Vietnam Home Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Vietnam Home Furniture Market Size and Share:

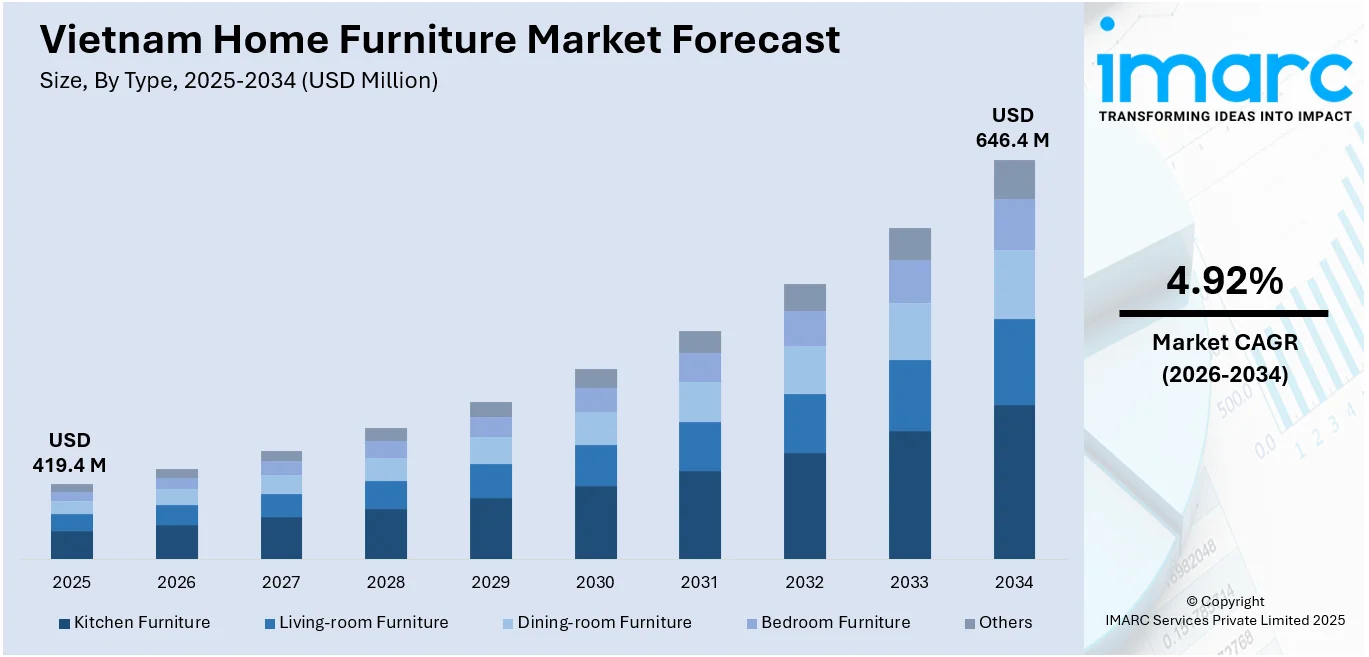

The Vietnam home furniture market size was valued at USD 419.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 646.4 Million by 2034, exhibiting a CAGR of 4.92% from 2026-2034. The market is fueled by factors such as rapid urbanization, a rising middle class, and inflating disposable incomes. The increasing demand for stylish and functional furniture, coupled with changing user preferences towards modern designs, is also strengthening the market growth. Additionally, the growth of e-commerce platforms, rising interest in eco-friendly products, and increased investment in residential developments are expanding the Vietnam home furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 419.4 Million |

| Market Forecast in 2034 | USD 646.4 Million |

| Market Growth Rate 2026-2034 | 4.92% |

As an increasing number of individuals relocate from rural regions to cities in Vietnam, especially to urban areas such as Hanoi and Ho Chi Minh City, the need for housing and home decor rises. These regions face swift population growth, resulting in more people residing in compact apartments and houses that need functional furniture options. City dwellers seek space-saving, aesthetically pleasing, and practical furniture that meets their requirements, increasing the demand for different kinds of home décor. Additionally, the growth of the real estate sector, especially in residential building, is vital for boosting furniture sales. With the construction of new residential complexes, housing developments, and apartments driven by population growth and urbanization, there is a need to equip these spaces. Numerous new homeowners or renters seek furniture that suits their space, aligns with contemporary design trends, and offers comfort, leading to heightened demand in the furniture industry.

To get more information on this market Request Sample

Apart from this, e-commerce platforms are simplifying the process for buyers to purchase home furniture conveniently from their residences. E-commerce enables shoppers to explore an extensive range of styles, brands, and prices, evaluate products, read feedback, and complete transactions without entering brick-and-mortar stores. Online marketing and social media significantly impact buyer choices, as companies employ targeted advertisements to connect with prospective clients. Furthermore, the growing awareness about environmental is influencing buying choices, driving the need for furniture crafted from eco-friendly materials, like reclaimed wood or safe finishes. Brands that emphasize sustainability and environment-friendly production methods are becoming more popular. This trend is fostering innovation in the industry, as manufacturers prioritize the development of durable and eco-friendly products, appealing to individuals seeking to make mindful decisions

Vietnam Home Furniture Market Trends:

Rising Disposable Incomes

Increasing disposable incomes in Vietnam are supporting the home furniture market growth, as buyers now possess enhanced purchasing power to spend on stylish and visually appealing furniture. As people and households attain greater income levels, they are becoming more motivated to improve their living conditions and interior spaces. As reported by Euromonitor, Vietnam was positioned 12th in the Asia Pacific region in 2023 for average gross income, with per capita disposable income rising by 4.1%. This increase in disposable income is enabling people to pursue premium, fashionable furniture that aligns with their evolving tastes for comfort and aesthetics. With the growth of the middle class, an increasing number of individuals are eager to invest in high-quality furnishings, which boosts the market demand. As a result, the Vietnam home furniture market forecast shows continued growth driven by these economic trends and shifting user priorities.

Rapid Urbanization and Growing Middle-Class Population

The growth of the Vietnam home furniture market is supported by elements such as swift urbanization and a rising middle class. With more individuals relocating to cities, there is a higher need for furniture that suits compact, contemporary living environments. As reported by DataReportal, 39.8% of Vietnam's population resided in urban regions in 2024, and this figure is projected to increase notably, exceeding 50% by 2030. This transition is a component of the nation's larger urbanization strategy, which aims for a more urban society by 2050. The growing middle class, strengthened by higher disposable incomes, is catalyzing the demand for trendy, durable, and practical home furnishings. With an increasing number of families aiming to design cozy and visually appealing homes, the home furniture market is growing to meet these changing user demands, positioning it as one of the most rapidly expanding sectors of Vietnam’s economy.

Increasing Demand for Sustainable Furniture

The growing about sustainability is a key factor offering a favorable Vietnam home furniture market outlook. Shoppers are becoming more aware about their environmental footprint, leading to a movement towards sustainable and eco-friendly furniture choices. This shift corresponds with an increasing desire for eco-friendly products. NielsenIQ's 2024 research in Vietnam indicates that 16% of individuals are focused on sustainable futures over the long haul, while 24% emphasize short-term sustainable lifestyles. This change is influencing buying choices, as shoppers increasingly look for furniture created from renewable resources or made through sustainable methods. As a result, producers are progressively embracing sustainable methods to satisfy buyer needs. The growing interest in sustainability is influencing the furniture market in Vietnam, as more companies focus on eco-friendly designs, recycling, and minimizing their carbon footprint to appeal to environmentally-aware individuals.

Vietnam Home Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam home furniture market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Kitchen Furniture

- Living-room Furniture

- Dining-room Furniture

- Bedroom Furniture

- Others

Kitchen furniture segment is expanding because of the rising need for space-saving and contemporary styles. As living spaces in cities shrink, buyers are focusing on modular and multifunctional kitchen furnishings that optimize storage and improve usability. The increasing popularity of cooking at home and the rise in middle-class earnings also drive the need for both fashionable and functional kitchen designs.

Living-room furniture constitutes a substantial portion of the market as it mirrors user inclinations towards comfort and aesthetics. As the emphasis on interior design rises, there is an increase in need for premium sofas, coffee tables, and entertainment centers. The move toward modern and minimalist styles, along with the incorporation of technology like smart furniture, is fueling the Vietnam home furniture market growth.

Dining-room furniture is becoming more popular because of a growing interest in family-friendly living areas and home gatherings. Shoppers are purchasing premium dining tables, chairs, and storage solutions that integrate practicality with sophistication. The segment is also shaped by the rising population of young professionals and families looking for modern designs that enhance contemporary interiors. The popularity of custom and modular dining sets is increasing, offering flexibility for various room dimensions and configurations

Bedroom furniture segment is growing as shoppers emphasize comfort and practicality in their private areas. Furniture pieces like beds, wardrobes, and nightstands are sought after, emphasizing both aesthetics and storage options. There is a trend for multifunctional furniture, like storage beds and transformable items, particularly in cities where space is constrained.

Others include niche categories like outdoor furniture, office furniture, and children's furniture. These sub-segments are expanding as user needs evolve. With the rise in outdoor living spaces and home offices, there is a higher need for durable and weather-resistant outdoor furniture. Additionally, the growing awareness about ergonomic designs is catalyzing the demand for office furniture.

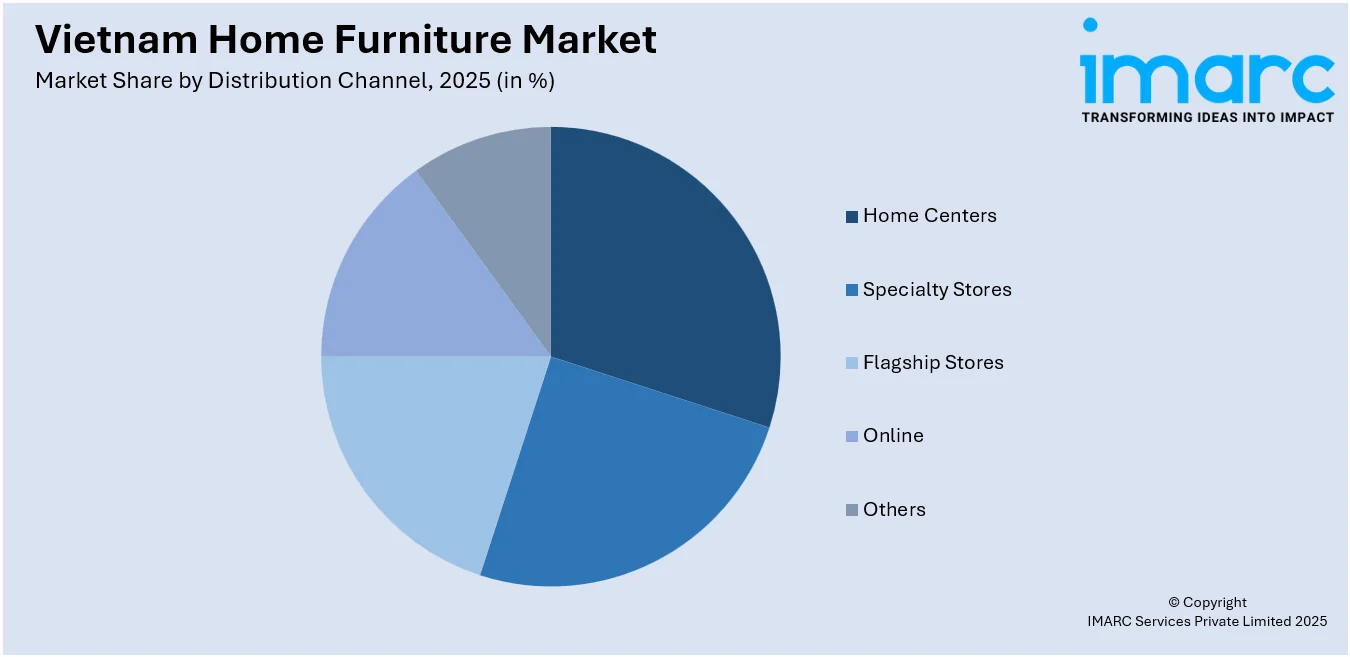

Analysis by Distribution Channel:

Access the Comprehensive Market Breakdown Request Sample

- Home Centers

- Specialty Stores

- Flagship Stores

- Online

- Others

Home centers serve provide a diverse assortment of furniture choices, addressing different user requirements. The ability to discover different furniture options all in one place, coupled with the chance to see and try products firsthand, influences buyer choice towards home centers. Furthermore, numerous home centers provide cost-effective bundles and deals, making them a preferred option for price-aware shoppers

Specialty stores concentrate on delivering premium, specialized furniture selections that meet particular user preferences. These stores generally provide a carefully chosen range of high-quality or one-of-a-kind furniture styles, aimed at wealthier clients who are ready to invest more for exclusive items. Specialty stores frequently highlight their expertise and personalized service, enabling buyers to obtain customized suggestions and design guidance.

Flagship stores are essential in defining brand identity and fostering buyer loyalty. These stores are positioned strategically in busy areas and provide an extensive selection of the brand's furniture items. Flagship stores enable shoppers to directly encounter the values and quality of the brand, emphasizing an engaging shopping experience. They also function as venues for launching new collections and innovations, positioning the brand as a significant contender in the market

Online is quickly gaining momentum, fueled by the rising popularity of e-commerce and the ease of shopping from home. Buyers are progressively opting for online platforms when purchasing furniture because of the extensive selection of items, attractive prices, and the convenience of comparing various brands. Online shopping sites also provide home delivery and adaptable return policies, enhancing convenience for shoppers.

Others consist of direct sales, wholesale distributors, and pop-up shops. These channels cater to specific market segments, such as bulk buyers or individuals seeking custom-made furniture. Direct sales allow for more personalized customer interactions, while wholesalers supply furniture to smaller retailers and regional markets. Pop-up shops, often temporary and located in high-traffic areas or at special events, are gaining popularity by offering limited-time collections or exclusive deals.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam features a blend of contemporary and traditional preferences, with rising demand for premium furniture driven by heightened urbanization in cities such as Hanoi. The area's wealthy residents seek fashionable, long-lasting furniture suitable for city apartments and country houses. In northern Vietnam, where economic growth is notable, especially in construction and real estate, there is an increase in demand for both functional and stylish furniture, focusing on classic designs and usability

Central Vietnam, encompassing cities such as Da Nang and Hue, is driven by a rising middle class and a boost in tourism. With the area's economy expanding, particularly in real estate and hospitality, there is a rise in need for contemporary, budget-friendly, and sturdy furniture. Individuals in Central Vietnam are drawn to locally made furniture, frequently combining traditional artistry with modern designs. This segment has a mix of demand for both affordable furniture and higher-end products for luxury homes and resorts.

Southern Vietnam, particularly Ho Chi Minh City and its surrounding areas, is the most dynamic and competitive region in the market. With a large, young, and growing middle class, the demand for modern, stylish, and multifunctional furniture is high. The region's rapid urbanization and real estate boom drive the need for a broad variety of home furniture. Individuals in Southern Vietnam also have a higher affinity for e-commerce, seeking both local and international brands.

Competitive Landscape:

Major participants in Vietnam's home furniture sector are concentrating on broadening their product variety to meet diverse user preferences, placing a strong emphasis on contemporary, minimalist, and eco-friendly designs. Numerous companies are embracing latest production technologies to enhance product quality and manufacturing efficiency while investigating sustainable materials to satisfy the increasing demand for eco-friendly products. These athletes are also enhancing their online presence by utilizing e-commerce platforms and incorporating digital tools to interact with clients more efficiently. Additionally, industry events like the VIFA EXPO 2025, Vietnam's biggest indoor and outdoor furniture exhibition, are crucial for market expansion. Set to take place from March 5–8, 2025, at the SECC in Ho Chi Minh City, the event will showcase more than 2,500 booths representing over 650 exhibitors from 19 countries and 17 provinces in Vietnam. This global trade exhibition, along with industry discussions and buyer assistance initiatives, provides essential participants chances for networking, displaying innovations, and enhancing their market presence.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam home furniture market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Kuka Home opened a 624,000-square-foot manufacturing facility in Binh Duong to support its growing motion upholstery business. The new plant reportedly expanded Kuka’s Vietnam footprint to 4.7 million square feet and added approximately 1,300 new jobs.

- March 2025: EuroStyle launched a mono-brand Lema showroom in Hanoi, showcasing high-end Italian furniture. The launch positioned EuroStyle to tap into a growing segment seeking luxury, Italian aesthetics, and bespoke furniture solutions.

- December 2024: Oppein opened its Vietnam B2B showroom focused on commercial furniture projects. The modern showroom showcased customizable furniture with sleek designs and sustainable materials.

- August 2024: FENDI Casa launched its high-end furniture line at Union Square, Ho Chi Minh City. Showcasing luxury designs rooted in Italian heritage, the brand and its launch highlighted iconic materials, modular creations, and Vietnam’s growing market for premium interior aesthetics.

- May 2024: Theodore Alexander launched a Vietnam-made upholstery line to offer stylish, value-priced seating. Introduced at the April High Point Market, the line featured 30 pieces blending wood, metal, and leather, produced in its Ho Chi Minh City facility.

Vietnam Home Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Furniture, Living-room Furniture, Dining-room Furniture, Bedroom Furniture, Others |

| Distribution Channels Covered | Home Centers, Specialty Stores, Flagship Stores, Online, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam home furniture market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam home furniture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam home furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home furniture market in the Vietnam was valued at USD 419.4 Million in 2025.

The growth of Vietnam home furniture market is driven by high urbanization rate, rising disposable incomes, and an increasing middle class. Additionally, the expansion of e-commerce platforms, demand for eco-friendly products, and a shift towards modern, functional designs are contributing to the market growth.

The Vietnam home furniture market is projected to exhibit a CAGR of 4.92% during 2026-2034, reaching a value of USD 646.4 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)