Vietnam Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Vietnam Bancassurance Market Overview:

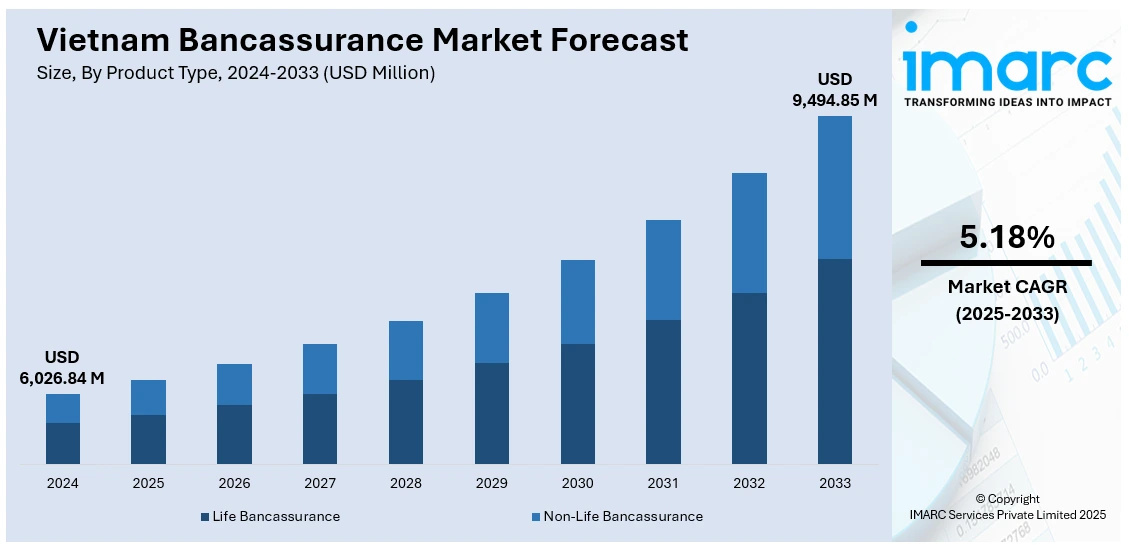

The Vietnam bancassurance market size reached USD 6,026.84 Million in 2024. Looking forward, the market is projected to reach USD 9,494.85 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The market is driven by exclusive bank–insurer alliances, expanding middle-class purchasing power, and rapid digital transformation. Financial literacy initiatives and bundled offerings are improving adoption in both urban and emerging markets. Technology integration through APIs, AI tools, and mobile onboarding, has streamlined sales and claims processes, further strengthening distribution efficiency, thereby augmenting the Vietnam bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,026.84 Million |

| Market Forecast in 2033 | USD 9,494.85 Million |

| Market Growth Rate 2025-2033 | 5.18% |

Vietnam Bancassurance Market Trends:

Exclusive Bank–Insurer Alliances Strengthening Distribution

Vietnam’s bancassurance sector is being shaped by exclusive long-term partnerships between banks and insurance companies, both local and international. Leading institutions have established multi-year tie-ups with insurers, enabling streamlined access to life, health, and general insurance products. For instance, in February 2025, Generali Vietnam and PVcomBank entered into a strategic partnership for exclusive distribution of life insurance products across PVcomBank’s national network. The collaboration aims to provide transparent, customer-centric insurance solutions and enhance advisor training, emphasizing technology integration and a shared commitment to long-term financial security for Vietnamese families. These collaborations allow insurers to tap into banks’ expansive branch networks, customer databases, and digital platforms, creating a highly efficient cross-selling environment. The State Bank of Vietnam’s supportive regulatory framework further enables banks to diversify offerings while ensuring compliance and consumer protection. The growth of Vietnam’s middle class is resulting in higher disposable incomes, better financial literacy, and increased demand for long-term financial security. Banks serve as reliable advisors, supported by trained relationship managers who guide customers through product selection. The Vietnam bancassurance market growth is being driven by the synergy of these exclusive partnerships and the operational integration that enhances sales conversion across both physical and digital channels.

To get more information on this market, Request Sample

Digital Transformation Accelerating Market Penetration

Rapid digitalization in Vietnam’s banking sector is transforming how insurance is distributed. Banks now integrate insurance offerings into mobile banking apps, online portals, and ATM interfaces, allowing customers to research, compare, and purchase policies seamlessly. Digital onboarding tools, AI-driven product recommendations, and instant claims processing are improving customer experience. This shift has opened the market to younger, tech-savvy consumers who prefer mobile-first solutions. Pandemic-driven adoption of remote consultations, chatbots, and e-signatures has further reduced friction in policy issuance and helped in market growth. Bancassurance offerings, particularly life, health, and savings-linked products, are gaining traction as customers view them as convenient, trustworthy, and professionally managed. In March 2025, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) reviewed its bancassurance business performance for 2024 and outlined strategic plans for 2025. BIDV MetLife achieved a 32% growth in life insurance revenue, reaching VND 446 Billion (USD 18.7 Million), while BIC maintained its leadership position in the non-life bancassurance segment with VND 2,064 Billion (USD 85.3 Million) in premium revenue. As both banks and insurers pursue omnichannel strategies, digital bancassurance is emerging as a scalable, cost-efficient distribution model capable of reaching underserved markets.

Vietnam Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

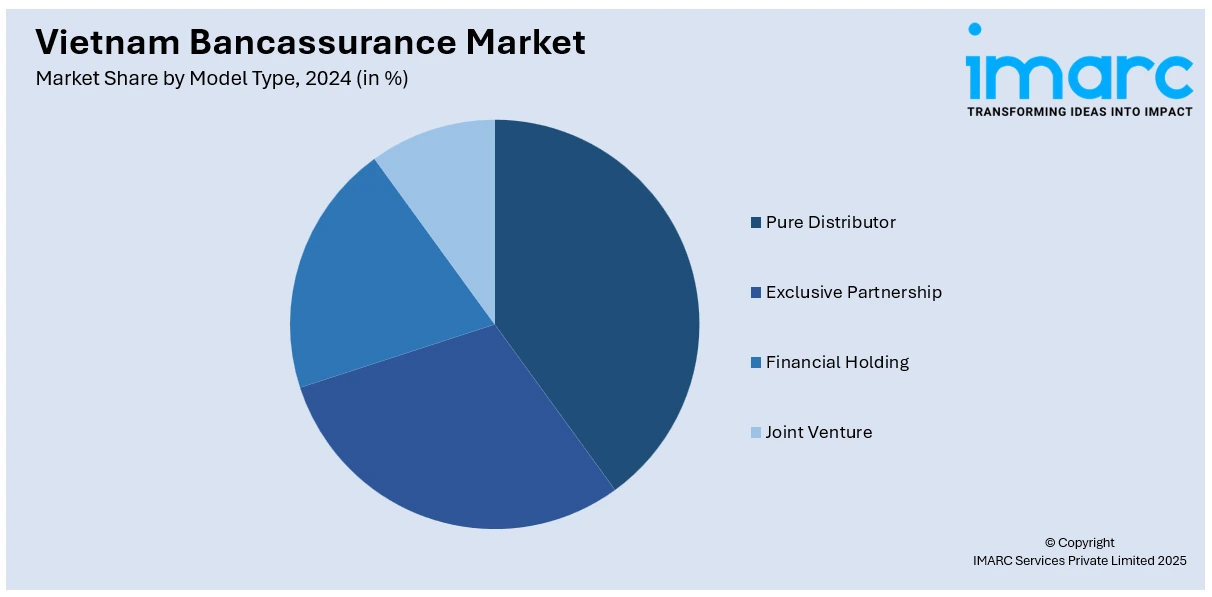

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Bancassurance Market News:

- In December 2024, Prudential Vietnam Assurance and HSBC Bank Vietnam formed a bancassurance partnership focusing on serving Vietnam’s growing middle class and high-net-worth customers. This alliance reflects shared ambitions to expand wealth management offerings in response to the country’s economic growth and increasing demand for investment-linked insurance products.

Vietnam Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam bancassurance market on the basis of product type?

- What is the breakup of the Vietnam bancassurance market on the basis of model type?

- What is the breakup of the Vietnam bancassurance market on the basis of region?

- What are the various stages in the value chain of the Vietnam bancassurance market?

- What are the key driving factors and challenges in the Vietnam bancassurance market?

- What is the structure of the Vietnam bancassurance market and who are the key players?

- What is the degree of competition in the Vietnam bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)