Vietnam CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Vietnam CCTV Camera Market Overview:

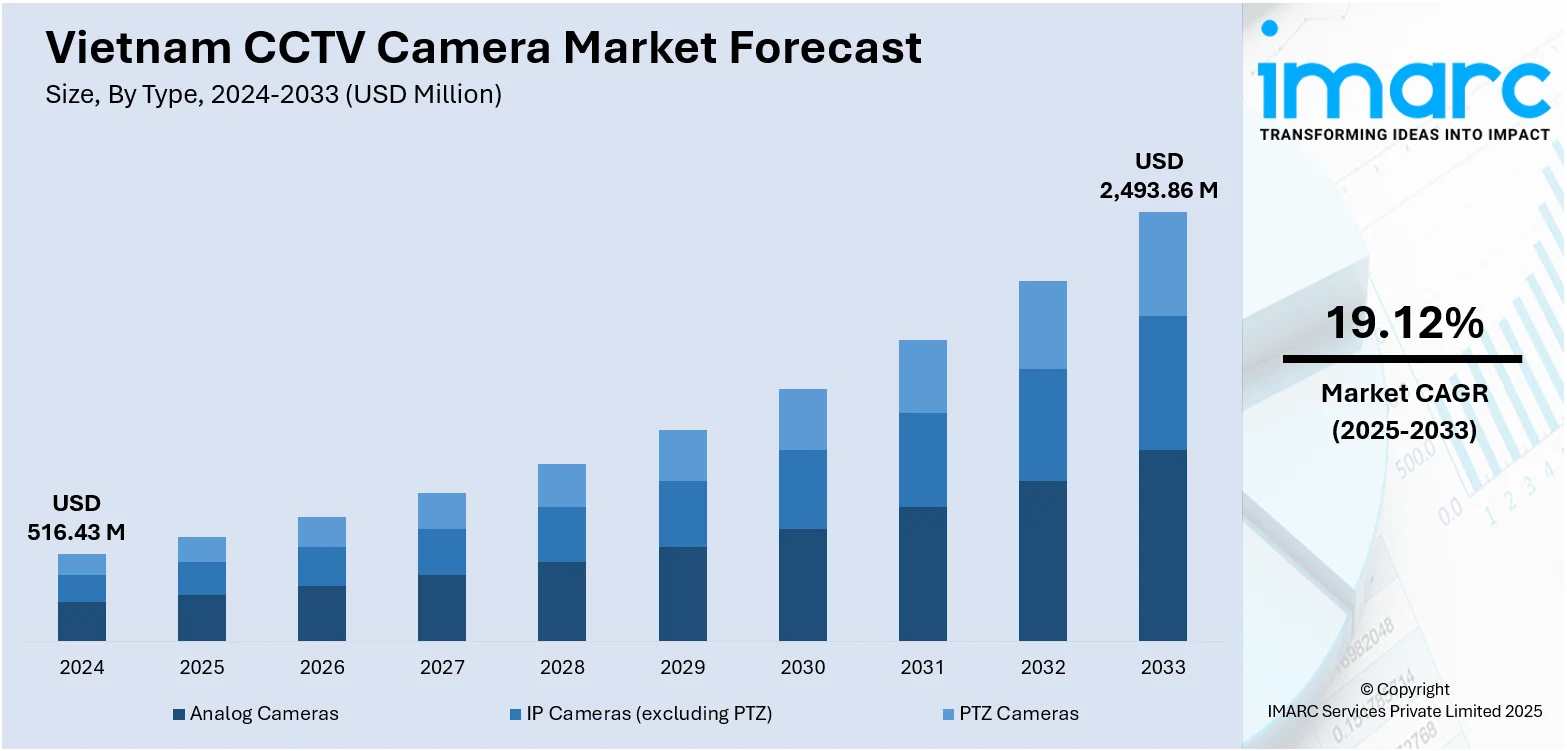

The Vietnam CCTV camera market size reached USD 516.43 Million in 2024. Looking forward, the market is projected to reach USD 2,493.86 Million by 2033, exhibiting a growth rate (CAGR) of 19.12% during 2025-2033. The market is witnessing steady growth due to rising security concerns across residential, commercial, and government sectors. Urbanization, infrastructure development, and smart city initiatives are driving increased adoption of surveillance systems. Advancements in camera technology, such as high-resolution imaging and remote access, and growing demand from public transportation and industrial sectors further supports expansion, contributing to a steady rise in Vietnam CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 516.43 Million |

| Market Forecast in 2033 | USD 2,493.86 Million |

| Market Growth Rate 2025-2033 | 19.12% |

Vietnam CCTV Camera Market Trends:

Shift Toward IP and AI-Enabled Systems

The Vietnam CCTV camera market is witnessing a significant change as it moves from traditional analog systems to advanced IP-based and AI-integrated surveillance solutions. This transformation is largely prompted by the increased demand for higher resolution, remote accessibility, and sophisticated video analytics. IP cameras offer scalable wireless connectivity and can seamlessly blend with existing IT infrastructures, making them suitable for both commercial and governmental applications. Moreover, AI-driven features such as motion detection, facial recognition, license plate reading, and behavioral pattern analysis boost the effectiveness and precision of surveillance efforts. For instance, in June 2024, FPT Telecom launched two "Made in Vietnam" security cameras, the IQ 3S and Play 3, enhancing surveillance with advanced features like integrated searchlights and AI detection. These models, manufactured locally, comply with international data security standards, addressing concerns over imported cameras and ensuring user safety and privacy. These advancements reduce the need for constant human oversight, support proactive threat identification, and foster predictive security measures. As businesses and urban development projects emphasize intelligent security, the uptake of smart, networked CCTV systems continues to grow. This technological advancement is vital for enhancing safety standards and driving continual growth in the Vietnam CCTV camera market.

To get more information on this market, Request Sample

Integration with Smart City Infrastructure

The incorporation of CCTV systems into smart city frameworks is a crucial element driving the Vietnam CCTV camera market growth. As cities throughout Vietnam experience swift modernization, the adoption of surveillance technologies is increasingly becoming a part of urban planning to improve safety, manage traffic, and enhance emergency response. Local authorities are implementing camera networks in public areas, transit stations, and vital infrastructure to facilitate real-time monitoring and data-supported decision-making. These systems aid in smart traffic management, deter criminal behaviors, and enable quicker law enforcement responses. Moreover, advanced analytical capabilities such as facial recognition, vehicle tracking, and crowd analysis are being integrated into CCTV networks, enhancing their functionality. For instance, in July 2025, Vietnam implemented AI-powered surveillance cameras to automatically identify traffic violations, aiming to reduce the need for physical patrols. The Traffic Police Department reports that the system can recognize around 20 types of infractions involving cars and motorcycles, with plans to broaden its detection capabilities. This cohesive integration of video surveillance within smart urban frameworks not only boosts operational efficiency but also reinforces public confidence in city safety measures, thus driving ongoing demand in both governmental and private sectors.

Vietnam CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

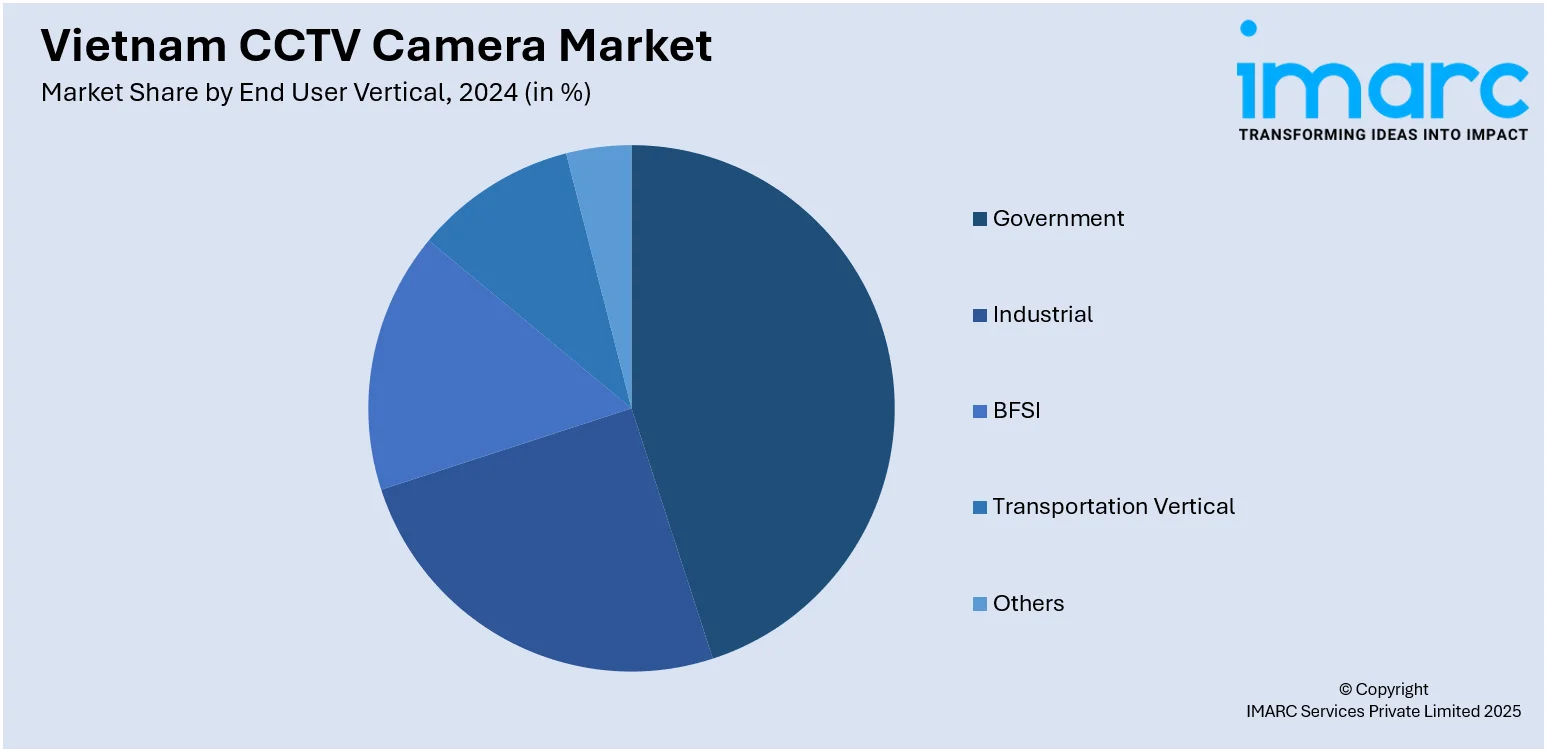

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam CCTV Camera Market News:

- In January 2025, Hanoi announced its plans to install over 40,000 new surveillance cameras by 2030 to enhance public safety and traffic management. Of the total, 16,000 will focus on state management, while over 23,700 will support security and violation detection. The expansion addresses current coverage limitations from the existing 19,400 cameras.

- In November 2024, Axis Communications partnered with Synnex FPT to enhance its distribution in Vietnam. This collaboration aims to expand access to Axis’s innovative security solutions through Synnex’s robust partner network, focusing on sectors like manufacturing and critical infrastructure. Both companies anticipate significant growth and effective collaboration in the Vietnamese market.

Vietnam CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam CCTV camera market on the basis of type?

- What is the breakup of the Vietnam CCTV camera market on the basis of end user vertical?

- What is the breakup of the Vietnam CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Vietnam CCTV camera market?

- What are the key driving factors and challenges in the Vietnam CCTV camera market?

- What is the structure of the Vietnam CCTV camera market and who are the key players?

- What is the degree of competition in the Vietnam CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)