Vietnam Jewellery Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

Vietnam Jewellery Market Report:

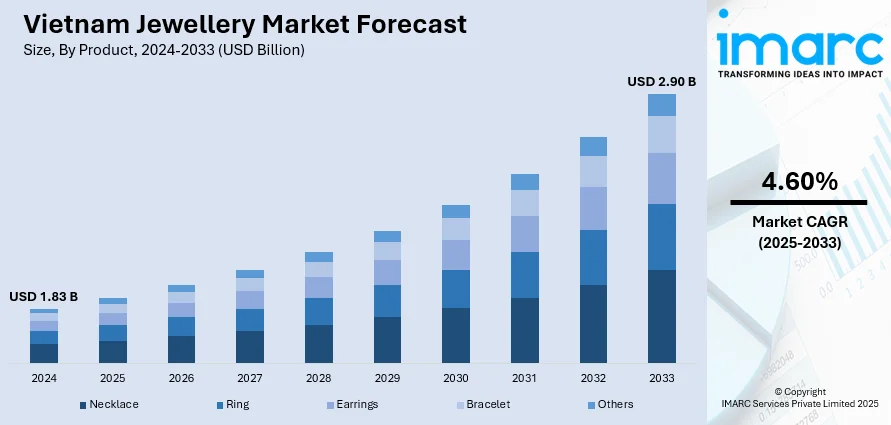

The Vietnam jewellery market size reached USD 1.83 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.90 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The market is driven by rising disposable incomes and a growing middle class, enabling higher spending on gold and gemstone jewellery as both adornments and investments, while cultural traditions sustain demand for ceremonial pieces. Urbanization and global fashion trends are accelerating preference for modern designs, supported by gold’s appeal as a safe-haven asset during economic fluctuations. Expanding retail channels, e-commerce penetration, and government policies are further augmenting the Vietnam jewellery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.83 Billion |

|

Market Forecast in 2033

|

USD 2.90 Billion |

| Market Growth Rate 2025-2033 | 4.60% |

The market is primarily driven by rising disposable incomes and a growing middle class. As economic growth continues, more consumers can afford luxury items, including gold and gemstone jewellery, which are traditionally valued as investments and status symbols. Cultural factors also play a key role, with jewellery being integral to weddings, festivals, and religious ceremonies. Additionally, increasing urbanization and exposure to global fashion trends have increased demand for modern, stylish designs. The preference for gold as a safe-haven asset further fuels the Vietnam jewellery market growth, especially during economic uncertainty, making Vietnam one of Southeast Asia’s most dynamic jewellery markets. Vietnam's gold price index experienced a significant 32.85% increase over the first four months of 2025, with April contributing a substantial 10.54% hike attributable to global geopolitical uncertainty and central bank purchases of gold. Global gold prices reached over USD 3,220 per ounce by the end of April, affirming their position as a safe-haven asset during periods of uncertainty. This growth presents profitable opportunities for Vietnam's jewelry industry to meet the increasing domestic demand for gold-inspired motifs and investment pieces.

To get more information on this market, Request Sample

Furthermore, the growth of organized retail and e-commerce is enhancing the accessibility of jewellery to a broader audience, which is creating a positive Vietnam jewellery market outlook. Local and international brands are entering the market, offering diverse designs and competitive pricing. Government policies supporting gold trading and gemstone exports also contribute to industry growth. Younger consumers, influenced by social media and digital marketing, are embracing new trends, increasing demand for personalized and branded jewellery. Additionally, tourism growth has spurred sales, with foreign visitors purchasing locally crafted pieces. In 2024, Vietnam welcomed 17.5 million international tourists, marking a 39.5% rise compared to the corresponding period in 2023. The growth was driven by increased air connectivity, the easing of visa restrictions, and a rebound in demand from major markets, including South Korea (4.5 million) and China (3.7 million). 84.4% were air arrivals, with almost 80% of all inbound travelers being from Asia. This tourism growth presents a strategic window of opportunity for Vietnam's jewellery sector to target high-spending visitors with locally produced, culturally distinct products. These factors, combined with Vietnam’s strong gold consumption culture, ensure steady market expansion, positioning the country as a key player in the regional jewellery industry.

Vietnam Jewellery Market Trends

Rising Disposable Income and Middle-Class Expansion Driving Luxury Purchases

Vietnam’s consistent economic growth has resulted in a noticeable increase in disposable income, encouraging more consumer spending on luxury items such as jewellery. An industry report forecasts that by 2027, 60% of middle-class households in Vietnam will earn more than USD 5,000 annually, signaling enhanced financial capability. This uprise in purchasing power aligns with growing aspirations for higher-status goods, with jewellery becoming a popular investment and lifestyle choice. Additionally, gold jewellery is seen not just as an accessory but as a safe investment and a method of wealth preservation, further fueling consumer interest. Jewellery is also deeply embedded in Vietnamese culture and continues to be a traditional gift for significant life events such as engagements and weddings. As per the Vietnam jewellery market trends, this cultural importance, combined with economic upliftment, plays a vital role in sustaining high demand for fine jewellery across income brackets.

Urbanization and Western Influence Reshaping Consumer Preferences

Vietnam's ongoing urbanization is reshaping consumer behavior, particularly among the youth. According to the urban and rural system plan (2021–2030), the urbanization rate is expected to surpass 50% by 2030, highlighting a shift toward more urban lifestyles. This transformation has exposed consumers, especially younger generations, to Western fashion trends, driving preference toward modern and contemporary jewellery designs. The trnsformation from traditional to Western-inspired aesthetics marks a significant change in the jewellery sector. Younger consumers are opting for minimalist, trendy, and custom-made pieces that align with global fashion movements. Retailers are adapting by expanding their offerings to include a wide range of products, from heritage-inspired pieces to bespoke, contemporary jewellery. This modern outlook, coupled with increased connectivity and access to global media, is pushing jewellery brands to diversify and innovate to meet the changing tastes of a dynamic urban population.

Tourism and Digital Platforms Expanding Market Accessibility

As per the Vietnam jewellery market forecast, Vietnam's growing popularity as a tourist destination is positively impacting the jewellery market. In 2024, the country received over 14.8 million international visitors by air (84.4%), 2.5 million by road (14.2%), and 248.1 thousand by sea (1.4%), according to the General Statistics Office. The majority of these visitors originate from Asia (79.6%), followed by Europe (11.3%), the Americas (5.7%), Oceania (3.1%), and Africa (0.3%). Tourists frequently buy locally made jewellery as mementos, which aids in boosting retail sales. In parallel, the expansion of e-commerce platforms and digital marketing has revolutionized jewellery shopping in Vietnam. Consumers can now browse, compare, and purchase jewellery online, significantly improving accessibility and reach for sellers. Additionally, government policies, such as lowered taxes on gold and jewellery, are encouraging local production and reducing dependence on imports. These combined forces are creating a vibrant, more inclusive marketplace for both domestic and international consumers.

Vietnam Jewellery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam jewellery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and material.

Analysis by Product:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

Necklaces are significantly driven by cultural significance and changing fashion trends. Gold necklaces, particularly traditional designs such as kiềng (heavy linked chains) and dây chuyền (pendant styles), remain popular for weddings and festivals, symbolizing prosperity. However, younger consumers are shifting toward minimalist and customizable designs, often incorporating gemstones or mixed metals. Urbanization and exposure to global trends have spurred demand for statement pieces, while branded luxury necklaces gain traction among affluent buyers. The segment also benefits from gold’s dual role as adornment and investment, especially during economic volatility. Manufacturers are responding with lightweight, versatile options to cater to daily wear, ensuring sustained growth in this key segment.

Rings are a high-growth segment in Vietnam, fueled by rising wedding demand and increasing preference for personalized jewellery. Bridal sets, particularly gold and diamond rings, remain essential for engagements and marriages, reflecting enduring cultural values. Meanwhile, younger buyers are embracing stackable rings, birthstone-adorned pieces, and Western-inspired designs, driven by social media influence. Men’s rings are also gaining popularity, with minimalist bands and symbolic motifs appealing to urban professionals. The segment’s expansion is further supported by competitive pricing from local artisans and international brands entering the market. As disposable incomes rise, demand for premium and branded rings is expected to climb, reinforcing this segment’s significance.

Earrings are a dynamic segment in Vietnam, with demand split between traditional gold hoops and contemporary designs. Classic bông tai (studs and dangling styles) remain staples for ceremonial wear, while millennials and Gen Z consumers opt for trendy shapes, geometric patterns, and mixed materials. The rise of affordable fashion jewellery has expanded accessibility, with silver and gemstone earrings gaining popularity for daily use. Luxury brands are also making inroads, particularly in urban centers, offering high-end diamond and pearl designs. E-commerce platforms and influencer marketing have amplified visibility, driving impulse purchases. With versatility and affordability as key selling points, earrings continue to capture a broad consumer base, ensuring steady market growth.

Bracelets hold a unique position in the market, balancing tradition and modernity. Gold bangles (vòng tay) are deeply rooted in cultural practices, often gifted during weddings and Lunar New Year celebrations as symbols of luck and wealth. However, lightweight chain bracelets, charm styles, and beaded designs are gaining favor among younger, fashion-conscious buyers. The segment also sees demand from men, with leather-cord and metallic cuff bracelets rising in popularity. Local artisans and international brands are introducing innovative designs, blending traditional craftsmanship with contemporary aesthetics. As consumers seek both ornamental and meaningful pieces, bracelets remain a resilient segment, supported by their cultural relevance and adaptability to trends.

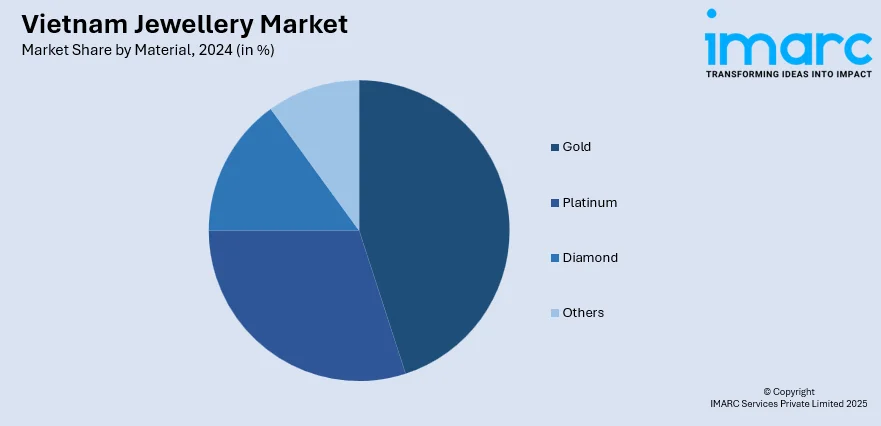

Analysis by Material:

- Gold

- Platinum

- Diamond

- Others

Gold is primarily driven by its cultural and economic significance. Deeply rooted in tradition, gold is considered both an auspicious symbol and a safe-haven asset, driving demand during weddings, festivals, and economic uncertainty. Consumers favor 18K and 24K gold for their purity, with intricate designs such as trơn (plain bands) and hoa văn (engraved patterns) remaining popular. However, younger buyers are shifting toward modern, lightweight pieces that blend traditional craftsmanship with contemporary aesthetics. Local brands such as PNJ and DOJI lead the market, while government policies regulating gold trading ensure quality and consumer trust. With gold prices closely tied to global markets, its dual role as adornment and investment ensures sustained dominance in Vietnam’s jewellery industry.

Platinum holds a niche but growing segment in Vietnam’s jewellery market, prized for its rarity and premium appeal. Primarily favored by affluent urban consumers, platinum is associated with luxury and modernity, often used in engagement rings and high-end watches. Its hypoallergenic properties and durability make it ideal for intricate designs, particularly in bridal and fine jewellery collections. International brands, including Cartier and Tiffany & Co. have introduced platinum pieces, elevating their status among younger, style-conscious buyers. However, high costs and limited consumer awareness restrict broader adoption compared to gold. As disposable incomes rise and preferences change toward understated elegance, platinum is gradually gaining traction, particularly in Ho Chi Minh City and Hanoi’s upscale markets.

Diamonds are the fastest-growing segment in Vietnam’s jewellery market, driven by rising affluence and Western influence on bridal trends. Once considered a luxury for the elite, diamonds are now accessible to the middle class, with solitaire engagement rings and eternity bands leading demand. Local retailers such as PNJ and SJC offer competitively priced lab-grown diamonds, appealing to cost-conscious yet aspirational buyers. Social media and celebrity endorsements have amplified diamond’s appeal, positioning it as a symbol of love and success. However, challenges such as counterfeit products and lack of certification persist. With millennials prioritizing quality and symbolism over sheer volume, the diamond segment is poised for expansion, supported by innovative cuts and ethical sourcing trends.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The jewellery market in Northern Vietnam, anchored by Hanoi's sophisticated consumer base, demonstrates a strong preference for traditional gold designs with cultural significance. Purchases are heavily influenced by ceremonial occasions such as weddings and Tết (Lunar New Year), where 24K gold jewellery serves as both adornment and wealth preservation. Urban centers show growing interest in contemporary designs, particularly among younger, affluent demographics, while rural areas maintain demand for classic, heavy-weight pieces. High-end international brands have gained traction in Hanoi's luxury retail spaces, though local jewelers dominate with their extensive gold offerings. The region's colder climate also drives demand for bolder, layered jewellery styles. With increasing disposable incomes and urbanization, Northern Vietnam remains a stable yet changing market where tradition and modernity intersect.

Central Vietnam's market is characterized by moderate demand, with cultural preferences leaning toward simpler, more practical gold designs compared to other regions. Cities such as Da Nang and Hue show a blend of traditional and modern tastes, where lightweight daily-wear pieces coexist with ceremonial jewellery for festivals and weddings. The region's tourism industry enhances sales of locally crafted silver and gemstone jewellery, particularly in heritage areas. However, gold remains the dominant choice, often purchased from reputable local brands such as SJC and PNJ. Economic constraints in some provinces limit high-value purchases, making affordability a key factor. As infrastructure improves and middle-class populations grow, Central Vietnam presents untapped potential for jewellers offering mid-range, versatile collections that balance cultural relevance with contemporary appeal.

Southern Vietnam, led by Ho Chi Minh City's dynamic consumer base, is the most progressive and fastest-growing jewellery market in the country. Consumers here exhibit a strong appetite for both investment-grade gold and fashionable, branded jewellery, with a notable shift toward diamonds and platinum among younger, urban buyers. The region's warm climate influences preferences for sleek, minimalist designs suited to casual wear, though ceremonial gold purchases remain robust. International brands thrive in high-end shopping districts, while local players such as PNJ dominate mass-market segments. Southern Vietnam's openness to global trends and higher disposable incomes drive innovation, making it a testing ground for new designs and retail formats such as omnichannel sales. This region is poised to lead Vietnam's jewellery market transformation, blending luxury, tradition, and modern retail dynamics.

Competitive Landscape:

The market's competitive landscape is defined by fierce competition among established local companies and new international brands. Leading local companies are expanding retail networks nationwide while investing in modern design capabilities to appeal to younger consumers. Many are vertically integrating operations from manufacturing to retail to ensure quality control and competitive pricing. Traditional gold-focused players are diversifying into gemstone and diamond collections to capture premium segments. International competitors are gaining ground through luxury mall partnerships and digital marketing strategies targeting affluent urban demographics. Both local and foreign brands are enhancing customer experience through digital platforms, with AI-powered jewelry customization and virtual try-ons becoming differentiators. Sustainability initiatives such as responsible sourcing and lab-grown gemstones are emerging as competitive advantages as consumer awareness grows. The market is seeing increased M&A activity as players seek to consolidate positions and acquire technical expertise.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam jewellery market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Phu Nhuan Jewelry (PNJ) raised VND 5 billion in Series A funding to upgrade production, expand R&D, enhance retail presence, and enhance employee training. The company aims to strengthen its market leadership and meet changing consumer demands with improved services and innovation.

- April 2025: PNJ partnered with the Emoji Company to launch the PNJ x emoji Brand Collection. This playful line features gold and silver jewellery, some adorned with gemstones, inspired by iconic emoji symbols. The collection blends PNJ’s craftsmanship with modern, expressive design, offering a fresh take on jewellery that resonates with contemporary pop culture.

- December 2024: Hanoia and Maison Kitsuné unveiled a limited-edition collection celebrating the Year of the Snake. This collaboration fuses Vietnamese lacquer artistry with French-Japanese design, featuring jewellery adorned with fox and snake motifs. The standout piece is a handcrafted lacquer jewellery box, available in lilac and red.

- September 2024: Huy Thanh Jewelry partnered with Appier to enhance customer engagement using AIQUA’s AI-powered recommendations. This collaboration reportedly achieved a 6.2x ROI increase, improved session engagement, and reduced bounce rates.

- June 2024: The Museum of Ethnic Jewellery opened in Ho Chi Minh City, showcasing over 2,500 years of jewelry from Vietnam’s 54 ethnic groups. It features artifacts, costumes, and cultural displays celebrating the country's diverse heritage and traditions.

- May 2024: Pandora announced its new USD 150 million crafting facility in Binh Duong, Vietnam, operating on 100% renewable energy with recycled gold and silver. Set to open in 2026, it is projected to create 7,000 jobs and produce up to 60 million jewelry pieces annually.

Vietnam Jewellery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Necklace, Ring, Earrings, Bracelet, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam jewellery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam jewellery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam jewellery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The jewellery market in Vietnam was valued at USD 1.83 Billion in 2024.

The Vietnam jewellery market is projected to exhibit a CAGR of 4.60% during 2025-2033, reaching a value of USD 2.90 Billion by 2033.

Rising disposable income, a growing middle class, and strong cultural traditions are driving demand for gold and gemstone jewellery. Urbanization, global fashion influences, tourism growth, and supportive government policies are also accelerating market expansion and modern product adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)