by urban jogging culture and marathon participation. Brands segment offerings into cushioned neutral runners for beginners, stability models for overpronators, and carbon-plated racers for competitive athletes. Breathable knit uppers and responsive foams such as thermoplastic polyurethane (TPU) are key differentiators. Night-running safety features, such as reflective detailing, appeal to city dwellers. Domestic brands gain traction with budget-friendly, durable options, while global labels leverage sponsored events, including the Ho Chi Minh City Midnight Run. The segment’s growth aligns with expanding running clubs and government-backed fitness campaigns.

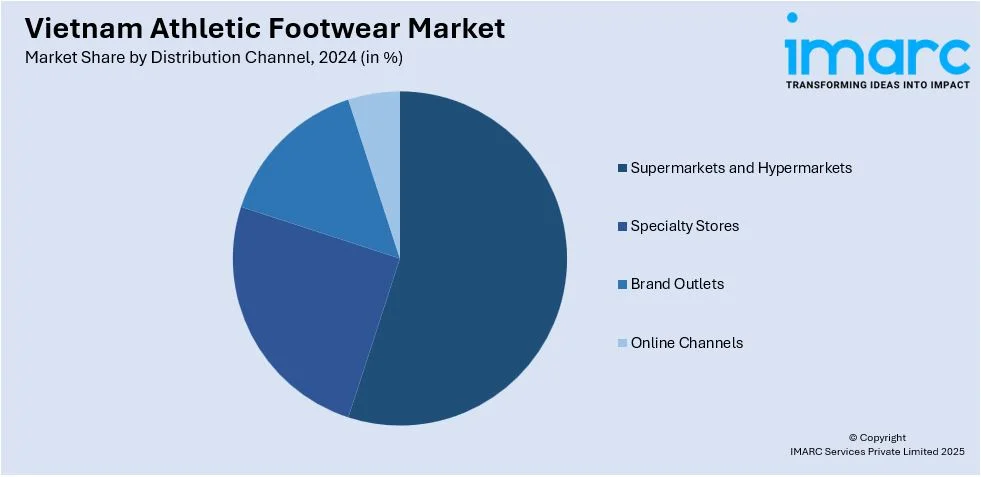

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Brand Outlets

- Online Channels

Specialty stores lead the market with around 43.7% of market share in 2024. Sport-focused specialty stores are offering curated selections backed by trained staff who conduct gait analyses and fit consultations. Multi-brand retailers such as authorized dealers for international labels cater to serious athletes, stocking niche products such as trail-running shoes or badminton-specific models rarely found elsewhere. Their in-store experiences, including treadmill trials and pressure mapping, build trust among discerning buyers. These stores face pressure from e-commerce but counter with exclusive launches and loyalty programs offering early access. Urban hubs, including Hanoi and Ho Chi Minh City, see clustering of specialty stores, creating destination shopping corridors. However, high operational costs limit expansion into smaller cities, where online channels fill the gap.

Analysis by End User:

- Men

- Women

- Kids

Men lead the market with around 48.7% of market share in 2024. Vietnam's market is driven by performance-driven purchases and urban streetwear crossover. Male consumers prioritize technical features, including responsive cushioning for basketball and multidirectional traction for futsal, often influenced by professional athlete endorsements and local league partnerships. The segment sees strong demand for versatile designs that transition from gym to casual wear, with neutral colorways dominating sales. Brands are responding with Vietnam-specific releases, including breathable uppers adapted for tropical climates and wider lasts to accommodate local foot shapes. Men aged 18-35 show a growing preference for limited-edition drops, creating secondary resale markets in major cities. However, price sensitivity remains acute outside urban centers, where domestic brands gain share through durable, value-oriented options.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share of over 37.5%. Southern Vietnam, anchored by Ho Chi Minh City, represents the most sophisticated and competitive athletic footwear market in the country. Consumers demonstrate strong brand consciousness and willingness to pay premium prices for the latest international releases, particularly in basketball and running categories. The region's year-round tropical climate drives demand for breathable, lightweight designs with enhanced ventilation. Southern consumers are early adopters of e-commerce and omnichannel shopping, with click-and-collect services thriving in urban centers. Niche segments such as gym training shoes and urban streetwear hybrids outperform other regions, reflecting both fitness trends and fashion consciousness. Distribution is the most developed nationally, spanning global brand flagships, specialty multi-brand stores, and robust online platforms. However, counterfeit products remain an ongoing challenge in this high-demand market.

Competitive Landscape:

The market is witnessing global brands leveraging cutting-edge tech such as energy-return midsoles and smart wearables integration, while flooding digital channels with hyper-localized influencer campaigns. Domestic players counter with hybrid designs merging streetwear trends with traditional motifs, targeting style-conscious budget shoppers. Sustainability drives innovation, with top competitors racing to launch plant-based leather alternatives and carbon-neutral production claims. Quick-commerce partnerships now enable 2-hour delivery in major cities, raising convenience stakes. Niche specialists gain ground with sport-specific performance gear for Vietnam’s emerging trail-running and urban basketball scenes. Counterfeit resistance tactics include blockchain-verified authenticity tags and AR-powered verification apps. The battleground has shifted beyond product features to encompass experiential retail, with flagship stores offering gait analysis and 3D foot scanning for customized fittings.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam athletic footwear market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Nguyễn Tiến Linh released an exclusive collection of soccer sports shoes in collaboration with sports fashion company Kaiwin Vietnam. The shoes, titled TL22 and TL22 Pro, feature a sleek, modern style and a framework that is tailored for a variety of grounds and playing techniques.

- April 2025: International sportswear company Hoka opened its first footwear store in Vietnam in collaboration with distributor Central Brand & Specialty Group (CBS). The store is situated at Saigon Center in Ho Chi Minh City and provides a wide variety of footwear options, ranging from street-ready styles to road and trail running shoes.

- April 2024: Hoka debuted its newest innovations in athletic footwear, the Skyward X and Cielo X1, at the FLYLAB event in Ho Chi Minh City. While the Skyward X is for recreational walkers and runners, the Cielo X1 is for professionals and athletes.

Vietnam Athletic Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Aerobic Shoes, Running Shoes, Walking Shoes, Trekking and Hiking Shoes, Sports Shoes |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Brand Outlets, Online Channels |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam athletic footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam athletic footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam athletic footwear industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The athletic footwear market in Vietnam was valued at USD 113.89 Million in 2024.

The Vietnam athletic footwear market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 178.51 Million by 2033.

Rising health consciousness, youth sports participation, and growing disposable incomes are driving demand for high-performance footwear. Major sporting events, e-commerce expansion, athleisure trends, and Vietnam’s role as a global manufacturing hub further accelerate market growth.

The men segment accounted for the largest end user market share in 2024, holding approximately 48.7% of the market, driven by strong sports participation and cultural norms favoring male athleticism. Brands actively target this segment through professional athlete endorsements, local league sponsorships, and limited-edition releases that resonate with male consumers' technical preferences and collectability mindset.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)