Vietnam Digital Video Content Market Size, Share, Trends and Forecast by Business Model, Type, Device, and Region, 2026-2034

Vietnam Digital Video Content Market Summary:

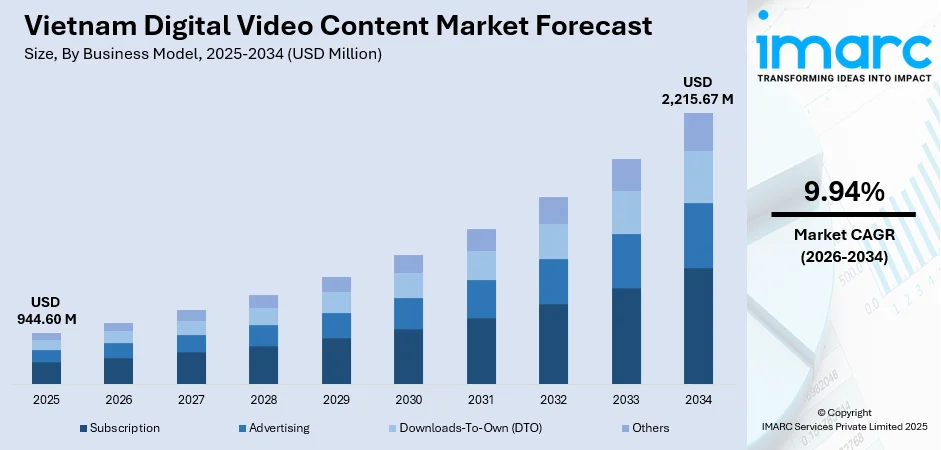

The Vietnam digital video content market size was valued at USD 944.60 Million in 2025 and is projected to reach USD 2,215.67 Million by 2034, growing at a compound annual growth rate of 9.94% during 2026-2034.

The Vietnam digital video content market is experiencing robust expansion driven by rising smartphone penetration, expanding internet infrastructure, and increasing consumer preference for on-demand entertainment. At the beginning of 2025, Vietnam had 79.8 Million internet users, with a 78.8% online penetration rate. Growing adoption of localized content, the proliferation of short-form video platforms, and the integration of video commerce are reshaping how Vietnamese consumers engage with digital media, strengthening the Vietnam digital video content market share.

Key Takeaways and Insights:

- By Business Model: Subscription dominates the market with a 57.14% revenue share in 2025, driven by consumer demand for ad-free viewing experiences, exclusive content access, and competitive pricing offered by both local and international streaming platforms.

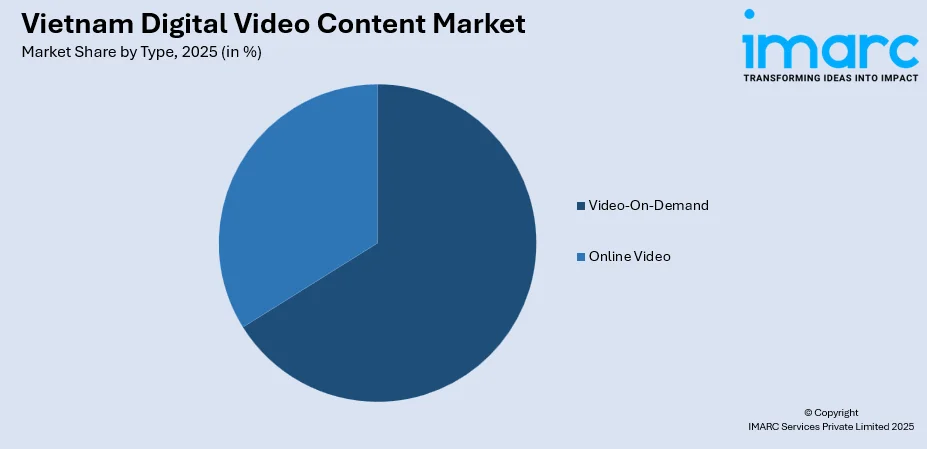

- By Type: Video-On-Demand (VOD) holds the largest share at 66.32% in 2025, owing to rising consumer preference for flexible, on-demand entertainment that allows viewers to watch content anytime and anywhere on their preferred devices.

- By Device: Mobile leads the market with 38.75% share in 2025, reflecting Vietnam's high smartphone penetration rate and the preference of young, tech-savvy consumers to stream video content on handheld devices.

- By Region: North Vietnam accounts for a share of 36.70% in 2025, owing to the rising middle class population and the overall expanding internet connectivity in the region.

- Key Players: The Vietnam digital video content market exhibits intensifying competition, with international streaming services competing alongside domestic platforms through content localization strategies, technology investments, strategic partnerships with telecommunications providers, and expansion of original Vietnamese-language programming.

To get more information on this market Request Sample

The Vietnam digital video content market is advancing rapidly as digital infrastructure modernizes and consumer habits shift from traditional television toward on-demand streaming services. On October 15, 2024, in Hanoi, Viettel Group officially launched the country's first 5G network, become the first business in Vietnam to formally offer 5G services. The deployment of 5G technology is expected to enhance streaming quality and enable seamless viewing experiences, particularly for mobile users. Vietnamese users spend an average of 120 minutes per day watching long-form content on OTT platforms, demonstrating strong engagement with digital video content. The growing integration of video commerce, influencer-driven content, and social media platforms is creating new consumption patterns that are accelerating the Vietnam digital video content market growth.

Vietnam Digital Video Content Market Trends:

Expansion of Video Commerce and Shoppertainment

The convergence of video content and e-commerce is transforming Vietnam's digital landscape, creating a powerful shoppertainment ecosystem. In October 2024, Vietnam became the sixth nation in the world to use YouTube Shopping when the platform was formally introduced there in October 2024. Livestream shopping and short-form video commerce are gaining momentum as consumers increasingly prefer interactive purchasing experiences. In a single year of introduction in Vietnam, YouTube Shopping recorded remarkable progress, with the time spent watching shopping-related content increasing by more than 500%. This trend is reshaping how brands engage audiences through video-driven retail strategies.

Rise of Local OTT Platforms and Original Content

Vietnamese streaming platforms are gaining significant traction by investing heavily in localized and original content production that reflects domestic culture, language, and storytelling traditions. Local platforms have emerged as formidable competitors to international services by offering culturally relevant programming that deeply resonates with Vietnamese audiences seeking authentic entertainment experiences. Domestic streaming providers are prioritizing exclusive Vietnamese dramas, variety shows, and web series that capture local sensibilities and viewing preferences. This strategic focus on homegrown content has enabled Vietnamese platforms to differentiate themselves in an increasingly competitive market, building strong viewer loyalty and driving sustained engagement among audiences who value seeing their own stories represented on screen.

Mobile-First Consumption and 5G Acceleration

Vietnam's digital video landscape is predominantly mobile-driven, with the recent 5G rollout expected to further accelerate consumption patterns. Mobile internet subscriptions in Vietnam surpassed 90% of the population for the first time, with 100.7 Million smartphone users among 120 Million mobile subscriptions. The enhanced connectivity enables higher-quality streaming on mobile devices, particularly benefiting young urban consumers. Viettel's 5G network reached 4 million subscribers within two months of launch, with average 5G users consuming approximately 21GB of data per month. This infrastructure expansion is creating optimal conditions for streaming services.

Market Outlook 2026-2034:

The Vietnam digital video content market is positioned for sustained expansion as digital infrastructure continues to modernize and consumer preferences increasingly favor on-demand entertainment. The market generated a revenue of USD 944.60 Million in 2025 and is projected to reach a revenue of USD 2,215.67 Million by 2034, growing at a compound annual growth rate of 9.94% from 2026-2034. The industry growth is driven by rising smartphone adoption, expanding 5G coverage, and growing investments in localized content production. The integration of video commerce, proliferation of short-form content platforms, and strategic partnerships between streaming services and telecommunications providers are expected to create new revenue streams and strengthen audience engagement across urban and rural markets.

Vietnam Digital Video Content Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Business Model | Subscription | 57.14% |

| Type | Video-On-Demand (VOD) | 66.32% |

| Device | Mobile | 38.75% |

| Region | Northern Vietnam | 36.70% |

Business Model Insights:

- Subscription

- Advertising

- Downloads-To-Own (DTO)

- Others

Subscription dominates with a market share of 57.14% of the total Vietnam digital video content market in 2025.

The subscription business model dominates Vietnam's digital video content market as consumers increasingly seek premium, ad-free viewing experiences with access to exclusive content libraries. In comparison to 2022, Vietnam's pay TV market grew by 4% in revenue and 14% in subscriptions. Major streaming platforms offer competitive pricing strategies and bundled packages with telecommunications services to attract and retain subscribers. OTT and IPTV have become mainstream, with their revenue share accelerating from just 11% in 2019 to 45% by end of 2023. The preference for uninterrupted viewing and premium content access continues to drive subscription model dominance.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Video-On-Demand

- Online Video

Video-On-Demand (VOD) leads with a share of 66.32% of the total Vietnam digital video content market in 2025.

The video-on-demand segment commands the largest market share as Vietnamese consumers increasingly prefer flexible content consumption that aligns with their schedules and viewing preferences. VOD platforms offer extensive libraries encompassing both local and international content, enabling viewers to access entertainment anytime and anywhere without the constraints of traditional broadcast schedules. Domestic subscription video-on-demand providers have emerged as formidable competitors, successfully challenging established international streaming services through superior localization strategies and culturally relevant programming. This pronounced shift toward on-demand viewing reflects evolving lifestyle preferences among Vietnamese audiences, particularly younger demographics who prioritize convenience, content variety, and the freedom to curate personalized entertainment experiences across multiple devices.

Device Insights:

- Laptop

- PC

- Mobile

- Others

Mobile exhibits a clear dominance with a 38.75% share of the total Vietnam digital video content market in 2025.

Mobile devices lead video content consumption in Vietnam due to high smartphone penetration and the strong preference of younger demographics for portable entertainment access. Vietnamese consumers demonstrate equal enthusiasm for mobile viewing as traditional television, with the majority of OTT viewers spending most of their streaming time on smartphones and tablets. The affordability of smartphones combined with widespread mobile data coverage and competitive data pricing have democratized streaming access across all demographic segments. Budget-friendly smartphone options from various manufacturers have expanded the consumer base significantly, while low data costs ensure that streaming remains accessible to price-sensitive users. The convenience of on-the-go entertainment and the proliferation of mobile-optimized streaming applications continue to drive sustained growth in mobile video consumption across urban and rural markets alike.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with 36.70% share of the total Vietnam digital video content market in 2025.

Northern Vietnam is anchored by the capital city of Hanoi, which benefits from significant governmental and corporate investment in digital infrastructure development. The region's growing middle class and expanding internet connectivity have fostered increasing adoption of video streaming services, particularly among younger urban demographics seeking on-demand entertainment options. Educational content and news-oriented video platforms also find strong audiences in this region due to its concentration of universities and government institutions.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Digital Video Content Market Growing?

Rising Internet and Smartphone Penetration

The expansion of digital infrastructure and affordable smartphone availability are fundamentally transforming video content consumption in Vietnam. Over 82% of Vietnamese homes now have fiber internet, while smartphone penetration among mobile users has climbed to nearly 89%. This widespread connectivity enables seamless streaming experiences across diverse demographics. The percentage of Vietnamese people using smartphones has increased to 84.4%, exceeding the global average of 63%, with the IT and telecommunications sector aiming for 100% smartphone penetration. The combination of affordable devices, competitive data pricing, and expanding network coverage has democratized access to digital video content. The number of mobile connections in Vietnam increased by 2.2 million between the start of 2024 and the beginning of 2025. This infrastructure development continues to fuel streaming adoption.

Growing Demand for Localized Content

Vietnamese audiences increasingly prefer digital video content that reflects their culture, language, and daily experiences, driving substantial investment in local production. Viewers demonstrate strong trust in content from local creators, showing significantly higher engagement with homegrown programming compared to imported alternatives. This cultural preference has prompted streaming platforms to prioritize Vietnamese-language programming and locally relevant storytelling that resonates with domestic sensibilities. Both domestic and international streaming services are responding by investing heavily in exclusive, locally produced content tailored for Vietnamese audiences. The success of original Vietnamese dramas, variety shows, and web series demonstrates strong audience appetite for authentic local narratives that capture the nuances of Vietnamese life. This trend is encouraging platforms across the market to expand their Vietnamese content libraries, partnering with local production houses and talent to develop programming that connects meaningfully with viewers seeking entertainment that speaks to their identity and experiences.

Expansion of 5G Network Infrastructure

The commercial launch of 5G services is creating transformative opportunities for high-quality video streaming and immersive content experiences. Within two weeks of the launch, Viettel attracted 3 million 5G users, reaching 4 million in late December 2024. The enhanced network speeds and reduced latency enable seamless streaming of high-definition and potentially 4K content on mobile devices. Viettel has installed over 6,500 base stations to provide 5G services to all 63 localities in Vietnam, with connection speeds of up to 1 Gbps. As 5G coverage expands and more compatible devices enter the market, the infrastructure upgrade is expected to significantly elevate streaming quality and consumer engagement.

Market Restraints:

What Challenges the Vietnam Digital Video Content Market is Facing?

Widespread Digital Piracy

Piracy remains a significant obstacle to sustainable market growth, with a substantial portion of Vietnamese consumers continuing to access unauthorized streaming platforms and illegal content websites. Despite government anti-piracy measures and enforcement efforts, the prevalence of free pirated content significantly reduces subscription revenues for legitimate streaming service providers. The cultural acceptance of free content consumption and the widespread availability of illegal streaming sites continue to undermine the commercial viability of licensed platforms and discourage investment in original content production.

Evolving Regulatory Compliance Requirements

The rapidly changing regulatory landscape for digital content and internet services creates operational complexities for streaming providers operating in Vietnam. New decrees and content regulations impose stringent requirements for content monitoring, user authentication, and data management that increase compliance costs and administrative burdens. Both domestic and international platforms must navigate evolving content licensing rules, censorship requirements, and data localization mandates, which can affect content availability and service delivery capabilities across the market.

Infrastructure Gaps in Rural Areas

Despite significant progress in expanding digital connectivity, infrastructure limitations in rural and remote regions continue to restrict market expansion potential. Many areas outside major urban centers experience intermittent internet access and inadequate network coverage that prevents seamless video streaming experiences. These connectivity challenges create geographic disparities in digital video content consumption and limit the addressable market size for platform providers seeking to expand beyond traditional urban strongholds into emerging rural audiences.

Competitive Landscape:

The Vietnam digital video content market features intensifying competition between established international streaming services and rapidly growing domestic platforms. Market participants differentiate through content localization strategies, exclusive original programming, and technology investments to enhance user experiences. Domestic platforms leverage deep understanding of local preferences and partnerships with telecommunications providers to expand subscriber bases. Strategic collaborations between streaming services and e-commerce platforms are creating new engagement opportunities through video commerce integration. Investment in content production capabilities, mobile optimization, and pricing strategies appropriate for Vietnamese consumers remains central to competitive positioning as platforms vie for market share.

Vietnam Digital Video Content Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Subscription, Advertising, Downloads-To-Own (DTO), Others |

| Types Covered | Video-On-Demand, Online Video |

| Devices Covered | Laptop, PC, Mobile, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam digital video content market size was valued at USD 944.60 Million in 2025.

The Vietnam digital video content market is expected to grow at a compound annual growth rate of 9.94% from 2026-2034 to reach USD 2,215.67 Million by 2034.

Subscription holds the largest revenue share at 57.14%, driven by strong consumer preference for ad-free viewing experiences, exclusive content access, competitive pricing strategies, and bundled offerings from streaming platforms partnered with telecommunications providers.

Key factors driving the Vietnam digital video content market include rising smartphone penetration, expanding internet and 5G infrastructure, growing demand for localized content, increasing adoption of video commerce, proliferation of short-form content platforms, and strategic partnerships between streaming services and telecom providers.

Major challenges include widespread digital piracy reducing legitimate platform revenues, evolving regulatory compliance requirements, limited rural infrastructure coverage, competition from free ad-supported platforms, and the need for continuous investment in original local content production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)