Vietnam Automotive Rocker Panel Market Size, Share, Trends and Forecast by Type, Vehicle Type, Sales Channel, Material, and Region, 2026-2034

Vietnam Automotive Rocker Panel Market Summary:

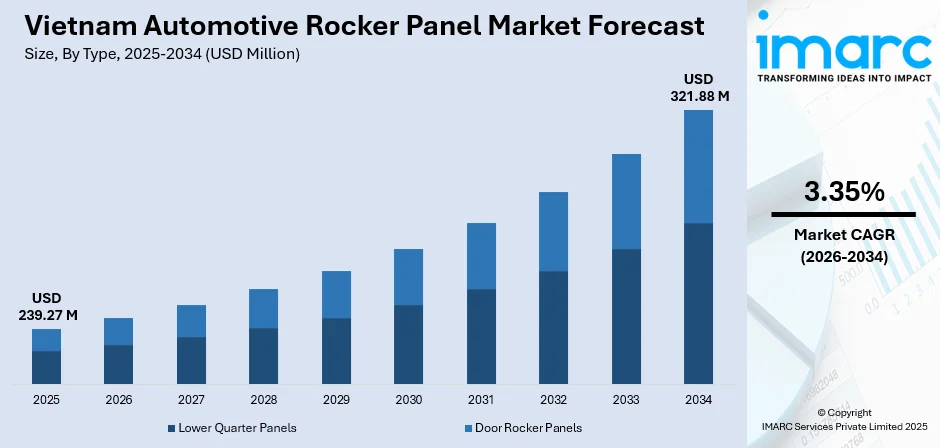

The Vietnam automotive rocker panel market size was valued at USD 239.27 Million in 2025 and is projected to reach USD 321.88 Million by 2034, growing at a compound annual growth rate of 3.35% from 2026-2034.

The growth is driven by rapid expansion in Vietnam's automotive sector, with vehicle production increasing, coupled with significant foreign direct investments from Chinese and Japanese manufacturers establishing local assembly operations. Apart from this, the heightened emphasis on vehicle safety standards and structural integrity, combined with government policies supporting domestic automotive manufacturing through registration fee reductions and favorable tax incentives, continues to expand the Vietnam automotive rocker panel market share.

Key Takeaways and Insights:

- By Type: Lower quarter panels dominate the market with a share of 56% in 2025, serving as fundamental protective components beneath vehicle doors across all vehicle types, safeguarding lower body structure from road debris and corrosion while reinforcing chassis integrity for passenger cars and commercial vehicles.

- By Vehicle Type: Light duty vehicles lead the market with a share of 54% in 2025, driven by passenger car predominance, and presence of various established brands maintaining strong presence, reflecting rising middle-class purchasing power and urbanization trends.

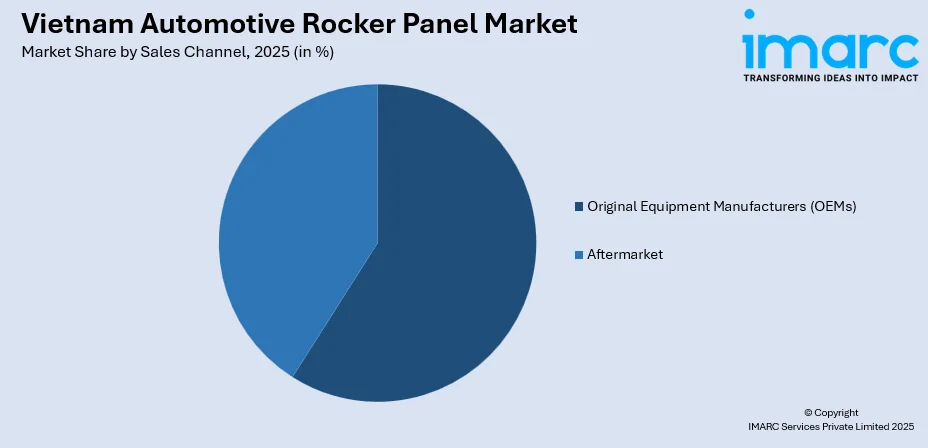

- By Sales Channel: Original equipment manufacturers (OEMs) represent the largest segment with a market share of 59% in 2025, reflecting Vietnam's domestic assembly focus, with major OEMs, and new entrants establishing manufacturing operations through joint ventures.

- By Material: Stainless steel leads the market with a share of 53% in 2025, due to superior corrosion resistance suited to Vietnam's tropical climate, supported by robust supply infrastructure.

- By Region: Northern Vietnam represents the largest segment with a market share of 38% in 2025, anchored by major manufacturing facilities, alongside strategic steel production hubs in Hai Phong and Ha Tinh.

- Key Players: Leading companies are improving operations by localizing manufacturing, adopting lighter and more durable materials, upgrading production technology, collaborating with vehicle manufacturers, and optimizing supply chains to reduce costs, support electric vehicles, and strengthen their competitive position in Vietnam’s market.

To get more information on this market Request Sample

The Vietnam automotive rocker panel market is experiencing robust growth fueled by the country's emergence as one of Southeast Asia's fastest-growing automotive markets, with total vehicle sales reaching 340,142 units in 2024 representing a 12.6% year-on-year increase. The market benefits from Vietnam's strategic position within 18 bilateral and multilateral free trade agreements that reduce barriers and provide access to cutting-edge technology and export markets. Foreign automotive manufacturers are committing to substantial local investments, with Geely establishing a joint venture with Tasco in Thai Binh for 75,000 units annual capacity at an investment of $168 million set to commence in early 2025. VinFast's achievement as Vietnam's best-selling brand in late 2024 with a large number of domestic deliveries demonstrates the accelerating demand for vehicles and associated components including rocker panels.

Vietnam Automotive Rocker Panel Market Trends:

Electric Vehicle Transition Driving Component Innovation

Vietnam's automotive market is experiencing rapid electrification with electric vehicles accounting for a significant percentage of total new car sales in 2024, supported by government incentives. This shift toward electric mobility necessitates innovative rocker panel designs to accommodate battery packs and meet distinct structural requirements for EVs, driving manufacturers to develop specialized lightweight yet durable solutions. VinFast Auto Ltd. reported its initial domestic deliveries in Vietnam of 11,496 electric vehicles for May 2025. So far in 2025, the Company has supplied 56,187 EVs to customers in Vietnam, strengthening its top position in the local EV market.

Foreign Brand Expansion and Manufacturing Localization

Vietnam witnessed an influx of Chinese automotive manufacturers in 2024 with seven new brands entering the market, bringing the total to 13 Chinese brands surpassing Japan's nine brands, distinguished by strong commitments to local manufacturing and long-term investments. BYD entered the Vietnamese market in July 2024, followed by Omoda and Jaecoo, many planning local assembly operations. The wave of new entrants reflects growing competition particularly in electric and hybrid vehicle segments, directly increasing demand for locally produced automotive components including rocker panels. Major international OEMs maintain assembly operations through joint ventures with domestic partners, creating substantial opportunities for component suppliers to integrate into expanding local supply chains.

Government Policy Support Stimulating Domestic Manufacturing

Vietnam's government implemented comprehensive supportive policies to accelerate domestic automotive manufacturing, most notably Decree No. 109/2024/ND-CP reducing registration fees for locally manufactured and assembled vehicles by 50% during September, October, and November 2024, marking the fourth such policy since the COVID-19 pandemic. Vietnam's extensive network of bilateral and multilateral free trade agreements strengthens its position as a strategic investment destination by reducing trade barriers and providing manufacturers access to cutting-edge technology and new export markets. These favorable policies create stable long-term growth prospects for automotive component manufacturers including rocker panel producers, encouraging investments in production capacity and technological capabilities to serve the expanding domestic market and regional export opportunities.

Market Outlook 2026-2034:

The market is benefitting from continued foreign direct investments with major projects, while motor vehicle manufacturing in Vietnam demonstrated robust growth in 2025 following strong 2024 performance. The market generated a revenue of USD 239.27 Million in 2025 and is projected to reach a revenue of USD 321.88 Million by 2034, growing at a compound annual growth rate of 3.35% from 2026-2034. The transition toward electric and hybrid vehicles will accelerate component innovation and create premium pricing opportunities for advanced rocker panel solutions, while government policies supporting domestic manufacturing through tax incentives and registration fee reductions will sustain healthy demand growth. Vietnam's industrial production index surged in 2025 marking the highest growth rate since 2019, with manufacturing and processing sectors creating favorable macroeconomic conditions for automotive component suppliers.

Vietnam Automotive Rocker Panel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Lower Quarter Panels |

56% |

|

Vehicle Type |

Light Duty Vehicles |

54% |

|

Sales Channel |

Original Equipment Manufacturers (OEMs) |

59% |

|

Material |

Stainless Steel |

53% |

|

Region |

Northern Vietnam |

38% |

Type Insights:

- Lower Quarter Panels

- Door Rocker Panels

Lower quarter panels dominate with a market share of 56% of the total Vietnam automotive rocker panel market in 2025.

Lower quarter panels represent the largest product category in Vietnam's automotive rocker panel market, accounting for the majority of production volume due to their critical structural function and universal application across all vehicle types. These panels serve as fundamental protective components located beneath vehicle doors, safeguarding the lower body structure from road debris, corrosion, and impact damage while reinforcing overall chassis integrity. The dominance of lower quarter panels reflects their essential role in both original equipment manufacturing and aftermarket replacement segments, with manufacturers prioritizing durability and corrosion resistance particularly suited to Vietnam's tropical climate conditions.

The segment benefits from Vietnam's automotive production surge with motor vehicle manufacturing leading industrial expansion. The influx of foreign automotive manufacturers establishing local assembly operations, creates expanding demand for lower quarter panels as essential structural components. Vietnam's emphasis on domestic vehicle assembly where approximately 70% of vehicles sold were assembled locally in 2023, combined with government policies including Decree No. 109/2024/ND-CP reducing registration fees by 50%, directly stimulates component demand throughout the supply chain supporting sustained growth for lower quarter panel manufacturers.

Vehicle Type Insights:

- Light Duty Vehicles

- Medium Duty Vehicles

- Heavy Duty Vehicles

Light duty vehicles lead with a share of 54% of the total Vietnam automotive rocker panel market in 2025.

Light duty vehicles (LDVs) form the largest segment in the automotive rocker panel market due to their widespread adoption and high production volumes. This segment includes passenger cars, hatchbacks, sedans, and compact SUVs that are primarily used for personal and urban transportation. Growing urbanization, increasing disposable incomes, and improved access to vehicle financing have accelerated demand for light duty vehicles. In addition, rising consumer preference for comfort, safety, and vehicle aesthetics has encouraged manufacturers to integrate high-quality rocker panels that enhance structural strength and side-impact protection. Frequent model upgrades and shorter vehicle replacement cycles further contribute to sustained demand within this segment.

The dominance of light duty vehicles is also reinforced by the rapid growth of electric and hybrid passenger cars. Automakers are increasingly using lightweight materials such as aluminum and advanced composites in rocker panels to improve energy efficiency and extend driving range. Moreover, stricter safety and emission regulations are pushing manufacturers to adopt innovative designs and corrosion-resistant materials. The strong presence of global and regional automotive brands, combined with continuous technological advancements, ensures that light duty vehicles remain the primary growth driver in the automotive rocker panel market.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Aftermarket

- Original Equipment Manufacturers (OEMs)

Original equipment manufacturers (OEMs) exhibit a clear dominance with a 59% share of the total Vietnam automotive rocker panel market in 2025.

Original equipment manufacturers (OEMs) represent the largest sales channel in the automotive rocker panel market, driven by strong demand from vehicle manufacturers during the production stage. OEMs integrate rocker panels directly into new vehicles, ensuring consistent quality, precise fitment, and compliance with safety and design standards. Growing vehicle production, particularly in passenger cars and light commercial vehicles, has significantly supported OEM demand. Automakers increasingly collaborate with component suppliers to develop customized rocker panels that enhance structural rigidity, crash performance, and overall vehicle aesthetics. These long-term supplier agreements help OEMs maintain cost efficiency and stable supply chains.

The dominance of the OEM segment is further strengthened by advancements in automotive technology and material innovation. Manufacturers are adopting lightweight metals, high-strength steel, and composites to improve fuel efficiency and meet emission regulations. OEM channels also benefit from the rapid expansion of electric and hybrid vehicle production, where rocker panels play a critical role in battery protection and structural safety. Additionally, strict quality control requirements and regulatory standards favor OEM-supplied components over aftermarket alternatives, ensuring that the OEM segment continues to hold the largest share in the automotive rocker panel market.

Material Insights:

- Stainless Steel

- Fiber

- Rubber

Stainless steel leads with a share of 53% of the total Vietnam automotive rocker panel market in 2025.

Stainless steel is the largest material segment in the automotive rocker panel market due to its superior strength, durability, and corrosion resistance. Rocker panels are exposed to moisture, road debris, and harsh environmental conditions, making stainless steel an ideal choice for long-term performance. Its high resistance to rust and impact damage helps extend vehicle lifespan while maintaining structural integrity and safety. Automakers widely prefer stainless steel rocker panels for passenger cars and commercial vehicles, as the material supports both functional protection and aesthetic appeal. Its ability to withstand extreme conditions with minimal maintenance further reinforces its dominant market position.

The continued leadership of stainless steel is also driven by its compatibility with modern manufacturing processes and safety standards. The material allows for precise shaping and welding, enabling manufacturers to design rocker panels that enhance side-impact protection and overall vehicle rigidity. Additionally, stainless steel is recyclable, aligning with the automotive industry’s growing focus on sustainability and environmental responsibility. While lightweight materials are gaining attention, stainless steel remains the preferred option due to its cost-effectiveness, reliability, and proven performance, ensuring its strong demand across a wide range of vehicle types and market segments.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with a 38% share of the total Vietnam automotive rocker panel market in 2025.

Northern Vietnam represents the largest regional segment in the automotive rocker panel market, supported by its strong industrial base and concentration of automotive manufacturing facilities. The region hosts several major vehicle assembly plants, component suppliers, and industrial zones, particularly around Hanoi and neighboring provinces. Well-developed infrastructure, skilled labor availability, and proximity to key ports and logistics hubs make Northern Vietnam an attractive location for automotive production. As a result, demand for rocker panels is consistently high, driven by steady vehicle manufacturing activities and strong OEM presence in the region.

The dominance of Northern Vietnam is further reinforced by supportive government policies and increasing foreign direct investment in the automotive sector. International automakers and suppliers continue to expand operations in the region to serve both domestic and export markets. Additionally, rising vehicle ownership and growing demand for passenger cars contribute to sustained component consumption. Ongoing improvements in transportation infrastructure and supply chain efficiency are expected to further strengthen Northern Vietnam’s position, ensuring it remains the leading regional contributor to the automotive rocker panel market.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Automotive Rocker Panel Market Growing?

Rapid Expansion of Vietnam's Automotive Manufacturing Sector

Vietnam's automotive industry is experiencing unprecedented growth with vehicle production reaching 388,500 units in 2024 marking a 27% increase from 2023 levels, while motor vehicle manufacturing led industrial expansion contributing significantly to the country's highest industrial production index growth rate. The automotive sector's transformation is evidenced by total vehicle sales rising demonstrating robust forward momentum. Major foreign automotive manufacturers are establishing substantial manufacturing presence through significant investments. The influx of Chinese manufacturers in 2024 with seven new brands entering the market bringing the total to 13 Chinese brands surpassing Japan's nine brands, distinguished by strong commitments to local manufacturing and long-term investments, creates expanding demand for locally produced automotive components.

Government Policies and Foreign Direct Investment Incentives

The Vietnamese government has implemented comprehensive supportive policies to accelerate domestic automotive manufacturing. The government introduced 0% registration tax for battery electric vehicles through 2026 catalyzing EV adoption, with experts expecting similar positive impacts following the recently announced extension of EV registration incentives in 2025. These favorable policies and investment incentives create stable long-term growth prospects for automotive component manufacturers including rocker panel producers, encouraging investments in production capacity, technological capabilities, and supply chain integration to serve expanding domestic demand and regional export opportunities within ASEAN markets.

Infrastructure Development and Supply Chain Localization Initiatives

Vietnam's strategic emphasis on building robust automotive supply chains is addressing the current situation where limited percentage of components are produced within Vietnam reflecting heavy dependence on imported parts particularly from Thailand, Indonesia, and Japan, underscoring pressing needs for greater local production capacity. The combination of increasing local component production capacity, material supply infrastructure, skilled workforce development, and government support for manufacturing sector growth creates favorable conditions for rocker panel manufacturers to establish operations, secure long-term OEM contracts, and capture market share from imported components while benefiting from cost advantages and proximity to assembly plants. A recent report from the General Statistics Office under the Ministry of Finance indicates that approximately 76,186 new vehicles, including both domestic and imported, were introduced to the Vietnamese market in December 2025. This represented a 12.8% rise in comparison to November (67,550 units).

Market Restraints:

What Challenges the Vietnam Automotive Rocker Panel Market is Facing?

High Dependence on Imported Raw Materials and Components

Vietnam's automotive industry faces significant challenges from heavy reliance on imported parts and raw materials, creating vulnerability to global supply chain disruptions and price fluctuations. The localization rate remains substantially lower compared to mature automotive markets like Thailand and Indonesia, limiting cost competitiveness and supply chain resilience for Vietnamese manufacturers. Addressing this restraint requires sustained investments in domestic steel production capacity, material processing technologies, and supplier development programs to achieve higher localization rates that enhance supply chain stability and cost efficiency.

Intense Competition from Imported Completely Built-Up Vehicles

Vietnam's automotive market is experiencing intensifying pressure from imported completely built-up vehicles with import sales soaring in 2024 while domestically assembled vehicle sales declined during the same period, indicating shifting competitive dynamics. The growing presence of imported vehicles from China and Thailand leveraging established manufacturing scale, advanced production technologies, and competitive pricing creates challenging environment for domestic component suppliers whose customer base depends on local assembly operations. This competitive pressure is exacerbated by relatively higher production costs in Vietnam due to immature supply chain ecosystem, limited economies of scale, and need to import numerous components, making locally assembled vehicles generally more expensive than foreign built vehicles contrary to typical localization benefits.

Underdeveloped Local Supply Chain and Infrastructure Constraints

Vietnam's automotive component manufacturing sector remains in developmental stage compared to substantially larger and more mature supplier bases in Thailand and Indonesia, limiting depth and breadth of local supply chain capabilities for sophisticated automotive components. The industry faces challenges related to insufficient manufacturing scale with many component producers operating below optimal capacity levels that prevent achievement of cost competitiveness necessary to compete with established regional suppliers benefiting from larger production volumes. Infrastructure constraints including high inland transport costs pose significant challenges for component distribution, with manufacturers identifying securing vessel capacity and inland logistics as key operational difficulties impacting both inbound raw material movement and outbound finished product delivery.

Competitive Landscape:

The Vietnam automotive rocker panel market features a competitive landscape comprising established global component manufacturers, regional suppliers, and emerging domestic producers serving OEM assembly operations and aftermarket distribution channels. International suppliers leverage advanced manufacturing technologies, extensive product portfolios, and global supply chain networks to serve major automotive assemblers operating in Vietnam. Domestic players operate multiple supporting-industry plants producing OEM automotive components at Chu Lai complex for local assembly and export markets, demonstrating growing capabilities of Vietnamese manufacturers. Steel suppliers provide high-quality stainless steel materials supporting rocker panel manufacturing with corrosion resistance and durability suited to local climate conditions. The competitive landscape is evolving as new automotive OEM entrants establish assembly operations creating opportunities for component suppliers to secure long-term supply contracts. Market positioning strategies emphasize product quality, cost competitiveness, delivery reliability, and technical support capabilities to meet stringent OEM requirements for dimensional accuracy, surface finish, and mechanical properties while maintaining competitive pricing against imported components.

Vietnam Automotive Rocker Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lower Quarter Panels, Door Rocker Panels |

| Vehicle Types Covered | Light Duty Vehicles, Medium Duty Vehicles, Heavy Duty Vehicles |

| Sales Channels Covered | Aftermarket, Original Equipment Manufacturers (OEMs) |

| Materials Covered | Stainless Steel, Fiber, Rubber |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam automotive rocker panel market size was valued at USD 239.27 Million in 2025.

The Vietnam automotive rocker panel market is expected to grow at a compound annual growth rate of 3.35% from 2026-2034 to reach USD 321.88 Million by 2034.

Lower quarter panels dominated with 56% market share, serving as fundamental protective components beneath vehicle doors across all vehicle types, providing essential structural reinforcement and corrosion protection while meeting universal application requirements for passenger cars, commercial vehicles, and multipurpose vehicles in Vietnam's expanding automotive sector.

Key factors driving the Vietnam automotive rocker panel market include rapid automotive manufacturing expansion with production reaching new heights, substantial foreign direct investments including Geely's $168 million joint venture and Chinese brand influx, government supportive policies with registration fee reductions, and supply chain localization initiatives.

Major challenges include heavy dependence on imported raw materials with only a small percentage of local component production versus domestic assembly, intense competition from imported completely built-up vehicles growing while domestic sales declined, and underdeveloped supply chain infrastructure with limited supplier base and high logistics costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)