Vietnam Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

Vietnam Commercial Insurance Market Summary:

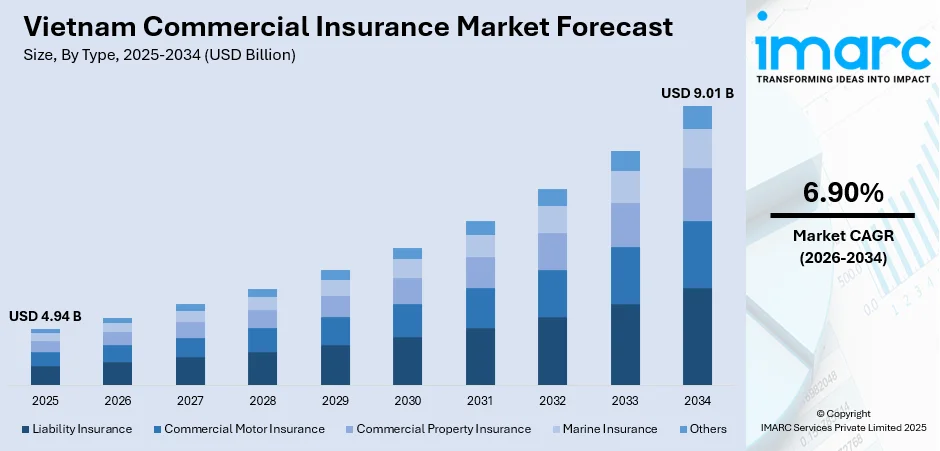

The Vietnam commercial insurance market size was valued at USD 4.94 Billion in 2025 and is projected to reach USD 9.01 Billion by 2034, growing at a compound annual growth rate of 6.90% from 2026-2034.

Vietnam's commercial insurance sector is experiencing significant growth driven by sustained foreign direct investment (FDI) inflows, accelerating infrastructure development, and increasing regulatory compliance requirements across manufacturing, logistics, and construction industries. The market benefits from the 2023 Insurance Business Law reforms that permit full foreign ownership, combined with growing enterprise risk awareness and expanding digital distribution channels connecting insurers with corporate clients through banking partnerships and platform integrations, facilitating the Vietnam commercial insurance market share.

Key Takeaways and Insights:

- By Type: Liability insurance dominates the market with a share of 35% in 2025, driven by compulsory insurance mandates for construction businesses including professional liability, third-party coverage, and worker's compensation requirements.

- By Enterprise Size: Large enterprises lead the market with a share of 65% in 2025, reflecting their dominant role as FDI-driven manufacturers and exporters requiring comprehensive commercial coverage.

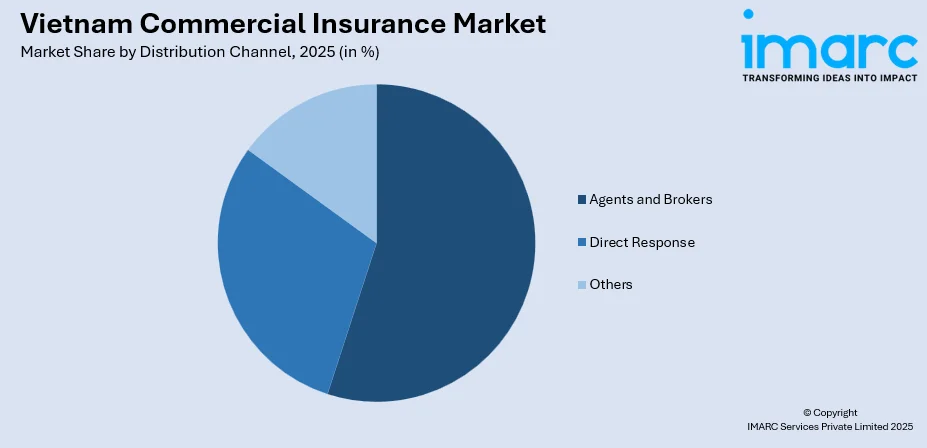

- By Distribution Channel: Agents and brokers represent the largest segment with a market share of 50% in 2025, leveraging established corporate relationships and specialized underwriting expertise for complex commercial risks.

- By Industry Vertical: Transportation and logistics lead the market with a share of 20% in 2025, supported by the sector's contribution to Vietnam's export economy and expanding freight operations.

- Key Players: The Vietnam commercial insurance market exhibits moderate consolidation, with state-owned enterprises competing alongside foreign-invested insurers across corporate segments, supported by strategic international partnerships and digital transformation initiatives.

To get more information on this market, Request Sample

The commercial insurance landscape in Vietnam reflects the country's position as a manufacturing hub and emerging Southeast Asian economy. Foreign direct investment reached USD 25.35 billion in realized capital during 2024, with manufacturing accounting for 66.9% of total investment. The real estate sector followed with an overall investment of 6.31 billion USD, representing 16.5% of the total and increasing by 18.8% compared to the previous year. Next were power generation and distribution, along with wholesale and retail at 1.42 billion USD and 1.41 billion USD. This industrial expansion drives commercial insurance demand across property, liability, and specialty lines, while regulatory frameworks mandate coverage for construction activities and vehicle operations, creating baseline market demand that supports sustained premium growth.

Vietnam Commercial Insurance Market Trends:

Digital Platform Integration Reshaping Distribution Models

Vietnamese commercial insurers are embedding insurance products into corporate banking platforms, e-commerce ecosystems, and enterprise resource planning systems to streamline policy administration and enhance client accessibility. Digital transformation initiatives have accelerated dramatically, with a major portion of insurance companies increasing technology investments in 2025. The Vietnamese government also intends to invest approximately VND95 trillion (US$3.6 billion) in 2026 for advancements in science and technology, innovation, and digital transformation. This shift enables real-time risk assessment, automated underwriting, and seamless claims processing for corporate clients.

Artificial Intelligence (AI) Deployment in Risk Management and Claims

Commercial insurers are implementing artificial intelligence (AI) technologies to enhance underwriting precision, accelerate claims settlement, and improve fraud detection across corporate portfolios. Vietnam ranks first in Southeast Asia for readiness and trust in AI users, as stated in the 10th edition of the e-Conomy SEA 2025 report by Google, Temasek, and Bain & Company. Moreover, machine learning (ML) algorithms analyze historical loss patterns, assess property risks, and optimize premium pricing for commercial clients across manufacturing, logistics, and construction sectors. In May 2025, PTI partnered with Akur8 to deploy a machine learning pricing platform, strengthening actuarial precision and accelerating new product launches for commercial insurance offerings tailored to corporate risk profiles.

Regulatory Reforms Attracting Foreign Insurance Capital

Vietnam's 2023 Insurance Business Law permits 100% foreign ownership of insurance operations, eliminating previous local partnership requirements and streamlining licensing procedures for international carriers. This regulatory liberalization creates opportunities for global insurers to enter the commercial insurance market directly, leveraging their expertise in specialized corporate coverages, risk engineering, and claims management capabilities. Enhanced regulatory frameworks focus on risk governance, internal controls, and actuarial standards to improve industry transparency and financial conduct. In 2025, several prominent Vietnamese banks are working to expand their financial ecosystems by creating or acquiring insurance firms. This trend is clear among institutions like Asia Commercial Joint Stock Bank (ACB), Techcombank, and VPBank, which aim to incorporate insurance with their current banking, securities, and asset management offerings. ACB has recently begun processes to engage its shareholders regarding the establishment of a non-life insurance subsidiary.

Market Outlook 2026-2034:

The Vietnam commercial insurance market is positioned for sustained expansion as manufacturing growth, infrastructure investment, and regulatory compliance requirements drive corporate risk protection needs across enterprise segments. The market generated a revenue of USD 4.94 Billion in 2025 and is projected to reach a revenue of USD 9.01 Billion by 2034, growing at a compound annual growth rate of 6.90% from 2026-2034. Foreign direct investment inflows exceeding USD 35 billion support industrial development, while government infrastructure spending on transportation networks, renewable energy projects, and logistics facilities creates insurable asset bases requiring property and liability coverage.

Vietnam Commercial Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Liability Insurance | 35% |

| Enterprise Size | Large Enterprises | 65% |

| Distribution Channel | Agents and Brokers | 50% |

| Industry Vertical | Transportation and Logistics | 20% |

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Liability insurance dominates with a market share of 35% of the total Vietnam commercial insurance market in 2025.

Liability insurance commands the largest revenue share within Vietnam's commercial insurance market, driven by comprehensive mandatory coverage requirements and expanding corporate risk awareness across construction, manufacturing, and service sectors. Decree 7 mandates compulsory professional liability insurance, third-party insurance, and worker's compensation coverage for construction businesses, creating baseline demand that supports market volumes. Manufacturing enterprises, particularly foreign-invested operations, require product liability and employer's liability protection to comply with international supply chain standards and mitigate operational risks.

Small and medium enterprises are progressively adopting public liability and professional indemnity coverage as business sophistication increases and contractual relationships with larger corporations require proof of insurance. Professional service firms including technology companies, consultancies, and healthcare providers recognize liability insurance as essential protection against errors, omissions, and negligence claims. The segment's growth trajectory aligns with Vietnam's economic maturation and integration into global value chains, where liability coverage represents a fundamental component of corporate risk management frameworks.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead with a share of 65% of the total Vietnam commercial insurance market in 2025.

Large enterprises constitute the primary customer base for commercial insurance in Vietnam, reflecting their substantial asset bases, complex operational risks, and regulatory compliance requirements that necessitate comprehensive coverage programs. According to the latest report from the Ministry of Finance's Foreign Investment Agency (FIA), foreign investors reported US$21.5 billion in investments in Vietnam in the first half of 2025, which represents a 33 per cent rise compared to the same timeframe last year.

State-owned corporations and domestic conglomerates operating across infrastructure, energy, and telecommunications sectors procure substantial commercial insurance capacities given their large-scale projects and regulatory mandates. Multinational corporations establishing manufacturing presence in Vietnam transfer global insurance program structures that specify minimum coverage limits and risk management standards, elevating market sophistication and premium volumes. Large enterprises benefit from dedicated account management, customized policy terms, and access to international reinsurance capacity that enables coverage for high-value assets and catastrophic loss scenarios beyond domestic market retention capabilities.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Agents and Brokers

- Direct Response

- Others

Agents and brokers exhibits a clear dominance with a 50% share of the total Vietnam commercial insurance market in 2025.

Agents and brokers dominate commercial insurance distribution through specialized expertise in corporate risk assessment, tailored policy structuring, and claims advocacy that complex business clients require. Brokers provide value-added services including risk engineering surveys, policy comparisons across multiple carriers, and contract negotiation that justify their intermediary role for enterprises managing diverse insurance portfolios. Large corporations and foreign-invested operations prefer broker relationships that offer access to international reinsurance markets and enable centralized program management across multiple locations.

Insurance agents maintain deep relationships with small and medium enterprises through regular client interactions, renewal consultations, and claims support that build long-term retention. Moreover, the heightened number of efficient agents and brokers is supporting the market growth. As reported by the Department of Insurance Management and Supervision under the Ministry of Finance, the total gross written premium revenue in the non-life sector amounted to $1.74 billion in the first half of 2025, representing an increase of over 11 percent compared to the corresponding period last year, even amid challenges from decreased investment returns and stricter regulations.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics lead with a share of 20% of the total Vietnam commercial insurance market in 2025.

The transportation and logistics sector generates substantial commercial insurance demand driven by vehicle fleet operations, cargo liability exposures, and warehouse facility risks that require comprehensive coverage across multiple insurance lines. Vietnam's freight and logistics market is projected to exhibit a growth rate (CAGR) of 6.37% during 2025-2033, according to IMARC Group. Compulsory third-party liability insurance for commercial vehicles creates baseline market volumes, while voluntary comprehensive coverage, goods-in-transit insurance, and warehouse property protection represent additional premium opportunities.

Foreign logistics operators and domestic freight forwarders require marine cargo insurance for international shipments, complemented by inland transit coverage for domestic distribution networks connecting manufacturing zones with port facilities. The sector benefits from infrastructure investments to roads, ports, and airports that expand insurable asset bases. Commercial vehicle insurance encompasses fleet management programs for trucking companies, motorcycle delivery services, and specialized transport operations including refrigerated vehicles and hazardous materials carriers requiring enhanced liability limits.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam encompasses the capital Hanoi and major industrial provinces hosting substantial foreign direct investment in manufacturing, electronics assembly, and automotive production that generate commercial insurance demand across property, liability, and specialty lines. The region benefits from proximity to China and serves as a logistics hub connecting domestic markets with international trade corridors. Manufacturing concentration in Bac Ninh, Hai Phong, and Thai Nguyen provinces creates demand for factory property insurance, business interruption coverage, and machinery breakdown protection.

Central Vietnam features growing industrial activity alongside tourism development in cities including Da Nang and Hue, with commercial insurance supporting hospitality operations, transportation services, and emerging manufacturing investments. The region's exposure to typhoons and flooding elevates demand for natural catastrophe coverage within property insurance programs, while coastal logistics operations require marine insurance for port facilities and cargo handling. Agricultural processing and seafood export industries generate specialized insurance requirements for cold storage, food safety liability, and supply chain protection.

Southern Vietnam, anchored by Ho Chi Minh City, represents the country's economic powerhouse with the highest concentration of manufacturing, logistics, and financial services activity. Foreign-invested manufacturing clusters in Binh Duong and Dong Nai provinces require comprehensive commercial insurance programs covering electronics production, textile operations, and industrial estates. The region's port infrastructure and logistics networks supporting export-oriented manufacturing generate marine cargo, warehouse, and transportation insurance demand that positions Southern Vietnam as the market's revenue leader.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Commercial Insurance Market Growing?

Foreign Direct Investment Driving Industrial Insurance Demand

Vietnam's sustained attraction of foreign direct investment generates commercial insurance requirements across manufacturing facilities, production equipment, and export operations that foreign corporations establish throughout the country's industrial zones. As of December 31, 2024, the entire nation has 42,002 approved projects with an overall registered capital of 502.8 billion USD. The total realized capital from foreign investment initiatives amounted to approximately 322.5 billion USD, which is 64.1% of the overall valid registered investment capital. International investors transfer global risk management standards requiring comprehensive insurance programs that specify minimum coverage limits, preferred carriers, and specialized policy endorsements aligned with corporate governance frameworks.

Infrastructure Development Expanding Insurable Asset Base

Government infrastructure investments across transportation networks, renewable energy installations, and industrial facilities create substantial construction insurance demand while establishing long-term property and liability coverage requirements once projects reach operational status. Public spending allocated a massive portion toward roads, ports, and airports infrastructure that requires contractor's all-risk insurance during construction phases and comprehensive property coverage upon completion. Moreover, infrastructure expansion supports GDP growth projections, creating favorable macroeconomic conditions that encourage business investment and corresponding risk protection purchases. In 2025, Vietnam has initiated a bold plan for infrastructure and housing development, supported by investments amounting to 10% of its GDP, aiming to boost the economy and drive the country toward its objective of achieving high-income status by 2045.

Regulatory Compliance Mandates Creating Baseline Market Demand

Mandatory insurance requirements across construction activities, motor vehicle operations, and specific industry sectors establish minimum commercial insurance volumes that support market stability and create foundations for voluntary coverage expansion. Decree 7 mandates compulsory professional liability insurance, third-party insurance, and worker's compensation coverage for construction businesses engaged in building projects, infrastructure development, and renovation activities. Third-party liability motor insurance applies to all commercial vehicles including trucks, delivery motorcycles, and corporate fleet operations, ensuring baseline premium flows from the transportation sector. Foreign ownership regulations and lending institution requirements often specify insurance coverage as preconditions for investment approvals and financing arrangements, compelling enterprises to secure adequate protection. The 2023 Insurance Business Law enhanced consumer protection measures and market transparency requirements. In 2025, the Ministry of Finance (MOF) is inviting public input on proposed changes to the Insurance Business Law, with the goal of establishing a more unified legal structure and encouraging sustainable development in the industry.

Market Restraints:

What Challenges the Vietnam Commercial Insurance Market is Facing?

Low Insurance Penetration Limiting Market Development Potential

Vietnam's insurance penetration rate stands at merely 2.3-2.8% of GDP, significantly below the ASEAN average of 3.35%, Asia's 5.37%, and the global benchmark of 6.3%, reflecting underdeveloped risk awareness and limited insurance purchasing culture among enterprises. Small and medium enterprises often view commercial insurance as discretionary expense rather than essential business protection, prioritizing immediate operational costs over risk transfer mechanisms. Limited understanding of specialized coverage benefits including business interruption, liability protection, and supply chain insurance constrains voluntary coverage adoption beyond mandatory requirements.

Consumer Confidence Erosion Following Industry Misconduct

Recent mis-selling scandals in the life insurance sector negatively impact broader insurance market credibility, making businesses more cautious when purchasing commercial coverage and requiring extended relationship-building to overcome trust deficits. Policy cancellation rates reach 20 to 30% after the first year of issuance, while bancassurance experienced cancellation rates as high as 73% following sales practice irregularities that damaged industry reputation. Premium revenue declined in 2023 compared to the previous year, driven by decreases in life insurance that spilled over into commercial lines through general market skepticism. Corporate clients increasingly scrutinize policy terms and insurer financial strength ratings before committing to insurance programs.

Intense Market Competition Pressuring Premium Rates and Profitability

Twenty-two active non-life insurance companies compete for commercial business across limited market segments, creating pricing pressure that compresses underwriting margins and challenges sustainable profitability, particularly for smaller domestic carriers without foreign capital support. Market consolidation trends favor larger state-owned enterprises and foreign-invested insurers capable of offering broader coverage capacities and international program coordination. Smaller insurance companies struggle to differentiate offerings beyond price competition, leading to inadequate risk pricing and potential underwriting losses. Foreign insurers entering through the 100% ownership pathway intensify competitive dynamics by introducing sophisticated products and service standards that elevate client expectations across the market.

Competitive Landscape:

The Vietnam commercial insurance market exhibits moderate concentration with state-owned enterprises maintaining substantial market shares alongside increasing foreign-invested carrier participation enabled by 2023 regulatory reforms permitting 100% foreign ownership. Leading non-life insurers leverage extensive distribution networks and long-standing corporate relationships to dominate large enterprise segments, while foreign insurers compete through specialized product offerings and international program coordination capabilities. Strategic partnerships between domestic insurers and global reinsurers provide access to capacity for large risks and natural catastrophe exposures exceeding local market retention capabilities. Digital transformation initiatives and artificial intelligence deployments differentiate carriers through enhanced underwriting precision, streamlined claims processing, and embedded insurance distribution models that reduce customer acquisition costs while improving client accessibility across enterprise segments.

Recent Developments:

- In March 2025, Shinhan Life Vietnam is launching initiatives centered on three main strategic pillars including investing in distribution channels and broadening business operations, streamlining operational management processes while creating a more varied and competitive life insurance product range, and improving employee and consultant satisfaction. The company is enhancing its distribution network, optimizing internal processes and business activities, and introducing clear and organized training programs to improve customer satisfaction.

Vietnam Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam commercial insurance market size was valued at USD 4.94 Billion in 2025.

The Vietnam commercial insurance market is expected to grow at a compound annual growth rate of 6.90% from 2026-2034 to reach USD 9.01 Billion by 2034.

Liability Insurance dominated the market with 35% share in 2024, driven by compulsory insurance mandates for construction businesses including professional liability, third-party coverage, and worker's compensation requirements that create baseline demand across commercial segments.

Key factors driving the Vietnam Commercial Insurance market include sustained foreign direct investment inflows that generated capital during 2024 with manufacturing accounting for a major portion of total investment, government infrastructure development spending on roads, ports, and airports creating substantial insurable asset bases, and regulatory compliance mandates including compulsory liability insurance for construction businesses and motor vehicle operations that establish minimum market volumes supporting commercial insurance expansion across enterprise segments.

Major challenges include low insurance penetration rates reflecting underdeveloped risk awareness among enterprises, consumer confidence erosion following industry mis-selling scandals that resulted in high policy cancellation rates for bancassurance products, intense market competition among twenty-two active non-life insurance companies creating pricing pressure that compresses underwriting margins particularly for smaller domestic carriers, and limited specialized coverage understanding among small and medium enterprises that constrains voluntary insurance adoption beyond mandatory requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)