Vietnam Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Vietnam Board Games Market Overview:

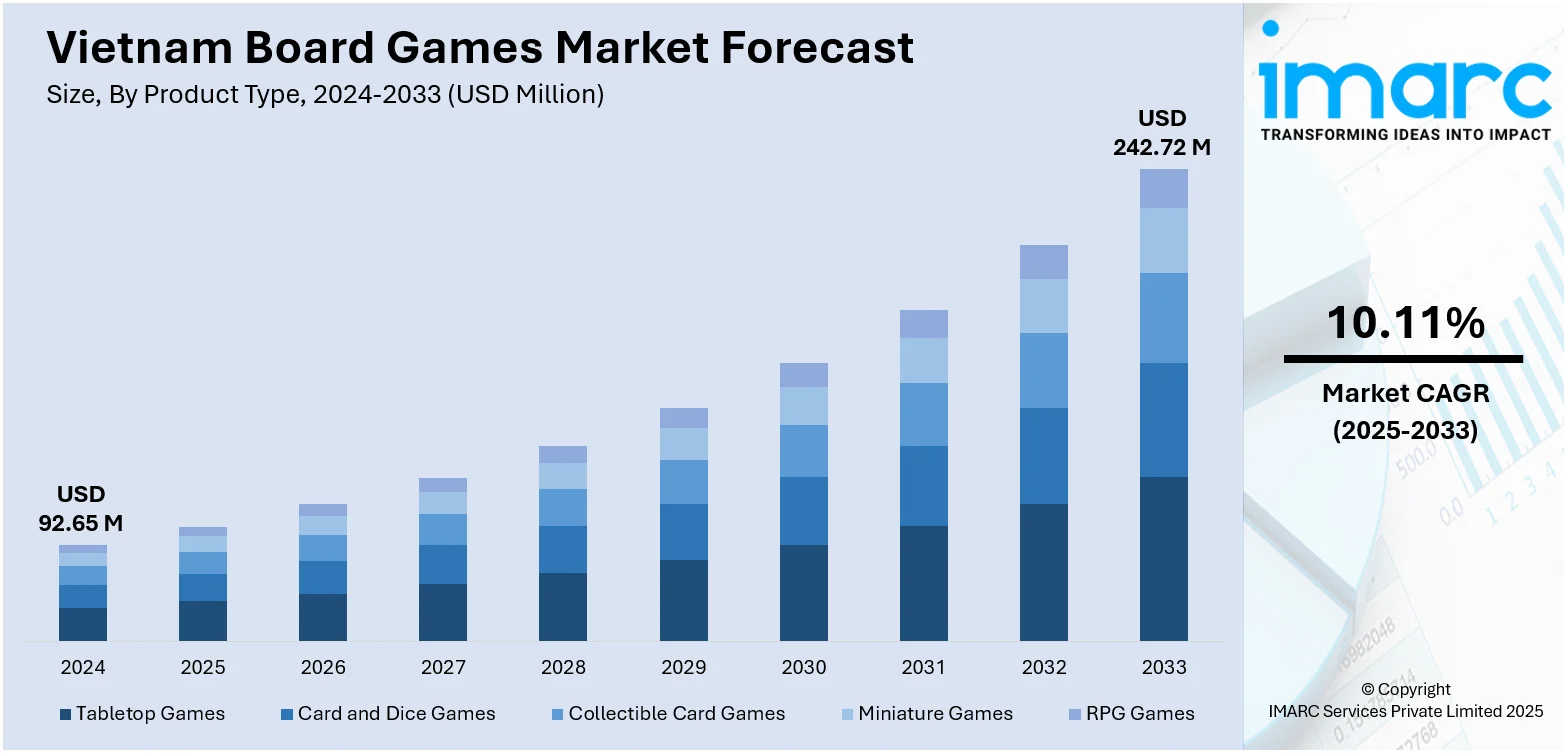

The Vietnam board games market size reached USD 92.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 242.72 Million by 2033, exhibiting a growth rate (CAGR) of 10.11% during 2025-2033. At present, the rising demand for social and family-based entertainment activities is supporting the market growth. Moreover, the ongoing development of contemporary distribution channels and specialty outlets is offering a favorable market outlook. Apart from this, the deep penetration of youth culture and the entry of global pop culture trends are expanding the Vietnam board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 92.65 Million |

| Market Forecast in 2033 | USD 242.72 Million |

| Market Growth Rate 2025-2033 | 10.11% |

Vietnam Board Games Market Trends:

Increased Popularity of Social and Family Entertainment

The market for board games in Vietnam is experiencing rapid growth owing to the rising demand for social and family-based entertainment activities. Families and groups of friends are constantly looking for alternatives to electronic entertainment that provide personal interaction and quality time together. Moreover, middle class in Vietnam is projected to see a rise in disposable income, with 60% of households anticipated to earn more than $5,000 each year by 2027. This forecast arises during swift urban development and economic expansion, as noted by KPMG Vietnam and Cambodia’s Head of Markets Group, Tam Tran. With disposable incomes going up, increasing numbers of households are willing to spend money on board games as affordable forms of leisure that can be enjoyed by all age groups. Specialty board game cafes and retailers are increasing in large cities such as Ho Chi Minh City and Hanoi, creating a thriving community culture for tabletop gaming enthusiasts.

To get more information on this market, Request Sample

Expansion of Distribution Channels and Specialty Stores

The Vietnamese board game market is experiencing major growth as a result of the ongoing development of contemporary distribution channels and specialty outlets. Online platforms are creating affordable outlets for people to discover and buy local and imported board games, filling gaps for fans in secondary cities and rural areas, thereby impelling the Vietnam board games market growth. At the same time, the development of specialty board game cafes and hobby shops in city centers is building devoted environments where people can learn, try, and purchase games. This retail shift is building a strong sense of community that encourages frequent gaming sessions and events, which is introducing the pastime to new consumers. Local retailers and distributors are partnering with international companies to bring in new games and localized versions, thereby creating a constant flow of new content.

Increased Impact of Youth Culture and Pop Culture Trends

The Vietnamese board games industry is evolving as a result of the deep penetration of youth culture and the entry of global pop culture trends. Younger generations are adopting board gaming as a trendy activity that complements their wider interests in anime, comics, and fan communities. This cultural change is being fueled by social media, where online communities and influencers are posting reviews, gameplay footage, and tutorials that encourage others to become a part of the hobby. Structured board game competitions and theme nights are taking off, backed by schools and universities that recognize gaming as an educational and social development tool. The popularity of crowdfunding sites is empowering local designers to introduce one-of-a-kind, culturally significant board games that capture Vietnamese heritage, history, and contemporary issues, appealing to the youth market. Such increasing cultural integration is maintaining the market vibrant and innovative, making board games continue to be relevant amidst the presence of competing digital entertainment. Apart from this, the heightened focus on conducting board game tournaments is contributing to the market growth. For instance, in 2024, Vietnam declared the decision to conduct at least four chess competitions of the Hà Nội International Chess Series.

Vietnam Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The report has provided a detailed breakup and analysis of the market based on the game type. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

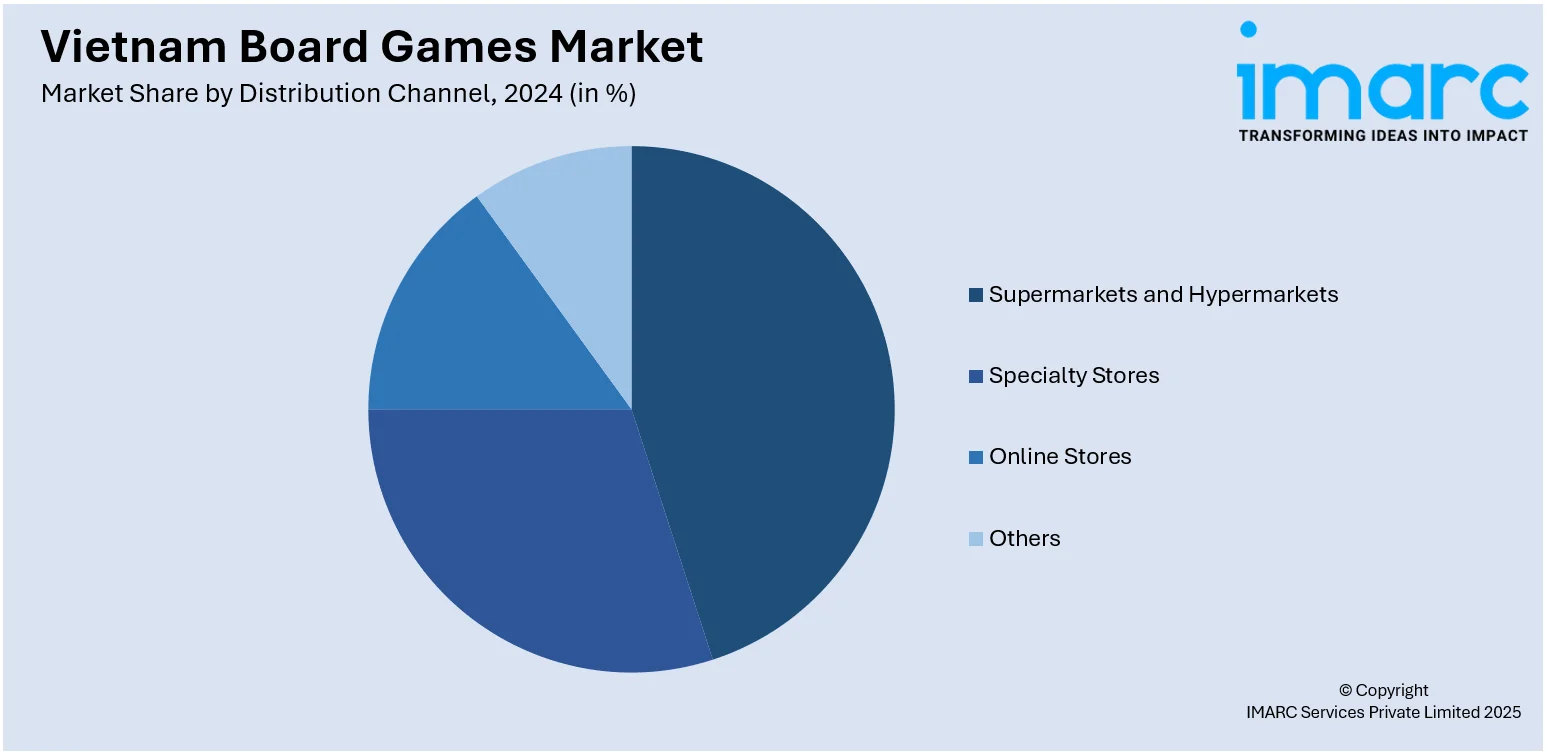

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam board games market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam board games market on the basis of product type?

- What is the breakup of the Vietnam board games market on the basis of game type?

- What is the breakup of the Vietnam board games market on the basis of age group?

- What is the breakup of the Vietnam board games market on the basis of distribution channel?

- What is the breakup of the Vietnam board games market on the basis of region?

- What are the various stages in the value chain of the Vietnam board games market?

- What are the key driving factors and challenges in the Vietnam board games market?

- What is the structure of the Vietnam board games market and who are the key players?

- What is the degree of competition in the Vietnam board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)