Vietnam Data Center Colocation Market Size, Share, Trends and Forecast by Type, Organization Size, End-Use Industry, and Region, 2026-2034

Vietnam Data Center Colocation Market Summary:

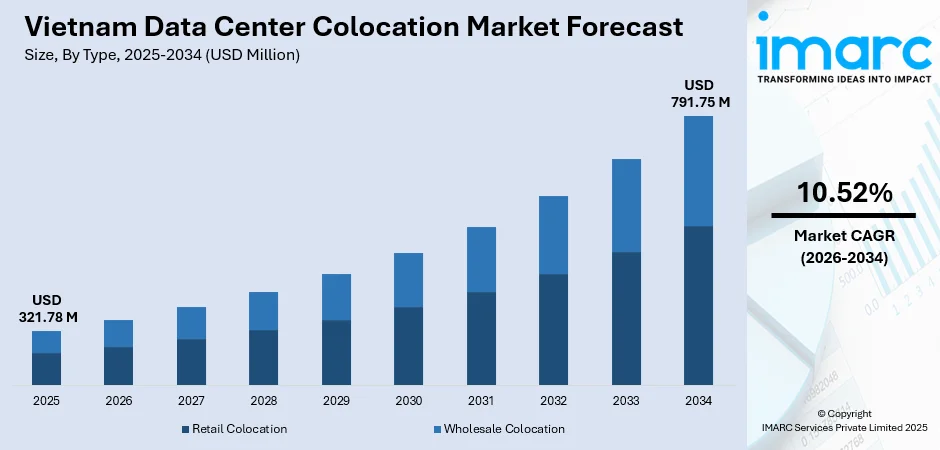

The Vietnam data center colocation market size was valued at USD 321.78 Million in 2025 and is projected to reach USD 791.75 Million by 2034, growing at a compound annual growth rate of 10.52% from 2026-2034.

Vietnam's data center colocation market is experiencing robust expansion fueled by comprehensive regulatory reforms that now permit full foreign ownership of data centers, rapid cloud adoption driven by nationwide digital transformation initiatives, and substantial infrastructure investments by both domestic and international operators. The country's strategic position as an emerging technology hub in Southeast Asia, combined with competitive construction costs and growing demand for scalable IT infrastructure, is collectively expanding the Vietnam data center colocation market share.

Key Takeaways and Insights:

- By Type: Retail colocation dominates the market with a share of 73% in 2025, driven by its flexibility and cost-effectiveness for small to medium enterprises seeking managed infrastructure without substantial capital investment, enabling organizations to scale operations incrementally based on demand.

- By Organization Size: Large enterprises lead the market with a share of 60% in 2025, owing to their extensive data storage requirements, complex IT infrastructure needs, and demand for high-security Tier 3 facilities with dedicated cages and multi-factor physical security systems.

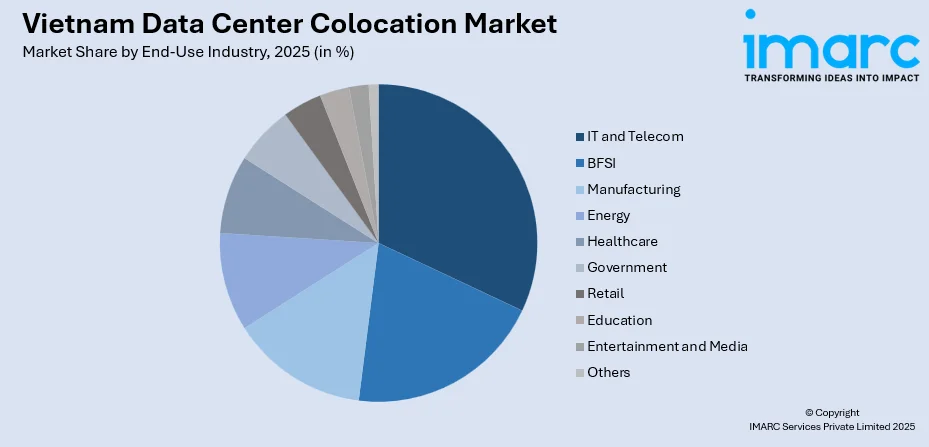

- By End-Use Industry: IT and telecom represent the largest segment with a market share of 32% in 2025, attributed to the sector's foundational role in digital infrastructure, network core modernization initiatives, and substantial 5G deployment requiring robust colocation support.

- By Region: Northern Vietnam dominates the market with a share of 38% in 2025, supported by Hanoi's concentration of government workloads, federal data requirements, and strategic positioning as a disaster recovery hub with geographic dispersion from southern facilities.

- Key Players: The Vietnam data center colocation market exhibits moderate competitive intensity, with domestic telecommunications operators competing alongside emerging international entrants. The market structure is evolving rapidly as regulatory reforms attract substantial foreign investment and new market participants seek to capitalize on growing demand.

To get more information on this market Request Sample

The Vietnam data center colocation market is emerging as a pivotal digital infrastructure hub in Southeast Asia. There were 78.44 million internet users in Vietnam at the beginning of 2024, representing an internet penetration rate of 79.1 percent. Additionally, the country had 72.70 million social media users in January 2024, accounting for 73.3 percent of the total population. The government’s strong focus on digital transformation has accelerated the adoption of colocation services across sectors such as finance, healthcare, retail, and public administration. This policy-driven momentum is encouraging enterprises to migrate critical workloads to secure, scalable data center environments. As a result, the market is evolving toward advanced facilities equipped to handle high-density computing, artificial intelligence applications, and cloud-based operations. Growing emphasis on data security, regulatory compliance, and operational resilience is further shaping demand for modern colocation infrastructure capable of supporting next-generation digital services.

Vietnam Data Center Colocation Market Trends:

Enhanced Regulatory Framework and Foreign Investment Liberalization

The Vietnamese colocation market is experiencing a fundamental transformation following comprehensive regulatory reforms that have eliminated barriers to foreign participation. The government has implemented groundbreaking policy changes that create unprecedented investment opportunities for international operators. In July 2024, the Vietnamese government introduced legislation permitting foreign investors to fully own data centers, abolishing previous equity limitations and positioning the country as an attractive alternative to capacity-constrained markets like Singapore. This liberalization extends beyond ownership patterns to include simplified licensing procedures and operational guidelines aligned with international best practices.

Accelerated Cloud Adoption and Digital Transformation Initiatives

The swift pace of digital transformation in Vietnam is fueling exceptional growth in demand for colocation services, as businesses increasingly shift toward cloud-based platforms and adopt digital-centric operational models. Organizations across all sectors are recognizing the strategic importance of reliable, scalable, and secure data storage solutions to support their digital initiatives. According to the Ministry of Information and Communications, Vietnam's information and communications technology industry revenue in 2024 reached an estimated VND 4,244 trillion (approximately USD 165.9 billion), representing an increase of 13.2 percent from the previous year. This remarkable growth trajectory reflects widespread adoption of digital technologies fueling sustained colocation demand.

AI-Ready Infrastructure Development and Sustainability Focus

The market is witnessing substantial investment in specialized facilities capable of supporting artificial intelligence workloads and meeting rising efficiency expectations. Operators are implementing innovative design approaches, such as modular construction, integrating renewable energy agreements, and employing water-saving technologies. Data center providers are targeting Power Usage Effectiveness below 1.4 as green compliance transitions from optional to strategic priority. In May 2025, Viettel and Korea Telecom signed a USD 95 million partnership to develop AI data centers and GPU farms in Hanoi, exemplifying the market's evolution toward high-performance computing infrastructure with integrated sustainability features.

Market Outlook 2026-2034:

The Vietnam data center colocation market outlook remains highly positive, supported by continued regulatory improvements, growing foreign direct investment, and expanding digital economy initiatives. The introduction of stricter data protection regulations requiring sensitive user information to be stored locally is expected to accelerate demand for domestic colocation services, particularly among international enterprises seeking regulatory compliance. At the same time, the government’s push to digitize administrative processes is encouraging both public institutions and private organizations to rely on secure, scalable data center infrastructure. Together, these policy initiatives are strengthening the role of local colocation facilities as critical enablers of digital governance, data sovereignty, and enterprise-level digital transformation. The market generated a revenue of USD 321.78 Million in 2025 and is projected to reach a revenue of USD 791.75 Million by 2034, growing at a compound annual growth rate of 10.52% from 2026-2034.

Vietnam Data Center Colocation Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Retail Colocation |

73% |

|

Organization Size |

Large Enterprises |

60% |

|

End-Use Industry |

IT and Telecom |

32% |

|

Region |

Northern Vietnam |

38% |

Type Insights:

- Retail Colocation

- Wholesale Colocation

The retail colocation dominates with a market share of 73% of the total Vietnam data center colocation market in 2025.

The retail colocation segment maintains market leadership by offering flexible, cost-effective infrastructure solutions that enable organizations to scale operations incrementally without substantial capital investment. This model particularly appeals to small and medium enterprises, startups, and organizations with variable computing requirements who benefit from the ability to lease individual racks or cabinet space rather than committing to wholesale capacity. Retail colocation providers deliver comprehensive managed services including power management, cooling, physical security, and network connectivity, allowing tenants to focus on core business operations while infrastructure specialists handle facility management and maintenance requirements.

The segment's dominance reflects the Vietnamese market's current maturity stage, where numerous enterprises are transitioning from on-premises infrastructure to colocation environments for the first time. Domestic telecommunications operators have strategically positioned retail colocation offerings to capture this migration wave, bundling connectivity services with facility access to create compelling value propositions. In August 2025, FPT Corporation inaugurated its fourth data center, the FPT Fornix HCM02 facility in Ho Chi Minh City's Saigon Hi-Tech Park, featuring 3,600 racks and developed according to the Carrier Neutral model, allowing customers flexibility in choosing telecommunications service providers.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The large enterprises leads with a share of 60% of the total Vietnam data center colocation market in 2025.

Large enterprises drive the majority of colocation demand due to their extensive data storage requirements, complex IT infrastructure needs, and stringent compliance obligations. These organizations typically require dedicated cages or private suites within colocation facilities, equipped with multi-factor physical security systems, isolated power distribution, and redundant network paths. Financial institutions, multinational corporations, and government agencies mandate Tier 3 or higher facility certifications to ensure the high availability and fault tolerance necessary for mission-critical applications, pushing colocation providers to invest in premium infrastructure that commands higher revenue per rack.

The segment benefits from Vietnam's data localization requirements, which compel large international enterprises to establish domestic infrastructure footprints. Mandatory stress testing, real-time settlement systems, and ISO 27001 audit requirements push financial institutions toward certified colocation facilities offering comprehensive compliance reporting and managed security services. The growing presence of hyperscale cloud providers establishing local availability zones has created additional wholesale demand from large enterprises seeking hybrid cloud architectures that combine on-premises colocation with public cloud resources for optimal workload distribution.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

The IT and telecom exhibits clear dominance with a 32% share of the total Vietnam data center colocation market in 2025.

The IT and telecom sector drives the largest share of colocation demand, highlighting its central role in Vietnam’s digital infrastructure ecosystem. Service providers require significant colocation capacity to support network modernization, next-generation mobile deployments, and high-performance content delivery. Extensive fiber networks and established client bases enable these operators to integrate connectivity and colocation services efficiently, making the sector a key contributor to the growth and utilization of data center infrastructure across the country.

The segment benefits from Vietnam's aggressive 5G deployment timeline, with commercial services already covering core urban districts and plans for nationwide population coverage by 2030. Cloud service providers establishing local points of presence drive additional demand as they require low-latency interconnection with carrier networks and enterprise customers. The proliferation of over-the-top streaming platforms, gaming services, and e-commerce applications has intensified requirements for edge computing infrastructure positioned close to end users, creating sustained demand for strategically located colocation facilities across major metropolitan areas.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam represents the largest regional share at 38% of the total Vietnam data center colocation market in 2025.

Northern Vietnam, centered around the capital, holds the largest share of the regional colocation market due to its high concentration of government workloads and strategic importance for disaster recovery and business continuity. The political and administrative significance of the region drives steady demand from public sector agencies pursuing digital initiatives. Its geographic positioning, separate from southern facilities, provides critical redundancy for enterprises. The area’s established infrastructure supports a mix of government, corporate, and multinational operations, reinforcing its role as a key hub for secure and resilient data center services.

The region is witnessing accelerated infrastructure expansion as operators enhance capacity to meet rising demand and support enterprise growth. Surrounding provinces are emerging as important nodes for server assembly and logistical support, strengthening the regional ecosystem. Large-scale facilities serve as central anchors for national-level digital initiatives, integrating advanced technologies to ensure reliability, security, and operational continuity. This combination of strategic location, robust infrastructure, and growing enterprise reliance solidifies Northern Vietnam’s position as a leading center for colocation and digital infrastructure development.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Data Center Colocation Market Growing?

Comprehensive Regulatory Reforms and Foreign Investment Liberalization

Recent policy reforms in Vietnam have fundamentally reshaped the landscape for data center investment. Changes allowing full foreign ownership of data center operations have removed previous participation limits, creating a more attractive environment for international investors. Regulatory updates also include simplified licensing processes, clearer operational guidelines, and cybersecurity requirements aligned with global standards. Together, these reforms have facilitated accelerated development, enabling greater capacity expansion and modernization across the sector. By easing entry barriers and providing a stable, transparent framework, Vietnam is increasingly positioned as a competitive destination for large-scale data center infrastructure and advanced digital services.

Data Sovereignty Requirements and Localization Mandates

Vietnam's evolving data governance framework is creating structural demand for domestic colocation infrastructure as multinational corporations and cloud service providers establish compliant local footprints. The Personal Data Protection Law, ratified by the National Assembly in June 2025 and effective January 2026, mandates domestic storage of Vietnamese user data with substantial penalties reaching up to five percent of annual revenue for cross-border transfer violations. This requirement compels enterprises previously relying on regional data center hubs to establish Vietnamese infrastructure presence, driving immediate demand for colocation capacity. The framework extends beyond personal data to encompass cybersecurity law provisions under Decree 53 requiring local data retention and processing. These regulations force major technology platforms and service providers to pre-commit colocation capacity, ensuring sustained demand visibility for operators and supporting long-term market growth.

Rapid Digital Transformation and Cloud Service Adoption

Vietnam's commitment to building a digital economy is generating unprecedented demand for colocation services across all sectors. The government's National Digital Transformation Programme targets the digital economy, contributing 20 percent of gross domestic product, driving enterprise adoption of cloud computing, big data analytics, artificial intelligence, and Internet of Things solutions that require robust underlying infrastructure. Administrative digitalization goals mandating 80 percent of government procedures completed online by end-2025 are pulling public agencies into cloud platforms hosted domestically. Financial services digitalization proceeds rapidly, with AI-based risk assessment and real-time compliance workloads demanding secure, high-performance colocation infrastructure.

Market Restraints:

What Challenges the Vietnam Data Center Colocation Market is Facing?

Power Infrastructure and Grid Reliability Constraints

Ensuring a reliable, high-capacity power supply is a major challenge for colocation operators, as uninterrupted electricity is critical for data center operations. Grid limitations and rising demand make consistent power delivery essential, requiring robust backup systems and energy management solutions. Strengthening power reliability supports high-density workloads, mitigates operational risks, and maintains service continuity, particularly in rapidly growing urban centers where digital infrastructure expansion drives increasing electricity consumption.

Skilled Workforce Availability and Technical Expertise Gaps

The development of a skilled labor force capable of supporting advanced data center operations presents ongoing challenges for market growth. Professionals with expertise in data center management, cybersecurity, advanced cooling systems, and artificial intelligence infrastructure remain in limited supply. Addressing this constraint requires sustained investment in workforce development through education, vocational training, certification programs, and collaboration between universities, industry stakeholders, and government agencies.

High Capital Investment and Operational Cost Pressures

Colocation operators face significant cost pressures from high capital investments, rising energy expenses, and competitive pricing challenges. Building and maintaining data centers requires careful financial planning to balance operational efficiency, service quality, and sustainability goals. New entrants encounter barriers in establishing robust infrastructure, while existing operators must optimize energy management, maintenance, and operational practices to control costs and remain competitive in a rapidly expanding and demanding digital infrastructure market.

Competitive Landscape:

The Vietnam data center colocation market exhibits moderate competitive intensity, with domestic telecommunications operators maintaining significant market presence while international entrants increasingly participate following regulatory liberalization. The market structure features established domestic providers leveraging state-backed fiber networks and extensive land banks competing alongside emerging international operators bringing global expertise and capital. Competitive strategy centers on vertical differentiation through specialized service offerings rather than undifferentiated rack space, with operators pursuing AI-optimized facilities, sustainability certifications, and integrated managed services to attract premium tenants. The liberalization of foreign ownership is reshaping competitive dynamics as substantial international capital flows into the market, compelling incumbents to pursue technology partnerships and renewable energy sourcing to sustain competitiveness.

Recent Developments:

- August 2025: Viettel inaugurated the An Khanh Data Centre in Hanoi valued at approximately VND 17.5 trillion, featuring Uptime Tier III standards, 60MW designed capacity, and integrated AI solutions, making it the largest data center in Northern Vietnam with phase one operational by Q2 2026.

- May 2024: ST Telemedia Global Data Centers entered a joint venture with VNG Corporation to develop, build, and manage data center facilities in Ho Chi Minh City with 60MW power capacity and expected completion in 2026, marking significant foreign investment in the colocation sector.

Vietnam Data Center Colocation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam data center colocation market size was valued at USD 321.78 Million in 2025.

The Vietnam data center colocation market is expected to grow at a compound annual growth rate of 10.52% from 2026-2034 to reach USD 791.75 Million by 2034.

Retail colocation represents the largest market share at 73% in 2025, driven by its flexibility and cost-effectiveness for organizations seeking managed infrastructure without substantial capital investment and the ability to scale operations incrementally.

Key factors driving the Vietnam data center colocation market include regulatory reforms permitting full foreign ownership, data sovereignty requirements mandating local storage, rapid digital transformation initiatives, cloud service adoption, and substantial infrastructure investment by domestic and international operators.

Major challenges include power infrastructure constraints and grid reliability concerns requiring substantial investment, skilled workforce shortages in advanced data center operations, high capital investment requirements, rising operational costs, and the need for regulatory compliance across evolving data protection frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)