Vietnam Car Sharing Market Size, Share, Trends and Forecast by Car Type, Business Model, Application, and Region, 2026-2034

Vietnam Car Sharing Market Summary:

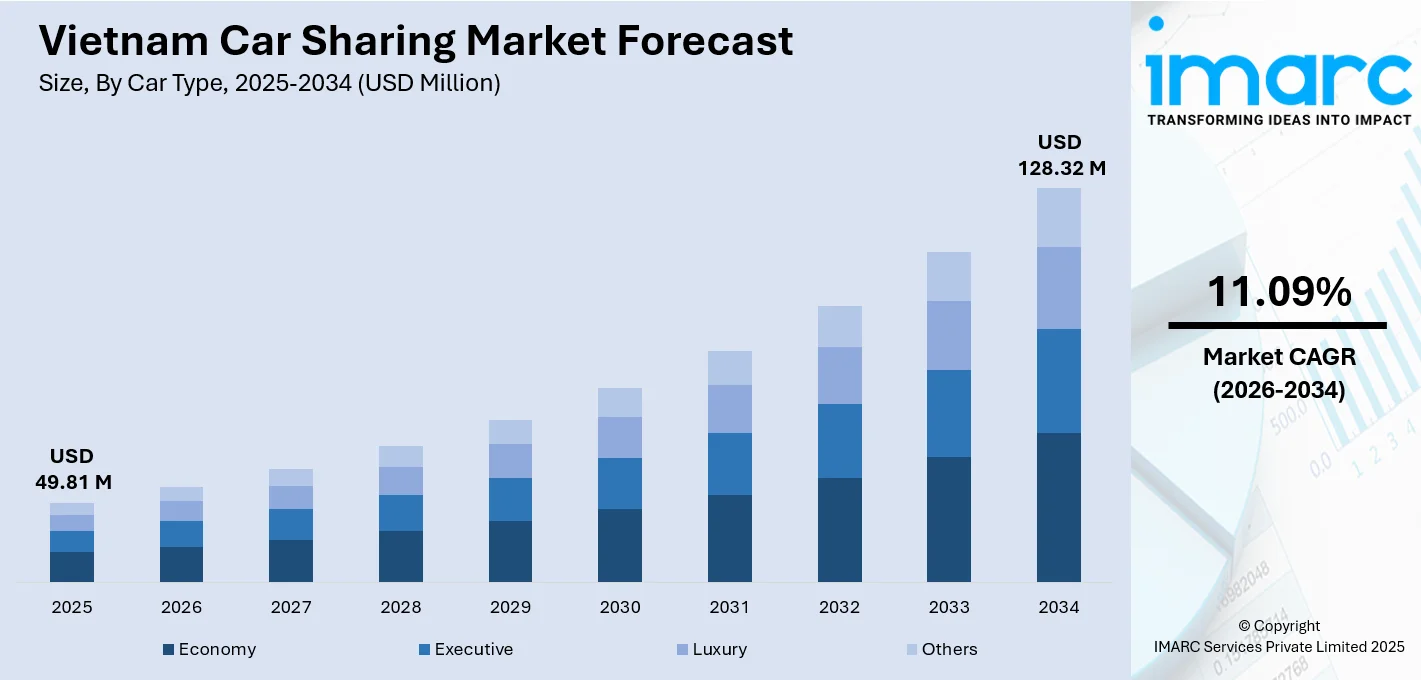

The Vietnam car sharing market size was valued at USD 49.81 Million in 2025 and is projected to reach USD 128.32 Million by 2034, growing at a compound annual growth rate of 11.09% from 2026-2034.

The Vietnam car sharing market is gaining strong momentum, as rapid urbanization transforms mobility patterns across major metropolitan areas. Increasing traffic congestion in key urban centers, such as Hanoi and Ho Chi Minh City, has encouraged consumers to embrace shared mobility solutions over traditional vehicle ownership. The proliferation of smartphone applications and digital payment platforms has enhanced the accessibility and convenience of car sharing services, attracting a growing base of tech-savvy users. Government initiatives promoting sustainable transportation and smart city development are further strengthening market fundamentals.

Key Takeaways and Insights:

-

By Car Type: Economy dominates the market with a share of 54% in 2025, owing to its affordability, lower rental costs, and widespread availability that appeals to cost-conscious consumers seeking practical transportation solutions for daily commuting and short-distance travel needs.

-

By Business Model: Station based leads the market with a share of 39% in 2025. This dominance is driven by the operational reliability, predictable vehicle availability at designated locations, and infrastructure support that facilitates seamless pickup and drop-off experiences for users.

-

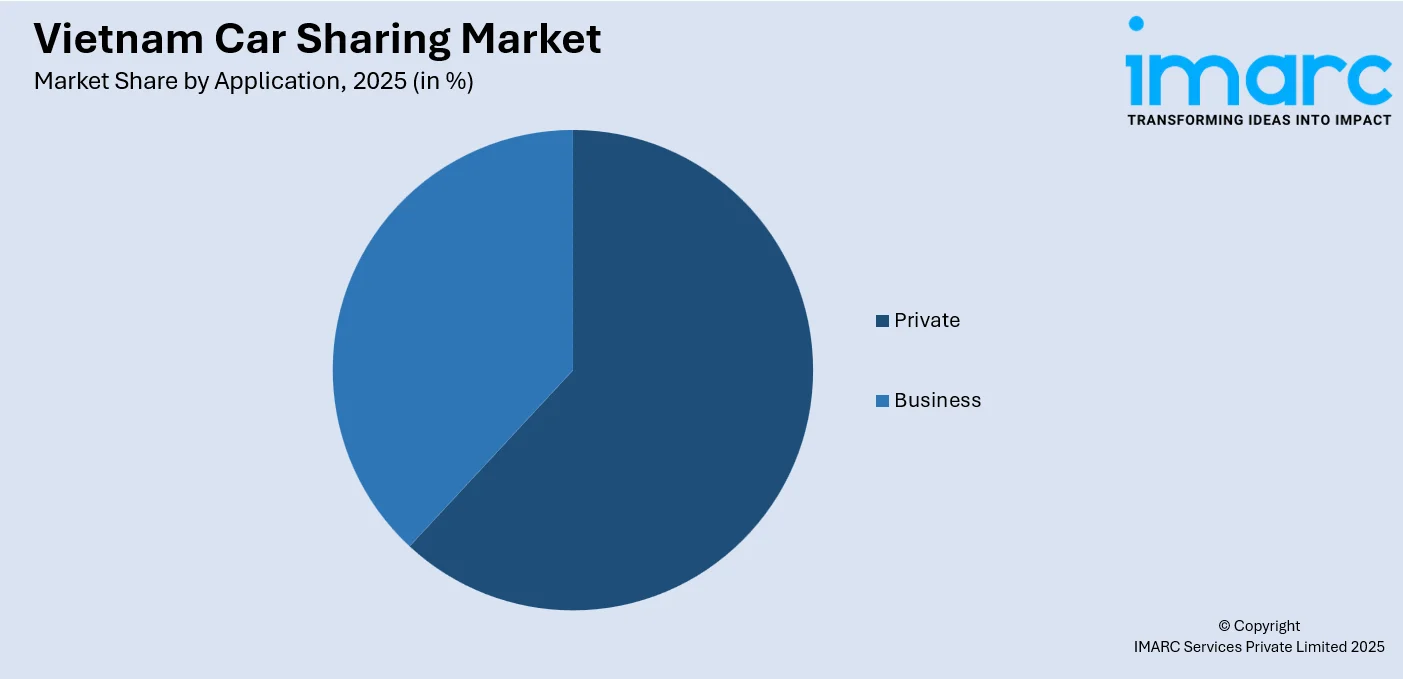

By Application: Private comprises the largest segment with a market share of 65% in 2025, reflecting strong individual consumer demand for flexible personal transportation alternatives that offer convenience without the financial burden of vehicle ownership.

-

By Region: Northern Vietnam represents the largest region with 40% share in 2025, driven by the concentration of economic activities in Hanoi, high population density, and advanced digital infrastructure that supports app-based mobility services.

-

Key Players: Key players drive the Vietnam car sharing market by expanding fleet networks, integrating electric vehicles (EVs), enhancing mobile application features, and forming strategic partnerships with technology providers. Their investments in user experience, pricing optimization, and geographic expansion are accelerating adoption across urban and suburban markets.

To get more information on this market Request Sample

The Vietnam car sharing market is advancing, as urbanization accelerates and consumers increasingly prioritize flexible mobility solutions over traditional vehicle ownership. Growing smartphone penetration, standing at around 84% in 2024, has enabled seamless access to car sharing platforms through mobile applications. The market is characterized by the integration of EVs into shared fleets, with major operators transitioning to sustainable transportation options. Additionally, the rise of multi-service platforms offering integrated transportation, delivery, and rental services is expanding market reach across diverse consumer segments, contributing to the market growth. Convenience, cost-effectiveness, and time-saving benefits are driving consumer adoption, particularly among young professionals and urban dwellers. Strategic partnerships with payment providers and local businesses are enhancing service accessibility and customer engagement. Furthermore, government initiatives promoting smart city development and sustainable urban mobility are creating a supportive environment for the continued expansion of car sharing services in Vietnam.

Vietnam Car Sharing Market Trends:

Accelerating Transition to EV Fleets

The Vietnam car sharing market is witnessing a significant shift towards EVs and hybrid vehicles (HVs) as operators prioritize sustainable transportation solutions. This transition is driven by government incentives, including 100% registration fee exemptions for EVs extended through 2027, and supportive policies promoting green mobility in major cities. Leading service providers are progressively electrifying their fleets to reduce operational costs associated with fuel consumption while appealing to environmentally conscious consumers.

Digital Platform Integration and Smart Mobility Solutions

Advanced digital technologies are transforming how consumers access and utilize car sharing services in Vietnam. Mobile applications offer sophisticated features, including real-time vehicle availability, seamless digital payments, and integrated navigation systems that enhance user convenience. The widespread adoption of digital payment platforms, with the Vietnam mobile payments market valued at approximately USD 12.1 Billion in 2025, enables frictionless transactions within car sharing applications. Operators are leveraging data analytics and artificial intelligence (AI) to optimize fleet distribution, predict demand patterns, and personalize service offerings for enhanced customer experiences.

Emergence of Multi-Service Mobility Platforms

The convergence of transportation services within unified platforms is reshaping the competitive landscape of the Vietnam car sharing market. Operators are expanding beyond traditional car rental to incorporate ride-hailing, delivery services, and long-term rental options within single applications. This integrated approach addresses diverse consumer mobility needs while maximizing asset utilization and revenue streams. By offering multiple services through a single platform, operators enhance customer convenience and loyalty, encouraging repeat usage. Additionally, data-driven insights from these integrated platforms enable optimized fleet management, dynamic pricing, and targeted marketing strategies, strengthening competitive advantage.

Market Outlook 2026-2034:

The Vietnam car sharing market is positioned for sustained expansion, as urbanization continues to reshape transportation preferences across the country. Growing environmental awareness and government initiatives promoting sustainable mobility are expected to accelerate the adoption of shared vehicle services among diverse consumer segments. The market generated a revenue of USD 49.81 Million in 2025 and is projected to reach a revenue of USD 128.32 Million by 2034, growing at a compound annual growth rate of 11.09% from 2026-2034. Infrastructure development, including expanded charging networks for EVs and enhanced digital payment systems, will support market growth. Strategic partnerships between car sharing operators and automotive manufacturers are anticipated to introduce innovative service models.

Vietnam Car Sharing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Car Type | Economy | 54% |

| Business Model | Station Based | 39% |

| Application | Private | 65% |

| Region | Northern Vietnam | 40% |

Car Type Insights:

- Economy

- Executive

- Luxury

- Others

Economy dominates with a market share of 54% of the total Vietnam car sharing market in 2025.

The economy car segment commands the largest share of the Vietnam car sharing market, driven by the strong preference for affordable and practical transportation solutions among price-sensitive consumers. These vehicles offer optimal fuel efficiency and lower rental rates, making them attractive for daily commuting, short-distance travel, and budget-conscious users. The widespread availability of economy vehicles across car sharing platforms ensures consistent accessibility for users in both urban and suburban areas. By 2025, at least 95% of all households in Hanoi will utilize smartphones, enabling seamless booking of economy car sharing services.

The segment's dominance in the market is further reinforced by the operational cost advantages that economy vehicles provide to service operators, enabling competitive pricing strategies. These compact vehicles are well-suited for navigating congested urban traffic conditions prevalent in Vietnamese cities, offering maneuverability advantages in densely populated areas. The growing young professional demographic, seeking practical mobility solutions without the burden of vehicle ownership, increasingly favors economy car sharing options.

Business Model Insights:

- P2P

- Station Based

- Free-Floating

Station based leads with a share of 39% of the total Vietnam car sharing market in 2025.

The station based business model maintains its leadership position through the reliability and predictability it offers to car sharing users across Vietnam. Designated pickup and return locations provide users with certainty regarding vehicle availability while simplifying the logistics of trip planning. This model benefits from established infrastructure at strategic locations, including transportation hubs, commercial centers, and residential complexes. This fixed-location approach also fosters user trust and convenience, encouraging higher adoption rates among daily commuters and regular car-sharing customers.

The operational efficiency of station based services enables better fleet management and maintenance scheduling, contributing to consistent service quality and vehicle reliability. Charging infrastructure for EVs is more efficiently deployed at fixed stations, supporting the transition to sustainable shared mobility. Corporate clients particularly favor station-based models for their accountability and ease of expense management. The integration of digital technologies allows users to reserve vehicles in advance at preferred stations, while real-time availability tracking through mobile applications reduces wait times and enhances the overall user experience.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Business

- Private

Private exhibits a clear dominance with a 65% share of the total Vietnam car sharing market in 2025.

Private dominates the Vietnam car sharing market, as individual consumers are increasingly seeking flexible personal transportation alternatives to vehicle ownership. Rising costs associated with purchasing and maintaining private vehicles, combined with limited parking availability in urban centers, have driven consumers towards shared mobility solutions. In Vietnam, the convenience of on-demand vehicle access through mobile applications appeals to young professionals and urban residents who prioritize flexibility over asset ownership.

The private segment benefits from the lifestyle preferences of Vietnam's growing middle class, which is set to reach 26% of the population by 2026, seeking cost-effective and convenient mobility options. Weekend travel, holiday trips, and occasional transportation needs are efficiently addressed through car sharing services without long-term financial commitments. Digital payment integration and user-friendly booking interfaces have lowered barriers to adoption among individual consumers. The expansion of car sharing networks to suburban areas and tourist destinations is broadening the private segment's reach, enabling users to access vehicles for diverse personal mobility requirements.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam represents the leading region with a 40% share of the total Vietnam car sharing market in 2025.

Northern Vietnam commands the largest share of the car sharing market in the country, anchored by Hanoi's position as the political and economic capital with a population projected to reach 8.5 Million residents in 2024. The region's concentrated urban development and high population density create substantial demand for efficient transportation alternatives. Severe traffic congestion has accelerated the adoption of shared mobility solutions. Advanced digital infrastructure and high smartphone penetration rates in the region facilitate seamless access to car sharing applications, supporting market growth.

The region benefits from substantial investments in transportation infrastructure and charging networks that support both conventional and electric car sharing services. Educational institutions, corporate offices, and government centers concentrated in Hanoi generate consistent demand for flexible vehicle access among students, professionals, and visitors. Tourism-related demand from destinations, including Ha Long Bay and surrounding provinces, contributes to seasonal market expansion. Service providers prioritize fleet deployment in Northern Vietnam, with operators establishing extensive station networks and charging facilities to capture the region's significant market opportunity.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Car Sharing Market Growing?

Accelerating Urbanization and Traffic Congestion

Vietnam's rapid urbanization is fundamentally reshaping transportation demand and driving the adoption of car sharing services across major metropolitan areas. The country's urban population reached 40.2% of the total population in 2024. Major cities, including Hanoi and Ho Chi Minh City, are experiencing significant traffic congestion challenges as private vehicle numbers increase faster than road infrastructure capacity. This imbalance creates favorable conditions for car sharing services, which provide efficient and flexible alternatives to private vehicle ownership. The concentration of economic activities, employment hubs, and educational institutions in urban centers continues to attract population migration, further intensifying transportation demand. Car sharing services help meet the mobility needs of urban residents while alleviating pressure on congested roads, offering a convenient, cost-effective, and eco-friendly solution. As a result, shared mobility is becoming an essential part of Vietnam’s urban transportation ecosystem, supporting sustainable city development and enhancing overall traffic management.

Digital Technology Advancement and Smartphone Penetration

The rapid proliferation of smartphones and digital payment platforms has created essential infrastructure for the growth of car sharing market in Vietnam. Increasing smartphone adoption, combined with widespread 4G and 5G network coverage, enables seamless access to car sharing applications across urban and suburban areas. Mobile applications allow users to book vehicles, make payments, and access cars effortlessly, creating frictionless experiences that enhance convenience and reliability. The rise of integrated digital payment solutions, including quick response (QR) code-based wallets and super apps, supports secure and efficient non-cash transactions, reducing barriers to adoption. High engagement with mobile technology also allows operators to gather real-time data on usage patterns, optimize fleet allocation, and improve service availability. This strong digital ecosystem not only simplifies daily mobility for consumers but also provides a scalable platform for operators to expand service coverage, integrate new features, and foster broader adoption of shared car solutions across Vietnam.

Government Initiatives Supporting Sustainable Transportation

Vietnam’s government is actively promoting green transportation and sustainable urban mobility, creating a supportive regulatory environment for car sharing market growth. Policies encourage the adoption of EVs, green energy initiatives, and environment-friendly transportation practices, positioning shared electric mobility as a core component of sustainable urban planning. Incentives for EV acquisition, coupled with regulatory support for low-emission fleets, encourage operators to transition from traditional fuel vehicles to cleaner alternatives. Urban planning and policy frameworks emphasize reducing carbon emissions, enhancing air quality, and developing integrated mobility solutions that align with long-term environmental targets. Strategic programs provide visibility and confidence for private operators to invest in electric car sharing infrastructure, charging networks, and fleet expansion. By fostering collaboration between municipal authorities, transport agencies, and private mobility providers, these initiatives accelerate the deployment of sustainable car sharing services, support net-zero emission goals, and encourage public adoption of low-emission, shared mobility solutions across Vietnamese cities.

Market Restraints:

What Challenges the Vietnam Car Sharing Market is Facing?

High Vehicle Acquisition and Operational Costs

The substantial capital investment required for vehicle fleet acquisition and maintenance presents financial challenges for car sharing operators in Vietnam. EVs, while offering operational cost advantages, require significant upfront investment that may strain the resources of smaller market participants. Vehicle insurance, maintenance, and depreciation costs impact profitability margins, particularly for operators competing on pricing. The need for continuous fleet renewal to maintain service quality and incorporate newer vehicle technologies demands sustained capital allocation.

Intense Competition from Ride-Hailing Services

The presence of well-established ride-hailing platforms creates competitive pressure for car sharing services in the shared mobility industry in Vietnam. Major ride-hailing operators benefit from extensive driver networks, brand recognition, and integrated service ecosystems that address diverse consumer needs. Car sharing operators must differentiate their value propositions and invest in user acquisition to compete effectively within the broader mobility landscape.

Regulatory Uncertainty and Compliance

Car sharing operators in Vietnam encounter regulatory uncertainty, as local authorities continue to develop frameworks for shared mobility services. Licensing requirements, insurance obligations, and road usage regulations vary between municipalities, creating compliance challenges. Delays in regulatory clarity can limit expansion plans and discourage investment in new services or fleet types. Operators must maintain close engagement with policymakers to navigate evolving rules, ensure legal compliance, and align service offerings with government expectations for safety, sustainability, and urban mobility management.

Competitive Landscape:

The Vietnam car sharing market features a dynamic competitive environment, characterized by both domestic operators and international service providers expanding their presence. Market participants are differentiating through fleet electrification, digital platform enhancement, and geographic expansion strategies. The integration of car sharing within broader mobility ecosystems enables operators to capture diverse revenue streams while addressing comprehensive transportation needs. Strategic partnerships between car sharing platforms, automotive manufacturers, and charging infrastructure providers are strengthening competitive positions. Service providers are investing in technology upgrades to improve user experiences, optimize fleet utilization, and reduce operational costs. The entry of new market participants and consolidation among existing players continue to reshape the competitive landscape, driving innovations and service improvements across the industry.

Vietnam Car Sharing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Car Types Covered | Economy, Executive, Luxury, Others |

| Business Models Covered | P2P, Station Based, Free-Floating |

| Applications Covered | Business, Private |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam car sharing market size was valued at USD 49.81 Million in 2025.

The Vietnam car sharing market is expected to grow at a compound annual growth rate of 11.09% from 2026-2034 to reach USD 128.32 Million by 2034.

Economy dominated the market with a share of 54%, driven by affordability, fuel efficiency, and widespread availability that appeals to cost-conscious consumers seeking practical and convenient mobility solutions.

Key factors driving the Vietnam car sharing market include rapid urbanization, rising traffic congestion, increasing smartphone penetration, digital payment adoption, government support for green transportation, and growing consumer preference for flexible mobility solutions.

Major challenges include limited EV charging infrastructure in rural areas, high vehicle acquisition and operational costs, intense competition from ride-hailing services, and the need for continued investment in digital platforms and fleet expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)