Vietnam Cassava Processing Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

Vietnam Cassava Processing Market Overview:

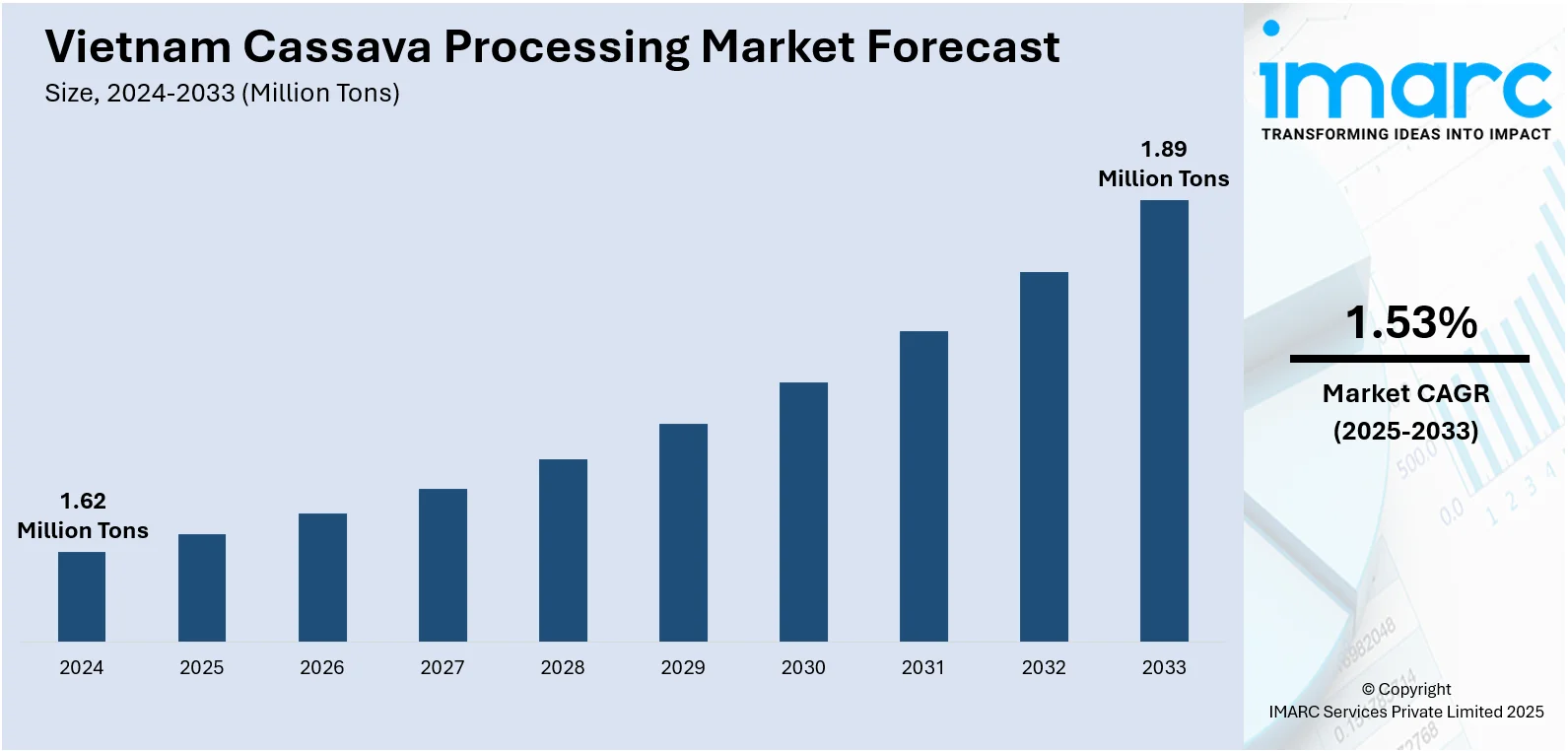

The Vietnam cassava processing market size reached 1.62 Million Tons in 2024. The market is projected to reach 1.89 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.53% during 2025-2033. The market is evolving with advances in sustainable farming, technology integration, and supply chain efficiency. Strategic responses to shifting trade flows and export competition continue to support Vietnam cassava processing market share across both domestic consumption channels and high-value international markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.62 Million Tons |

| Market Forecast in 2033 | 1.89 Million Tons |

| Market Growth Rate 2025-2033 | 1.53% |

Vietnam Cassava Processing Market Trends:

Sustainability and Technology Reshaping Production Models

The Vietnam cassava processing market growth is being shaped by a shift toward sustainable production practices and advanced technologies. The industry is increasingly aligning with low-emission targets, efficiency improvements, and quality enhancement measures to maintain competitiveness in both domestic and export markets. Stakeholders are investing in improved cultivation methods, processing efficiency, and value chain management systems to reduce environmental impact and boost productivity. In July 2025, Vietnam launched its first circular cassava farming model using Japanese technology, integrating smart soil monitoring, carbon measurement, and intelligent value chain oversight. This initiative supported the national strategy for sustainable cassava industry development, with a vision to 2050. By focusing on sustainability and technology-driven operations, processors are better equipped to meet evolving market requirements and environmental regulations. These advancements not only improve output quality but also position the industry to attract investment and secure long-term export contracts. As sustainable practices become more widespread, the sector is expected to see enhanced resilience, cost efficiency, and stronger market positioning in regional and global trade.

To get more information on this market, Request Sample

Trade Dynamics Driving Competitive Adjustments

Vietnam’s cassava processing sector is experiencing structural changes influenced by evolving regional trade dynamics. Export competitiveness remains a priority, with processors focusing on operational efficiency, cost control, and diversification to adapt to shifting market conditions. Strong dependency on China as the main export destination makes the sector vulnerable to changes in trade flows. In February 2025, the completion of the China-Laos Railway enabled China to source cassava and tapioca starch directly from Laos at lower costs, significantly reducing Vietnam’s export volumes. This development intensified competition, prompting processors to reassess supply chains, explore alternative export markets, and improve value-added offerings. The sector is now placing greater emphasis on building strategic trade relationships, upgrading facilities, and aligning with higher quality standards to maintain relevance in a more competitive environment. While the challenge is significant, it is also driving innovation and encouraging the industry to strengthen its domestic market presence, invest in branding, and pursue long-term resilience strategies that can offset export-related risks.

Vietnam Cassava Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on end use.

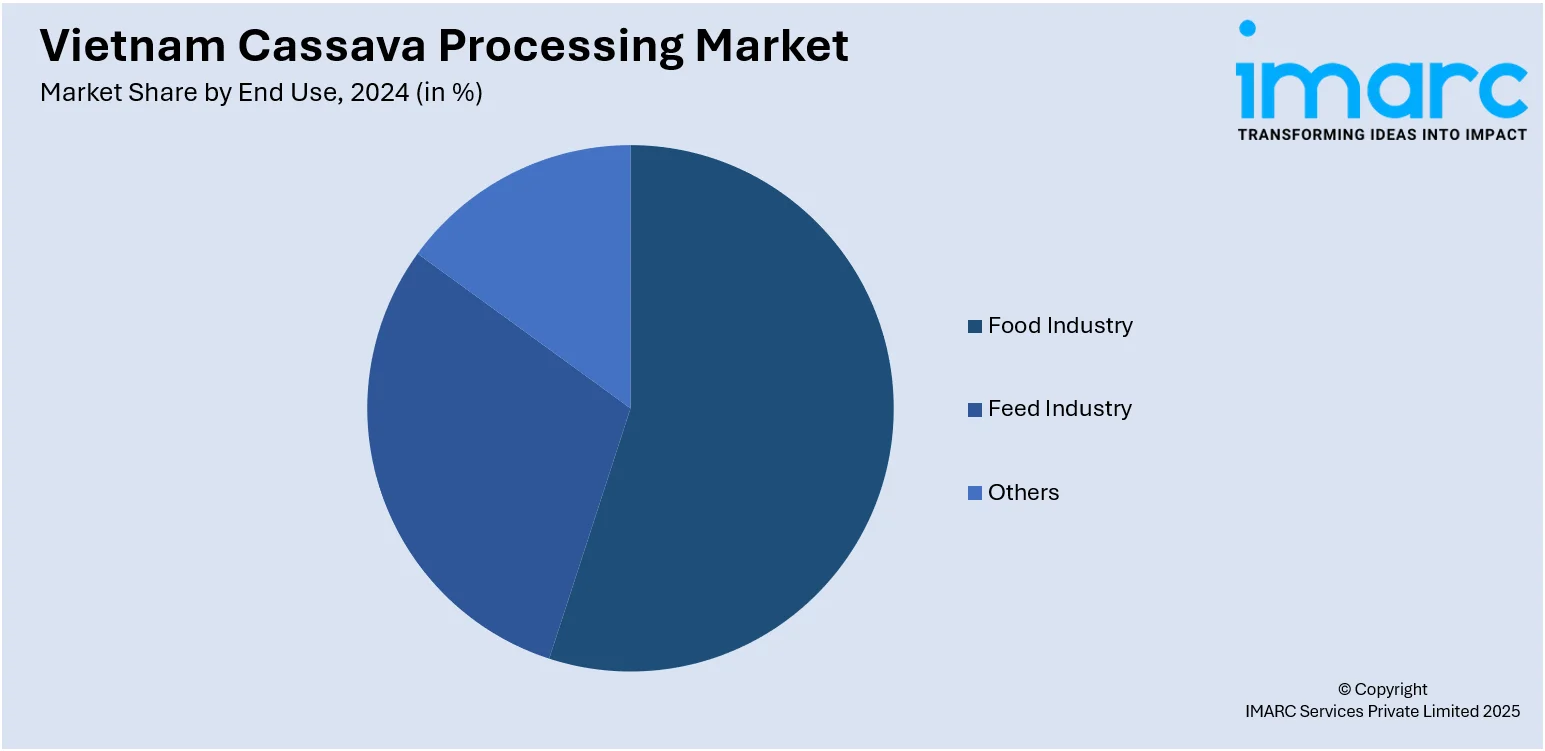

End Use Insights:

- Food Industry

- Feed Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food industry, feed industry, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Cassava Processing Market News:

- July 2025: Vietnam launched its first circular cassava farming model using Japanese technology. The initiative enhanced sustainability, integrated carbon monitoring, and improved value chain efficiency, boosting cassava processing potential and strengthening the sector’s competitiveness in domestic and international markets.

- February 2025: The China-Laos Railway reshaped Vietnam’s cassava processing sector by reducing transport costs and enabling China to source directly from Laos. This shift intensified competition, lowered Vietnam’s export volumes, and pressured processors to enhance efficiency and diversify market destinations.

Vietnam Cassava Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food Industry, Feed Industry, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam cassava processing market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam cassava processing market on the basis of end use?

- What is the breakup of the Vietnam cassava processing market on the basis of region?

- What are the various stages in the value chain of the Vietnam cassava processing market?

- What are the key driving factors and challenges in the Vietnam cassava processing market?

- What is the structure of the Vietnam cassava processing market and who are the key players?

- What is the degree of competition in the Vietnam cassava processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam cassava processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam cassava processing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam cassava processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)