Vietnam Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

Vietnam Children’s Entertainment Centers Market Overview:

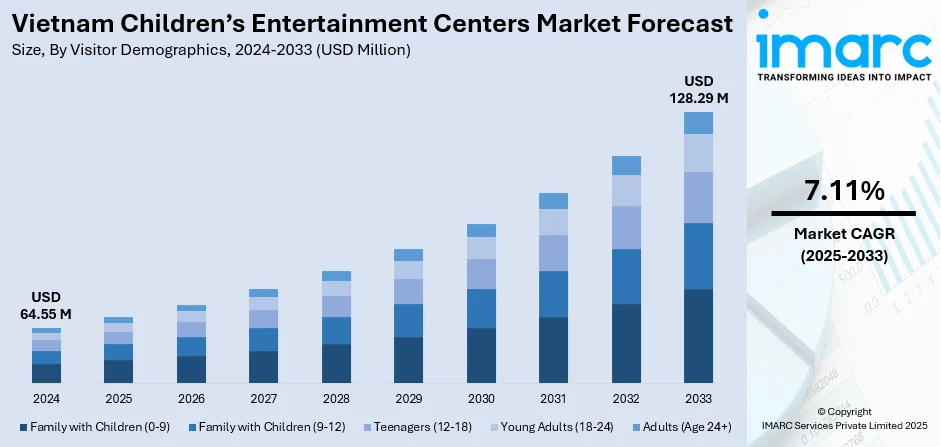

The Vietnam children’s entertainment centers market size reached USD 64.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 128.29 Million by 2033, exhibiting a growth rate (CAGR) of 7.11% during 2025-2033. Rising urban population, increasing disposable income, and demand for family leisure activities are some of the factors contributing to Vietnam children’s entertainment centers market share. Parents seek safe, interactive spaces for child development. Malls and retail hubs integrating play zones also drive growth, alongside seasonal events and school tie-ups.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.55 Million |

| Market Forecast in 2033 | USD 128.29 Million |

| Market Growth Rate 2025-2033 | 7.11% |

Vietnam Children’s Entertainment Centers Market Trends:

Tech Integration Driving Personalized Play Experiences

Children’s entertainment centers in Vietnam are shifting away from traditional playgrounds and arcade setups toward technology-rich experiences. Operators are integrating AR, interactive projection mapping, and motion-sensing games into play zones to create immersive, customized environments. These setups are being used not just for entertainment but also to blend educational content with play. Several urban centers have adopted app-connected wristbands that allow parents to monitor their child’s activities in real time or collect loyalty rewards based on usage. This trend appeals especially to affluent, tech-savvy Vietnamese families who view screen-based engagement as inevitable but want it to be meaningful. It’s also creating cross-selling opportunities with edtech firms and toy brands. Investment is flowing into VR zones, digital climbing walls, and multi-sensory rooms. Many centers are rebranding as "digital discovery hubs" rather than simple play areas. As competition tightens, tech is becoming the edge operators need to hold attention and increase repeat visits, particularly in tier 1 cities where digital literacy is high and novelty drives footfall. These factors are intensifying the Vietnam children’s entertainment centers market growth.

To get more information on this market, Request Sample

Surge in Eco-Themed and Nature-Based Play Centers

In parallel with Vietnam’s growing environmental awareness, there’s rising interest in nature-inspired children's entertainment spaces. These are outdoor or semi-indoor venues focused on physical play, farm visits, treehouse zones, recycled-material playsets, and sensory gardens. Parents are gravitating toward these centers as an antidote to screen exposure and indoor confinement. Many of them are located on city outskirts and marketed as full-day family destinations rather than short-term activity spots. Operators are capitalizing on this demand by emphasizing sustainability credentials, solar lighting, bamboo construction, compost toilets, etc., which resonate with younger Vietnamese parents educated in eco-conscious practices. Corporate sponsors are also getting involved, using these spaces for environmental campaigns and brand engagement. Some centers are offering seasonal workshops on gardening, waste sorting, or wildlife conservation, turning play into participation. The focus is on open-ended, child-led play in green spaces, giving children more autonomy and creativity, and parents a stronger emotional connection to the experience. This trend is especially strong in Hanoi, Da Lat, and smaller provinces looking to differentiate.

Vietnam Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

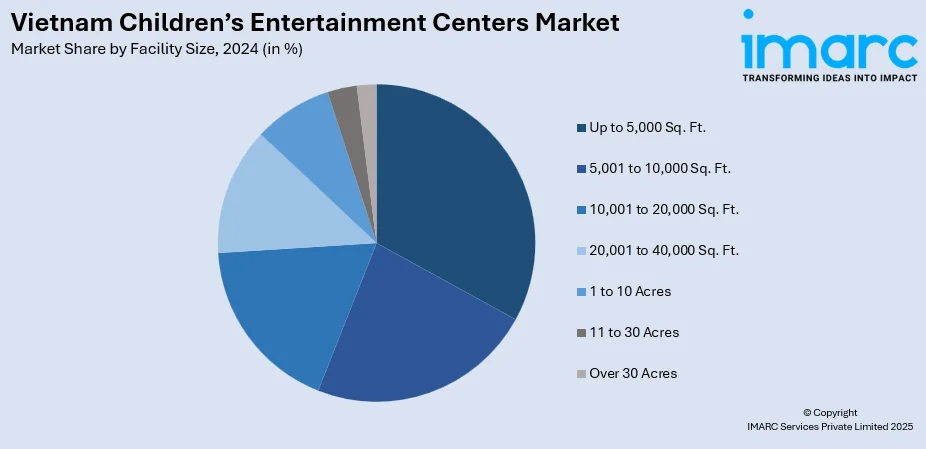

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Children’s Entertainment Centers Market News:

- In May 2025, BASF Vietnam and its partners inaugurated a new children’s playground and classrooms at Phuong Ninh Primary & Secondary School in Hau Giang. This marks the eighth facility built under their decade-long school renovation initiative, aimed at improving learning environments in remote areas. The new facility will support around 150 students annually, contributing to the broader development of child-friendly spaces, including entertainment and learning zones, across rural Vietnam.

Vietnam Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the Vietnam children’s entertainment centers market on the basis of facility size?

- What is the breakup of the Vietnam children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the Vietnam children’s entertainment centers market on the basis of activity area?

- What is the breakup of the Vietnam children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the Vietnam children’s entertainment centers market?

- What are the key driving factors and challenges in the Vietnam children’s entertainment centers market?

- What is the structure of the Vietnam children’s entertainment centers market and who are the key players?

- What is the degree of competition in the Vietnam children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)