Vietnam Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

Vietnam Hot Sauce Market Overview:

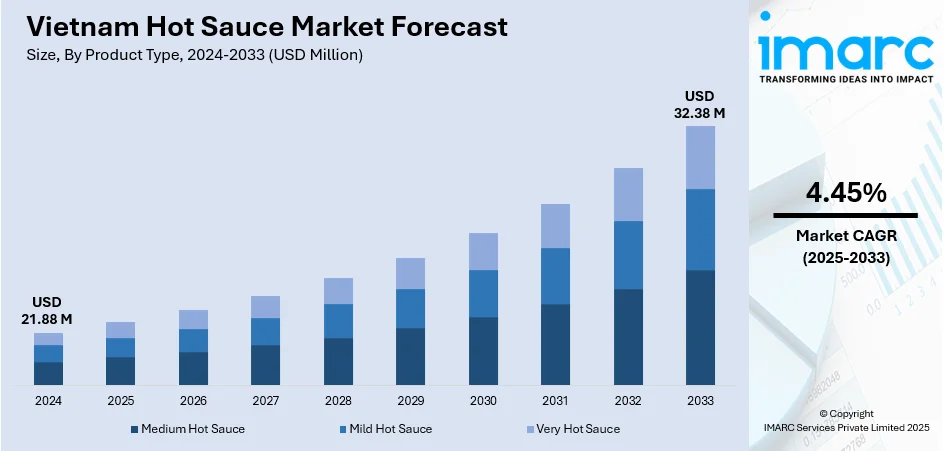

The Vietnam hot sauce market size reached USD 21.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 32.38 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. At present, consumers are coming to appreciate traditional meals that depend on strong, piquant flavors. Moreover, the increasing emergence of restaurants, fast-food joints, and street food stalls offering spicy condiments as menu items is propelling the market growth in the country. Additionally, the growing penetration of new retail formats and e-commerce platforms is expanding the Vietnam hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.88 Million |

| Market Forecast in 2033 | USD 32.38 Million |

| Market Growth Rate 2025-2033 | 4.45% |

Vietnam Hot Sauce Market Trends:

Increase in Demand for Spicy and Traditional Food

The market for hot sauce in Vietnam is experiencing rapid growth because consumers are coming to appreciate traditional meals that depend on strong, piquant flavors. Vietnamese cooking has deep roots in regional spice profiles, and hot sauces are staple condiments for both consumers and restaurants. As the younger generation continues to discover cultural heritage via food, the domestic demand for traditional hot sauces is increasing. Street food restaurants and local food shops are also selling spicy food products, provoking repeat buys of hot sauce items. In addition, travelers to Vietnam also look for hot spices in local tastes, catalyzing the demand for hot sauce bottles as souvenirs. Local brands benefit from this trend through the launch of various flavors that appeal to both locals and international curiosity. The growing popularity of cooking programs, social media food bloggers, and recipe websites is increasing the consumption of spices in food products, steadily fueling the growth in hot sauce popularity. In 2024, at Seoul Food 2024, alongside the popular Specialty Spice Set and Sriracha Chili Sauce, well-received in Japan, Chin-su also presented a new set of seasoning powders, fish sauce, coffee, instant pho, and unveiled a new collection of Chin-su chili sauces. The complete range of products was meticulously studied, blending the essence of Korean cuisine with distinctive Vietnamese ingredients, achieving the perfect flavor, authentic Korean taste, and delightful appeal to the palate.

To get more information on this market, Request Sample

Innovations in the Foodservice Industry

Increasing emergence of foodservice establishments is propelling the Vietnam hot sauce market growth, with restaurants, fast-food joints, and street food stalls offering spicy condiments as menu items. Global fast-food chains expanding in the Vietnamese market are modifying their menus to fit regional preferences by introducing hot sauces or producing spicy versions of favorites. At the same time, indigenous quick-service restaurants are employing spicy dipping sauces as distinguishing factors to appeal to spice enthusiasts. With more consumers eating out or ordering takeaways, the application of hot sauces in burgers, noodles, spring rolls, and grilled meat is becoming popular. The rise in food delivery platforms is also facilitating the trend as restaurants are making condiments, particularly hot sauces, part of every meal. The foodservice segment is constantly innovating by employing fusion cuisines that include traditional hot sauces in new-age dishes, which in turn is driving their usage. This constant innovation in the foodservice sector is catalyzing the demand for hot sauces.

Increasing Dominance of New-Age Retail and Online Platforms

The growing penetration of new retail formats and e-commerce platforms is contributing significantly to the growth of the Vietnam hot sauce market. Supermarkets, hypermarkets, convenience stores, and specialty food stores are allocating increasing shelf space to condiments, including hot sauces, in different packaging and flavor options. The stores are selling wider ranges of local and international brands, enabling consumers to sample varying heat levels and flavor profiles. Meanwhile, online platforms are facilitating easy access to these products for individuals from urban and semi-urban regions with a few clicks. Online promotions, bundle offers, and influencer marketing on digital channels are stimulating greater online buying of hot sauces. Additionally, increased smartphone penetration and mobile payment solutions are simplifying online transactions, resulting in increased direct-to-consumer (D2C) sales. This contemporary retail transformation is not just enhancing product visibility but also building brand loyalty and experimentation, driving the market. IMARC Group predicts that the Vietnam e-commerce market is projected to reach USD 239.3 Billion by 2033.

Vietnam Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

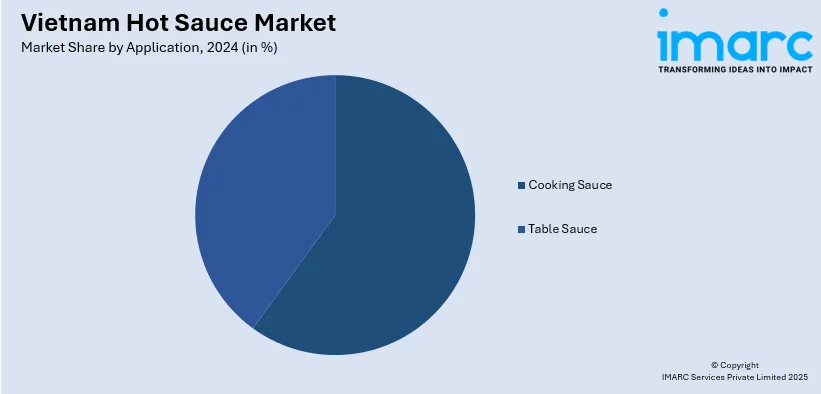

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam hot sauce market on the basis of product type?

- What is the breakup of the Vietnam hot sauce market on the basis of application?

- What is the breakup of the Vietnam hot sauce market on the basis of packaging?

- What is the breakup of the Vietnam hot sauce market on the basis of distribution channel?

- What is the breakup of the Vietnam hot sauce market on the basis of end use?

- What is the breakup of the Vietnam hot sauce market on the basis of region?

- What are the various stages in the value chain of the Vietnam hot sauce market?

- What are the key driving factors and challenges in the Vietnam hot sauce market?

- What is the structure of the Vietnam hot sauce market and who are the key players?

- What is the degree of competition in the Vietnam hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)