Vietnam Frozen Food Market Size, Share, Trends and Forecast by Product and Region, 2026-2034

Vietnam Frozen Food Market Size and Share:

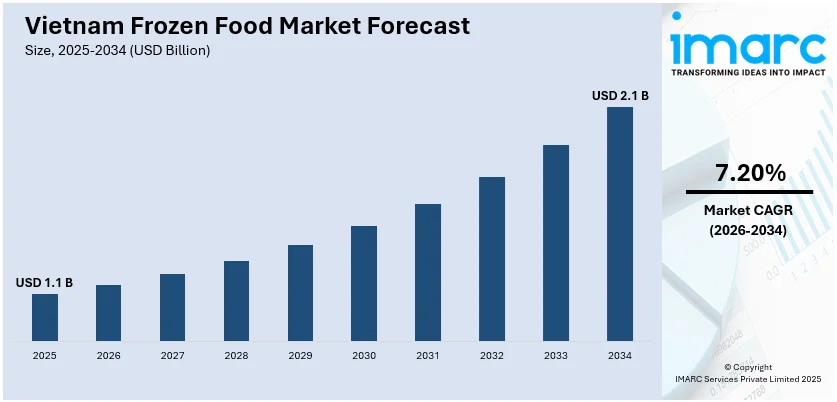

The Vietnam frozen food market size was valued at USD 1.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.1 Billion by 2034, exhibiting a CAGR of 7.20% from 2026-2034. The demand is fueled by urbanization, hectic lifestyles, and growing health consciousness, generating more demand for convenient and healthy frozen foods. Improvements in freezing technology and the growth of internet-based platforms have increased the accessibility of frozen food. Rising retail networks and changing consumer tastes are compelling businesses to innovate and diversify. Strategic visibility and brand distribution efforts are further defining competition, leading to the consistent boost of the Vietnam frozen food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.1 Billion |

|

Market Forecast in 2034

|

USD 2.1 Billion |

| Market Growth Rate 2026-2034 | 7.20% |

Urbanization and widening of the middle class are playing a big role in stimulating growth of the frozen food market in Vietnam. With increasing numbers of people moving to urban locations, there is a significant rise in the need for quick and convenient food options that can fit busier lifestyles and shrinking cooking time. City residents, particularly working professionals and students, frequently desire ready-to-cook or heat-and-serve foods that are both quick and consistent. Furthermore, an expanding middle-income group is facilitating a change in eating habits, with increased receptivity to new food groups, such as frozen foods. This population shift is complementing higher demand for diversified and value-added frozen foods, including snacks, seafood, vegetables, and ready meals. For example, in May 2024, Vietnam's Mekong Delta Gourmet reinforced the frozen food industry by embracing OctoFrost's IQF technology, improving the efficiency and quality of tropical fruit freezing close to Ho Chi Minh City. Moreover, heightening numbers of dual-income households are further broadening the demand since time-pressured consumers value offerings that offer convenience without loss of taste or quality. Conjointly, urbanization and amplified incomes are transforming buying habits and leading to deeper market penetration of frozen food throughout Vietnam.

To get more information on this market Request Sample

Vietnam's growing retail infrastructure is also a strong force behind the expansion of frozen food markets. Expanding modern trade formats like supermarkets, hypermarkets, and convenience stores has improved consumers' access to a wide variety of frozen products. These channels normally have advanced cold chain infrastructure, maintaining uniform temperature levels and protecting products. For instance, in June 2024, Vietnam's cold chain logistics industry is growing rapidly, solidly backing the frozen food industry amidst growing domestic demand, exports, and shifting retail and e-commerce channels. Furthermore, with the outreach of retail chains to suburban and rural areas from the traditional metropolitan zones, frozen foods are made widely accessible to consumers. Point-of-purchase promotions, better merchandising, and more product exposure are also contributing toward educating consumers and stimulating trial purchases. Additionally, the incorporation of technology in-store, including digital signage and intelligent freezers which improves the shopping experience and encourages greater interaction with frozen items. This burgeoning and more advanced retail environment not only amplify volume sales but also facilitates brand diversification and competitiveness within the market. Finally, the development of Vietnam's retail environment is key to maintaining the momentum of frozen food penetration.

Vietnam Frozen Food Market Trends:

Increasing Demand for Easy-to-Use and Health-Oriented Frozen Meal Options

The frozen food market in Vietnam is experiencing tremendous growth as customers increasingly demand convenience and nutrition. Busy lifestyles, particularly in cities, are making people look for convenient meal options that are easy to prepare but are also nutritious. This has resulted in a rapid increase in the demand for frozen food items that are both convenient and healthy. The market is reacting with an increasing variety of premium and health-oriented frozen products, which are of special interest to health-aware consumers. As a notable example, consumers in the Mekong Delta area are at the forefront of this trend, with 55% of weekly health-related expenditures. In addition, reports show that consumers pay on average VND 1.38 million per month on health-related products and services. This trend reflects a general move toward wellness-oriented consumption. The need for frozen meals compatible with dietary objectives and lifestyle wishes keeps increasing, further solidifying the Vietnam frozen food market growth transition towards convenient but health-focused solutions.

Innovative Advances and Digital Accessibility Revolutionizing the Market

Advancements in technology in freezing and packaging are at the forefront of increasing the attractiveness and sustainability of frozen food in Vietnam. These breakthroughs are enhancing shelf life, maintaining nutritional value, and minimizing food waste—top of mind for today's shoppers and suppliers. Better packaging not only retains product freshness but also aids more sustainable consumption by limiting spoilage. Concurrently, the integration of online commerce is transforming distribution channels. With close to 725,000 organizations and individuals selling on e-commerce platforms, with total transaction values of over USD 2.94 billion, digital access is bringing frozen foods closer than ever. Consumers are able to explore a vast range of frozen products online easily and have them delivered to their doorsteps, increasing Vietnam frozen food market forecast reach and convenience. This unified coming together of enhanced technology and online platforms is transforming consumer buying habits, making possible amplified product variety and solidifying the position of frozen food within contemporary eating patterns.

Plant-Based and Sustainability Innovation at the Forefront of Change

Sustainability is emerging as the pillar of Vietnam's frozen food industry as manufacturers respond to more environmentally aware consumer demands. Businesses are adopting sustainable measures like local manufacturing to lower food miles and carbon footprints, and reducing packaging waste with recyclable or biodegradable materials. All these are bringing operations in line with international environmental standards and consumer ethics. There is also a significant increase in demand for plant-based and vegetarian frozen foods due to ethical reasons and the heightening popularity of the flexitarian and vegan lifestyle. In accordance with industry research, more than 90% of Vietnamese consumers are demonstrating intensified interest in plant-based options. This trend is driving the innovation in products, as companies are providing more varied meat-free and dairy-free frozen products to suit changing tastes. With ethical consumption and sustainability increasingly becoming key considerations for consumers when making purchases, eco-friendly and plant-based frozen foods are set to play an increasingly dominant role in the Vietnam frozen food market outlook.

Vietnam Frozen Food Industry Segmentation:

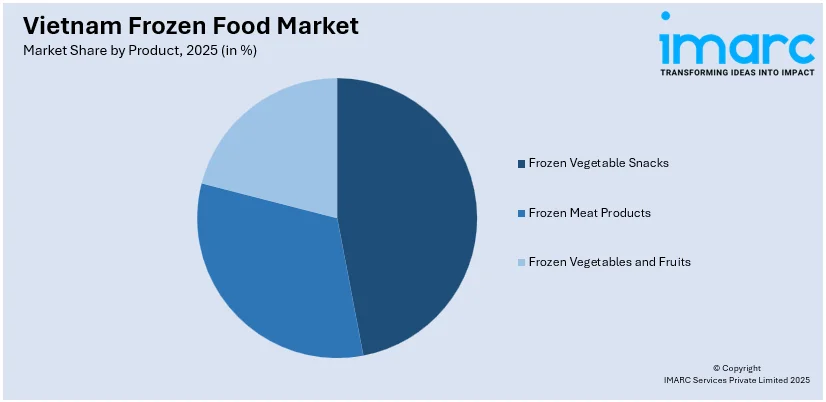

IMARC Group provides an analysis of the key trends in each segment of the Vietnam frozen food market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product.

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Frozen Vegetable Snacks

- French Fries

- Bites, Wedges and Smileys

- Aloo Tikki

- Nuggets

- Others

- Frozen Meat Products

- Chicken

- Fish

- Pork

- Mutton

- Others

- Frozen Vegetables and Fruits

- Frozen Vegetables

- Green Peas

- Corn

- Mixed Vegetables

- Carrot

- Cauliflower

- Others

- Frozen Fruits

- Strawberries

- Berries (Raspberries, Blueberries and Blackberries)

- Cherries

- Others

- Frozen Vegetables

Frozen vegetable snacks market addresses convenience- and health-seeking consumers with products such as spring rolls, vegetable patties, and dumplings. These foods are favored for ease of preparation and ease of use for busy lifestyles. Their popularity is increasing among urban populations and the young urban population looking for plant-based, easy-cook types of foods with regional taste and short cooking time.

Frozen meat products continue to be household favorites in Vietnam because of their convenience and extended shelf life. The category consists of foods like chicken cuts, pork, seafood, and processed meat. The demand is fueled by uniform quality, storage convenience, and increasing protein intake. Growth in modern retail and food service markets underpins greater market penetration.

Convenient, healthy, and accessible all year-round, frozen fruits and vegetables are growing in popularity among time-pressed busy consumers seeking healthy eating. These products maintain their freshness using sophisticated freezing processes and fulfill a broad spectrum of cooking requirements. Enhanced awareness of food safety and less wastage further enhance their popularity throughout Vietnam.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, including Hanoi and surrounding provinces, shows rising demand for frozen foods due to increasing urbanization and modern retail development. The region's colder climate also supports stronger storage and distribution logistics. Consumers are embracing frozen options for convenience, with a preference for traditional and ready-to-cook meals suited to local tastes.

In Central Vietnam, the market is slowly developing, boosted by increasing urban cities and tourism activities. Smaller in population but a city like Da Nang is also experiencing penetration for retail and evolving consumer behavior. Frozen meat products and seafood are especially sought after, taking advantage of better cold chain facilities and rising incomes in this part of the country.

The Southern Vietnam market, dominated by Ho Chi Minh City, is the biggest and most vibrant frozen food market. Demands are fueled by high urbanization, fast-paced lifestyles, and a prosperous foodservice sector. The region is the leader in product assortment, retail penetration, and use of online groceries and hence contributes significantly to national frozen food consumption and expansion.

Competitive Landscape:

The Vietnam frozen food market industry is defined by both local and foreign players competing in several product categories. The competitors are differentiating themselves through innovation in the products, centering on providing a wider range of offerings that meet changing consumer tastes, including regional taste profiles, portion-controlled packaging, and richer nutritional profiles. The competitive landscape is also influenced by investment in cold chain logistics and storage facilities to ensure product quality and safety. Moreover, price positioning continues as a key strategy, with an effective segmentation between affordable products and premium products addressing health-oriented or quality-driven consumers. Domestic producers use the comfort of familiarity with regional tastes to ensure customer loyalty, while foreign entrants contribute technical capabilities and scale benefits. Promotions on the internet and the retail alliances augment further the competition. Consequently, the situation is ever-changing with players constantly revising their product offerings, marketing strategy, and distribution channels in order to maintain or expand their share of the market.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam frozen food market with detailed profiles of all major companies, including:

- Daiphat Food

- Dalat Natural Food JSC

- Ky Phong Agro Seafood Co. Ltd.

- L&H Food Co. Ltd.

- Minh Huy Foods

- Viet Asia Foods

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- March 2025: JBS announced plans to invest USD 100 million in two meat plants in Vietnam, producing beef, pork, and poultry products, primarily using raw materials from Brazil. The facilities will also focus on frozen meat production, with one site in Hải Phòng and another in southern Vietnam, creating 500 jobs.

- February 2025: Willcom, a seafood trading company, and Sanyo Foods, a frozen food manufacturer, announced that they would launch a joint venture to produce frozen shucked oysters in Vietnam. Leveraging Vietnam's year-round oyster, they aim to produce 100 metric tons annually.

- September 2024: Nutifood acquired a 51% majority stake in KIDO Foods, a Vietnamese ice cream producer. This acquisition strengthens Nutifood’s position in the frozen foods market, leveraging KIDO's extensive distribution network, which includes key brands like Merino and Celano, to drive expansion.

- September 2024: Nisshin Seifun Welna entered Vietnam's ready-made food market, launching sauces and premix products tailored to local tastes. The company aims to leverage its production facilities in Vietnam, Japan, and Thailand, expanding its frozen food line, including meat products, to cater to the growing demand for convenient cooking solutions.

- May 2024: Vedan Vietnam launched a new frozen food line featuring global delicacies made with local ingredients. Products include Vedan Sichuan Sauerkraut Fish, Golden Fish Balls, Taiwanese Moon Cuttle Shrimp Cakes, Japanese Takoyaki, and Korean Pancakes.

Vietnam Frozen Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Daiphat Food, Dalat Natural Food JSC, Ky Phong Agro Seafood Co. Ltd., L&H Food CO. LTD., Minh Huy Foods, Viet Asia Foods, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam frozen food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam frozen food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam frozen food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frozen food market in the Vietnam was valued at USD 1.1 Billion in 2025.

The Vietnam frozen food market is projected to exhibit a CAGR of 7.20% during 2026-2034, reaching a value of USD 2.1 Billion by 2034.

Key drivers of the Vietnam frozen foods market are increasing urbanization, hectic lives, and health awareness, which raise demand for easy, healthy meals. Technological improvements in freezing technology as well as accelerating e-commerce channels enhance product accessibility. Moreover, the evolution of new retail infrastructure and rising disposable incomes facilitate higher adoption of varied frozen foods throughout the nation.

Some of the major players in the Vietnam frozen food market include Daiphat Food, Dalat Natural Food JSC, Ky Phong Agro Seafood Co. Ltd., L&H Food CO. LTD., Minh Huy Foods, Viet Asia Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)