Vietnam Beer Market Size, Share, Trends and Forecast by Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel, and Region, 2026-2034

Vietnam Beer Market Summary:

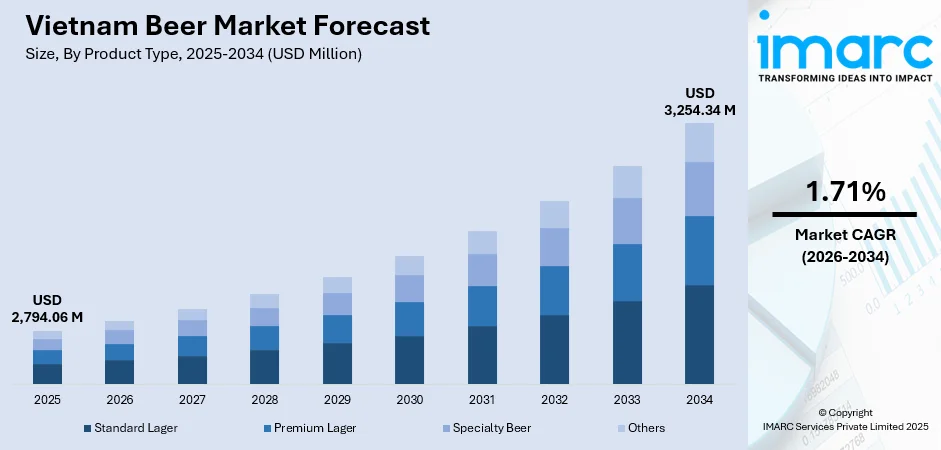

The Vietnam beer market size was valued at USD 2,794.06 Million in 2025 and is projected to reach USD 3,254.34 Million by 2034, growing at a compound annual growth rate of 1.71% from 2026-2034.

The market is driven by rising disposable incomes, expanding urban populations, and strong cultural acceptance of beer consumption during social gatherings and celebrations. Tourism growth and evolving consumer preferences toward premium offerings further stimulate demand. Modern retail expansion and aggressive marketing campaigns by breweries enhance product accessibility. The hot tropical climate encourages higher beverage consumption throughout the year, sustaining market momentum across the Vietnam beer market share.

Key Takeaways and Insights:

-

By Product Type: Standard lager dominates the market with a share of 46% in 2025, driven by its widespread affordability, consumer familiarity with traditional lager taste profiles, and strong distribution networks across both urban and rural markets.

-

By Packaging: Glass leads the market with a share of 39% in 2025, owing to consumer perception of superior taste preservation in glass bottles, recyclability benefits, and strong cultural associations with traditional beer consumption experiences.

-

By Production: Macro-brewery represents the largest segment with a market share of 64% in 2025, driven by massive production capacities, established brand recognition, extensive distribution networks, and economies of scale enabling competitive pricing.

-

By Alcohol Content: High dominates the market with a share of 50% in 2025, owing to Vietnamese consumer preferences for full-strength beers during the social occasions and traditional drinking customs of people.

-

By Flavor: Unflavored leads the market with a share of 77% in 2025, driven by consumer preference for classic beer taste profiles and traditional brewing methods that have long characterized Vietnamese beer consumption patterns.

-

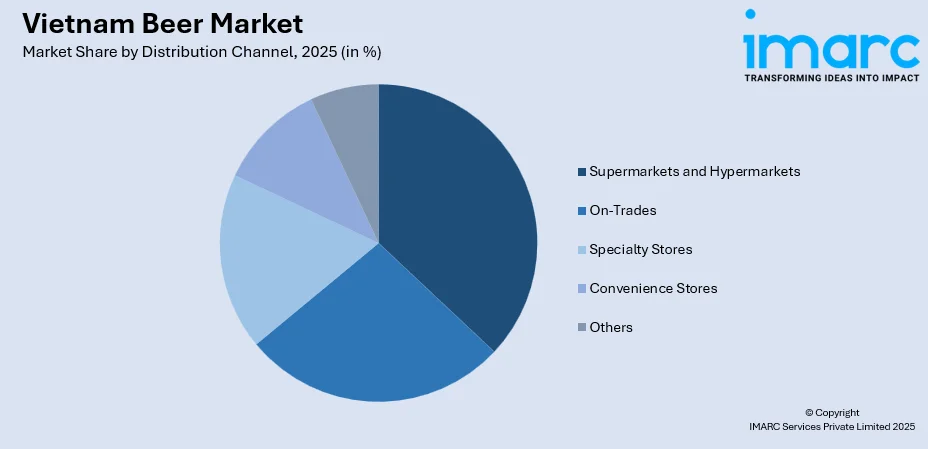

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 35% in 2025, owing to convenience of one-stop shopping, promotional offers, product variety, and the expansion of modern retail formats across Vietnam.

-

By Region: Northern Vietnam leads the market with a share of 41% in 2025, driven by the concentration of population in Hanoi metropolitan area, higher alcoholic beverage consumption in the Red River Delta region, and strong industrial development.

-

Key Players: The Vietnam beer market exhibits a concentrated competitive structure, with established multinational corporations and domestic breweries competing across price segments through extensive distribution networks, brand differentiation strategies, and continuous product innovation to capture diverse consumer preferences.

To get more information on this market Request Sample

The Vietnam beer market flourishes through a confluence of demographic, economic, and cultural forces reshaping beverage consumption patterns. Rapid urbanization concentrates populations in cities where modern retail infrastructure and vibrant nightlife ecosystems create abundant consumption occasions. The country's youthful demographic profile, with a median age favoring active social lifestyles, drives sustained demand for affordable alcoholic beverages. Cultural traditions emphasizing communal drinking during festivals, business gatherings, and family celebrations embed beer deeply within social rituals. Rising middle-class prosperity expands discretionary spending power, enabling consumers to trade up from traditional rice wines toward branded beer products. The tropical climate sustains year-round thirst, while tourism influx introduces international drinking habits that domestic consumers increasingly adopt. Government policies supporting manufacturing investments strengthen local production capabilities, ensuring competitive pricing that maintains accessibility across income segments. As per sources, in September 2024, HEINEKEN Vietnam reported contributing 0.5% to Vietnam’s GDP and achieving 99% renewable energy usage in production during 2023, reinforcing its long-term sustainability and low-carbon ambitions.

Vietnam Beer Market Trends:

Premiumization and Craft Beer Emergence

Vietnamese consumers increasingly gravitate toward premium and craft beer offerings as rising affluence transforms purchasing priorities beyond mere affordability considerations. Urban millennials and professionals seek differentiated taste experiences, artisanal brewing methods, and sophisticated brand narratives that align with aspirational lifestyle identities. This shift manifests through growing acceptance of higher price points for products emphasizing quality ingredients, unique flavor profiles, and authentic brewing heritage. As per sources, in August 2025, Carlsberg Vietnam inaugurated its expanded Phu Bai Brewery, investing nearly USD 90 Million to raise brewing capacity by 50%, positioning the site as its largest production facility in Asia. Additionally, there is a proliferation of small craft breweries, especially in large cities, offering seasonal varieties and tasting rooms conducive to community interaction.

Digital Commerce and Direct-to-Consumer Channels

The proliferation of e-commerce platforms and food delivery applications revolutionizes beer distribution, creating direct pathways between producers and consumers that bypass traditional retail intermediaries. According to sources, in August 2025, Carlsberg Asia launched its Digital Acceleration Program, partnering with Meituan, Grab, and Delivery Hero to strengthen e-commerce, quick-commerce delivery, and data-driven consumer engagement across the beer markets. Furthermore, younger demographics comfortable with digital transactions embrace the convenience of doorstep delivery, particularly for social gatherings and home entertainment occasions. Online platforms enable breweries to showcase extensive product portfolios, share brand stories, and implement targeted promotions based on consumer data analytics. Subscription models emerge, offering curated monthly selections that introduce consumers to diverse beer styles while building recurring revenue streams.

Health-Conscious and Low-Alcohol Innovations

Vietnamese beer consumers are demonstrating increasing health awareness, driving demand for low-alcohol and non-alcoholic beer alternatives. This trend aligns with global shifts toward healthier lifestyles and growing awareness of alcohol consumption impacts on wellness. Breweries are responding by expanding product portfolios to include lighter options with reduced calorie content and lower alcohol levels. As per sources, in December 2025, the No & Low-Alcohol and Beyond Beer beverage range by Carlsberg Hong Kong offered an extended range, encouraging consumers to adopt a balanced and healthy approach to beverage consumption. Furthermore, the emergence of functional beverages and health-oriented alternatives reflects changing consumer priorities, particularly among younger demographics seeking balanced approaches to social drinking. This evolution presents opportunities for product innovation while challenging traditional high-alcohol consumption patterns that have historically characterized the market.

Market Outlook 2026-2034:

The Vietnam beer market demonstrates robust expansion potential through sustained economic development, demographic advantages, and evolving consumption patterns favoring modern alcoholic beverages. Revenue growth trajectories reflect increasing per-capita consumption as urbanization concentrates populations in cities with vibrant hospitality sectors and retail infrastructure. Rising disposable incomes enable consumers to upgrade purchasing frequency and explore premium product tiers, expanding market value beyond volume increases. Tourism recovery and international business activity restoration inject additional demand through hotels, restaurants, and entertainment venues catering to foreign visitors. The market generated a revenue of USD 2,794.06 Million in 2025 and is projected to reach a revenue of USD 3,254.34 Million by 2034, growing at a compound annual growth rate of 1.71% from 2026-2034.

Vietnam Beer Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Standard Lager | 46% |

| Packaging | Glass | 39% |

| Production | Macro-Brewery | 64% |

| Alcohol Content | High | 50% |

| Flavor | Unflavored | 77% |

| Distribution Channel | Supermarkets and Hypermarkets | 35% |

| Region | Northern Vietnam | 41% |

Product Type Insights:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Standard lager dominates with a market share of 46% of the total Vietnam beer market in 2025.

Standard lager commands the dominant market position through its universal appeal rooted in taste familiarity, climate appropriateness, and price accessibility across diverse consumer segments. The crisp, refreshing characteristics align perfectly with tropical weather conditions, encouraging frequent consumption during hot seasons dominating Vietnam's annual climate patterns. Decades of market presence establish strong brand loyalty and habitual purchasing behaviours, particularly among older demographics and rural populations less exposed to craft alternatives. As per sources, in December 2025, SABECO’s 333 Pilsner and Saigon Chill won Gold Medals at the Brussels Beer Challenge, highlighting consistent quality and reinforcing the dominance of Vietnamese standard lagers. Moreover, production economies of scale enable competitive pricing maintaining affordability for middle and lower-income consumers comprising the market majority.

Standard lager continued dominance reflects successful alignment with Vietnamese taste preferences shaped by historical brewing traditions and climatic conditions. The light body facilitates extended drinking sessions during social gatherings without overwhelming palates or causing rapid intoxication. Breweries continuously refine formulations balancing consistency with subtle innovations that refresh product perception without alienating core consumers. The segment's infrastructure advantages, including established supply chains and distribution partnerships, create formidable barriers for alternative beer styles seeking market penetration. While premiumization trends gradually erode share, standard lager maintains overwhelming leadership through its foundational role in Vietnamese drinking culture.

Packaging Insights:

- Glass

- PET Bottle

- Metal Can

- Others

Glass leads with a share of 39% of the total Vietnam beer market in 2025.

Glass maintains substantial market presence through deeply ingrained consumer perceptions associating transparency with product purity and quality assurance. Vietnamese consumers traditionally prefer visually inspecting beverage clarity before purchase, a practice glass container uniquely accommodate while generating confidence in brewing standards. Cultural symbolism elevates glass bottles within social drinking contexts, particularly during celebrations and formal gatherings where presentation aesthetics influence product selection. The tactile experience and weight convey premium positioning that plastic alternatives struggle to replicate, even when functional properties prove comparable. Environmental consciousness among urban consumers increasingly values glass recyclability. As per sources, in June 2025, SABECO reported achieving 100 percent reuse or recycling of all primary and secondary packaging, including glass bottles, underscoring its commitment to sustainable glass usage and recycling initiatives.

The segment endures despite logistical challenges including breakage risks and transportation weight penalties elevating distribution costs compared to alternative formats. Breweries maintain glass packaging emphasis because consumer willingness to pay premium pricing offsets operational inefficiencies, particularly for flagship products targeting social consumption occasions. Returnable bottle systems create economic incentives encouraging repeat purchases while supporting sustainability narratives appealing to environmentally aware demographics. However, convenience-driven consumption occasions gradually shift preferences toward cans and plastic bottles offering portability advantages for outdoor activities and home delivery scenarios, creating segmentation where glass dominates on-premises venues.

Production Insights:

- Macro-Brewery

- Micro-Brewery

- Others

Macro-brewery exhibits a clear dominance with a 64% share of the total Vietnam beer market in 2025.

Macro-brewery dominates through unmatched distribution reach, capital investment capacity, and operational efficiencies that smaller producers cannot replicate across Vietnam's geographically fragmented market. Established macro-breweries operate extensive nationwide distribution networks penetrating urban centers, provincial towns, and remote rural communities, ensuring product availability regardless of location or infrastructure limitations. Substantial marketing budgets finance mass media campaigns, event sponsorships, and retailer incentive programs building overwhelming brand awareness and preference. Quality consistency achieved through industrial-scale processes and rigorous quality control protocols reassures consumers accustomed to reliable taste profiles across purchase occasions.

The segment's competitive advantages extend beyond operational efficiencies to encompass regulatory navigation, government relationships, and supply chain leverage that smaller breweries struggle to develop. Macro-breweries secure preferential raw material pricing through volume commitments while maintaining buffer inventories protecting against supply disruptions. According to reports, in August 2025, Sabeco announced a $32.4 Million expansion at its Cu Chi brewery, aiming to raise annual capacity from 264 Million to 350 Million Liters, including new workshops for production efficiency. Further, their established infrastructure investments create sunk cost advantages deterring market exit even during temporary profitability pressures. However, emerging craft brewery movements and premiumization trends gradually erode share among urban millennials seeking authenticity and differentiation that mass-produced offerings cannot provide, forcing macro-breweries to acquire craft brands or launch premium line extensions defending against niche erosion.

Alcohol Content Insights:

- High

- Low

- Alcohol Free

High leads with a market share of 50% of the total Vietnam beer market in 2025.

High captures dominant market share by aligning with Vietnamese drinking culture emphasizing social camaraderie and celebratory intoxication during gatherings. Consumers perceive higher alcohol concentrations as delivering superior value propositions, offering greater potency per volume consumed and justifying slightly elevated price points through enhanced efficacy. Traditional drinking customs favor robust beverages that facilitate bonding rituals and demonstrate hospitality generosity when hosts serve guests during festivals or business entertainment occasions. The segment appeals to male demographics comprising the primary consumer base, who associate strength with masculinity and authenticity in alcoholic beverage selection.

Market dynamics sustain high dominance despite emerging health consciousness trends that might favor moderation in other markets. Cultural norms around drinking occasions emphasize celebratory excess rather than casual moderation, creating contexts where higher alcohol content serves functional purposes within social rituals. As per sources, in 2025, Vietnam approved a gradual increase of alcohol and beer taxes to 90 percent by 2031, aiming to regulate consumption without drastically disrupting entrenched drinking culture. Further, the segment benefits from established taste preferences shaped by decades of consumption patterns, making lower-alcohol alternatives seem diluted or inadequate for traditional drinking occasions. However, premiumization trends and younger consumer segments gradually introduce moderation preferences that challenge this dominance, particularly among urban professionals balancing social drinking with fitness lifestyles and workplace productivity demands requiring next-day functionality.

Flavor Insights:

- Unflavored

- Flavored

Unflavored dominates with a market share of 77% of the total Vietnam beer market in 2025.

Unflavored commands the market dominance through alignment with traditional taste preferences valuing authentic brewing heritage over experimental flavor innovations. Vietnamese consumers demonstrate strong loyalty toward classic beer profiles familiar from decades of consumption history, viewing unflavored variants as genuine representations of brewing craftsmanship. Cultural conservatism in beverage selection resists novelty for novelty's sake, particularly among older demographics and rural populations forming the market majority. Unflavored offerings provide versatile food pairing capabilities across Vietnamese cuisine's diverse flavor profiles, from spicy to savory dishes, without clashing or overwhelming complementary tastes.

The segment's continued dominance reflects deeper cultural attitudes toward alcoholic beverages as social lubricants rather than culinary experiences requiring flavor complexity. Traditional drinking occasions emphasize quantity and camaraderie over taste exploration, creating contexts where unflavored beer serves functional purposes without demanding attention. Breweries focus innovation investments on production efficiency and marketing rather than flavor experimentation, recognizing limited consumer demand for departures from established profiles. According to sources, in 2025, AB InBev doubled its Binh Duong brewery capacity to 100 Million Liters, integrating advanced automation, solar power, and water-saving systems, strengthening sustainability and regional market presence in Vietnam. However, emerging urban sophistication and international exposure gradually introduce openness toward flavored variants among younger demographics, particularly fruit-infused options positioned as refreshing alternatives for female consumers and casual drinking occasions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Supermarkets and hypermarkets lead with a share of 35% of the total Vietnam beer market in 2025.

Supermarkets and hypermarkets capture leading distribution share through convenience advantages, promotional pricing strategies, and evolving consumer shopping behaviors favoring consolidated purchasing trips. According to sources, in 2025, Hanoi supermarkets including Co.op Mart, WinMart, and LOTTE Mart offered up to 50% discounts and buy-one-get-one deals on beer, soft drinks, and seasonal New Year products. Furthermore, modern retail formats concentrate in urban areas experiencing rapid population growth and rising disposable incomes, creating natural alignment with beer consumption demographics. These channels offer one-stop shopping convenience enabling consumers to purchase beer alongside groceries and household essentials, reducing transaction costs and encouraging impulse buying through strategic product placement. Air-conditioned storage environments ensure optimal product temperatures and freshness guarantees that traditional retail formats struggle to maintain, particularly important for quality-conscious consumers trading up to premium offerings.

The segment benefits from retailer consolidation trends strengthening negotiating leverage with suppliers and enabling sophisticated inventory management systems that optimize assortment depth and turnover rates. Large format retailers invest in customer experience enhancements including tasting promotions, brand ambassador programs, and educational displays that drive trial and conversion. However, traditional trade channels including small independent retailers and hospitality venues collectively maintain substantial volume share through superior geographic coverage, personalized relationships, and immediate consumption occasions. The competitive dynamic increasingly bifurcates between modern retail dominating take-home consumption and traditional channels controlling on-premise occasions, with breweries developing differentiated strategies.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam dominates with a market share of 41% of the total Vietnam beer market in 2025.

Northern Vietnam dominates market share through demographic concentration, cultural traditions, and economic development patterns favoring sustained beer consumption growth. The region encompasses Hanoi metropolitan area, the nation's political capital and major economic hub concentrating affluent consumer populations with elevated discretionary spending capacity. Population density advantages enable efficient distribution networks and marketing investments generating superior returns compared to geographically dispersed southern regions. Cultural traditions in northern provinces embed beer deeply within social rituals around family gatherings, business entertainment, and festival celebrations, creating habitual consumption patterns across demographic segments. Cooler winter climate patterns extend comfortable outdoor drinking seasons beyond tropical south's year-round heat.

The region's economic dynamism attracts domestic migration and foreign investment, expanding consumer bases while elevating income levels that support premiumization trends and increased per-capita consumption. Industrial development creates working-class populations with disposable incomes directed toward affordable leisure activities including beer consumption during after-work socialization. Tourism infrastructure concentrating in Hanoi and heritage destinations throughout northern provinces generates additional demand from domestic and international visitors seeking authentic local beverage experiences. However, southern regions demonstrate faster growth rates driven by younger demographics and entrepreneurial cultures, gradually narrowing northern dominance as market development spreads more evenly across geographic territories.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Beer Market Growing?

Young Population Demographics and Rising Disposable Incomes

Vietnam's demographic profile presents powerful drivers for sustained beer market growth, with a substantial portion of the population within legal drinking age forming an extensive consumer base. The country's youthful population demonstrates strong affinity for beer consumption during social occasions, entertainment activities, and casual gatherings. Rapid economic development has significantly increased disposable incomes, enabling consumers to allocate greater spending toward beverages and leisure activities. The expanding middle class exhibits willingness to explore diverse beer offerings spanning from affordable domestic options to premium imported brands. As per sources, in 2025, Sabeco targets VND4.835 Trillion ($194 Million) after-tax profit, 8 percent growth, and strengthens brand, distribution, and premium offerings, while increasing 2024 dividend payout by 15 percent. Further, urban migration concentrates young working-age consumers in cities where vibrant nightlife, entertainment venues, and social drinking cultures flourish.

Deep-Rooted Beer Culture and Social Drinking Traditions

Beer occupies a central position in Vietnamese culture, serving as an essential element of social gatherings, business meetings, family celebrations, and festival occasions. The cultural practice of communal drinking, where sharing beer strengthens relationships and marks important occasions, creates sustained demand across diverse consumer segments. As per sources, in 2024, GBA Oktoberfest Vietnam welcomed over 10,500 guests and served more than 20,000 Litres of beer, highlighting beer’s cultural significance and communal drinking traditions. Moreover, beer consumption accompanies Vietnamese cuisine exceptionally well, with the beverage's refreshing characteristics complementing the country's flavorful culinary traditions. Street-side beer establishments and informal drinking venues form integral parts of urban landscapes, facilitating accessible consumption occasions. Traditional drinking customs passed through generations maintain beer's cultural significance while contemporary social trends introduce new consumption contexts. This cultural embedding ensures resilient demand that transcends economic fluctuations.

Rapid Urbanization and Modern Retail Expansion

Vietnam's accelerating urbanization drives beer market growth through concentrated population centers that support diverse consumption occasions and distribution channels. Cities provide environments where restaurants, bars, entertainment venues, and modern retail formats proliferate to serve growing consumer demand. Urban lifestyles involve frequent social interactions, after-work gatherings, and recreational activities where beer consumption features prominently. The expansion of supermarkets, hypermarkets, and convenience stores enhances product accessibility and consumer choice across urban areas. Modern retail environments enable effective brand merchandising, promotional activities, and impulse purchases that stimulate consumption. E-commerce growth further extends market reach by offering home delivery convenience to urban consumers with busy lifestyles.

Market Restraints:

What Challenges the Vietnam Beer Market is Facing?

High Excise Taxation and Regulatory Pressures

The Vietnamese government has implemented increasing excise taxes on alcoholic beverages as part of public health initiatives to moderate consumption levels. These tax increases have elevated beer prices, potentially affecting affordability for price-sensitive consumers particularly in rural markets. Breweries face margin pressures as rising production costs from taxation combine with competitive pricing requirements. The regulatory environment continues evolving with additional tax increases planned, creating uncertainty for long-term planning and investment decisions.

Strict Drink-Driving Regulations and Enforcement

Vietnam's stringent drink-driving laws prohibiting any alcohol in bloodstreams while operating vehicles have significantly impacted consumption patterns. Heavy penalties including substantial fines and license suspensions deter consumers from drinking when they need to drive. These regulations have particularly affected on-trade consumption occasions where patrons historically consumed beer before driving home. Consumer behavior adaptations include reduced drinking frequency, switching to non-alcoholic alternatives, or limiting consumption quantities during outings requiring subsequent driving.

Health Consciousness and Lifestyle Shifts

Growing health awareness among Vietnamese consumers is influencing alcohol consumption decisions as wellness priorities gain prominence. Younger demographics increasingly consider health implications when making beverage choices, leading some to moderate beer consumption or explore alternatives. Public health campaigns highlighting alcohol-related health risks have raised consumer consciousness about consumption impacts. The global wellness trend influences Vietnamese consumers through international media, travel exposure, and social media platforms promoting healthier lifestyles.

Competitive Landscape:

The Vietnam beer market exhibits a concentrated competitive structure characterized by the dominance of established multinational corporations and major domestic breweries that have built substantial market positions through decades of investment and brand development. Competition occurs across multiple dimensions including product quality, pricing strategies, distribution network strength, marketing effectiveness, and innovation capabilities. Major players leverage extensive production facilities, comprehensive distribution infrastructure, and strong brand portfolios to maintain market leadership. The competitive environment has intensified with premiumization trends creating new battlegrounds in craft and specialty segments where product differentiation and experiential marketing drive consumer choices. International brands bring global best practices, advanced brewing technologies, and sophisticated marketing approaches that elevate overall industry standards.

Recent Developments:

-

In March 2025, Saigon Beer – Dak Lak Factory launched its first export batch of Lowen beer, shipping nearly half a million liters to Indonesia and Malaysia. The export line includes Lowen Lager, Special, Chill, and Premium beers, highlighting the factory’s production quality, ESG compliance, and international aspirations.

Vietnam Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packaging Covered | Glass, PET Bottle, Metal Can, Others |

| Production Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Content Covered | High, Low, Alcohol Free |

| Flavor Covered | Unflavored, Flavored |

| Distribution Channel Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request)q |

Key Questions Answered in This Report

The Vietnam beer market size was valued at USD 2,794.06 Million in 2025.

The Vietnam beer market is expected to grow at a compound annual growth rate of 1.71% from 2026-2034 to reach USD 3,254.34 Million by 2034.

Standard lager held the largest Vietnam beer market share, supported by strong consumer familiarity, competitive pricing, and well-established distribution networks ensuring wide availability across both urban centers and rural regions nationwide.

Key factors driving the Vietnam beer market include the country's young population demographics, rising disposable incomes among expanding middle class, deep-rooted beer drinking culture, rapid urbanization, modern retail expansion, and growing tourism industry.

Major challenges include increasing excise taxation on alcoholic beverages, strict drink-driving regulations with zero tolerance policies, growing health consciousness among consumers, regulatory uncertainties regarding future tax increases, and competition from alternative beverages.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)