Vietnam Kitchen Furniture Market Size, Share, Trends and Forecast by Furniture Type, Distribution Channel, and Region, 2026-2034

Vietnam Kitchen Furniture Market Overview:

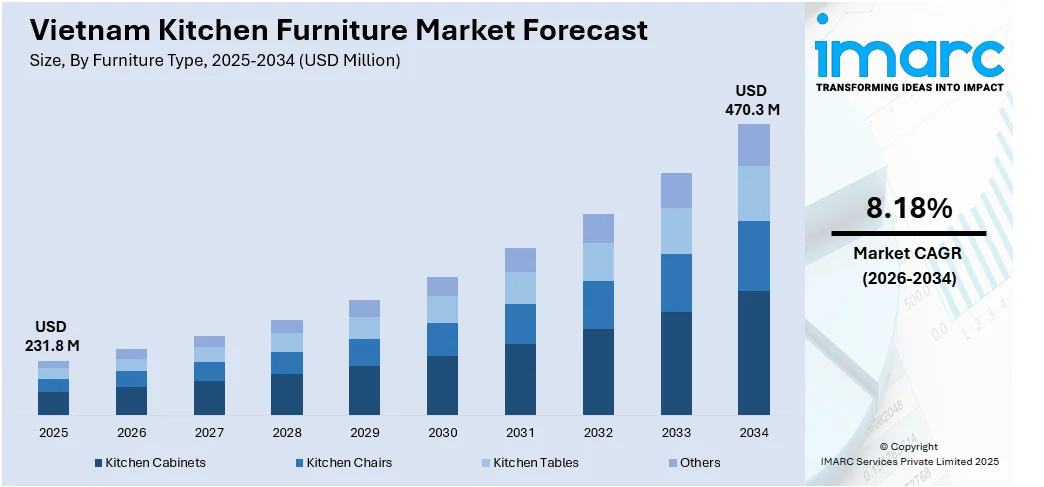

The Vietnam kitchen furniture market size reached USD 231.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 470.3 Million by 2034, exhibiting a growth rate (CAGR) of 8.18% during 2026-2034. The market share is increasing owing to international design trends, local craftsmanship, e-commerce growth, and rising demand from hospitality and real estate sectors. Manufacturers are blending modern aesthetics with traditional values and digital platforms and increased tourism, which are supporting the market growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 231.8 Million |

| Market Forecast in 2034 | USD 470.3 Million |

| Market Growth Rate 2026-2034 | 8.18% |

Vietnam Kitchen Furniture Market Trends:

Impact of International and Local Design Trends

The influence of international and local design trends is taking on an essential role in shaping the Vietnam kitchen furniture market outlook. As Vietnam becomes more integrated into international markets, people are exposed to global design trends, ranging from Scandinavian minimalism to Italian sleekness, influencing their furniture preferences. At the same time, local design elements, such as traditional craftsmanship and natural materials, are being included into modern kitchen furniture, creating a hybrid style that appeals to both global tastes and Vietnamese cultural values. Manufacturers are responding by offering a wide range of designs that blend aesthetic appeal with functionality, keeping up with user expectations for quality and design. The influx of design ideas, coupled with local tastes and needs, is fostering innovation within the market, creating a dynamic environment where both classic and contemporary designs thrive. For example, in 2024, the "Kitchen Insight Plus" competition showcased nearly 500 innovative kitchen designs, reflecting new ideas and humanistic values. The event featured presentations on future kitchen design trends, including a talk by Architect Takashi Niwa on Vietnamese kitchen spaces.

To get more information on this market Request Sample

Development of E-commerce and Online Shopping

Individuals are able to browse, contrast, and buy kitchen furniture from the ease of their residences, expanding the reach of manufacturers and retailers beyond traditional brick-and-mortar stores. This digital revolution is enabling a more diverse range of products to enter the market, ranging from high-end designer pieces to budget-friendly options, catering to all segments of the population. E-commerce platforms are also offering tailored services such as virtual consultations and customized designs, allowing buyers to make informed purchasing decisions. With online sales channels becoming increasingly popular, manufacturers are focusing on enhancing their digital presence and offering competitive prices, simplifying access for purchasers to a broad range of kitchen furniture options. This online accessibility is significantly supporting the Vietnam kitchen furniture market growth, particularly among younger, tech-savvy users. The size of the Vietnam e-commerce market is expected to show a compound annual growth rate (CAGR) of 28% from 2025 to 2033, as per the IMARC Group.

Rise of Hospitality and Real Estate Sectors

As the country experiences an influx of international tourists and a growing middle class, the demand for high-quality kitchen furniture in hotels, resorts, and vacation homes is increasing. Real estate developments, especially in urban areas, are also catalyzing the demand for stylish and durable kitchen furniture in residential properties. Developers are incorporating modern kitchens with premium furnishings as part of their offerings to attract buyers and renters. Furthermore, the luxury housing segment, which emphasizes upscale, well-equipped kitchens, is witnessing strong growth. This boost in demand from both commercial and residential sectors is creating new opportunities for kitchen furniture manufacturers to design products that meet the needs of both private homes and hospitality businesses, ultimately contributing to the overall market. In 2024, Oppein Vietnam inaugurated its new B2B franchise showroom, specializing in commercial projects, including kitchen designs. This launch strengthened Oppein’s presence in the Vietnamese market, capitalizing on the growing demand for modern furnishings.

Vietnam Kitchen Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on furniture type and distribution channel.

Furniture Type Insights:

- Kitchen Cabinets

- Kitchen Chairs

- Kitchen Tables

- Others

The report has provided a detailed breakup and analysis of the market based on the furniture type. This includes kitchen cabinets, kitchen chairs, kitchen tables, and others.

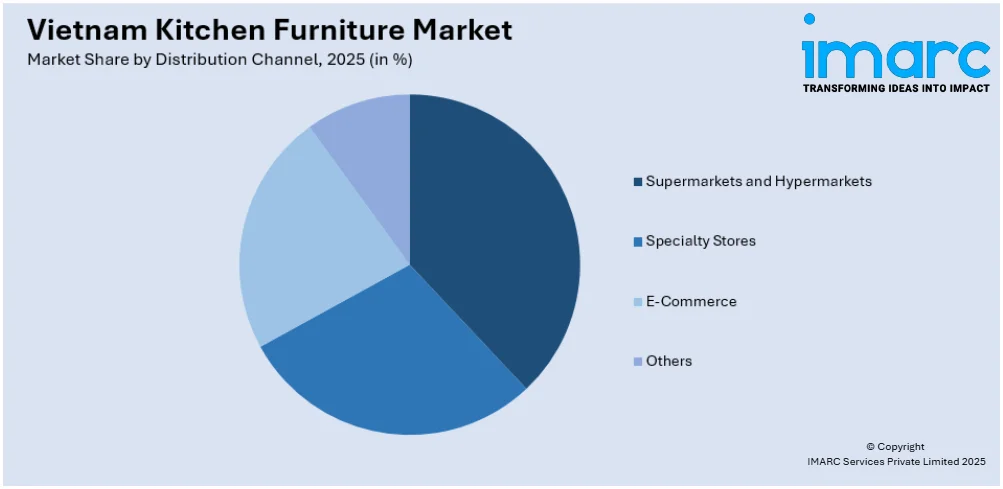

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- E-Commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, e-commerce, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Kitchen Furniture Market News:

- In August 2024, VIFA ASEAN 2024, the premier Southeast Asian furniture fair, took place from August 27-30, at SECC in Ho Chi Minh City, Vietnam. The event featured 300 exhibitors, including kitchen furniture, showcasing a wide range of products, including eco-friendly and sustainable designs. It aimed to connect international buyers with top suppliers and manufacturers from the region.

- In June 2023, YOSHIMOTO Global opened its first showroom in Hanoi, Vietnam, marking its official entry into the Vietnamese market. The showroom showcased Japanese-made products, including kitchen counters, sinks, and vanity counters, tailored to local needs. The space also featured material technology exhibits and an event area for workshops and designer engagements.

Vietnam Kitchen Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Furniture Types Covered | Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-Commerce, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam kitchen furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam kitchen furniture market on the basis of furniture type?

- What is the breakup of the Vietnam kitchen furniture market on the basis of distribution channel?

- What is the breakup of the Vietnam kitchen furniture market on the basis of region?

- What are the various stages in the value chain of the Vietnam kitchen furniture market?

- What are the key driving factors and challenges in the Vietnam kitchen furniture market?

- What is the structure of the Vietnam kitchen furniture market and who are the key players?

- What is the degree of competition in the Vietnam kitchen furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam kitchen furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam kitchen furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam kitchen furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)