Vietnam Food Intolerance Products Market Size, Share, Trends and Forecast by Type, Product Type, Distribution Channel, and Region, 2026-2034

Vietnam Food Intolerance Products Market Summary:

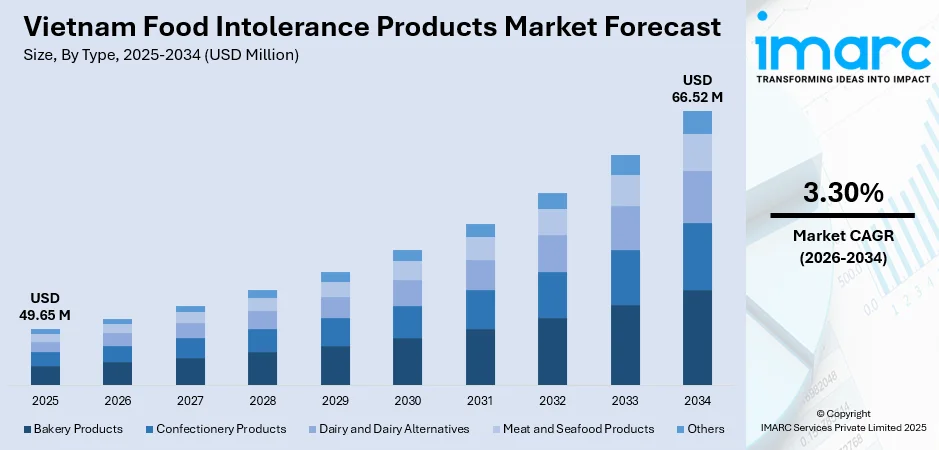

The Vietnam food intolerance products market size was valued at USD 49.65 Million in 2025 and is projected to reach USD 66.52 Million by 2034, growing at a compound annual growth rate of 3.30% from 2026-2034.

The market growth is mainly propelled by rising health consciousness among Vietnamese consumers, increasing prevalence of digestive disorders including lactose intolerance and gluten sensitivity, and growing awareness of food-related health conditions. The escalating number of middle class with higher disposable incomes is fueling demand for specialized dietary products, while modernization of retail infrastructure enhances product accessibility across urban and rural markets. The convergence of demographic shifts, evolving dietary preferences, and expanded distribution channels is fundamentally reshaping the competitive landscape and creating substantial growth opportunities for market participants across the Vietnam food intolerance products market share.

Key Takeaways and Insights:

- By Type: Bakery products dominate the market with a share of 30% in 2025, driven by increasing demand for allergen-free bread, cookies, and pastries among health-conscious consumers seeking convenient dietary alternatives.

- By Product Type: Gluten-free food leads the market with a share of 35% in 2025, owing to rising awareness of celiac disease and gluten sensitivity, particularly among urban populations embracing wellness-oriented lifestyles.

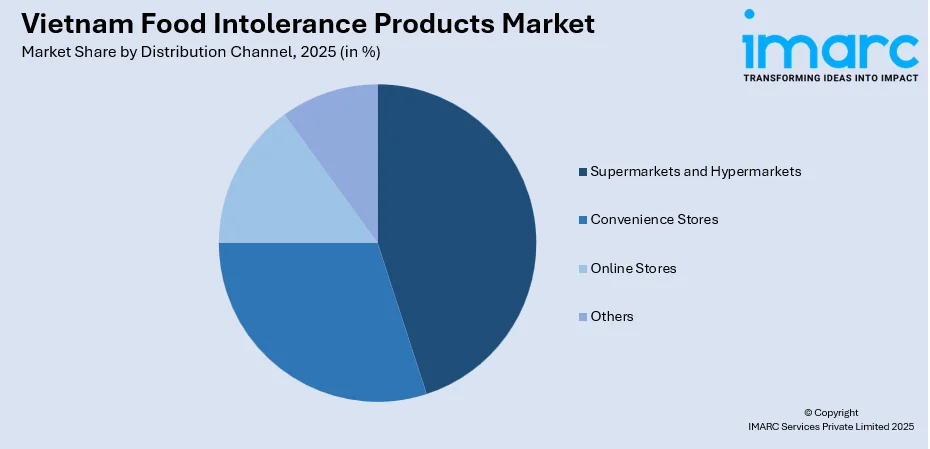

- By Distribution Channel: Supermarkets and Hypermarkets represent the largest segment with a market share of 45% in 2025, supported by extensive retail networks, product variety, and consumer trust in organized retail environments.

- Key Players: The Vietnam food intolerance products market exhibits moderate competitive intensity, with multinational food corporations competing alongside regional manufacturers. Major participants, alongside international specialty brands offering gluten-free and lactose-free product portfolios. Companies compete through product innovation, strategic distribution partnerships, and targeted marketing campaigns addressing consumer health concerns.

To get more information on this market, Request Sample

Vietnam's food intolerance products market represents a rapidly evolving segment in the wider health and wellness food industry, driven by fundamental shifts in consumer awareness and dietary preferences. Research indicates that Vietnamese adults exhibit high prevalence of lactose malabsorption, consistent with patterns observed across Asian populations traditionally characterized by non-dairy dietary traditions. This biological predisposition, combined with increasing diagnostic awareness and healthcare access, has catalyzed demand for lactose-free dairy alternatives and digestive-friendly food products. The market has witnessed notable expansion in product availability, with specialty retailers and organized retail chains increasingly dedicating shelf space to food intolerance products. Urban centers, particularly Ho Chi Minh City and Hanoi, serve as primary consumption hubs, benefiting from higher income levels, modern retail penetration, and greater exposure to global health trends.

Vietnam Food Intolerance Products Market Trends:

Rising Health Consciousness Driving Premium Product Demand

Vietnamese consumers are demonstrating unprecedented levels of health consciousness and dietary awareness, fundamentally transforming their approach to food consumption and driving substantial demand for food intolerance products. This behavioral shift encompasses increased understanding of food sensitivities, with consumers actively seeking products aligned with specific dietary requirements. In August 2025, a new low-sugar version of its flagship product, Vietngucoc Nutritional Cereal Milk, has been released by Thanh Anh, a well-known brand in Vietnam's plant-based beverage market. This introduction caters to the growing customer demand for healthier, lower-sugar alternatives in the functional plant-based beverage category. This reflects the broader Vietnam food intolerance products market growth and manufacturer response to evolving consumer preferences.

Expansion of Modern Retail and E-commerce Channels

The modernization of Vietnam's retail infrastructure is dramatically enhancing accessibility of food intolerance products across diverse consumer segments. Modern trade, encompassing supermarkets, hypermarkets, and convenience stores, has expanded significantly, accounting for increased retail sales as organized retail formats proliferate in urban and suburban areas. E-commerce platforms have emerged as critical distribution channels, with online grocery sales experiencing substantial growth and enabling consumers to access niche dietary products regardless of geographic location. Major retailers including WinMart, AEON, and Saigon Co-op are expanding dedicated health food sections, while platforms like Shopee and Lazada facilitate nationwide distribution of specialty dietary products.

Product Innovation and Clean Label Movement

Manufacturers operating within Vietnam's food intolerance products market are increasingly focusing on product innovation to address evolving consumer expectations for transparency and nutritional integrity. The clean label movement, characterized by demand for minimal processing and recognizable ingredients, is reshaping product formulation strategies across gluten-free, lactose-free, and allergen-free categories. Companies are investing in research and development to enhance taste profiles and nutritional content while eliminating common allergens, addressing historical consumer concerns regarding palatability of specialty dietary products.

Market Outlook 2026-2034:

The Vietnam food intolerance products market demonstrates sustained growth potential throughout the forecast period, underpinned by irreversible demographic trends, expanding health awareness, and evolving retail infrastructure. The market generated a revenue of USD 49.65 Million in 2025 and is projected to reach a revenue of USD 66.52 Million by 2034, growing at a compound annual growth rate of 3.30% from 2026-2034. The market trajectory reflects steady maturation as consumer awareness increases, product availability expands, and dietary intolerance diagnosis rates improve. Vietnam's robust economic growth, with GDP expanding by over seven percent in recent years, continues to strengthen consumer purchasing power for premium health-oriented food products.

Vietnam Food Intolerance Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bakery Products | 30% |

| Product Type | Gluten-free Food | 35% |

| Distribution Channel | Supermarkets and Hypermarkets | 45% |

Type Insights:

- Bakery Products

- Confectionery Products

- Dairy and Dairy Alternatives

- Meat and Seafood Products

- Others

The bakery products segment dominates the Vietnam food intolerance products market with a share of 30% in 2025.

Bakery products represent the leading segment within Vietnam's food intolerance products market, driven by increasing consumer demand for gluten-free bread, cookies, pastries, and breakfast items. The segment's prominence reflects broader trends in the Vietnamese bakery industry where health-conscious consumption patterns are accelerating demand for artisanal and organic bakery products. Local bakeries are expanding their offerings to include organic sourdoughs and gluten-free breads, gaining traction among consumers seeking convenient dietary alternatives. The reduction in import tariffs on key ingredients like wheat alternatives through Vietnam's strategic trade agreements is enhancing the capability of local bakeries to produce diverse and premium gluten-free products, supporting segment growth.

Product Type Insights:

- Diabetes-free Food

- Gluten-free Food

- Lactose-free Food

- Others

The gluten-free food segment leads the market with a share of 35% of the total Vietnam food intolerance products market in 2025.

Gluten-free food products have emerged as the dominant product type within Vietnam's food intolerance products market, reflecting rising awareness of celiac disease and gluten sensitivity among Vietnamese consumers. In Vietnam, traditional cuisine offers inherent advantages for gluten-free consumption, as rice-based dishes and rice noodles naturally avoid gluten content. However, urbanization and adoption of Western dietary patterns have increased exposure to gluten-containing foods, driving demand for dedicated gluten-free alternatives. Specialty retailers like Annam Gourmet in Ho Chi Minh City and Hanoi have expanded certified gluten-free product offerings, while consumers increasingly seek products with transparent labeling and international certifications.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The supermarkets and hypermarkets segment accounts for the largest share of 45% of the total Vietnam food intolerance products market in 2025.

Supermarkets and hypermarkets have established dominance within Vietnam's food intolerance products distribution landscape, benefiting from extensive retail networks, consumer trust in organized retail environments, and superior product assortment capabilities. Vietnam's retail market has witnessed significant expansion of modern trade formats, with chains including WinMart, AEON, Big C, and Saigon Co-op expanding their footprint across urban and suburban markets. These retailers provide dedicated health food sections offering comprehensive selections of gluten-free, lactose-free, and allergen-free products from both domestic and international brands. The segment's strength is reinforced by consumer preferences for one-stop shopping experiences, promotional activities, and the assurance of product authenticity and quality standards associated with organized retail.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, anchored by capital city Hanoi, represents a significant market for food intolerance products driven by manufacturing clusters and proximity to cross-border supply routes. The region benefits from substantial retail penetration and brand presence, with international retailers including AEON and Fujimart expanding store networks. Northern consumers demonstrate growing health consciousness, with traditional cuisine featuring wheat-based elements creating demand for gluten-free alternatives. The region's expanding middle class and improving retail infrastructure support market development.

Central Vietnam, encompassing coastal cities including Da Nang and Nha Trang, emerges as a growing market for food intolerance products supported by tourism-led dining and hospitality demand. The region's expanding tourism sector, attracting both domestic and international visitors, drives demand for dietary accommodation options across hotels and restaurants. Urbanization in provincial cities is accelerating modern retail development, enhancing product accessibility. The region's strategic location and improving transportation infrastructure facilitate distribution network expansion.

Southern Vietnam, led by Ho Chi Minh City and surrounding industrial corridors, dominates the food intolerance products market supported by population density, higher disposable incomes, and superior logistics infrastructure. The region accounts for the largest market share, benefiting from faster rollout of modern trade and foodservice networks. Ho Chi Minh City serves as the primary consumption hub, hosting major retail chains, specialty grocery stores, and e-commerce distribution centers. The region attracts significant foreign investment in food processing and distribution facilities.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Food Intolerance Products Market Growing?

Rising Prevalence and Awareness of Digestive Disorders

Vietnam is experiencing significant growth in the diagnosis and awareness of food intolerance conditions, fundamentally reshaping consumer demand for specialized dietary products. Research indicates that Vietnamese adults exhibit high prevalence of lactose malabsorption, consistent with patterns observed across Asian populations characterized by traditional non-dairy dietary cultures. This biological predisposition, combined with increasing healthcare access and diagnostic capabilities, has catalyzed demand for lactose-free dairy alternatives and digestive-friendly food products. The Ministry of Health's National Nutrition Strategy emphasizes the importance of dietary supplements and specialized foods in preventing malnutrition and addressing digestive health concerns, providing policy support for market development. Healthcare professionals are increasingly recommending dietary modifications for patients presenting with digestive symptoms, driving consumer awareness and product adoption.

Expanding Middle Class and Rising Disposable Incomes

Vietnam's robust economic growth is creating favorable conditions for premium food product consumption, with the expanding middle class demonstrating increased willingness to invest in health-oriented dietary solutions. Vietnam's GDP expanded by over seven percent in 2024, reflecting strong economic recovery and improving living standards that directly support retail spending on specialized food categories. The growing segment of health-conscious consumers with higher purchasing power is driving demand for premium, imported, and specialty food intolerance products that were previously inaccessible to broader population segments. Urban consumers in Ho Chi Minh City and Hanoi demonstrate particularly strong propensity for premium product adoption, influenced by exposure to global health trends and access to modern retail formats. Rising income levels enable consumer trade-up from basic dietary modifications to branded, certified food intolerance products.

Modernization of Retail Infrastructure and Distribution Networks

The transformation of Vietnam's retail landscape is dramatically enhancing accessibility and visibility of food intolerance products across diverse consumer segments and geographic locations. Modern trade formats have expanded significantly, with the number of supermarkets, hypermarkets, and convenience stores proliferating across urban and suburban areas. Major retail chains are dedicating increased shelf space to health food categories, creating organized product displays that facilitate consumer discovery and education. E-commerce platforms have emerged as critical distribution channels, enabling nationwide access to specialty dietary products regardless of local retail availability. The development of cold-chain logistics infrastructure supports distribution of temperature-sensitive dairy alternatives and fresh food intolerance products, expanding addressable market scope.

Market Restraints:

What Challenges the Vietnam Food Intolerance Products Market is Facing?

Premium Pricing Limiting Market Penetration

Cost barriers represent a fundamental challenge constraining broader adoption of food intolerance products among price-sensitive Vietnamese consumers, particularly those in lower and middle-income segments. Specialty dietary products typically command premium prices compared to conventional alternatives, limiting accessibility for consumers who would benefit from dietary modifications but cannot justify the incremental expenditure within household budgets.

Limited Consumer Education and Diagnostic Awareness

Inadequate understanding of food intolerance conditions and their dietary management continues to impede market development by preventing consumer recognition of symptoms and appropriate product selection. Many Vietnamese consumers experiencing digestive discomfort remain undiagnosed or unaware of the connection between their symptoms and specific food intolerances, resulting in underutilization of available specialty products.

Taste and Texture Perception Challenges

Consumer perceptions regarding the palatability of food intolerance products present ongoing challenges for market acceptance and repeat purchase behavior. Historical associations between specialty dietary products and compromised taste or texture profiles create adoption barriers among consumers reluctant to sacrifice sensory experience for health benefits, requiring manufacturers to invest significantly in product reformulation.

Competitive Landscape:

The Vietnam food intolerance products market exhibits moderate competitive intensity characterized by the presence of multinational food corporations alongside regional manufacturers competing across product categories and distribution channels. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing advanced formulation and international certifications to value-oriented products targeting cost-conscious consumers seeking basic dietary alternatives. The competitive landscape is increasingly shaped by product innovation initiatives, e-commerce capabilities, and brand marketing effectiveness in addressing consumer education needs and reducing adoption barriers. Domestic players leverage local market knowledge and distribution relationships, while international brands contribute advanced product technologies and brand recognition. Strategic partnerships between food manufacturers and retail chains are emerging as key competitive differentiators.

Recent Developments:

- In May 2025, Nestlé Vietnam launched MILO A2, an upgraded version featuring easily digestible A2 protein combined with whole grain barley, specifically targeting lactose-intolerant consumers and active individuals seeking energy-boosting options with improved digestive comfort.

Vietnam Food Intolerance Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bakery Products, Confectionery Products, Dairy and Dairy Alternatives, Meat and Seafood Products, Others |

| Product Types Covered | Diabetes-Free Food, Gluten-Free Food, Lactose-Free Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam food intolerance products market size was valued at USD 49.65 Million in 2025.

The Vietnam food intolerance products market is expected to grow at a compound annual growth rate of 3.30% from 2026-2034 to reach USD 66.52 Million by 2034.

The gluten-free food segment accounted for the largest revenue share of 35% in 2025, driven by rising awareness of celiac disease and gluten sensitivity, particularly among urban populations embracing wellness-oriented lifestyles and seeking products with transparent labeling.

Key factors driving the Vietnam food intolerance products market include rising prevalence and awareness of digestive disorders among Vietnamese consumers, expanding middle class with higher disposable incomes enabling premium product adoption, and modernization of retail infrastructure enhancing product accessibility across urban and rural markets.

Major challenges include premium pricing limiting market penetration among price-sensitive consumers, limited consumer education regarding food intolerance conditions and dietary management, taste and texture perception challenges affecting product acceptance, and insufficient diagnostic awareness preventing symptom recognition and appropriate product adoption

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)