Vietnam Automotive Radar Market Size, Share, Trends and Forecast by Range, Vehicle Type, Application, and Region, 2026-2034

Vietnam Automotive Radar Market Overview:

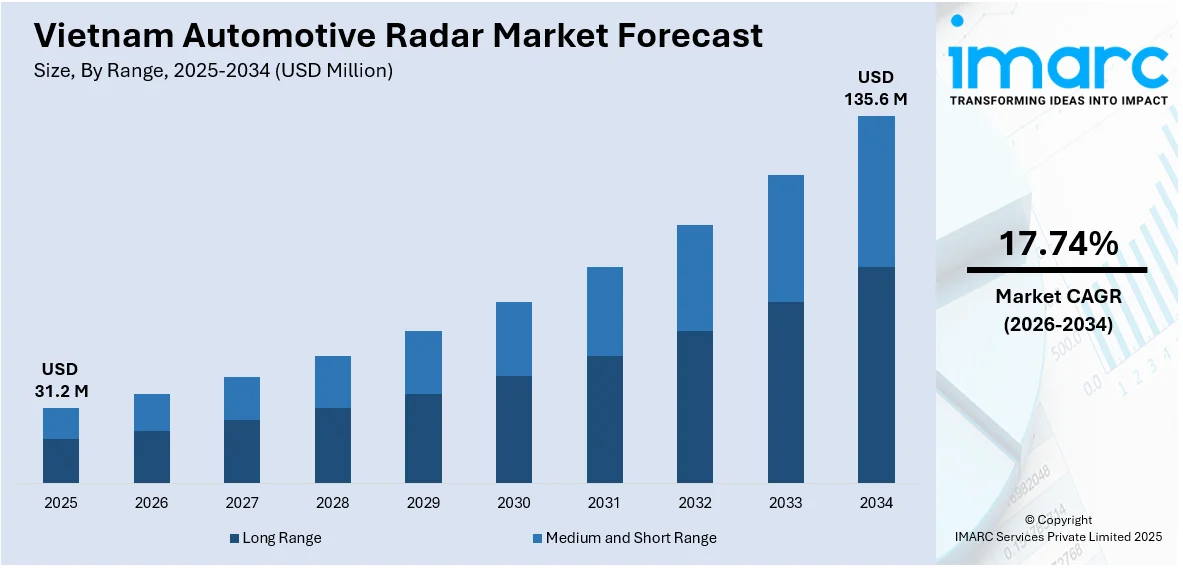

The Vietnam automotive radar market size reached USD 31.2 Million in 2025. The market is projected to reach USD 135.6 Million by 2034, exhibiting a growth rate (CAGR) of 17.74% during 2026-2034. The market is driven by growing government focus on road safety regulations, expansion of advanced driver assistance systems throughout the country, and increasing market entry of global automotive manufacturers establishing local operations and partnerships. These factors, along with extensive R&D efforts, are collectively expanding the Vietnam automotive radar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 31.2 Million |

| Market Forecast in 2034 | USD 135.6 Million |

| Market Growth Rate 2026-2034 | 17.74% |

Vietnam Automotive Radar Market Trends:

Enhanced Road Safety Regulatory Framework

Vietnam has significantly strengthened its road safety regulatory environment with new legislations. This regulatory push extends beyond child safety to encompass broader vehicle safety technologies, creating a conducive environment for automotive radar adoption. The government's commitment to reducing road traffic fatalities and injuries has led to increased emphasis on mandatory safety features in vehicles. Advanced driver assistance systems, which rely heavily on automotive radar technology, are becoming essential components for vehicle manufacturers seeking to comply with evolving safety standards. This regulatory framework is encouraging both domestic and international automotive manufacturers to integrate more sophisticated radar-based safety systems into their vehicle offerings. The enhanced focus on road safety is creating substantial demand for automotive radar systems across passenger cars and commercial vehicles, as manufacturers prioritize compliance with safety regulations while meeting consumer expectations for advanced safety features.

To get more information on this market Request Sample

Rapid ADAS Market Expansion

The Vietnam advanced driver assistance systems market is experiencing robust growth, driven by the expansion of the automotive sector and rising government safety regulations. This growth directly correlates with increased demand for automotive radar systems, which serve as critical components in ADAS applications including adaptive cruise control, autonomous emergency braking, and blind spot detection. Vietnamese consumers are increasingly prioritizing safety features when purchasing vehicles, leading to higher adoption rates of ADAS-equipped vehicles. The integration of radar technology in passenger cars and commercial vehicles is becoming standard practice among manufacturers operating in Vietnam. Additionally, the growing awareness of road safety benefits provided by ADAS features is driving consumer willingness to invest in vehicles equipped with these technologies. The Vietnam automotive radar market growth is further supported by technological advancements in radar systems, making them more affordable and accessible to a broader range of vehicle segments, from economy models to luxury vehicles.

International Manufacturer Market Entry

Vietnam's automotive market witnessed significant international expansion. This influx of global manufacturers is transforming Vietnam's automotive landscape and creating substantial demand for automotive radar technologies. These international companies bring advanced safety standards and ADAS capabilities that rely heavily on radar systems, elevating the overall technology requirements in the Vietnamese market. Many of these brands are planning local assembly operations, which will create local demand for automotive radar components and systems. The competitive environment created by multiple international entrants is driving innovation and cost optimization in radar technology deployment. Furthermore, these manufacturers' global experience with radar-based safety systems is accelerating the adoption timeline in Vietnam, as they introduce vehicles already equipped with advanced radar technologies. The establishment of local partnerships and manufacturing facilities by these international companies is creating a robust ecosystem for automotive radar suppliers and technology providers.

Vietnam Automotive Radar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on range, vehicle type, and application.

Range Insights:

- Long Range

- Medium and Short Range

The report has provided a detailed breakup and analysis of the market based on range. This includes long range and medium and short range.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

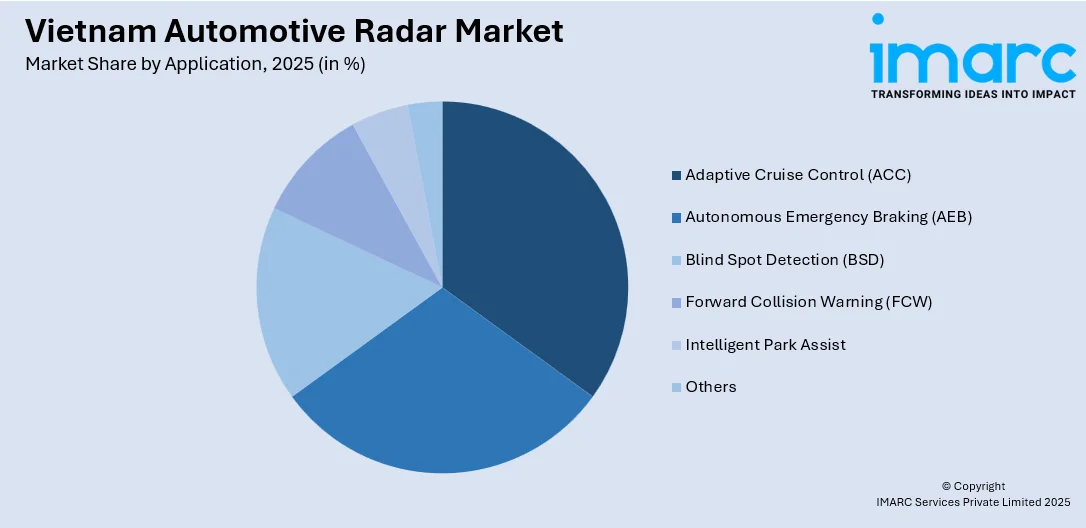

Application Insights:

Access the comprehensive market breakdown Request Sample

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning (FCW)

- Intelligent Park Assist

- Others

A detailed breakup and analysis of the market based on application have also been provided in the report. This includes adaptive cruise control (ACC), autonomous emergency braking (AEB), blind spot detection (BSD), forward collision warning (FCW), intelligent park assist, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Automotive Radar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ranges Covered | Long Range, Medium and Short Range |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Intelligent Park Assist, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam automotive radar market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam automotive radar market on the basis of range?

- What is the breakup of the Vietnam automotive radar market on the basis of vehicle type?

- What is the breakup of the Vietnam automotive radar market on the basis of application?

- What is the breakup of the Vietnam automotive radar market on the basis of region?

- What are the various stages in the value chain of the Vietnam automotive radar market?

- What are the key driving factors and challenges in the Vietnam automotive radar market?

- What is the structure of the Vietnam automotive radar market and who are the key players?

- What is the degree of competition in the Vietnam automotive radar market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam automotive radar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam automotive radar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam automotive radar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)