Vietnam Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Vietnam Insurtech Market Overview:

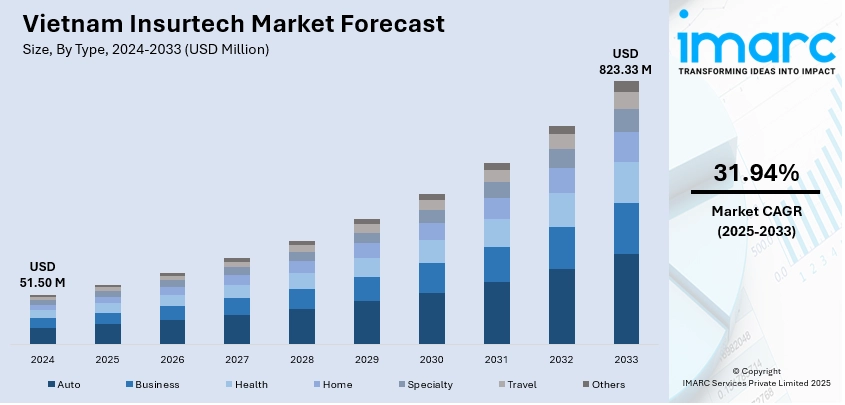

The Vietnam Insurtech market size reached USD 51.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 823.33 Million by 2033, exhibiting a growth rate (CAGR) of 31.94% during 2025-2033. The growth of Insurtech market in Vietnam is driven by collaborations between traditional insurers and Insurtech startups, boosting innovation and operational efficiency. Venture capital investments are providing the resources needed for technology enhancements, product expansion, and improved user service, contributing to the expansion of the Vietnam Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.50 Million |

| Market Forecast in 2033 | USD 823.33 Million |

| Market Growth Rate 2025-2033 | 31.94% |

Vietnam Insurtech Market Trends:

Collaboration with Traditional Insurers

The rising partnership between established insurers and new Insurtech startups to meet the evolving needs of clients is propelling the market growth. Instead of viewing one another as rivals, traditional insurance providers are collaborating with digital-centric companies to utilize advanced technologies, improve operational efficiency, and access new user markets. These partnerships allow conventional insurers to update their services and meet the increasing demand for digital insurance solutions, while also providing Insurtech firms with access to established insurance structures, regulatory knowledge, and larger client segments. This collaborative ecosystem boosts innovation and market growth, enhancing the accessibility and efficiency of insurance. An excellent instance of this partnership is the 2024 alliance between Poni Insurtech and Global Care, which introduced GlobalCare.vn, a platform for health insurance comparison. This platform enabled users in Vietnam to effortlessly compare and tailor insurance plans in a clear, accessible manner. It also simplified the claims process and helps insurers in digitalizing their offerings, improving the overall client experience. Additionally, this partnership supported Poni Insurtech's wider strategy to grow throughout the ASEAN region, representing an important advancement in the digital evolution of Vietnam’s insurance industry. By forming these strategic partnerships, Insurtech companies and traditional insurance providers can effectively address the changing demands of users while fostering innovation in the sector.

To get more information on this market, Request Sample

Support from Venture Capital and Investment

Investors are becoming more aware about the enormous opportunities within digital insurance, channeling investments into creative startups that feature disruptive business strategies. This funding allows Insurtech firms to enhance their operations, invest in cutting-edge technologies, and upgrade client service while broadening their product range. The additional funding aids not only the swift expansion of individual companies but also the overall progress of the Insurtech ecosystem in Vietnam. A significant instance of this trend is Huize Holding Limited's acquisition of Global Care, a prominent Insurtech platform based in Vietnam, in 2024. The purchase signified Huize’s entry into the ASEAN market with its global brand, Poni Insurtech. By incorporating Global Care’s offerings into its larger digital insurance framework, Huize intended to speed up the uptake of digital insurance solutions in Vietnam. The combination of Global Care’s knowledge of the Vietnamese market with Huize’s advanced technology and AI abilities aimed to improve the user experience and optimize operations. This strategic action emphasizes the expanding importance of venture capital in fostering the Vietnam Insurtech market growth, guaranteeing that firms possess the necessary resources to innovate and satisfy the needs of a more digitally-savvy users.

Vietnam Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

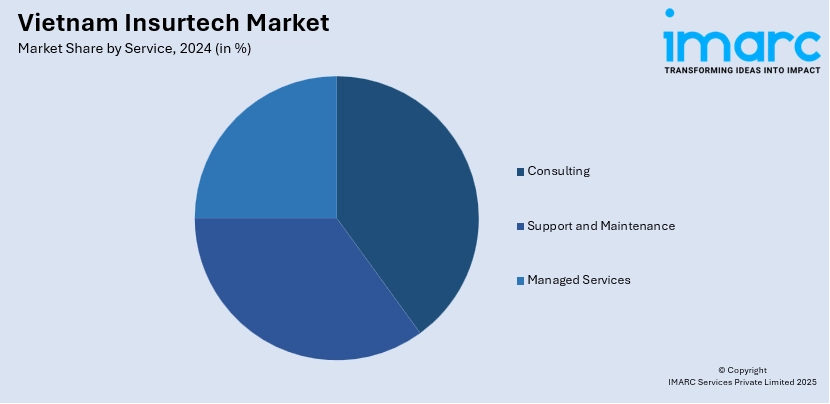

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Insurtech Market News:

- In July 2025, Shin Kong Vietnam and PVI Insurance formed a strategic partnership to enhance digital insurance services in Vietnam. The collaboration combines Shin Kong's global expertise with PVI's local presence, supported by AIFT Enterprise's insurance platform and Chunghwa Telecom's cloud services. This initiative aims to create a comprehensive Insurtech ecosystem, delivering customer-focused solutions in the region.

- In July 2025, Global Care, a leading Insurtech in Vietnam, launched the country's first insurance KOL platform. The platform leverages social media to broaden insurance sales, enabling individuals from various backgrounds to sell insurance and increase their income.

Vietnam Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam Insurtech market on the basis of type?

- What is the breakup of the Vietnam Insurtech market on the basis of service?

- What is the breakup of the Vietnam Insurtech market on the basis of technology?

- What is the breakup of the Vietnam Insurtech market on the basis of region?

- What are the various stages in the value chain of the Vietnam Insurtech market?

- What are the key driving factors and challenges in the Vietnam Insurtech market?

- What is the structure of the Vietnam Insurtech market and who are the key players?

- What is the degree of competition in the Vietnam Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)