Vietnam Biopharmaceutical Market Size, Share, Trends and Forecast by Product, Indication, and Region, 2025-2033

Vietnam Biopharmaceutical Market Size and Share:

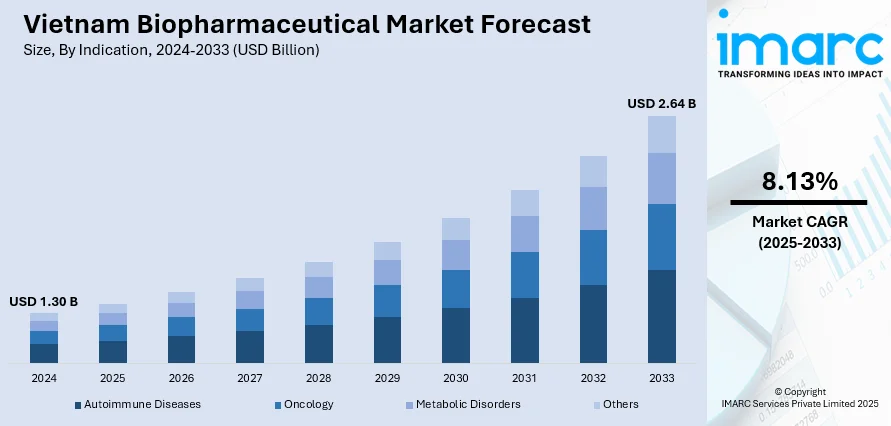

The Vietnam biopharmaceutical market size was valued at USD 1.30 Billion in 2024. Looking forward, the market is expected to reach USD 2.64 Billion by 2033, exhibiting a CAGR of 8.13% during 2025-2033. Southern Vietnam currently dominates the market, holding a significant market share of 40.8% in 2024. The rising chronic disease rates, government healthcare initiatives, burgeoning population, and growing middle-class population base with increased purchasing power. Strategic geographic positioning, collaborations between domestic and international firms, improved regulatory environment, and rising consumer awareness regarding biopharmaceuticals are some of the other factors fueling the Vietnam biopharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 2.64 Billion |

| Market Growth Rate (2025-2033) | 8.13% |

The country's rising burden of chronic and lifestyle-related diseases, such as cancer, diabetes, and autoimmune disorders, is creating a strong demand for advanced biologics and biosimilars. Vietnam’s rapidly aging population, with a significant increase in those over 60 years old, is expanding the long-term patient base for biopharmaceutical treatments. Economic development plays a key role as well. A growing middle class and increasing disposable incomes are enabling greater access to premium healthcare options. Simultaneously, the Vietnamese government is pushing for healthcare self-sufficiency by promoting domestic pharmaceutical manufacturing, regulatory reforms, and increased public healthcare funding. Initiatives like the goal to meet 70–80% of pharmaceutical demand with locally produced drugs by 2030 are reinforcing this momentum.

To get more information on this market, Request Sample

The Vietnam biopharmaceutical market growth is also driven by international partnerships, which are enhancing Vietnam’s capabilities through technology transfer, joint ventures, and investments in vaccine and biologics production. For instance, in September 2023, the Biotechnology Innovation Organization (BIO) entered a memorandum of understanding (MoU) with VinaPharm, a state-owned pharmaceutical firm in Vietnam, marking a significant step toward advancing the country’s biotechnology sector. The agreement, signed jointly by BIO, VinaPharm, and Vietnam’s State Capital Investment Corporation, was formalized during the 78th session of the United Nations General Assembly, with Vietnam’s Prime Minister Pham Minh Chinh and his delegation in attendance. Companies like Sanofi, AstraZeneca, and Arcturus have entered strategic collaborations in the region. The adoption of digital health solutions, improved logistics, and an emerging research and development (R&D) ecosystem are accelerating innovation and market penetration.

Vietnam Biopharmaceutical Market Trends:

Rising Chronic Disease Burden and Government Support

Vietnam's biopharmaceutical market is significantly driven by the growing prevalence of chronic and noncommunicable diseases. According to the WHO, such diseases are responsible for 80% of deaths in the country. Between 2015 and 2021, adult hypertension rose from 1 in 5 to over 1 in 4, and diabetes cases increased from 1 in 24 to 1 in 14. In response, the Vietnamese government is heavily investing in healthcare infrastructure. In April 2025, Ho Chi Minh City announced it would allocate over VND 33,600 billion toward improving healthcare through public-private partnerships, specialized centers, and high-tech hospitals. According to the Vietnam biopharmaceutical market trends, these efforts are creating a favorable environment for biopharmaceutical growth by ensuring improved access to advanced treatments.

Demographic Advantage and Expanding Youth Base

Vietnam’s young and growing population presents a strong customer base for the biopharmaceutical sector. According to UNFPA, the country has 20.4 million young people aged 10–24, accounting for 21% of the total population. This demographic dividend is expected to last until 2039, providing an extended window for market expansion. A young population not only fuels future demand for innovative therapies but also promotes adoption of advanced healthcare solutions. Moreover, the increasing awareness of health and wellness among youth encourages early intervention and preventive treatments, aligning well with biopharmaceutical offerings. This demographic trend directly supports sustained market development for years to come.

Economic Growth, Regulatory Support, and Global Collaborations

Vietnam’s growing middle class is contributing to the rising affordability of advanced biopharmaceutical treatments, creating a positive Vietnam biopharmaceutical market outlook. Higher disposable incomes are enabling broader access to quality healthcare. In parallel, the government has enhanced its regulatory framework to support biopharmaceutical research and development (R&D), clinical trials, and drug approvals. Additionally, Vietnam's strategic location in Southeast Asia is making it a hub for international partnerships. Collaborations between domestic players and global biopharma firms are accelerating technology transfer and manufacturing capabilities. This includes increased foreign investment, joint ventures, and licensing deals that bring innovation to the local market. Combined, these economic and institutional advancements are propelling the country’s biopharmaceutical industry forward.

Vietnam Biopharmaceutical Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam biopharmaceutical market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on indication and class.

Analysis by Indication:

- Autoimmune Diseases

- Oncology

- Metabolic Disorders

- Others

As per the Vietnam biopharmaceutical market analysis, oncology stands as the largest indication in 2024, holding 18.7% of the market share due to the country’s rising cancer burden and growing need for targeted therapies. Cancer is among the leading causes of death in Vietnam, with an increasing number of new cases reported annually, driven by aging, urbanization, and lifestyle changes. Biopharmaceuticals offer advanced treatment options like immunotherapies and targeted biologics, which are more effective and have fewer side effects compared to conventional chemotherapy. The Vietnamese government's focus on cancer care infrastructure, including specialized oncology centers and high-tech hospitals, further supports this segment. Additionally, growing public awareness, improving diagnostic capabilities, and expanded health insurance coverage are accelerating demand for innovative oncology treatments, making it the most dominant therapeutic area in the market.

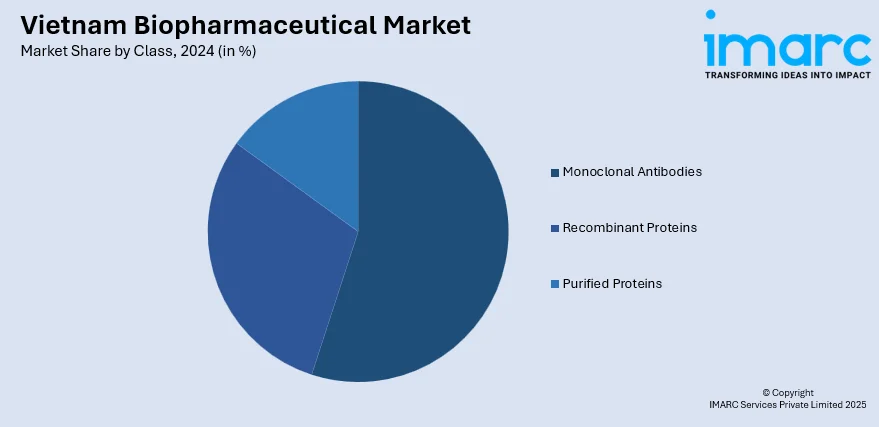

Analysis by Class:

- Recombinant Proteins

- Monoclonal Antibodies

- Purified Proteins

Monoclonal antibodies (mAbs) hold the largest share in the market due to their growing use in treating chronic and life-threatening conditions such as cancer, autoimmune disorders, and infectious diseases. Their high specificity and effectiveness make them preferred options for targeted therapy, especially in oncology and immunology. Vietnam's increasing disease burden and shift toward personalized medicine have fueled demand for these biologics. Moreover, rising healthcare investments, improved hospital infrastructure, and expanded insurance coverage have made high-cost therapies like mAbs more accessible. International partnerships and technology transfers are also boosting local availability of monoclonal antibody treatments. As a result, mAbs have emerged as the most dominant product class within the biopharmaceutical segment, driven by both clinical effectiveness and market demand.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share of 40.8%. Southern Vietnam, especially Ho Chi Minh City, plays a central role in driving the Vietnam biopharmaceutical market demand due to a combination of strategic, economic, and healthcare-related factors. The region benefits from a well-developed healthcare infrastructure, with a high concentration of public and private hospitals, research institutions, and advanced medical facilities that support the adoption of biopharmaceutical innovations. Southern Vietnam is a key hub for pharmaceutical manufacturing and foreign investment, housing industrial parks and production facilities that attract global biotech firms and facilitate technology transfer. Moreover, the area has a dense and aging urban population with a rising incidence of chronic and noncommunicable diseases, fueling demand for targeted therapies like biologics and biosimilars.

Competitive Landscape:

The Vietnam biopharmaceutical market features a dynamic competitive landscape with a mix of domestic and international players. Leading local companies like VinaPharm, Traphaco, and Domesco are expanding their capabilities through R&D and partnerships. Multinational firms such as Roche, Sanofi, AstraZeneca, and Pfizer have a strong presence, leveraging Vietnam’s strategic location and growing demand for advanced therapies. The market is increasingly shaped by collaborations, technology transfers, and contract manufacturing agreements, especially in biologics and vaccines. Recent public-private initiatives and foreign direct investment are intensifying competition, while government policies supporting localization and innovation are empowering domestic firms. With rising disease burden and healthcare spending, the competitive environment is becoming more innovation-driven, making Vietnam a key target for biotech expansion in Southeast Asia.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam biopharmaceutical market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Sanofi and VNVC launched a USD 77 Million vaccine manufacturing project in Long An, Vietnam, aiming to produce 100 million doses annually by late 2027. Backed by technology transfer and training, the facility strengthens Vietnam–France health cooperation and boosts domestic biopharmaceutical and epidemic response capabilities.

- May 2025: Cuba and Vietnam launched a joint biopharmaceutical venture between BioCubaFarma and Genfarma Holdings to produce and export medicines. Focused on technology transfer and R&D in Vietnam, the initiative aims to generate revenue for Cuba’s domestic drug production amid severe national shortages of essential medications.

- January 2025: Vietnam began building its first plasma-based biopharmaceutical plant in Thu Duc, Ho Chi Minh City. Led by Binh Viet Duc Co., the USD 114 Million facility aims to reduce import reliance, enhance healthcare self-sufficiency, and will process 600,000 liters of plasma annually starting February 2026.

- January 2025: CPC launched the MicroCNX Nano Series, the industry’s smallest aseptic connectors for biopharmaceutical cell and gene therapy processing. These connectors simplify sterile workflows, reduce holdup volume, eliminate tube welding, and support cryopreservation to -190°C, marking a key advancement in CGT manufacturing and biopharmaceutical efficiency.

- January 2025: VNVC partnered with Germany’s Rieckermann Group to build Vietnam’s first LEED-certified vaccine and biopharmaceutical factory in Long An. With a near VND 2 Trillion investment, the facility aims for net-zero emissions, supporting local vaccine self-sufficiency and advancing Vietnam’s biopharmaceutical infrastructure and global health contributions.

- September 2024: Takeda advanced its biopharmaceutical presence in Vietnam with the official launch of its dengue vaccine, approved in May. The company focuses on innovative treatments for rare diseases and public health challenges, partnering with local stakeholders to expand access, education, and sustainable healthcare across Vietnam's evolving medical landscape.

Vietnam Biopharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Indications Covered | Autoimmune Diseases, Oncology, Metabolic Disorders, Others |

| Classes Covered | Recombinant Proteins, Monoclonal Antibodies, Purified Proteins |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam biopharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam biopharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam biopharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopharmaceutical market in Vietnam was valued at USD 1.30 Billion in 2024.

The Vietnam biopharmaceutical market is projected to exhibit a CAGR of 8.13% during 2025-2033, reaching a value of USD 2.64 Billion by 2033.

The Vietnam biopharmaceutical market is driven by a growing chronic disease burden, supportive government policies and infrastructure investment. Rising middle-class healthcare spending, strategic international partnerships and technology transfers, and expanding population, together fostering innovation, market penetration, and local manufacturing in biologics and vaccines.

Southern Vietnam currently dominates the Vietnam biopharmaceutical market due to strategic geographic distribution between North and South, upgraded healthcare facilities in DaNang and Hu, and tourism/expat demand boosting medicine access.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)