Vietnam Cat Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

Vietnam Cat Food Market Summary:

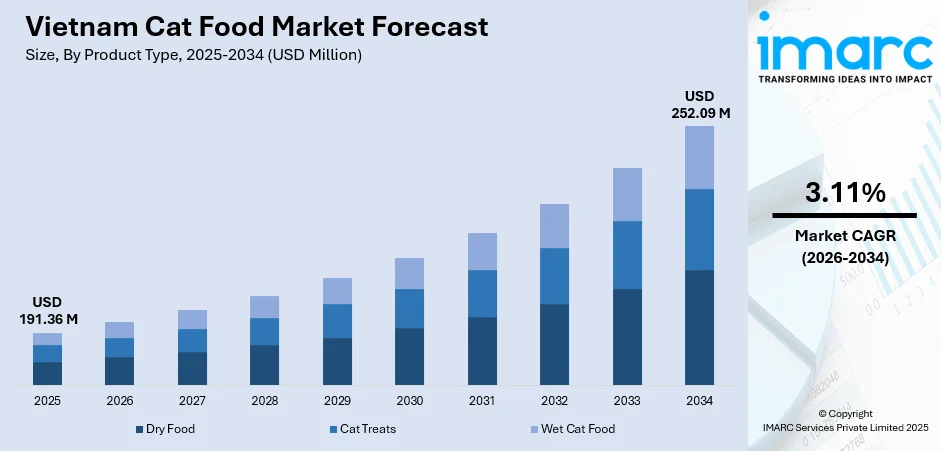

The Vietnam cat food market size was valued at USD 191.36 Million in 2025 and is projected to reach USD 252.09 Million by 2034, growing at a compound annual growth rate of 3.11% from 2026-2034.

The market is driven by the rising pet humanization trend among Vietnamese millennials and Gen Z consumers, increasing urbanization in major cities like Ho Chi Minh City and Hanoi, and growing disposable incomes enabling premium pet food purchases. The expanding cat population, combined with the cultural perception of cats as symbols of good fortune, is further propelling demand. Additionally, the shift from homemade pet food to commercial formulations and the expansion of retail and e-commerce channels are supporting the Vietnam cat food market share.

Key Takeaways and Insights:

- By Product Type: Dry food dominates the market with a share of 44.62% in 2025, owing to its affordability, convenience of serving, and longer shelf life compared to wet food alternatives.

- By Pricing Type: Mass products lead the market with a share of 44.54% in 2025, driven by price-sensitive Vietnamese consumers who prioritize affordable yet quality nutrition for their cats.

- By Ingredient Type: Animal derivatives represent the largest segment with a market share of 72.93% in 2025, as cats are obligate carnivores requiring essential amino acids like taurine found primarily in animal proteins.

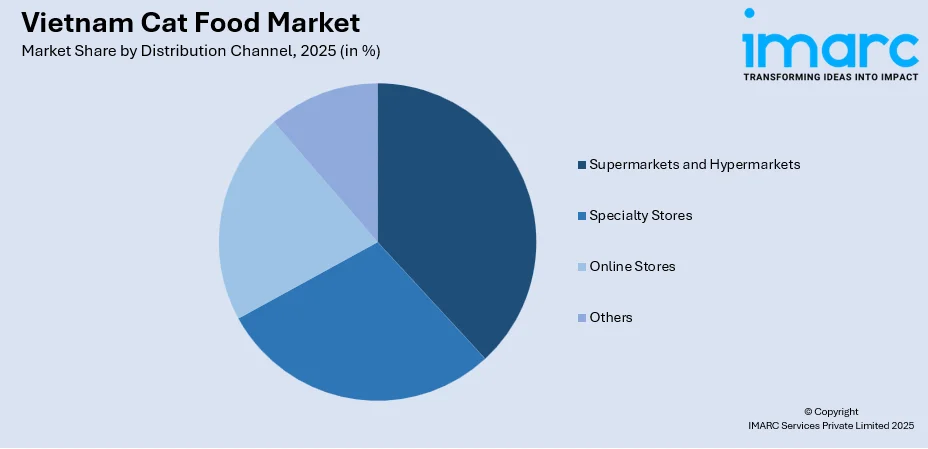

- By Distribution Channel: Supermarkets and hypermarkets hold the largest share at 23.55% in 2025, benefiting from their widespread presence and convenient one-stop shopping experience for pet owners.

- Key Players: The competitive landscape features major multinational corporations and regional manufacturers competing for market share. Leading companies leverage their extensive distribution networks, strong brand portfolios, and diverse product offerings spanning economy to premium segments. These established players focus on product innovation, nutritional research, and strategic marketing to maintain their positions while catering to evolving consumer preferences for quality cat food products.

To get more information on this market Request Sample

The Vietnam cat food market is dominated by a mix of well-established multinational corporations and strong domestic manufacturers. Leading international firms leverage their global expertise, strong branding, and high-quality product portfolios to command significant market share, particularly in the premium and specialized segments. These global players are often the main drivers of innovation, introducing novel formulations and packaging formats. Local and regional manufacturers focus on competitive pricing and extensive distribution networks, ensuring wide accessibility across diverse retail channels. Their deep understanding of local consumer habits and flavor preferences allows them to maintain a substantial presence. The market is increasingly competitive, with all participants actively investing in e-commerce and digital engagement to reach the rapidly growing population of pet owners.

Vietnam Cat Food Market Trends:

Pet Humanization and Premium Nutrition

The pet humanization trend is reshaping Vietnam's cat food market as urban consumers increasingly treat their cats as family members rather than pets. This cultural transformation is particularly pronounced among millennials and Gen Z in cities like Ho Chi Minh City and Hanoi, driving demand for premium, nutritionally balanced cat food products. Premium dry cat food is projected to grow, as rising disposable incomes support the expansion of premium cat food availability.

E-Commerce Channel Expansion

Digital transformation is accelerating cat food distribution as e-commerce platforms like Shopee, Lazada, and Tiki become increasingly popular shopping channels for pet products. Online distribution channels are projected to grow, driven by increasing digital adoption among Vietnamese pet owners and convenience offered by online platforms. Survey data indicates that 38% of Vietnamese pet owners purchase from e-commerce sites, including Shopee, Lazada, Tiki.

Natural and Organic Ingredients Preference

Vietnamese pet owners are demonstrating growing awareness about pet nutrition and health benefits, fueling demand for cat food products with natural and organic ingredients. The market is experiencing a shift toward products featuring locally sourced ingredients, high animal protein content, and functional formulations targeting digestive health, skin and coat condition, and weight management. Manufacturers are responding by investing in advanced processing technologies and introducing new product lines featuring probiotics, omega fatty acids, and limited-ingredient formulas.

Market Outlook 2026-2034:

The Vietnam cat food market outlook remains optimistic, supported by sustained growth in cat ownership, particularly in urban centers where the low-maintenance nature of cats suits apartment living. Vietnamese government initiatives to eliminate import taxes on key animal feed ingredients starting March 2025 are expected to enhance manufacturing competitiveness and product affordability. The market generated a revenue of USD 191.36 Million in 2025 and is projected to reach a revenue of USD 252.09 Million by 2034, growing at a compound annual growth rate of 3.11% from 2026-2034.

Vietnam Cat Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | On-body | 44.62% |

| Pricing Type | Mass Products | 44.54% |

| Ingredient Type | Animal Derivatives | 72.93% |

| Distribution Channel | Supermarkets & Hypermarkets | 23.55% |

Product Type Insights:

- Dry Food

- Cat Treats

- Wet Cat Food

Dry food dominates with a market share of 44.62% of the total Vietnam cat food market in 2025.

The dry food maintains its leadership position in Vietnam's cat food market due to its practical advantages including extended shelf life, ease of storage, and affordability. Dry food, commonly known as kibble, has become the preferred choice among Vietnamese cat owners who value convenience without compromising on nutritional quality. The product's ability to support dental health by reducing tartar buildup provides an additional benefit that resonates with health-conscious pet owners seeking comprehensive nutrition solutions. (Source: Expert Market Research Vietnam Pet Food Market Report 2025)

The segment's growth trajectory is further supported by the increasing availability of premium and mid-priced dry cat food variants across retail and online channels. Mid-priced dry cat food demonstrated the highest growth, reflecting Vietnamese consumers' preference for quality products at accessible price points. Major brands including SmartHeart, CP, and Me-O have established strong market presence by offering affordable yet nutritionally complete dry food formulations tailored to local preferences. The expansion of modern retail infrastructure and e-commerce platforms has enhanced product accessibility, enabling consumers to explore diverse dry food options.

Pricing Type Insights:

- Mass Products

- Premium Products

Mass products lead the market with a share of 44.54% of the total Vietnam cat food market in 2025.

The mass products segment dominates Vietnam's cat food market, reflecting the price-sensitive nature of Vietnamese consumers who seek quality nutrition at affordable price points. Consumers in Vietnam tend to trust mid-priced products for their pets while viewing trading down to economy products as not viable due to quality concerns. This pricing segment benefits from strong distribution networks across traditional grocery retailers, pet shops, and modern retail channels, ensuring widespread product availability across urban and semi-urban areas.

International mid-priced brands have maintained leading market positions, with local brand presence remaining relatively limited. The success of mass products in Vietnam is largely dependent on manufacturers' interaction capabilities with customers and promotional strength, as consumer awareness levels regarding pet nutrition remain relatively nascent compared to developed markets. However, the segment is experiencing gradual premiumization as rising disposable incomes and increased awareness about pet health encourage some consumers to transition toward premium offerings with specialized health benefits and superior ingredient quality.

Ingredient Type Insights:

- Animal Derivatives

- Plant Derivatives

Animal derivatives exhibit clear dominance with a 72.93% share of the total Vietnam cat food market in 2025.

The animal derivatives segment commands the largest share of Vietnam's cat food market, driven by the biological necessity of cats as obligate carnivores requiring essential amino acids found primarily in animal proteins. Taurine, one of the most crucial amino acids for feline health, cannot be synthesized by cats from sulfur amino acids and must be sourced from their diet to prevent vision impairment and other health complications. Animal-based proteins including chicken, fish, beef, and poultry byproducts provide the foundational nutrition that supports muscle development, healthy skin and coat, and overall vitality in cats.

Vietnamese cat food manufacturers are increasingly emphasizing high animal protein content in their formulations, with some premium brands featuring animal protein from fresh seafood and raw meat sourced locally. Research published in the journal Animals has demonstrated that dry pet food using only fresh meat is higher in amino acid content, including essential amino acids and taurine, compared to those using meat meals or combinations. This scientific evidence supports the growing preference for animal-derived ingredients among health-conscious pet owners seeking optimal nutrition for their cats.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets hold the largest share at 23.55% of the total Vietnam cat food market in 2025.

Supermarkets and hypermarkets represent the leading distribution channel for cat food in Vietnam, capitalizing on their strategic locations, extensive product assortments, and convenient shopping experiences. Vietnam's retail industry has witnessed significant growth with over 360 supermarkets across the country, primarily concentrated in major cities such as Hanoi and Ho Chi Minh City.

The expansion of supermarkets and hypermarkets in urban and suburban areas has significantly enhanced cat food accessibility for Vietnamese consumers. Major retailers including Aeon, eMart, and MM Mega Market continue to announce expansion plans with new store openings across northern and southern Vietnam. These modern retail outlets offer competitive pricing, frequent promotional offers, and the opportunity for consumers to physically examine products before purchase, factors that remain important for Vietnamese shoppers who are gradually transitioning from traditional wet markets to organized retail formats.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, anchored by the capital city Hanoi, represents a significant regional market for cat food driven by the concentration of middle-class families and expatriate communities. Pet humanization is particularly pronounced in Hanoi and secondary urban centers like Hai Phong, where approximately 18-19% of residents own pets. The region has witnessed rapid growth of specialized pet shops and modern retail outlets catering to evolving consumer preferences for premium cat food products.

Central Vietnam, featuring key cities like Da Nang and Hue, is emerging as a growing market for cat food products as urbanization and tourism drive economic development. The region benefits from improved retail infrastructure with major chains like Aeon expanding their presence through new supermarket openings. Da Nang's expanding middle-class population and increasing pet ownership rates are contributing to rising demand for quality cat food products distributed through both traditional and modern retail channels.

Southern Vietnam, dominated by Ho Chi Minh City as the nation's economic hub, commands the highest pet ownership rates in the country with approximately 25% of residents owning pets. The region's thriving pet culture is supported by the highest concentration of pet shops, supermarkets, and e-commerce activity. Ho Chi Minh City serves as the primary testing ground for new product launches and premium cat food offerings targeting affluent urban consumers seeking advanced nutrition solutions.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Cat Food Market Growing?

Rising Pet Humanization and Cat Ownership

The growing trend of pet humanization, where cats are increasingly considered family members rather than animals, is fundamentally transforming Vietnam's cat food market. This cultural shift is particularly strong among millennials and Gen Z consumers in major urban centers, driving demand for premium nutrition and specialized health products. The cat population in Vietnam experienced a significant increase, with cats being culturally regarded as symbols of good fortune and believed to bring prosperity to households. By 2024, Vietnam's penetration rate of pet ownership reached 74.5%, representing a 7.5 percentage point increase from 2023, demonstrating the accelerating adoption of pets as companions.

Urbanization and Rising Disposable Incomes

Vietnam's rapid urbanization, with majority of the population residing in urban areas as of 2024, is creating favorable conditions for cat food market expansion. The shift toward nuclear family structures in high-density residential areas has fueled demand for smaller pets like cats that fit well within urban living dynamics. Rising disposable incomes are enabling consumers to invest more in pet nutrition. In 2025, the pet care industry has grown to include over 12 million cats and dogs in Vietnamese households, with the pet economy valued at over USD 500 Million and projected for continued growth.

Expansion of Retail and E-Commerce Channels

The expansion of both modern retail infrastructure and e-commerce platforms is significantly improving cat food accessibility across Vietnam. Modern trade, covering supermarkets, hypermarkets, convenience stores, and specialty stores, has grown, while e-commerce continues to gain momentum with platforms like Shopee, Lazada, and Tiki reporting strong year-over-year increases in pet care sales. The easy availability of cat food products through both physical and online channels is facilitating the transition from homemade to commercial pet food products.

Market Restraints:

What Challenges the Vietnam Cat Food Market is Facing?

Price Sensitivity Among Consumers

Price sensitivity remains a significant constraint in Vietnam's cat food market, with many consumers prioritizing affordability over premium features. Vietnamese pet owners predominantly prefer economy to mid-priced products, limiting the growth potential of premium segments and creating challenges for international brands seeking to establish higher-priced offerings.

Limited Regulatory Framework

Vietnam's food safety regulations for pet food remain in development, with the Ministry of Agriculture and Rural Development leading efforts to establish clearer standards. As of 2024, no dedicated regulatory framework specific to pet food safety exists, creating uncertainty for manufacturers and potentially affecting consumer confidence in product quality and safety.

Threat from Illegal Cat Trade

The pet cat population in Vietnam faces threats from the illegal cat meat trade, which causes widespread fear among cat owners regarding pet theft. Thousands of pet cats are reported missing daily due to this activity, prompting government measures to prohibit the trade and campaigns promoting responsible cat ownership and adoption.

Competitive Landscape:

The Vietnam cat food market exhibits a moderately concentrated competitive structure with multinational corporations maintaining significant market presence alongside regional players. The market is characterized by the dominance of established international pet food manufacturers who have built strong brand recognition through extensive distribution networks and consistent product quality. These global companies compete primarily through product innovation, strategic pricing, and marketing initiatives tailored to local consumer preferences. Regional and domestic players also participate in the market by offering affordable alternatives and products formulated to suit Vietnamese tastes. Competition intensifies as companies invest in expanding their retail presence, strengthening e-commerce capabilities, and developing new product lines targeting specific nutritional needs. The market's consolidated nature among leading players reflects high barriers to entry including brand loyalty, distribution infrastructure requirements, and the need for significant marketing investments to capture consumer attention in this evolving sector.

Recent Developments:

- September 2024: Japanese retailer Aeon opened two new supermarkets in Ho Chi Minh City and Hue city, with plans to open four additional supermarkets in Northern Vietnam, expanding distribution access for pet food products including cat food across the country.

Vietnam Cat Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Food, Cat Treats, Wet Cat Food |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derivatives, Plant Derivatives |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam cat food market size was valued at USD 191.36 Million in 2025.

The Vietnam cat food market is expected to grow at a compound annual growth rate of 3.11% from 2026-2034 to reach USD 252.09 Million by 2034.

Dry food dominates the market with a 44.62% share in 2025, driven by its affordability, convenience, longer shelf life, and widespread availability across retail channels.

Key factors driving the Vietnam cat food market include rising pet humanization trends, increasing urbanization, growing disposable incomes, expansion of retail and e-commerce channels, and the cultural perception of cats as symbols of good fortune.

Major challenges include price sensitivity among consumers limiting premium product adoption, limited regulatory frameworks for pet food safety, and threats to the cat population from illegal trade activities that impact consumer confidence and pet welfare.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)