Vietnam Cardiac PoC Testing Devices Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Vietnam Cardiac PoC Testing Devices Market Summary:

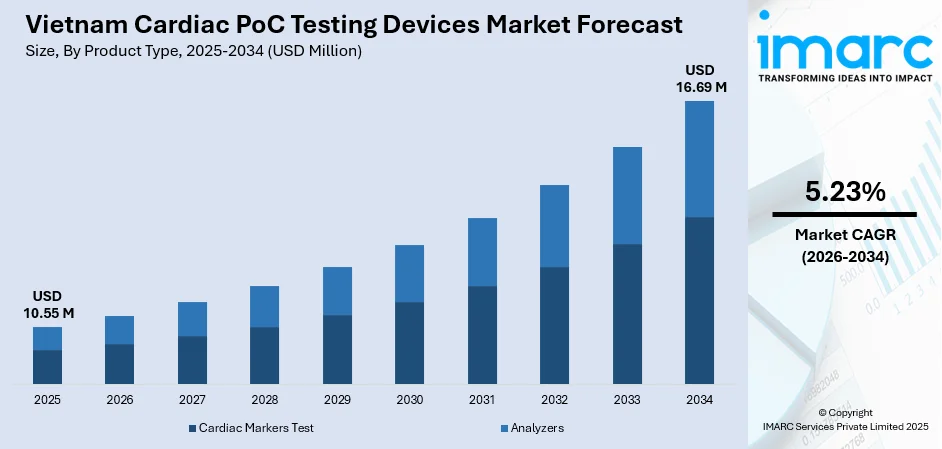

The Vietnam cardiac PoC testing devices market size was valued at USD 10.55 Million in 2025 and is projected to reach USD 16.69 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

The Vietnam cardiac PoC testing devices market is witnessing robust expansion driven by comprehensive government healthcare reforms and substantial investments in modernizing medical infrastructure across the nation. Rising awareness of cardiovascular health, coupled with increasing demand for rapid diagnostic solutions, is reshaping the healthcare delivery landscape. The rising focus on early disease detection and preventive medicine is accelerating the adoption of point-of-care cardiac testing technologies. Additionally, integration of advanced digital health solutions and artificial intelligence capabilities is enhancing diagnostic accuracy and clinical decision-making, thereby strengthening the Vietnam cardiac PoC testing devices market share.

Key Takeaways and Insights:

- By Product Type: Cardiac markers test dominates the market with a share of 63% in 2025, driven by high specificity in detecting myocardial injury and widespread clinical adoption for acute coronary syndrome diagnosis across healthcare facilities.

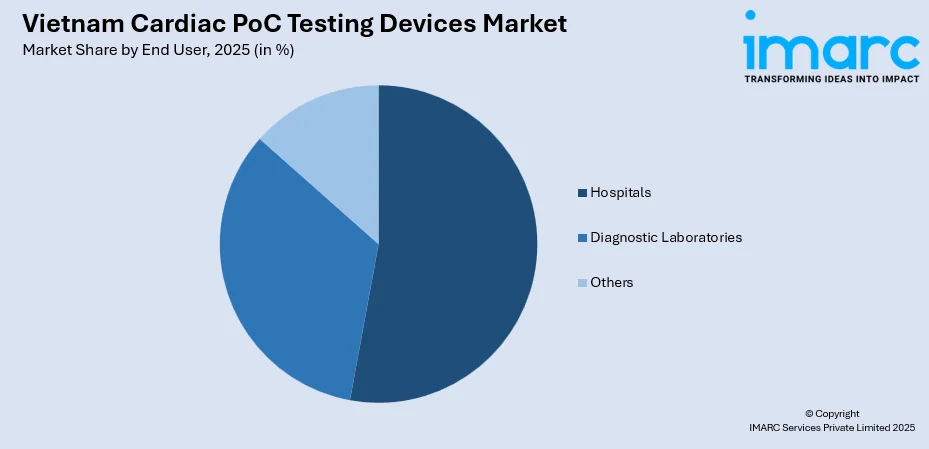

- By End User: Hospitals lead the market with a share of 55% in 2025, owing to their advanced infrastructure, higher patient intake capacity, and substantial investments in cutting-edge diagnostic technologies for comprehensive cardiac care.

- Key Players: The Vietnam cardiac PoC testing devices market exhibits moderate competitive intensity, with multinational diagnostic corporations competing alongside regional manufacturers across various price segments, focusing on technological innovation and distribution network expansion.

To get more information on this market Request Sample

The Vietnam cardiac PoC testing devices market is advancing as healthcare systems embrace digital transformation and modern diagnostic solutions. The Vietnam digital health market size reached USD 2.5 Billion in 2024. Looking forward, the market is expected to reach USD 9.5 Billion by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033. Government initiatives supporting healthcare infrastructure development, including ambitious targets for hospital bed capacity expansion and medical personnel training, are creating favorable conditions for market growth. The integration of artificial intelligence in cardiac diagnostic systems is enabling autonomous identification of cardiac abnormalities and streamlined clinical workflows. Growing urbanization and rising disposable incomes are further driving demand for accessible and efficient cardiac diagnostic services across both public and private healthcare settings.

Vietnam Cardiac PoC Testing Devices Market Trends:

Healthcare Infrastructure Modernization and Government Initiatives

The Vietnamese healthcare system is undergoing significant transformation through comprehensive government reforms aimed at modernizing medical facilities nationwide. The Vietnam healthcare asset management market size reached USD 77.57 Million in 2025. Looking forward, the market is expected to reach USD 159.41 Million by 2034, exhibiting a growth rate (CAGR) of 8.33% during 2026-2034. Strategic investments in hospital infrastructure and medical equipment upgrades are expanding diagnostic capabilities across all provinces. These developments are creating favorable conditions for the adoption of advanced point-of-care testing devices, supporting the Vietnam cardiac PoC testing devices market growth.

Artificial Intelligence Integration in Cardiac Diagnostics

The integration of artificial intelligence and digital health technologies is transforming the cardiac diagnostic landscape. For instance, in September 2025, with support from FPT Corporation, South Korea’s TR Group contributed a Spirokit, an AI-enabled smart device for pulmonary function testing, to Lam Dong General Hospital and Hue University of Medicine and Pharmacy. The initiative also featured a complimentary screening program for chronic obstructive pulmonary disease (COPD), providing diagnostic services and support to over 700 residents. This effort represents the inaugural activity in a series of joint initiatives between FPT, TR, and Vietnamese hospitals, conducted under the framework of the cooperation agreement established between the two companies. Modern cardiac ultrasound and imaging systems now incorporate AI capabilities to autonomously identify, segment, and analyze cardiac structures, streamlining diagnostic workflows for clinicians. AI-driven decision support tools are enhancing diagnostic accuracy and enabling more precise clinical interventions for cardiovascular conditions.

Expansion of Preventive Medicine and Decentralized Testing

Growing emphasis on preventive healthcare and improved accessibility to diagnostic services is reshaping market dynamics. Medical professionals are placing growing emphasis on the significance of timely diagnosis and ongoing surveillance of cardiovascular health conditions. The Vietnam healthcare IT market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.06% during 2025-2033. The healthcare IT market encompasses technologies supporting diagnostics, electronic health records, monitoring systems, and preventive care solutions. The shift toward preventive care is supported by public health campaigns promoting regular health screenings and the availability of point-of-care testing devices in diverse healthcare environments.

Market Outlook 2026-2034:

The Vietnam cardiac PoC testing devices market is positioned for sustained expansion as healthcare modernization initiatives accelerate and demand for rapid cardiac diagnostics intensifies. Government commitment to upgrading healthcare facilities to international standards and expanding medical personnel training programs will continue driving the adoption of advanced diagnostic technologies. The growing integration of telemedicine platforms and digital health solutions will enhance the accessibility of cardiac testing services across urban and rural settings. The market generated a revenue of USD 10.55 Million in 2025 and is projected to reach a revenue of USD 16.69 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

Vietnam Cardiac PoC Testing Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Cardiac Markers Test | 63% |

| End User | Hospitals | 55% |

Product Type Insights:

- Cardiac Markers Test

- Cardiac Troponin (cTn) Test

- Myoglobin Test

- Creatine Kinase MB Isoenzyme (CK-MB) Test

- Combinational Test Kits

- Brain Natriuretic Peptide (BNP) Test

- Analyzers

The cardiac markers test dominates with a market share of 63% of the total Vietnam cardiac PoC testing devices market in 2025.

Cardiac markers tests represent the cornerstone of point-of-care cardiac diagnostics, offering exceptional sensitivity and specificity for detecting myocardial injury. These biomarker-based tests enable rapid identification of acute coronary syndromes and myocardial infarctions, facilitating timely clinical interventions. The widespread clinical acceptance of troponin and natriuretic peptide assays has established cardiac markers testing as the gold standard for emergency cardiac assessment across healthcare facilities.

The growing adoption of high-sensitivity troponin assays is transforming early detection capabilities, enabling clinicians to identify cardiac events at significantly lower biomarker concentrations. Healthcare facilities are increasingly investing in multiplex biomarker platforms that allow simultaneous analysis of multiple cardiac markers, providing comprehensive diagnostic profiles for improved patient management and risk stratification in both emergency and chronic care settings.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Diagnostic Laboratories

- Others

The hospitals leads with a share of 55% of the total Vietnam cardiac PoC testing devices market in 2025.

Hospitals represent the primary adoption centers for cardiac point-of-care testing devices due to their comprehensive infrastructure and high patient volumes requiring rapid cardiac assessment. Emergency departments and intensive care units particularly benefit from immediate biomarker results that accelerate clinical decision-making and treatment initiation. The centralized nature of hospital settings enables efficient deployment and management of sophisticated diagnostic equipment.

Major hospital networks are increasingly integrating advanced cardiac monitoring and diagnostic technologies as part of broader digital health transformation initiatives. Private hospitals in urban centers are leading the adoption of cutting-edge diagnostic solutions, offering comprehensive cardiac care packages that attract patients seeking premium healthcare services. For instance, in September 2024, more than 1,000 individuals underwent complimentary cardiovascular and kidney health screenings at Bạch Mai Hospital through the ‘CAREME – Love Yourself’ initiative, a collaborative program organized by the Vietnam Youth Doctors Association, Bạch Mai Hospital, and AstraZeneca Vietnam. Government hospitals are also upgrading their diagnostic capabilities through public health modernization programs.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, including Hanoi and surrounding provinces, is witnessing rising demand for cardiac point-of-care (PoC) testing devices due to the increasing prevalence of cardiovascular diseases and growing healthcare awareness. Urban hospitals and diagnostic centers are expanding their infrastructure, while government initiatives encourage early detection and preventive care. Rising disposable incomes and greater patient focus on convenient, rapid diagnostic solutions are fueling the adoption of PoC devices in clinics and hospitals across the region.

In Central Vietnam, the growth of cardiac PoC testing is driven by the expansion of regional hospitals and healthcare networks in cities like Da Nang and Hue. Increasing cardiovascular risk factors among the population and rising awareness of timely diagnosis are creating demand for rapid, accessible testing solutions. Investments in medical infrastructure, government healthcare programs, and adoption of advanced diagnostic technologies are supporting the uptake of PoC devices in both public and private healthcare facilities.

Southern Vietnam, encompassing Ho Chi Minh City and Mekong Delta provinces, sees strong demand for cardiac PoC devices due to a combination of urbanization, lifestyle-related cardiovascular risks, and rising health awareness. The region’s advanced hospital networks and private clinics are adopting quick, reliable diagnostic solutions to improve patient care. Government programs, digital health initiatives, and increasing disposable incomes further promote the integration of PoC testing in clinical and community health settings.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Cardiac PoC Testing Devices Market Growing?

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases represent the leading cause of mortality in Vietnam, creating substantial demand for rapid and accurate diagnostic solutions. Lifestyle changes associated with urbanization, including sedentary behaviors, dietary shifts, and increased stress levels, are contributing to the rising incidence of cardiac conditions across all age groups. The growing burden of hypertension, diabetes, and obesity as intermediate risk factors is further amplifying cardiovascular disease prevalence. Healthcare providers are increasingly prioritizing early detection and continuous monitoring capabilities to manage the expanding patient population requiring cardiac assessment. This epidemiological shift is driving sustained investment in point-of-care testing infrastructure across hospitals and clinics.

Government Healthcare Investment and Infrastructure Development

The Vietnamese government is implementing comprehensive healthcare modernization programs with substantial budget allocations for medical infrastructure development. National strategies for medical equipment advancement aim to enhance local diagnostic capabilities and reduce dependence on overseas healthcare services. For instance, in June 2024, the Ministry of Health (MoH) has sanctioned a program focused on the prevention, early detection, and management of non-communicable diseases and mental health conditions through the end of 2025. The initiative aims to lower the incidence of pre-disease states, chronic illnesses, disabilities, and premature mortality associated with cancers, cardiovascular diseases, diabetes, chronic obstructive pulmonary disease, asthma, and various mental health disorders. Healthcare master plans establish ambitious targets for hospital bed capacity expansion, medical personnel ratios, and healthcare accessibility improvements across all provinces. These government-backed initiatives are facilitating the procurement of advanced diagnostic equipment in public hospitals while encouraging private sector investment in healthcare facilities. The regulatory framework supporting medical device registration and deployment is streamlining market access for innovative cardiac testing technologies.

Technological Advancements in Diagnostic Testing

Rapid technological evolution in cardiac biomarker testing is expanding clinical applications and improving diagnostic performance. High-sensitivity assays enable the detection of cardiac events at earlier stages and lower biomarker concentrations than conventional tests, facilitating timely clinical interventions. Integration of artificial intelligence and machine learning algorithms is enhancing result interpretation, reducing diagnostic uncertainty, and supporting clinical decision-making. Connected devices with cloud-based analytics enable real-time data sharing and trend monitoring, supporting telemedicine applications and population health management. These technological advancements are making point-of-care cardiac testing increasingly accurate, accessible, and cost-effective for healthcare providers.

Market Restraints:

What Challenges the Vietnam Cardiac PoC Testing Devices Market is Facing?

Limited Access to Advanced Diagnostic Technology

Access to advanced cardiac biomarker testing remains concentrated in large referral hospitals, with district and commune-level facilities lacking sophisticated diagnostic capabilities. Geographic disparities in healthcare infrastructure create challenges for patients in rural and remote areas requiring cardiac assessment. The uneven distribution of diagnostic resources limits the potential for early detection and timely intervention across all population segments.

Shortage of Skilled Healthcare Personnel

A nationwide shortage of trained point-of-care coordinators and laboratory professionals constrains optimal utilization of diagnostic equipment. Limited medical personnel in underserved areas reduces the capacity to operate and maintain sophisticated testing devices effectively. Training programs and certification pathways for point-of-care testing remain underdeveloped, affecting quality assurance and standardization of testing practices.

High Cost of Advanced Diagnostic Devices

The upfront investment required for advanced cardiac point-of-care testing equipment presents affordability challenges for resource-constrained healthcare facilities. Limited reimbursement policies and healthcare financing mechanisms reduce accessibility of sophisticated diagnostic services for lower-income populations. Ongoing costs associated with reagents, consumables, and equipment maintenance further contribute to the economic burden of implementing comprehensive cardiac testing programs.

Competitive Landscape:

The Vietnam cardiac PoC testing devices market is characterized by moderate competitive intensity, with established multinational diagnostic corporations maintaining significant market presence alongside emerging regional manufacturers. Leading international players leverage their technological capabilities, extensive product portfolios, and established distribution networks to serve major healthcare facilities. Competition is intensifying as companies focus on expanding product offerings, enhancing diagnostic performance, and improving service and support capabilities. Strategic partnerships between global manufacturers and local distributors are accelerating market penetration and improving access to advanced diagnostic solutions. Market participants are increasingly emphasizing technological differentiation through the integration of artificial intelligence, connectivity features, and user-friendly interfaces. Price competition remains relevant as healthcare providers balance quality requirements with budget constraints.

Vietnam Cardiac PoC Testing Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered | Hospitals, Diagnostic Laboratories, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam cardiac PoC testing devices market size was valued at USD 10.55 Million in 2025.

The Vietnam cardiac PoC testing devices market is expected to grow at a compound annual growth rate of 5.23% from 2026-2034 to reach USD 16.69 Million by 2034.

Cardiac markers test holds the largest revenue share of 63% in 2025, driven by high specificity and sensitivity in detecting myocardial injury and widespread clinical adoption for acute coronary syndrome diagnosis.

Key factors driving the Vietnam cardiac PoC testing devices market include rising cardiovascular disease prevalence, government healthcare investment initiatives, expanding digital health infrastructure, and technological advancements in biomarker testing.

Major challenges include limited access to advanced diagnostic technology in rural areas, shortage of skilled healthcare personnel for operating sophisticated equipment, high device costs, and uneven geographic distribution of healthcare infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)