Vietnam Automotive Cabin Air Quality Sensor Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, Sales Channel, and Region, 2026-2034

Vietnam Automotive Cabin Air Quality Sensor Market Summary:

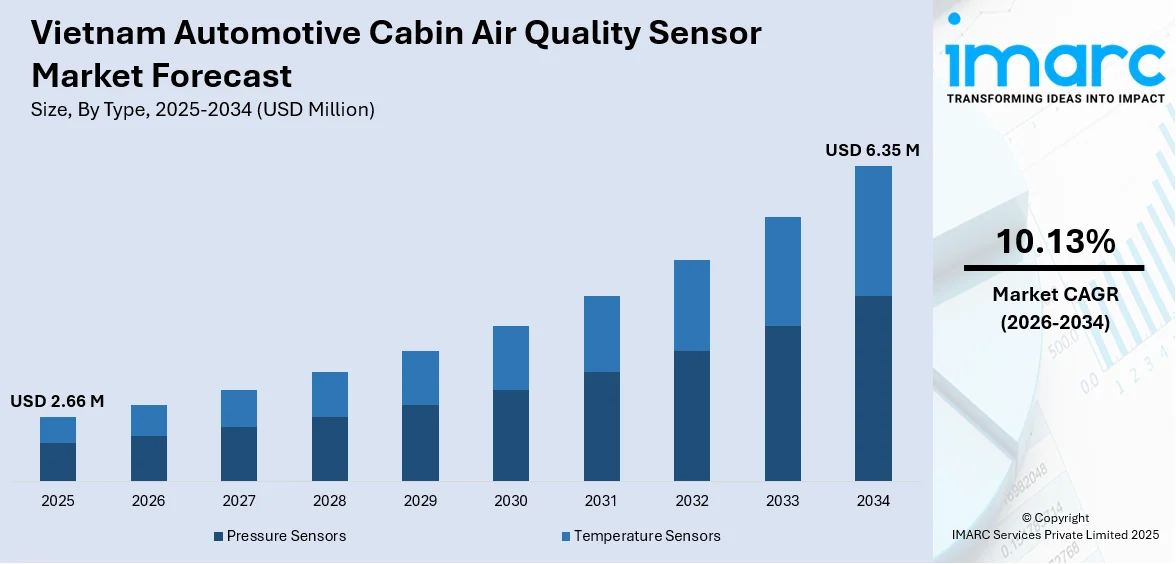

The Vietnam automotive cabin air quality sensor market size was valued at USD 2.66 Million in 2025 and is projected to reach USD 6.35 Million by 2034, growing at a compound annual growth rate of 10.13% from 2026-2034.

The Vietnam automotive cabin air quality sensor market is experiencing robust growth driven by the country's severe air pollution crisis and rising health consciousness among consumers. Vietnam ranks among the most polluted nations in Southeast Asia, creating urgent demand for in-vehicle air purification solutions. The market benefits from technological integration in smart vehicles, growing electric vehicle adoption, and increasing awareness of health impacts from poor cabin air quality. The government's focus on environmental regulations and stringent emission standards is further accelerating market expansion.

Key Takeaways and Insights:

-

By Type: Pressure sensors dominate the market with a share of 52% in 2025, driven by their critical role in monitoring cabin pressure differentials and ensuring optimal HVAC system performance for air quality management in vehicles.

-

By Technology: Active sensors lead the market with a share of 60% in 2025, owing to their superior accuracy in real-time pollutant detection and ability to provide continuous monitoring of particulate matter and volatile organic compounds.

-

By Vehicle Type: Passenger cars represent the largest segment with a market share of 72% in 2025, attributed to the growing middle-class population, rising personal vehicle ownership, and increasing consumer preference for health-focused vehicle features.

-

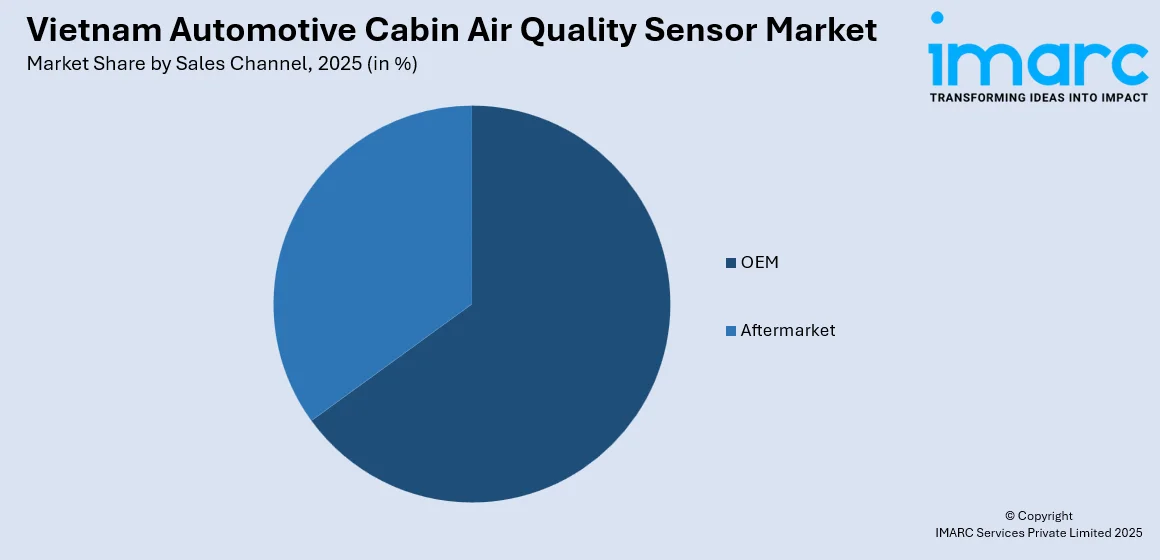

By Sales Channel: OEM leads the market with a share of 65% in 2025, reflecting automakers' strategy to integrate cabin air quality sensors as standard features rather than optional add-ons, particularly in premium and electric vehicle segments.

-

By Region: Northern Vietnam dominated with a share of 38% in 2025, driven by the concentration of automotive manufacturing facilities, higher air pollution levels in the Hanoi metropolitan area, and greater consumer awareness regarding indoor air quality.

-

Key Players: The Vietnam automotive cabin air quality sensor market exhibits a moderately competitive landscape, characterized by the presence of established multinational sensor manufacturers competing alongside emerging regional players. Market participants are focusing on technological innovation, strategic partnerships with local automotive manufacturers, and expansion of distribution networks to strengthen their market positioning.

To get more information on this market Request Sample

The Vietnam automotive cabin air quality sensor market is positioned at the intersection of environmental necessity and technological advancement. As one of Southeast Asia's fastest-growing automotive markets, Vietnam presents unique opportunities for sensor manufacturers. The country's rapid urbanization, coupled with increasing vehicle ownership rates projected to reach thirty percent by the end of this decade, creates substantial demand for advanced cabin air quality monitoring solutions. Electric vehicle manufacturers entering the Vietnamese market are increasingly positioning air quality management systems as key differentiators, driving standardization of these technologies across vehicle segments. The localization of automotive manufacturing in Vietnam, supported by significant foreign direct investment, is creating opportunities for sensor suppliers to establish regional partnerships and supply chains, potentially enhancing accessibility and affordability of these technologies.

Vietnam Automotive Cabin Air Quality Sensor Market Trends:

Rising Health Consciousness and Air Pollution Awareness

Vietnamese consumers are demonstrating heightened awareness regarding the health implications of poor air quality, particularly within enclosed vehicle cabins. This consciousness is transforming purchasing behavior as buyers increasingly prioritize vehicles equipped with advanced air quality monitoring and filtration systems. The trend is particularly pronounced among urban consumers who spend considerable time commuting through heavily congested areas. Health-focused vehicle features are transitioning from luxury additions to essential requirements, driving demand for comprehensive cabin air quality solutions across various vehicle price segments.

Integration of Smart Vehicle Technologies

The advancement of sensor technologies and their integration with intelligent vehicle systems is revolutionizing the market landscape. Modern sensors leverage connectivity features, artificial intelligence, and machine learning algorithms to provide real-time monitoring, predictive analytics, and automated responses to air quality threats. These technological innovations enable the simultaneous detection of multiple pollutants while optimizing climate control system performance automatically. Integration with vehicle infotainment systems allows occupants to monitor air quality in real-time and receive alerts about pollution levels throughout their journey.

Electric Vehicle Market Expansion

The rapid growth of Vietnam's electric vehicle market is creating new opportunities and driving standardization of cabin air quality sensors across vehicle segments. The Vietnam electric vehicle market size reached USD 3,020.00 Million in 2024. The market is projected to reach USD 17,764.32 Million by 2033, exhibiting a growth rate (CAGR) of 21.76% during 2025-2033. Electric vehicles naturally emphasize cabin comfort and cleanliness, operating more quietly and allowing passengers to better appreciate air quality improvements. Manufacturers are positioning advanced air quality management systems as key differentiators, often including filtration technologies and intelligent sensor networks as standard features. Government policies supporting electric vehicle adoption through tax incentives and reduced registration fees are accelerating this market transformation.

Market Outlook 2026-2034:

The Vietnam automotive cabin air quality sensor market demonstrates promising growth prospects driven by sustained urbanization, rising vehicle ownership, and increasing environmental awareness. The market outlook remains positive as manufacturers continue integrating advanced sensor technologies into new vehicle models while aftermarket demand grows among existing vehicle owners seeking air quality upgrades. Government environmental initiatives and emission regulations are expected to further accelerate adoption rates. Strategic investments by foreign automotive manufacturers in local production facilities are anticipated to strengthen supply chain capabilities and reduce costs. The market generated a revenue of USD 2.66 Million in 2025 and is projected to reach a revenue of USD 6.35 Million by 2034, growing at a compound annual growth rate of 10.13% from 2026-2034.

Vietnam Automotive Cabin Air Quality Sensor Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Pressure Sensors |

52% |

|

Technology |

Active Sensors |

60% |

|

Vehicle Type |

Passenger Cars |

72% |

|

Sales Channel |

OEM |

65% |

|

Region |

Northern Vietnam |

38% |

Type Insights:

- Pressure Sensors

- Temperature Sensors

The pressure sensors dominates with a market share of 52% of the total Vietnam automotive cabin air quality sensor market in 2025.

Pressure sensors lead the Vietnam automotive cabin air quality sensor market due to their critical role in monitoring and regulating air circulation systems. They accurately measure airflow within the HVAC (heating, ventilation, and air conditioning) system, ensuring optimal cabin ventilation while maintaining air quality standards. Their ability to detect subtle pressure differences allows efficient filtration and distribution of fresh air, which is essential for passenger comfort and safety. Manufacturers favor pressure sensors for their reliability, precision, and cost-effectiveness in automotive applications.

The widespread adoption of pressure sensors is further driven by their integration flexibility and low maintenance requirements, making them suitable for diverse vehicle models in Vietnam. These sensors provide real-time data that supports automated climate control, pollutant detection, and system diagnostics, enhancing overall vehicle performance. Additionally, regulatory emphasis on vehicle emissions and air quality standards encourages manufacturers to deploy sensors that ensure cabin environments remain safe and compliant. Their proven durability and compatibility with modern automotive electronics reinforce their dominant position in the market.

Technology Insights:

- Active Sensors

- Passive Sensors

The active sensors leads with a share of 60% of the total Vietnam automotive cabin air quality sensor market in 2025.

Active sensors hold a leading position in the Vietnam automotive cabin air quality sensor market due to their ability to provide continuous, real-time monitoring of air parameters. By emitting signals and measuring responses, they can detect a wide range of pollutants, including particulate matter, volatile organic compounds, and harmful gases. Their rapid and precise readings make them integral to automated air quality management systems, allowing HVAC systems to respond immediately to changing environmental conditions and maintain a healthy cabin environment.

The preference for active sensors is fueled by their high accuracy and reliability in simultaneously detecting multiple types of pollutants. Urban Vietnamese consumers increasingly seek comprehensive air quality solutions as pollution levels vary significantly during the day. Active sensors enable advanced filtration systems to adjust proactively, ensuring cleaner cabin air for passengers. Their ability to respond swiftly to environmental changes provides a safer and healthier commuting experience, particularly in heavily polluted metropolitan areas.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The passenger cars exhibit clear dominance with a 72% share of the total Vietnam automotive cabin air quality sensor market in 2025.

Passenger cars represent the largest segment, driven by Vietnam's expanding middle class and increasing personal vehicle ownership rates. Consumers purchasing private vehicles demonstrate a strong preference for health-focused features, viewing cabin air quality sensors as essential rather than optional equipment. The segment benefits from automakers' strategies to differentiate their offerings through enhanced comfort and wellness features, making air quality monitoring increasingly standard across various price points.

The electric vehicle revolution in Vietnam is significantly impacting the passenger car segment, with manufacturers positioning advanced air quality management as a key value proposition. Electric vehicle buyers, typically more environmentally conscious, show heightened interest in comprehensive cabin air monitoring capabilities. This trend is creating cascading effects on traditional internal combustion engine vehicles, where manufacturers incorporate similar features to remain competitive in the evolving market landscape.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The OEM dominates with a market share of 65% of the total Vietnam automotive cabin air quality sensor market in 2025.

OEMs (Original Equipment Manufacturers) dominate the Vietnam automotive cabin air quality sensor market because they integrate sensors directly into new vehicles during production, ensuring compatibility, reliability, and optimal system performance. By embedding sensors at the design stage, OEMs provide seamless integration with HVAC systems and vehicle electronics, enhancing overall air quality management. This built-in approach offers a competitive advantage over aftermarket solutions, as it guarantees consistent quality, adherence to safety standards, and long-term durability preferred by both manufacturers and consumers.

The dominance of OEMs is further supported by their ability to offer tailored, vehicle-specific solutions that meet stringent regulatory requirements and manufacturer specifications. OEM-installed sensors benefit from warranties, calibration standards, and integration with advanced climate control systems, increasing consumer trust and satisfaction. In Vietnam, rising demand for factory-installed, high-quality cabin air quality solutions in new vehicles reinforces OEM preference. Additionally, OEMs leverage scale production and established supply chains, enabling cost-effective deployment across multiple vehicle models while maintaining performance and reliability standards.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with a 38% share of the total Vietnam automotive cabin air quality sensor market in 2025.

The high rate of urbanization, as well as the increase in the number of vehicles being owned in Northern Vietnam, are major factors associated with the growth of the automotive cabin air quality sensor market. The traffic density, as well as the amount of air pollution being witnessed in urban areas such as Hanoi and Hai Phong, is high. This has triggered increased demand for healthier environments inside vehicles. The effect of poor air quality on human health is gradually generating interest in the use of advanced automotive cabin air sensors.

Government policies regarding vehicle emissions and air pollution, and rising awareness regarding the health of the environment among consumers, are important factors in Northern Vietnam. Automotive makers are including the feature of cabin air quality sensors in vehicles to meet emission requirements and ensure improved safety measures. Customers demand vehicles that feature auto air filtration and pollutant detectors, especially during unstable conditions of urban air quality. This factor of pressure and demand makes the automotive market of Northern Vietnam a favorable one for cabin air quality sensors.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Automotive Cabin Air Quality Sensor Market Growing?

Severe Air Pollution Crisis and Environmental Urgency

Vietnam faces one of the most severe air pollution challenges in Southeast Asia, creating unprecedented demand for automotive cabin air quality sensors. In Vietnam, air pollution is responsible for the deaths of at least 70,000 people annually. Major metropolitan areas experience dangerously high levels of particulate matter and harmful pollutants, particularly during seasonal weather patterns that trap contaminants close to ground level. This environmental reality has fundamentally transformed consumer awareness and purchasing behavior, with vehicles increasingly recognized as controllable environments where individuals can protect themselves from external air quality threats. The health implications are particularly concerning, as transportation contributes significantly to urban air pollution through emissions from the large number of vehicles on Vietnamese roads. This situation creates a unique market dynamic where consumers actively seek protection from environmental hazards, driving sustained demand for advanced cabin air quality monitoring and filtration systems. Rising disposable incomes among the growing middle class enable consumers to prioritize health-focused vehicle features.

Rapid Electric Vehicle Adoption and Premium Feature Standardization

The dramatic expansion of Vietnam's electric vehicle market is accelerating adoption of cabin air quality sensors across all vehicle segments. Electric vehicles inherently emphasize cabin comfort and environmental consciousness, with manufacturers positioning advanced air quality management systems as essential differentiators rather than premium options. Government policies supporting electric vehicle adoption through registration fee exemptions and tax incentives are creating favorable conditions for market growth. Foreign automakers entering Vietnam's expanding electric vehicle market bring advanced cabin air quality technologies as part of their value propositions, raising consumer expectations across the industry. The localization of automotive manufacturing through significant investments is creating opportunities for sensor suppliers to establish regional partnerships and supply chains. This manufacturing ecosystem evolution is expected to reduce costs and improve accessibility of air quality technologies across different vehicle price segments, democratizing access to these health-focused features.

Technological Innovation and Smart Vehicle Integration

Advancement of sensor technologies and their integration with intelligent vehicle systems is revolutionizing the automotive cabin air quality sensor market. Modern sensors leverage connectivity features, artificial intelligence, and machine learning algorithms to provide real-time monitoring, predictive analytics, and automated responses to air quality threats. These technological innovations enable simultaneous detection of multiple pollutants including fine particulate matter, volatile organic compounds, carbon monoxide, and nitrogen oxides commonly found in Vietnamese urban environments. Advanced sensor fusion technology combines data from multiple sources to provide comprehensive air quality assessments and optimize climate control system performance automatically. Integration with vehicle infotainment systems enables occupants to monitor air quality in real-time, receive alerts about pollution levels, and track exposure patterns over time. This technological sophistication is particularly valuable in urban areas where pollution levels vary dramatically throughout the day, enabling intelligent route planning and air filtration optimization.

Market Restraints:

What Challenges the Vietnam Automotive Cabin Air Quality Sensor Market is Facing?

High Implementation Costs and Price Sensitivity

The integration of advanced cabin air quality sensor systems involves significant costs that can impact vehicle pricing and consumer affordability. Premium sensor technologies and their associated integration requirements add to manufacturing expenses, potentially limiting adoption in budget-conscious market segments. Price sensitivity among Vietnamese consumers, particularly in entry-level vehicle categories, creates challenges for widespread market penetration.

Limited Awareness in Secondary Markets

Consumer awareness regarding cabin air quality sensor benefits remains limited outside major metropolitan areas. Rural and secondary urban markets demonstrate lower understanding of air quality health implications and sensor technology advantages. This knowledge gap restricts market expansion beyond primary urban centers where pollution concerns are most acute and consumer education levels regarding these technologies are higher.

Technical Integration Complexities

Integrating sophisticated air quality sensors with existing vehicle systems presents technical challenges, particularly for aftermarket installations. Compatibility requirements across different vehicle manufacturers and model years create complexities for universal sensor solutions. The need for specialized installation expertise and calibration procedures can limit accessibility and increase total ownership costs for consumers seeking to upgrade existing vehicles.

Competitive Landscape:

The Vietnam automotive cabin air quality sensor market exhibits a moderately competitive landscape characterized by the presence of established multinational sensor manufacturers alongside emerging regional players. Market participants are focusing on technological innovation, product differentiation, and strategic partnerships with local automotive manufacturers to strengthen their competitive positioning. International sensor specialists bring advanced technology portfolios and global manufacturing expertise, while regional competitors offer localized solutions and cost advantages. The competitive environment is intensifying as electric vehicle manufacturers increasingly integrate sophisticated air quality management systems as standard features, driving partnerships between sensor suppliers and automakers. Market players are investing in research and development to enhance sensor accuracy, reduce costs, and improve integration capabilities. Distribution network expansion and aftermarket service capabilities are becoming key competitive differentiators as the market matures beyond initial adoption phases.

Vietnam Automotive Cabin Air Quality Sensor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pressure Sensors, Temperature Sensors |

| Technologies Covered | Active Sensors, Passive Sensors |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam automotive cabin air quality sensor market size was valued at USD 2.66 Million in 2025.

The Vietnam automotive cabin air quality sensor market is expected to grow at a compound annual growth rate of 10.13% from 2026-2034 to reach USD 6.35 Million by 2034.

Pressure sensors dominated the market with a 52% share in 2025, driven by their critical role in monitoring cabin pressure differentials and enabling precise control of air circulation systems for optimal air quality management.

Key factors driving the Vietnam automotive cabin air quality sensor market include severe air pollution levels in major urban areas, rising health consciousness among consumers, rapid electric vehicle adoption, technological advancements in sensor integration, and government environmental initiatives supporting cleaner transportation.

Major challenges include high implementation costs affecting vehicle pricing, limited consumer awareness in secondary markets outside major metropolitan areas, technical integration complexities for aftermarket installations, compatibility requirements across different vehicle manufacturers, and the need for specialized installation expertise.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)