Vietnam Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034

Vietnam Digital Health Market Summary:

The Vietnam digital health market size was valued at USD 2.84 Billion in 2025 and is projected to reach USD 9.52 Billion by 2034, growing at a compound annual growth rate of 14.39% from 2026-2034.

The Vietnam digital health market is experiencing robust expansion driven by the government's comprehensive healthcare digitalization initiatives and the nation's young, tech-savvy population rapidly embracing digital solutions. Rising incidence of non-communicable diseases including cardiovascular conditions, diabetes, and hypertension is accelerating demand for remote monitoring and telehealth services that offer convenient access to medical consultations. The proliferation of smartphones, expanding 5G connectivity, and increasing internet penetration across urban and rural areas are creating favorable conditions for digital health adoption. Strategic investments from both domestic technology conglomerates and international healthcare providers are strengthening the digital health ecosystem, while regulatory frameworks supporting electronic health records and telemedicine are facilitating market maturation across the Vietnam digital health market share.

Key Takeaways and Insights:

-

By Type: Telehealth dominates the market with a share of 28.04% in 2025, owing to the government's telemedicine scheme connecting over 1,000 hospitals nationwide, increasing acceptance of virtual consultations among the population, and enhanced telecommunications infrastructure enabling reliable remote healthcare delivery.

-

By Component: Software leads the market with a share of 57.05% in 2025, driven by mandatory electronic health record adoption requirements, increasing deployment of hospital information systems, and integration of artificial intelligence-powered diagnostic tools across healthcare facilities.

-

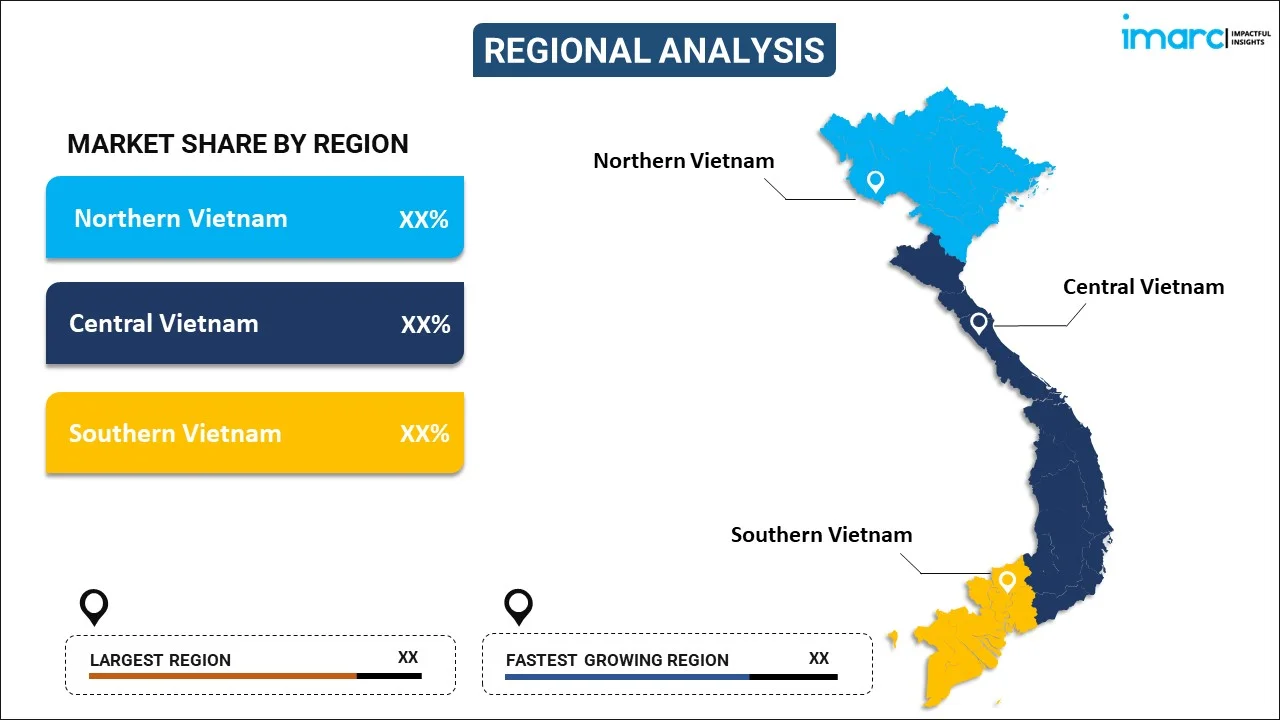

By Region: Southern Vietnam is the largest region with 46% share in 2025, reflecting the concentration of healthcare technology investments in Ho Chi Minh City, superior digital infrastructure, higher internet penetration rates, and the presence of leading private healthcare providers driving digital health innovation.

-

Key Players: Key players drive the Vietnam digital health market by expanding telemedicine platforms, developing AI-powered diagnostic solutions, and strengthening healthcare data management capabilities. Their investments in electronic medical records, mobile health applications, and partnerships with government agencies accelerate digital adoption. Some of the key players operating in the market include eDoctor, Med247 and MedLink

The Vietnam digital health market is positioned at a transformative juncture as the nation accelerates its healthcare modernization agenda. The government has allocated substantial funding for healthcare digitalization, targeting comprehensive electronic health record coverage across the national healthcare system. This significant investment reflects the commitment to enhancing telemedicine services, deploying digital health platforms, and integrating artificial intelligence into medical services. The market evolution is characterized by increasing collaboration between state telecommunications giants and private healthcare innovators developing integrated solutions for remote patient monitoring, chronic disease management, and preventive care. Vietnam's demographic profile, featuring a rapidly aging population and rising prevalence of non-communicable diseases, necessitates scalable digital interventions that can extend quality healthcare access beyond urban centers. The convergence of regulatory support, technological advancement, and shifting patient preferences toward convenient healthcare delivery is establishing Vietnam as an emerging digital health hub within Southeast Asia.

Vietnam Digital Health Market Trends:

Integration of Artificial Intelligence in Healthcare Diagnostics

Healthcare facilities across Vietnam are increasingly adopting artificial intelligence technologies for diagnostic support and clinical decision-making. Hospitals are implementing AI-powered imaging analysis for X-rays, CT scans, and MRI interpretation to improve diagnostic accuracy while reducing physician workload. The Ho Chi Minh City Oncology Hospital has integrated AI-assisted radiation therapy planning for precise cancer treatments. Nhan Dan 115 Hospital became the first facility in Vietnam to deploy AI RAPID software for thrombolysis interventions, enabling life-saving treatment for cerebral infarction patients within critical timeframes and significantly enhancing survival rates.

Expansion of Mobile Health Applications and Digital Platforms

Mobile health applications are experiencing substantial growth as smartphone penetration reaches approximately 168.5 Million cellular connections across Vietnam. Digital health platforms are offering comprehensive services including remote consultations, personal health record tracking, appointment booking, and medication management. The integration of these applications with national identification systems is creating unified health records accessible to the broader population. Healthcare providers are leveraging mobile platforms to deliver chronic care management, vaccination reminders, and preventive health education directly to patients.

Rise of Remote Patient Monitoring and Wearable Technologies

The adoption of wearable health monitoring devices is gaining momentum as consumers become increasingly health-conscious and seek real-time tracking of vital parameters. Devices enabling continuous monitoring of heart rate, blood pressure, blood oxygen levels, and sleep patterns are supporting preventive healthcare approaches. Healthcare providers are integrating data from wearable devices into telehealth consultations for comprehensive patient assessments. The convergence of wearable technology with AI algorithms is enabling personalized health insights, early warning detection, and proactive disease management interventions.

Market Outlook 2026-2034:

The Vietnam digital health market outlook remains highly promising as the nation continues its ambitious healthcare digitalization trajectory. Government initiatives mandating electronic health record adoption by 2025-2026 are creating substantial demand for health IT solutions across both public and private healthcare providers. The market generated a revenue of USD 2.84 Billion in 2025 and is projected to reach a revenue of USD 9.52 Billion by 2034, growing at a compound annual growth rate of 14.39% from 2026-2034. The expansion of 5G infrastructure combined with growing investments in telemedicine will enable high-quality remote healthcare services across the country. Integration of AI-powered diagnostic tools, expansion of electronic health record systems, and development of interoperable health data platforms are expected to drive sustained market growth. Strategic partnerships between domestic technology companies and international healthcare providers will accelerate innovation and service delivery capabilities.

Vietnam Digital Health Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Telehealth |

28.04% |

|

Component |

Software |

57.05% |

|

Region |

Southern Vietnam |

46% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

Telehealth dominates with a market share of 28.04% of the total Vietnam digital health market in 2025.

Telehealth services have emerged as the cornerstone of Vietnam's digital health transformation, enabling remote consultations between patients and healthcare professionals through video conferencing, secure messaging, and virtual platforms. The segment's leadership position reflects the government's strategic investment in connecting healthcare facilities nationwide through telemedicine networks. Vietnam's Ministry of Health launched a scheme connecting hospitals across the country to strengthen medical service quality by leveraging central hospital expertise to support provincial facilities. This infrastructure enables teleconsultations, telesurgery consultations, and remote medical examinations throughout the nation.

The expansion of telehealth services addresses critical healthcare access challenges, particularly for populations in remote or underserved regions where specialized medical care was previously unavailable. Virtual consultations reduce travel burden for patients while enabling continuous care management for chronic conditions. In November 2024, the United Nations Development Programme, in collaboration with the Korean Foundation for International Healthcare, launched a telehealth project targeting disadvantaged populations across ten Vietnamese provinces including Ha Giang, Lao Cai, and Ca Mau. Healthcare providers are increasingly adopting integrated telehealth platforms that combine remote consultations with electronic prescriptions, laboratory result sharing, and follow-up care coordination.

Component Insights:

- Software

- Hardware

- Service

Software leads with a share of 57.05% of the total Vietnam digital health market in 2025.

Software solutions form the technological backbone of Vietnam's digital health ecosystem, encompassing electronic medical records, hospital information systems, telemedicine platforms, and AI-powered diagnostic applications. The segment's dominance reflects the mandatory requirement for all healthcare providers to implement electronic health records by 2025-2026, creating substantial non-optional demand for health IT solutions. Major telecommunications companies including Viettel, VNPT, and FPT Corporation have invested extensively in healthcare data management systems and artificial intelligence applications. The integration of electronic health records with the national digital identification system (VNeID) is unifying health data for the population.

Healthcare software development is increasingly focused on interoperability standards enabling seamless data exchange between facilities and treatment continuity across providers. In October 2024, the Vietnamese government launched an electronic health record function within the VNeID application, with over 32.1 Million accounts created and 14.6 Million integrated with the national identification system. Hospital information systems are evolving to incorporate clinical decision support tools, automated billing, and quality monitoring dashboards. The software segment is also benefiting from the deployment of AI algorithms for medical imaging analysis, pathology interpretation, and predictive analytics supporting early disease detection.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam exhibits a clear dominance with a 46% share of the total Vietnam digital health market in 2025.

Southern Vietnam's market leadership is anchored by Ho Chi Minh City's position as the nation's digital health innovation hub, benefiting from superior infrastructure, higher internet penetration rates, and concentrated healthcare technology investments. The region hosts leading private healthcare systems including Vinmec and FV Hospital, which have pioneered digital adoption in diagnostics, telemedicine, and AI-powered medical imaging. Ho Chi Minh City has witnessed substantial investments from technology companies implementing telehealth solutions and electronic health record systems. The municipal Department of Health has achieved widespread implementation of electronic medical records across hospitals, enabling secure patient information storage and efficient transfer between healthcare facilities.

The region's healthcare sector is making significant progress in establishing smart healthcare systems that enhance efficiency, accessibility, and patient outcomes. Several hospitals have pioneered AI applications including AI-driven imaging diagnostics for X-rays, CT scans, and MRI interpretation. The Ho Chi Minh City Oncology Hospital has integrated AI-assisted radiation therapy planning ensuring precise treatments. The region also benefits from the concentration of Vietnam's technology talent, established startup ecosystem, and presence of international healthcare investors attracted by the large patient population and growing middle class. Telemedicine infrastructure in Southern Vietnam facilitates remote consultations linking healthcare stations with specialists at general and specialized hospitals.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Digital Health Market Growing?

Government Investment in Healthcare Digitalization

The Vietnamese government has demonstrated strong commitment to healthcare digital transformation through substantial financial investments and comprehensive policy frameworks. Significant funding allocation for healthcare digitalization targets comprehensive electronic health record coverage across the national healthcare system. This investment focuses on enhancing telemedicine services, deploying digital health platforms, and integrating artificial intelligence into medical services nationwide. The National Digital Transformation Program designates healthcare as a top-priority sector with mandatory electronic health record adoption requirements creating substantial demand for health IT solutions. Government initiatives include the development of telehealth infrastructure connecting hospitals and clinics through telemedicine networks. The regulatory environment increasingly supports digital health adoption with established guidelines for telemedicine consultations, electronic medical records, and health data interoperability. These policy frameworks provide clarity for healthcare providers and technology companies while ensuring quality standards in digital health service delivery.

Rising Prevalence of Non-Communicable Diseases

Vietnam is experiencing a significant increase in non-communicable diseases including cardiovascular conditions, diabetes, and hypertension, creating urgent demand for digital health solutions that enable convenient access to medical consultations and continuous care management. A substantial portion of the adult population is affected by chronic conditions requiring ongoing medical management. This epidemiological transition necessitates healthcare delivery models that extend beyond traditional facility-based care. Digital health technologies including remote patient monitoring, telemedicine consultations, and mobile health applications enable patients to manage chronic conditions from home while maintaining regular contact with healthcare providers. The aging population profile further amplifies demand for digital health interventions supporting elderly care, medication adherence, and early detection of health deterioration.

Expanding Digital Infrastructure and Technology Adoption

Vietnam's rapidly expanding digital infrastructure characterized by high smartphone penetration, growing 5G connectivity, and increasing internet access creates a favorable foundation for digital health adoption. The majority of internet users access online services through smartphones, reflecting widespread mobile device usage across the country. The young, tech-savvy population demonstrates rapid technology adoption patterns, embracing digital solutions across various sectors. The proliferation of affordable smartphones and mobile data services enables healthcare applications to reach broader population segments including those in previously underserved areas. Major telecommunications providers are investing in network infrastructure supporting high-bandwidth healthcare applications including video consultations and real-time patient monitoring. The convergence of technology accessibility, digital literacy improvements, and changing patient preferences toward convenient healthcare delivery creates sustainable momentum for digital health market expansion across urban and rural communities.

Market Restraints:

What Challenges the Vietnam Digital Health Market is Facing?

Inadequate Digital Infrastructure in Rural Areas

Despite significant progress in urban centers, Vietnam's rural regions continue to lag in digital health adoption due to underdeveloped telecommunications infrastructure and limited connectivity. A significant proportion of rural healthcare centers still face connectivity challenges, hindering the effective rollout of telemedicine and other digital health initiatives. This digital divide creates substantial barriers to equitable healthcare access for rural residents who could benefit most from remote healthcare services.

Data Privacy and Cybersecurity Concerns

The rapid digitization of Vietnam's healthcare sector has raised significant concerns regarding data privacy and cybersecurity protections for sensitive patient information. The current cybersecurity framework remains insufficient to address the increasing complexity of digital health systems and the growing volume of electronic health data. Healthcare providers and patients express reluctance to fully embrace digital health platforms without clear, transparent security protocols. Building trust in the safety and confidentiality of personal health data represents a critical requirement for achieving widespread digital health adoption.

Limited Digital Literacy Among Population Segments

Digital literacy levels vary considerably across Vietnam's population, creating challenges for uniform digital health adoption. Elderly populations and residents in remote areas often lack familiarity with smartphone applications and digital platforms required for accessing telehealth services and managing electronic health records. Healthcare workers at grassroots facilities may require extensive training to effectively utilize digital health technologies. Addressing these literacy gaps requires substantial investment in education programs, user-friendly platform design, and community-based digital skills development initiatives.

Competitive Landscape:

The Vietnam digital health market features a dynamic competitive environment comprising established domestic technology conglomerates, specialized healthcare technology startups, and international healthcare providers. Major state-owned telecommunications companies including Viettel Group, VNPT, and FPT Corporation have invested significantly in healthcare data management systems and artificial intelligence solutions. Private healthcare systems led by Vinmec and Hoan My Medical Corporation are pioneering digital adoption in diagnostics, telemedicine, and patient engagement platforms. Specialized digital health companies offer focused solutions spanning remote consultations, health record management, and chronic care coordination. International technology companies are also establishing presence through partnerships with domestic healthcare providers, bringing global expertise in health informatics, AI diagnostics, and cloud-based healthcare platforms.

Some of the key players include:

- eDoctor

- Med247

- MedLink

Vietnam Digital Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | eDoctor, Med247, MedLink, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam digital health market size was valued at USD 2.84 Billion in 2025.

The Vietnam digital health market is expected to grow at a compound annual growth rate of 14.39% from 2026-2034 to reach USD 9.52 Billion by 2034.

Telehealth dominated the market with a share of 28.04%, driven by the government's telemedicine infrastructure connecting hospitals nationwide and increasing adoption of virtual healthcare consultations among the population.

Key factors driving the Vietnam digital health market include substantial government investment in healthcare digitalization, rising prevalence of non-communicable diseases requiring continuous care management, and expanding digital infrastructure with high smartphone penetration.

Major challenges include inadequate digital infrastructure in rural healthcare centers, data privacy and cybersecurity concerns affecting patient trust, limited digital literacy among elderly and remote populations, and the need for substantial workforce training on digital health technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)