Vietnam Beer Glassware Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Vietnam Beer Glassware Market Summary:

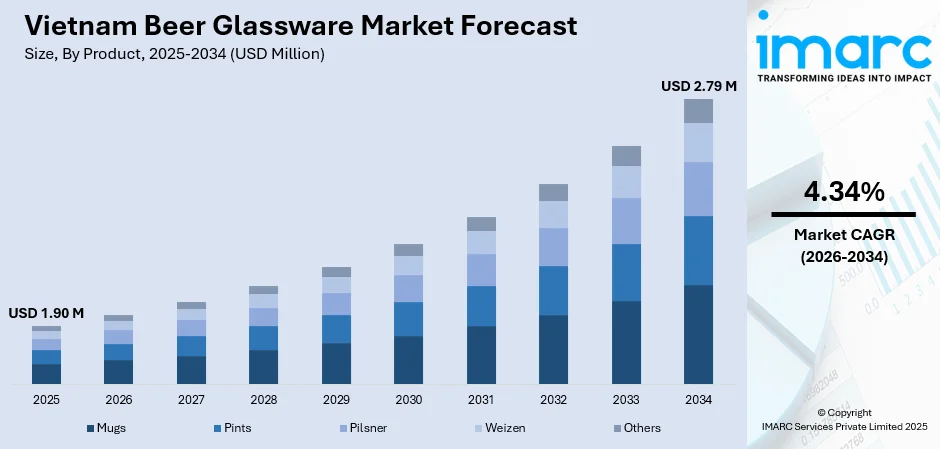

The Vietnam beer glassware market size was valued at USD 1.90 Million in 2025 and is projected to reach USD 2.79 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

The Vietnam beer glassware market is experiencing steady expansion driven by the country's robust beer culture and evolving consumer preferences toward premium beverages. Growing environmental consciousness is encouraging manufacturers to adopt sustainable glass packaging solutions, while technological advancements in glass production are enhancing product quality and affordability. The expanding hospitality sector and proliferation of craft beer establishments in metropolitan areas are further stimulating demand for specialized beer glassware across both household and commercial segments.

Key Takeaways and Insights:

-

By Product: Pints dominates the market with a share of 34% in 2025, driven by their versatility and widespread adoption across both household settings and commercial establishments serving diverse beer varieties.

-

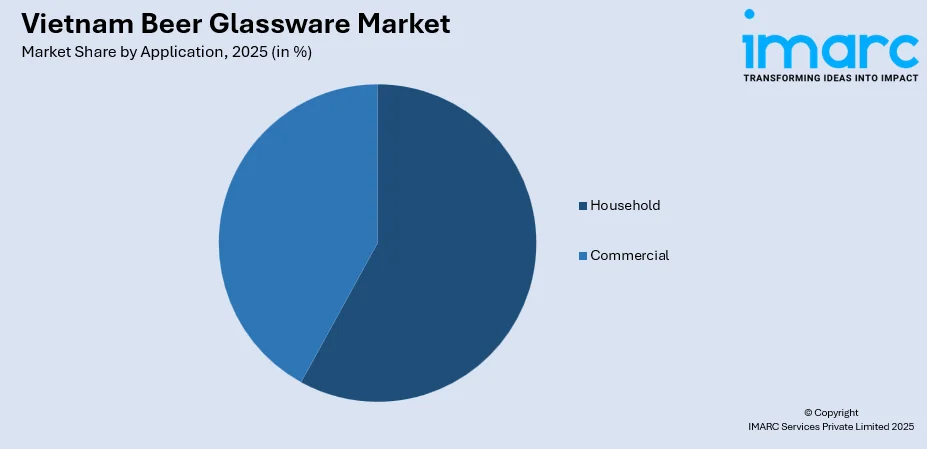

By Application: Household leads the market with a share of 58% in 2025, reflecting strong home consumption patterns and the cultural significance of social gatherings where beer remains the preferred beverage choice.

-

By Region: Northern Vietnam represents the largest segment with a market share of 40% in 2025, attributed to the concentration of major breweries, glass manufacturing facilities, and dense urban populations in Hanoi and surrounding provinces.

-

Key Players: The Vietnam beer glassware market exhibits a moderately fragmented competitive structure, with domestic glass manufacturers competing alongside international suppliers to serve the diverse requirements of major brewing companies and hospitality establishments.

To get more information on this market Request Sample

Vietnam's beer glassware market is fundamentally shaped by the country's position as one of Asia's leading beer consumers. The nation's beer production reached substantial volumes, creating consistent demand for high-quality glass containers that preserve taste and enhance brand presentation. The Vietnam beer market size reached USD 2,745.20 Million in 2024. Looking forward, the market is expected to reach USD 3,217.63 Million by 2033, exhibiting a growth rate (CAGR) of 1.78% during 2025-2033. Extended Producer Responsibility regulations are reshaping packaging practices, positioning glass as a favored material because of its endless recyclability and chemical stability. At the same time, the growing craft beer scene in major urban centers is driving demand for specialized glassware, such as pilsner and weizen glasses, designed to enhance the overall drinking experience. Glass manufacturers are responding by investing in advanced technologies such as narrow neck press and blow processes and automated production lines imported from industrialized nations, enabling stronger yet lighter containers at competitive price points.

Vietnam Beer Glassware Market Trends:

Premiumization Driving Specialized Glassware Demand

The growing preference for premium and craft beers among Vietnam's expanding middle class is generating substantial demand for specialized beer glassware designed to enhance flavor profiles and visual presentation. Craft breweries proliferating across major metropolitan centers are investing in distinctive glassware that communicates brand identity while optimizing the sensory experience. This trend extends to household consumers who increasingly seek restaurant-quality glassware for home entertaining, with specialty retailers reporting rising sales of pilsner glasses, weizen vessels, and branded pint glasses.

Sustainability Regulations Reshaping Packaging Preferences

Environmental regulations and Extended Producer Responsibility frameworks are fundamentally reshaping packaging preferences within Vietnam's beverage industry. Glass packaging is gaining prominence as manufacturers seek infinitely recyclable materials that satisfy regulatory requirements and consumer expectations for sustainable products. Major breweries are implementing glass waste collection programs and partnering with retail chains to improve recovery rates, while investing in energy-efficient furnace technologies that reduce environmental footprint without compromising production capacity or quality standards.

Technological Innovation in Glass Manufacturing

Vietnamese glass manufacturers are embracing advanced production technologies to enhance competitiveness and product quality. Automated manufacturing lines imported from Germany, Italy, and other industrialized nations are enabling consistent quality at scale, while innovative processes such as narrow neck press and blow technology produce lighter yet stronger containers. Manufacturers are increasingly incorporating decorative techniques including embossing, forming, and artistic finishes, to differentiate products and command premium pricing in an increasingly competitive marketplace.

Market Outlook 2026-2034:

The Vietnam beer glassware market outlook remains positive as fundamental demand drivers including urbanization, rising disposable incomes, and expanding hospitality infrastructure, continue strengthening. Investment in brewery expansion projects is creating sustained demand for glass packaging solutions, while regulatory emphasis on sustainable packaging is further elevating glass preference over alternative materials. The market generated a revenue of USD 1.90 Million in 2025 and is projected to reach a revenue of USD 2.79 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Vietnam Beer Glassware Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Pints |

34% |

|

Application |

Household |

58% |

|

Region |

Northern Vietnam |

40% |

Product Insights:

- Mugs

- Pints

- Pilsner

- Weizen

- Others

The pints dominate with a market share of 34% of the total Vietnam beer glassware market in 2025.

Pint glasses command the largest share of Vietnam's beer glassware market owing to their versatility and widespread acceptance across diverse consumption settings. These glasses accommodate various beer styles from traditional lagers to craft ales, making them essential equipment for households and commercial establishments alike. The standardized volume facilitates portion control in hospitality settings while enabling consumers to fully appreciate beer characteristics including color, carbonation, and head retention.

The proliferation of international-style bars and restaurants across Vietnamese cities is driving institutional demand for quality pint glasses that meet global hospitality standards. Domestic glass manufacturers are responding with products featuring improved durability, consistent dimensions, and enhanced clarity that rival imported alternatives while offering competitive pricing advantages that appeal to cost-conscious commercial buyers seeking reliable supply relationships.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

The household leads with a share of 58% of the total Vietnam beer glassware market in 2025.

The household segment dominates Vietnam's beer glassware market, reflecting deeply embedded cultural practices that position beer as the centerpiece of family gatherings, celebrations, and social occasions. Vietnamese consumers traditionally prefer hosting guests at home where quality glassware enhances the hospitality experience and demonstrates respect for visitors. Rising disposable incomes among urban populations are enabling households to invest in premium glassware that elevates everyday consumption occasions.

The segment benefits from Vietnam's high per capita beer consumption rates, which rank among Asia's highest, translating into consistent replacement demand as household glassware experiences normal wear and breakage. Retail distribution channels including modern trade formats and specialty homeware stores are expanding product accessibility while enabling consumers to select from increasingly diverse offerings that match personal preferences and home décor aesthetics.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with a 40% share of the total Vietnam beer glassware market in 2025.

Northern Vietnam leads the national beer glassware market driven by the concentration of major brewing operations, glass manufacturing facilities, and Vietnam's capital city Hanoi with its substantial consumer base. The region hosts production facilities for leading domestic breweries and international brands, creating integrated supply chains that favor locally sourced packaging materials. Glass manufacturers in Hanoi and Hai Phong benefit from proximity to these anchor customers while serving the broader regional hospitality market.

The northern region's robust industrial infrastructure and skilled workforce support glass production capabilities ranging from mass-market containers to specialized craft beer glassware. Cross-border trade flows with China provide access to raw materials and manufacturing equipment, while the region's cooler climate and distinct beer culture sustain year-round consumption patterns that generate consistent glassware demand across both household and commercial segments.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Beer Glassware Market Growing?

Expanding Premium Beer Segment and Craft Brewery Proliferation

Vietnam's beer market is undergoing significant premiumization as rising disposable incomes enable consumers to trade up from mass-market lagers to craft and premium offerings. This shift is generating corresponding demand for specialized glassware designed to optimize the sensory experience of higher-quality beverages. Craft breweries multiplying across Hanoi, Ho Chi Minh City, Da Nang, and other metropolitan centers require distinctive glassware that communicates brand identity while functionally enhancing beer presentation. The growing beer tourism phenomenon, evidenced by brewery tours and beer festivals attracting substantial attendance, further stimulates awareness and demand for quality beer glassware among engaged consumers.

Regulatory Support for Sustainable Glass Packaging

Extended Producer Responsibility regulations mandating that manufacturers manage end-of-life packaging are fundamentally reshaping material preferences within Vietnam's beverage industry. Glass packaging is gaining strategic advantage as an infinitely recyclable material that satisfies regulatory obligations while addressing consumer expectations for environmental responsibility. The regulations implemented under Decree No. 08/2022/ND-CP require producers and importers to either organize recycling systems or contribute to the Vietnam Environmental Protection Fund, creating financial incentives that favor glass over single-use alternatives. Major breweries are proactively investing in glass collection and recycling programs that strengthen circular economy practices.

Brewery Expansion Investments Driving Packaging Demand

Substantial capital investment in brewery expansion projects across Vietnam is creating sustained demand for glass packaging solutions including beer glassware. For instance, in August 2025, Carlsberg Việt Nam, together with the People’s Committee of Huế City, officially inaugurated the Phú Bài Brewery Expansion Project, celebrating a significant milestone in the company’s pursuit of innovation, sustainable development, and enduring dedication to Vietnam. Major brewing companies are committing significant resources to expand production capacity, with facilities in Ba Ria-Vung Tau, Quang Nam, and other provinces receiving substantial expansion investments. These capacity additions require corresponding increases in packaging supply, benefiting domestic glass manufacturers positioned to serve expanding requirements. The presence of international brewing giants investing in Vietnam validates the market's long-term growth potential and attracts additional investment across the value chain including glass manufacturing infrastructure.

Market Restraints:

What Challenges the Vietnam Beer Glassware Market is Facing?

Competition from Alternative Packaging Materials

Glass packaging is encountering growing competition from aluminum cans and plastic alternatives that provide benefits such as lighter weight, lower transportation costs, and greater resistance to breakage. Aluminum cans, in particular, continue to gain market share due to their convenience and suitability for outdoor and on-the-go consumption, where safety concerns around glass breakage limit usage.

Energy Cost Volatility Affecting Production Economics

Glass production is highly energy-intensive, with electricity and fuel costs accounting for a significant share of total manufacturing expenses. In Vietnam, fluctuating and rising energy prices are squeezing profit margins and introducing pricing uncertainty. This volatility complicates long-term supply contracts and discourages large-scale capital investments, making cost management a persistent challenge for glass manufacturers.

Import Competition from Regional Manufacturers

Domestic glass producers in Vietnam face strong competition from manufacturers in China and other ASEAN countries that benefit from large-scale operations and lower unit costs. These regional players can offer more competitive pricing, increasing import penetration in the local market. To remain competitive, Vietnamese manufacturers must continually invest in efficiency upgrades, capacity optimization, and product quality improvements.

Competitive Landscape:

The Vietnam beer glassware market demonstrates a moderately fragmented competitive landscape, shaped by the coexistence of established domestic manufacturers, global glass packaging companies, and specialized importers targeting niche demand segments. Local producers benefit from geographic proximity, cost efficiencies, and long-standing partnerships with major breweries, enabling them to secure a strong foothold in the market. Meanwhile, international suppliers compete by offering superior quality control, design capabilities, and technological expertise. This competitive mix drives ongoing innovation, prompting market participants to invest in automation, environmentally responsible production methods, and continuous product development to enhance differentiation, operational efficiency, and long-term customer engagement.

Recent Developments:

-

August 2025: Carlsberg unveiled a USD 90 million expansion project at one of its breweries in Vietnam, boosting production capacity by 50%, positioning the facility as the company's largest manufacturing hub across Asia and driving corresponding demand for glass packaging.

-

June 2024: Heineken Vietnam announced a USD 540 million expansion of its Ba Ria-Vung Tau facility, a project set to increase annual beer production by 500 million liters, effectively more than doubling the output of its existing factory in Quang Nam province.

-

November 2024: Saigon Beer-Alcohol-Beverage Corporation (SABECO) was recognized at the Gala commemorating 15 years of the Ministry of Industry and Trade's campaign encouraging Vietnamese consumers to prioritize locally produced goods, reflecting the company's commitment to domestic industry advancement.

Vietnam Beer Glassware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mugs, Pints, Pilsner, Weizen, Others |

| Applications Covered | Household, Commercial |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam beer glassware market size was valued at USD 1.90 Million in 2025.

The Vietnam beer glassware market is expected to grow at a compound annual growth rate of 4.34% from 2026-2034 to reach USD 2.79 Million by 2034.

Pints dominated the market with 34% share in 2025, driven by their versatility across household settings and commercial establishments, as well as their suitability for serving diverse beer styles popular in Vietnam.

Key factors driving the Vietnam beer glassware market include expanding premium beer consumption, regulatory support for sustainable glass packaging under EPR frameworks, and substantial brewery expansion investments creating sustained packaging demand.

Major challenges include intensifying competition from alternative packaging materials such as aluminum cans, energy cost volatility affecting production economics, import competition from regional manufacturers, and the need for continuous investment in manufacturing technology upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)