Vietnam Canned Food Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, and Region, 2026-2034

Vietnam Canned Food Market Summary:

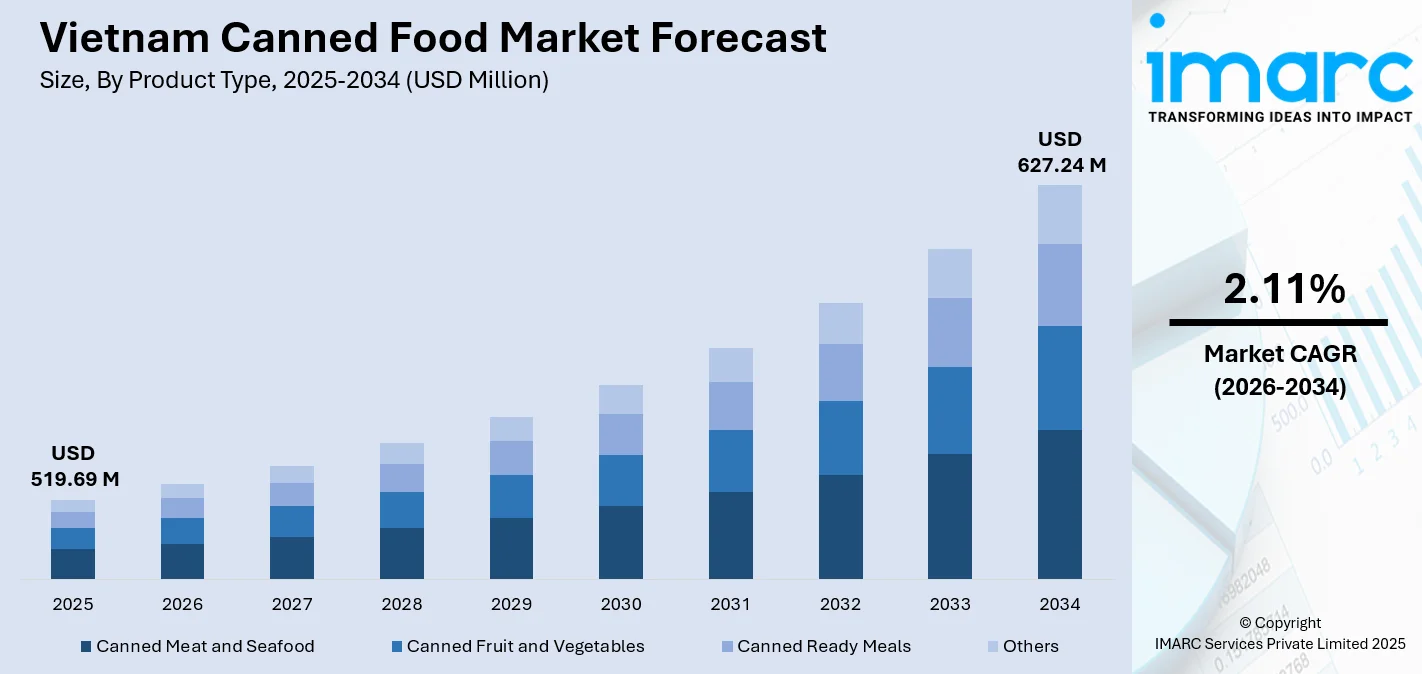

The Vietnam canned food market size was valued at USD 519.69 Million in 2025 and is projected to reach USD 627.24 Million by 2034, growing at a compound annual growth rate of 2.11% from 2026-2034.

The Vietnam canned food market is registering strong growth due to increasing urbanization, lifestyle trends, and greater demand for easy-to-eat ready foods in Vietnam. The Vietnam canned food market is also influenced by Vietnam having a growing middle class with higher disposable income, in addition to improved retail infrastructure development in Vietnam. Manufacturers are catering to this trend through diversified product offerings of manufacturers with local flavors and international standards of quality in Vietnam.

Key Takeaways and Insights:

- By Product Type: Canned meat and seafood dominate the market with a share of 46% in 2025, driven by Vietnam's rich maritime heritage, abundant seafood resources, and strong cultural preference for protein-rich preserved food products that offer extended shelf life and convenience.

- By Type: Conventional leads the market with a share of 74% in 2025, owing to its widespread availability, cost-effectiveness, and established consumer acceptance across urban and rural demographics seeking affordable preserved food options.

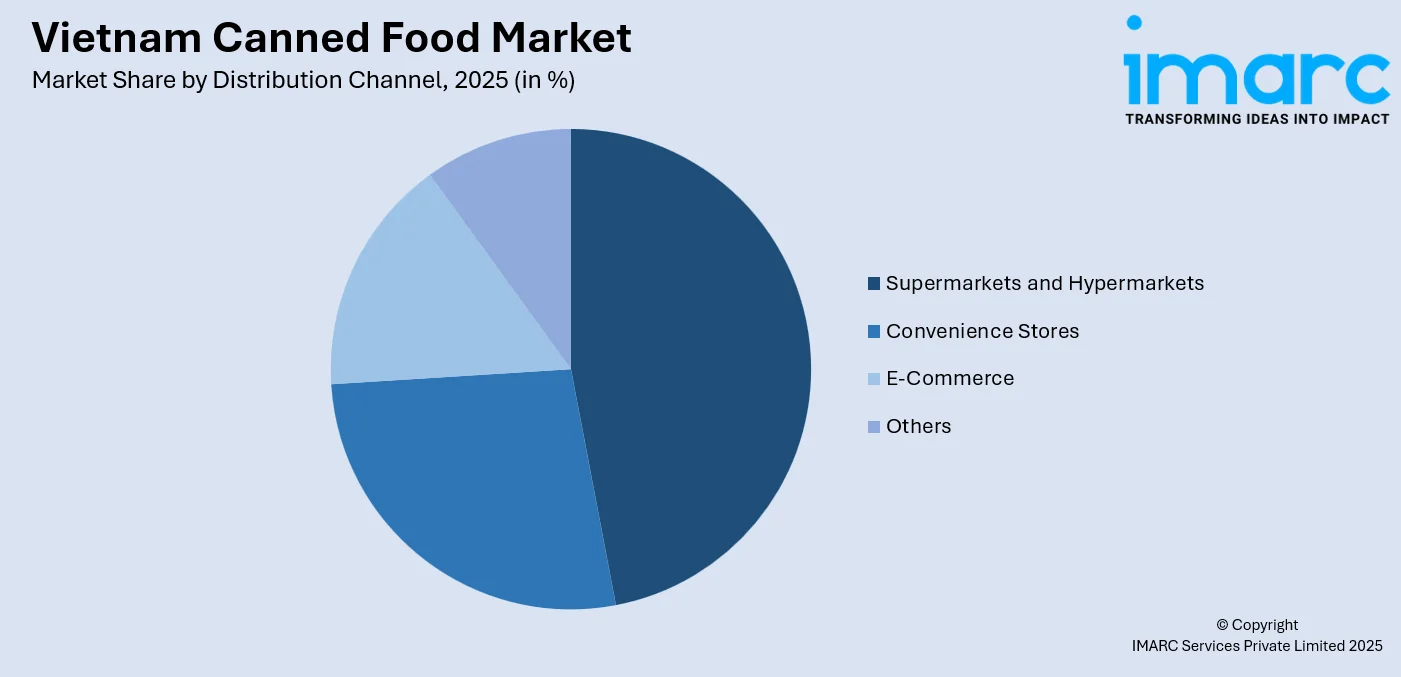

- By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 47% in 2025, facilitated by extensive retail network expansion, one-stop shopping convenience, and consumers' preference for inspecting product quality before purchase.

- By Region: Northern Vietnam leads the market with a share of 35% in 2025, supported by the concentration of urban population centers including Hanoi, advanced retail infrastructure, and higher consumer purchasing power in the region.

- Key Players: The Vietnam canned food market exhibits a moderately competitive landscape with both domestic manufacturers and multinational corporations competing across product segments. Market participants are focusing on product innovation, quality enhancement, and distribution network expansion to strengthen their market positioning.

To get more information on this market Request Sample

The Vietnam canned food industry is experiencing transformative growth as changing consumer lifestyles and increasing urbanization reshape food consumption patterns. The rising number of dual-income households has amplified demand for convenient meal solutions that offer extended shelf life without compromising nutritional value. In 2025, long-established producer Halong Canned Food Joint Stock Company reported expanded operations across Vietnam with enhanced manufacturing facilities, reinforcing its leadership in the ready-to-eat segment and meeting rising domestic and export demand. The market landscape is characterized by manufacturers investing in modern processing technologies to enhance product quality and safety standards. Strategic partnerships between domestic producers and international brands are facilitating knowledge transfer and technology upgrades across the value chain. Additionally, the expanding modern retail footprint across secondary cities and rural areas is improving product accessibility, while e-commerce channels are emerging as complementary distribution avenues catering to digitally-savvy consumers.

Vietnam Canned Food Market Trends:

Rising Preference for Premium and Health-Oriented Canned Products

Vietnamese consumers are increasingly gravitating toward premium canned food products that emphasize natural ingredients, reduced sodium content, and clean label formulations. Health-conscious urban consumers are seeking canned options that align with wellness trends, prompting manufacturers to develop products with enhanced nutritional profiles. In 2025, Halong Canfoco earned FSSC 22000 and ISO 22000:2018 certifications, strengthening trust in premium, safe, clean-label canned foods. This shift is driving innovation in product development as companies introduce fortified variants and reformulated recipes that cater to evolving dietary preferences without artificial preservatives.

Expansion of Ready-to-Eat and Convenience-Focused Offerings

The growing popularity of ready-to-eat canned meals reflects evolving consumer preferences shaped by busy lifestyles and limited time among working professionals. Manufacturers are broadening offerings with single-serve portions, meal kits, and microwaveable formats suited for on-the-go consumption. In May 2025, Vietnam-based Ben Food launched a ready-to-eat range featuring freeze-dried traditional dishes that combine authentic local flavors with advanced processing technology. This development underscores the industry’s shift toward convenient food solutions while preserving traditional Vietnamese tastes and culinary identity.

Sustainable Packaging and Eco-Friendly Initiatives

Environmental sustainability is increasingly shaping Vietnam’s canned food industry amid rising packaging waste concerns. For example, Nestlé Vietnam has committed to making more than 95% of its packaging recyclable by 2025, cut virgin plastics by one-third, and is investing in systems for better collection, sorting, and recycling to reduce environmental impact. Companies are transitioning toward recyclable materials, lightweight packaging designs, and reduced plastic usage in their product offerings. This sustainability-driven approach extends to sourcing practices, with increasing emphasis on responsibly harvested seafood and locally-sourced agricultural ingredients that support regional farming communities.

Market Outlook 2026-2034:

The Vietnam canned food market outlook remains optimistic as favorable demographic trends and evolving consumption patterns continue to drive sector expansion. Increasing urbanization, rising middle-class affluence, and modernizing food retail infrastructure are collectively strengthening market fundamentals. The growing acceptance of convenience food products across diverse consumer segments, coupled with manufacturers' commitment to quality enhancement and product diversification, positions the industry for sustained growth trajectory. The market generated a revenue of USD 519.69 Million in 2025 and is projected to reach a revenue of USD 627.24 Million by 2034, growing at a compound annual growth rate of 2.11% from 2026-2034.

Vietnam Canned Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Canned Meat and Seafood |

46% |

|

Type |

Conventional |

74% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

47% |

|

Region |

Northern Vietnam |

35% |

Product Type Insights:

- Canned Meat and Seafood

- Canned Fruit and Vegetables

- Canned Ready Meals

- Others

The canned meat and seafood dominate with a market share of 46% of the total Vietnam canned food market in 2025.

The canned meat and seafood product continues to take the leading market position in the canned market in Vietnam, which can be attributed to the affinity for protein-rich preserved foods and the geographical advantage of the country as a prominent producer of seafood. The long coastline and the aquaculture industry of Vietnam provide adequate raw material to the canned seafood industry to produce products that are cost-effective and of quality.

The consumer preference for canned tuna, sardines, and processed meats remains on the upward trend due to their ability to provide a long shelf life, nutritional benefits, and convenience for the consumer in meal preparation. The industry has the advantage of local production capacity that has been oriented towards exports, with local companies investing in superior processing technology in order to meet local and international standards in relation to export.

Type Insights

- Organic

- Conventional

The conventional leads with a share of 74% of the total Vietnam canned food market in 2025.

Conventional canned food products maintain overwhelming market dominance owing to their established presence, widespread availability, and price accessibility across diverse consumer segments. For instance, VISSAN, one of Vietnam’s most recognized food producers, announced plans in late 2025 to allocate over 530 billion VND to stock essential food products and launch new convenience-oriented offerings ahead of the Tết Nguyên Đán 2026 peak season, underscoring its role in meeting broad consumer demand for familiar, affordable canned goods. The segment's strength lies in its ability to serve mass-market demand while offering consistent quality and familiar taste profiles that resonate with Vietnamese consumers' culinary preferences and expectations.

The conventional segment benefits from well-developed supply chains, established distribution networks, and economies of scale that enable competitive pricing. While organic alternatives are gaining traction among premium consumers, conventional products remain the preferred choice for cost-conscious households seeking reliable preserved food options for everyday consumption and meal preparation needs, while supporting steady production volumes, consistent availability, and retailer inventory optimization.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- E-Commerce

- Others

The supermarkets and hypermarkets dominate with a market share of 47% of the total Vietnam canned food market in 2025.

Supermarkets and hypermarkets are still dominating the distribution of canned food in Vietnam due to the fast expansion of modern retail and one-stop shopping preferences. These channels have provided a wide range of product varieties, promotional activities, and thus offer more competitive prices, provide consumers an opportunity to physically check product quality for selection, which increases consumer confidence and trust in products while making it more convenient for shopping, drawing brand loyalty, and making focused campaigns on behalf of brands.

The expanding presence of major retail chains in secondary cities and suburban areas is bringing markets within the reach of many more consumers and also propelling category growth. Retailers are improving the merchandising of their canned food sections, allocating shelf space to premium offerings, and undertaking targeted promotional campaigns designed to drive consumer trial and repeat purchase behavior in a wide range of product categories, while reinforcing brand awareness, increasing customer involvement, and underpinning long-term sales.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with a 35% share of the total Vietnam canned food market in 2025.

The canned food industry in the Vietnam market is led by Northern Vietnam, which is followed by the Southern Vietnam market and the Central Vietnam market. The main factors responsible for the dominance of the Northern Vietnam market are the high concentration of city dwellers in the vicinity of the capital city of Hanoi, overall average per capita incomes, and the level of retail infrastructure developed in the region.

One major factor that will positively influence people from the northern region is the distribution advantage enjoyed due to proximity to manufacturing companies and a cold chain distribution system. Secondly, seasonal changes and traditional food preservation practices and culture among the people from the region will have historically promoted positive acceptance and therefore demand levels for products such as those preserved in cans.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Canned Food Market Growing?

Accelerating Urbanization and Evolving Consumer Lifestyles

Vietnam’s rapid urbanization is reshaping food consumption as more consumers move to cities for economic opportunities. Urban dwellers, especially young professionals and dual-income households, face time constraints that limit traditional cooking and drive demand for convenient meals. In August 2025, Vietnam’s Nature Foods Company (NFC) expanded ready-to-eat and freeze-dried offerings, positioning them as pantry staples for busy lifestyles. The canned food sector meets these needs with shelf-stable, nutritious products, appealing to smaller households and changing family structures that favor portion-controlled, quick-preparation solutions.

Expansion of Modern Retail Infrastructure

The expansion of modern retail across Vietnam is enhancing distribution opportunities for canned food manufacturers and improving consumer access. Supermarkets, hypermarkets, and convenience stores are extending into secondary cities and suburban areas, bringing organized retail to underserved populations. In 2025, WinCommerce (WinMart/WinMart+) opened 318 new stores, boosting modern retail presence nationwide. This modernization increases canned food visibility through dedicated merchandising, product categories, and promotions, while providing manufacturers with consumer insights. Advanced cold chain and inventory systems also ensure product quality and freshness across extended distribution networks.

Rising Middle-Class Affluence and Changing Food PreferencesQ2Y

Vietnam’s expanding middle class is transforming the canned food market as rising incomes drive demand for convenience, quality, and variety. Consumers increasingly prioritize food safety, nutritional content, and brand reputation, fueling premium product growth. In June 2025, Masan Consumer highlighted its premiumization strategy by expanding lines like the Omachi “Asian eateries” range, offering higher-quality, flavorful convenience foods for middle-income, quality-seeking consumers. This segment’s willingness to try diverse formats and international flavors, combined with strong brand loyalty and responsiveness to marketing, creates opportunities for manufacturers to innovate and capture a broader urban and semi-urban market.

Market Restraints:

What Challenges the Vietnam Canned Food Market is Facing?

Consumer Perception Regarding Freshness and Nutritional Quality

Persistent consumer perceptions regarding the comparative nutritional inferiority of canned foods versus fresh alternatives represent a significant market challenge. Traditional Vietnamese culinary culture emphasizes fresh ingredients, creating inherent skepticism about preserved food products. Manufacturers must invest substantially in consumer education initiatives to address misconceptions about canning processes and nutritional preservation capabilities while building trust in product quality and safety standards.

Competition from Traditional Wet Markets and Fresh Food Channels

Vietnam's deeply entrenched traditional wet market culture presents ongoing competitive pressure for canned food products. Consumers, particularly in rural and semi-urban areas, maintain strong preferences for purchasing fresh produce and proteins from familiar neighborhood vendors. These traditional channels offer perceived freshness advantages, relationship-based pricing flexibility, and cultural shopping experiences that modern retail formats struggle to replicate, limiting canned food penetration in certain market segments.

Raw Material Price Volatility and Supply Chain Pressures

Fluctuations in raw material costs, particularly for seafood and agricultural inputs, create margin pressures for canned food manufacturers. Climate variability affecting fishing yields and crop production introduces supply uncertainties that complicate production planning and pricing strategies. Additionally, packaging material costs and logistics expenses add to operational challenges, potentially constraining manufacturers' ability to maintain competitive pricing while preserving quality standards.

Competitive Landscape:

The Vietnam canned food market demonstrates a moderately fragmented competitive structure characterized by the coexistence of established domestic manufacturers and international food conglomerates. Market participants compete across multiple dimensions including product quality, pricing strategies, distribution network strength, and brand recognition. Leading domestic players leverage their understanding of local taste preferences and established supply chain relationships to maintain strong market positions. International entrants bring advanced processing technologies, global quality standards, and diverse product portfolios that appeal to premium consumer segments. The competitive environment is intensifying as companies invest in capacity expansion, product innovation, and marketing initiatives to capture growing consumer demand. Strategic partnerships, distribution agreements, and targeted acquisitions are reshaping competitive dynamics as players seek to strengthen their market presence and operational capabilities.

Recent Developments:

- In July 2025, Dong Giao Foodstuff Export JSC (Doveco), in partnership with Tetra Pak Vietnam, launched Vietnam’s first paper-can (Tetra Recart®) production line. The technology enhances shelf life without refrigeration, maintains food quality, and supports export-ready canned fruits and vegetables, marking a key advancement in Vietnam’s processed food packaging landscape.

Vietnam Canned Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Canned Meat and Seafood, Canned Fruit and Vegetables, Canned Ready Meals, Others |

| Types Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, E-Commerce, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam canned food market size was valued at USD 519.69 Million in 2025.

The Vietnam canned food market is expected to grow at a compound annual growth rate of 2.11% from 2026-2034 to reach USD 627.24 Million by 2034.

Canned meat and seafood held the largest share of 46%, driven by Vietnam's rich maritime resources, strong cultural preference for protein-rich preserved foods, and the segment's ability to offer extended shelf life with nutritional value at competitive price points.

Key factors driving the Vietnam canned food market include accelerating urbanization and evolving consumer lifestyles, expansion of modern retail infrastructure across urban and semi-urban areas, and rising middle-class affluence driving demand for convenient, quality food products.

Major challenges include consumer perceptions regarding freshness and nutritional quality compared to fresh alternatives, competition from traditional wet markets and fresh food channels, raw material price volatility, supply chain pressures, and the need for ongoing consumer education initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)