Vietnam Automotive Glass Market Size, Share, Trends and Forecast by Glass Type, Material Type, Vehicle Type, Application, End-User, Technology, and Region, 2026-2034

Vietnam Automotive Glass Market Overview:

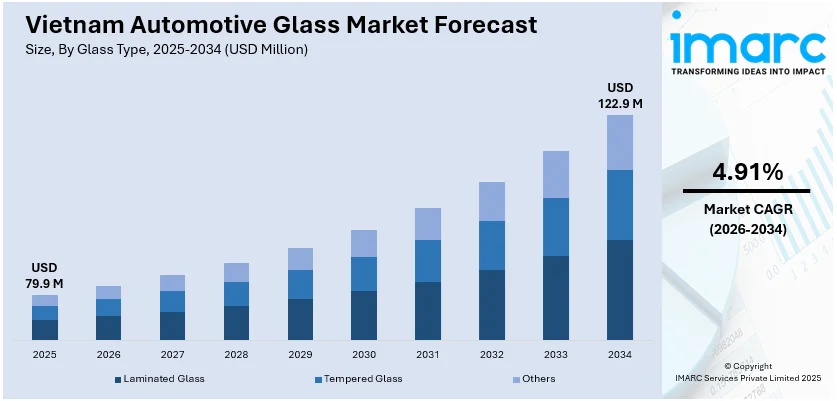

The Vietnam automotive glass market size reached USD 79.9 Million in 2025. The market is projected to reach USD 122.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.91% during 2026-2034. The market is fueled by the speedy progress of smart glass technology integration in vehicle applications, the large-scale development of float glass manufacturing capacity, and the growing electric vehicle uptake. Moreover, the heightened emphasis on improved automotive safety features and the heightened need for specialized glass solutions in luxury and performance vehicles are driving the Vietnam automotive glass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.9 Million |

| Market Forecast in 2034 | USD 122.9 Million |

| Market Growth Rate 2026-2034 | 4.91% |

Vietnam Automotive Glass Market Trends:

Smart Glass Technology Integration and Advanced Functionality

The Vietnamese automotive glass industry is undergoing rapid change fueled by advances in technology and consumer demands for more vehicle functions. With automotive makers incorporating smart glass technology into more vehicles, the industry is trending toward products that not only provide strength and safety but also sophisticated functions like privacy management, energy saving, and better aesthetics. Smart glass technology, including electrochromic and photochromic glass, is gaining traction as it can control transparency based on environmental conditions, leading to greater passenger comfort. In addition, the adoption of advanced sensors and connectivity aspects is boosting automotive glazing innovation with a focus on driver aid systems and in-car entertainment. As Vietnam increasingly adopts environmentally friendly and energy-efficient automobile solutions, high-performance automobile glass combined with advanced capabilities will see increasing demand, conforming to the general patterns of the global automobile sector.

To get more information on this market Request Sample

Float Glass Manufacturing Expansion and Infrastructure Development

The Vietnam automotive glass market growth is significantly supported by the country's robust expansion in float glass manufacturing capabilities and infrastructure development initiatives. Vietnam's float glass market is experiencing robust growth, propelled by the booming construction and automotive sectors, with Vietnam's construction industry marked by a 7.8% growth rate in 2024, directly correlating to increased demand for float glass as local automobile manufacturing ramps up. Though Vietnam has developed significant manufacturing capabilities over recent years, it still relies heavily on imports for high-end float glass. The Vietnamese float glass market presents lucrative opportunities for international players, supported by favorable government policies and investment trends, as strategic investments and collaboration capitalize on Vietnam's potential as an expanding market for both architectural and automotive float glass applications. Local production is currently dominated by low- and medium-end products due to underdeveloped technology compared to more mature markets, creating opportunities for technology transfer and advanced manufacturing partnerships.

Electric Vehicle Growth and Specialized Glass Requirements

Vietnam's automotive glass market is experiencing unprecedented growth driven by the rapid expansion of electric vehicles and the increasing demand for specialized glass solutions tailored to EV requirements. Electric vehicles require specialized automotive glass solutions including enhanced thermal management properties, integrated heating elements for rapid defrosting, and advanced connectivity features for heads-up displays and augmented reality applications. Hyundai introduced a Metal-Coated Heated Glass system in its luxury Genesis EV models featuring a 48-volt system that rapidly clears ice from windshields in just five minutes, demonstrating the integration of advanced heating technologies. The shift toward electric mobility necessitates automotive glass with improved aerodynamics, weight optimization, and enhanced thermal insulation properties, driving innovation in materials science and manufacturing processes throughout Vietnam's growing automotive supply chain ecosystem.

Vietnam Automotive Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional levels for 2026-2034. Our report has categorized the market based on glass type, material type, vehicle type, application, end-user, and technology.

Glass Type Insights:

- Laminated Glass

- Tempered Glass

- Others

The report has provided a detailed breakup and analysis of the market based on glass type. This includes laminated glass, tempered glass, and others.

Material Type Insights:

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

A detailed breakup and analysis of the market based on material type have also been provided in the report. This includes IR PVB, metal coated glass, tinted glass, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Others

A detailed breakup and analysis of the market based on vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, trucks, buses, and others.

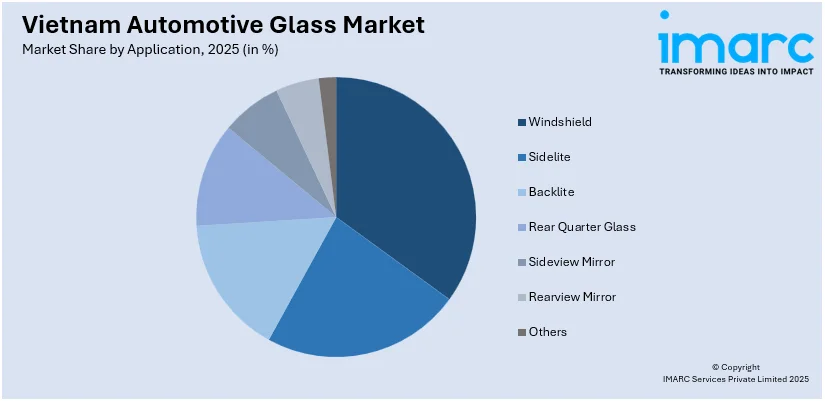

Application Insights:

Access the comprehensive market breakdown Request Sample

- Windshield

- Sidelite

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

A detailed breakup and analysis of the market based on application have also been provided in the report. This includes windshield, sidelite, backlite, rear quarter glass, sideview mirror, rearview mirror, and others.

End-User Insights:

- OEMs

- Aftermarket Suppliers

A detailed breakup and analysis of the market based on end-user have also been provided in the report. This includes OEMs and aftermarket suppliers.

Technology Insights:

- Active Smart Glass

- Suspended Particle Device Glass

- Electrochromic Glass

- Liquid Crystal Glass

- Passive Glass

- Thermochromic Glass

- Photochromic Glass

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes active smart glass (suspended particle device glass, electrochromic glass, liquid crystal glass) and passive glass (thermochromic glass, photochromic glass).

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Automotive Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| End Users Covered | OEMs, Aftermarket Suppliers |

| Technologies Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam automotive glass market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam automotive glass market on the basis of glass type?

- What is the breakup of the Vietnam automotive glass market on the basis of material type?

- What is the breakup of the Vietnam automotive glass market on the basis of vehicle type?

- What is the breakup of the Vietnam automotive glass market on the basis of application?

- What is the breakup of the Vietnam automotive glass market on the basis of end-user?

- What is the breakup of the Vietnam automotive glass market on the basis of technology?

- What is the breakup of the Vietnam automotive glass market on the basis of region?

- What are the various stages in the value chain of the Vietnam automotive glass market?

- What are the key driving factors and challenges in the Vietnam automotive glass market?

- What is the structure of the Vietnam automotive glass market and who are the key players?

- What is the degree of competition in the Vietnam automotive glass market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam automotive glass market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam automotive glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam automotive glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)