Vietnam Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Vietnam Co-Working Office Space Market Overview:

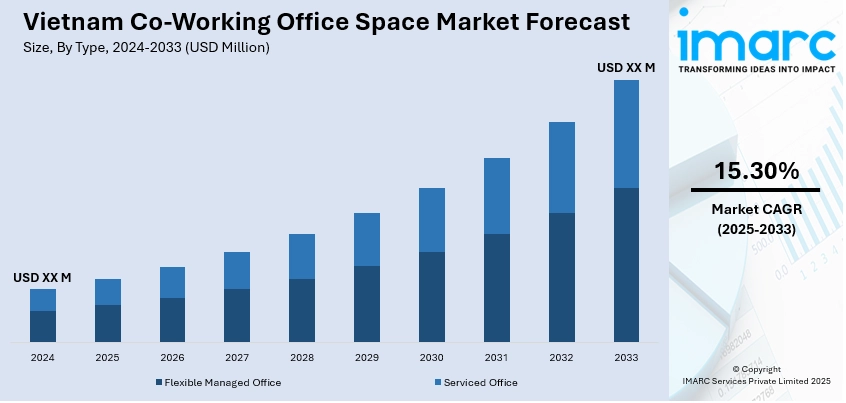

The Vietnam co-working office space market size is projected to exhibit a growth rate (CAGR) of 15.30% during 2025-2033. The market is fueled by a the fast-paced digital evolution, rising number of entrepreneurial and youthful labor force, and growing demand from multinational firms along with indigenous startups alike. Global movement toward hybrid and remote working models has also increased demand for flexible office space, especially in key city centers like Ho Chi Minh City and Hanoi. Government incentives to innovation centers and the escalated demand for the gig economy are further fueling the Vietnam co-working office space market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 15.30% |

Vietnam Co-Working Office Space Market Trends:

Emergence of Hybrid Work Models

The co-working space sector in Vietnam has grown enormously with the enhanced use of hybrid work models. According to property consultancy Knight Frank Vietnam, in September 2024, Ho Chi Minh City experienced a 20% rise in co-working spaces, largely due to the emergence of several large new premium centers in the downtown region. Its third annual report revealed that the city currently hosts 120 co-working spaces, with an additional five expected to launch by the end of the year. Significant additions comprise one in The Nexus measuring 1,908 square meters and another in the Bitexco Financial Tower at 1,063 square meters. Hence, organizations are looking for flexible office options where workers can be allowed to work from home and be present in the office, contributing to a boom in the demand for co-working areas. This phenomenon is being seen most clearly in large cities such as Ho Chi Minh City and Hanoi, where companies are seeking budget-friendly alternatives to the conventional office leases. Operators are reacting by providing flexible spaces that meet different business requirements, ranging from startups to established companies. The flexibility of co-working spaces enables companies to scale operations without the long-term commitment of conventional office spaces, aligning with the dynamic nature of modern work environments.

To get more information on this market, Request Sample

Integration of Green and Smart Technologies

Environmental sustainability and technological innovation are becoming central to the design and operation of Vietnam's co-working spaces. Developers are increasingly incorporating green building certifications and smart technologies to attract environmentally conscious businesses. For example, certain co-working facilities are making use of recycled materials and using energy-efficient systems to cut down on carbon emissions. These attempts aid in protecting the environment and improve the health of occupants by offering them healthier working spaces. Inclusion of intelligent systems, like IoT-based systems and high-speed connectivity, enhances the efficiency of operations and addresses the increasing demand for technology-friendly working spaces, further contributing to the Vietnam co-working office space market growth.

Expansion Beyond Major Urban Centers

While Hanoi and Ho Chi Minh City have historically been the hub for Vietnam's co-working spaces, there is an increasing presence in secondary cities such as Hai Phong and Da Nang. This geographical expansion is a response to trends like enhanced infrastructure, urbanization, and the growth of digital nomadism. Companies are realizing the promise of these new markets, so they are setting up co-working facilities that serve local businesspeople and telecommuters. This is indicative of a larger regional movement towards decentralization, as business corporations want to access new pools of skilled workers and lower operation costs linked with central cities.

Vietnam Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes flexible managed office and serviced office.

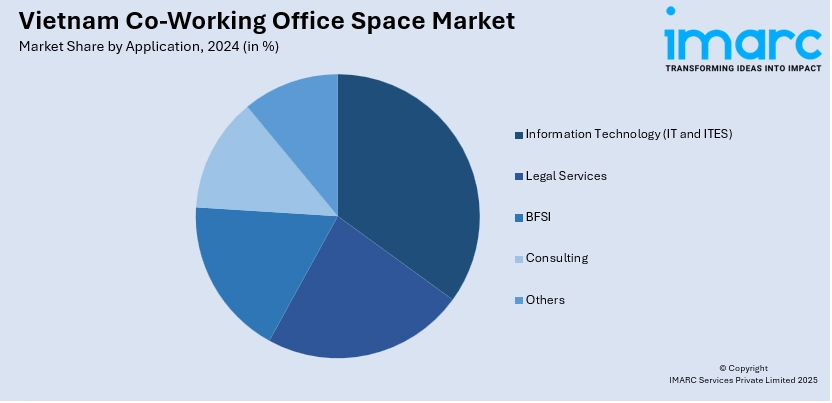

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam co-working office space market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam co-working office space market on the basis of type?

- What is the breakup of the Vietnam co-working office space market on the basis of application?

- What is the breakup of the Vietnam co-working office space market on the basis of end user?

- What is the breakup of the Vietnam co-working office space market on the basis of region?

- What are the various stages in the value chain of the Vietnam co-working office space market?

- What are the key driving factors and challenges in the Vietnam co-working office space market?

- What is the structure of the Vietnam co-working office space market and who are the key players?

- What is the degree of competition in the Vietnam co-working office space market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)