Vietnam Meat Substitutes Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Vietnam Meat Substitutes Market Overview:

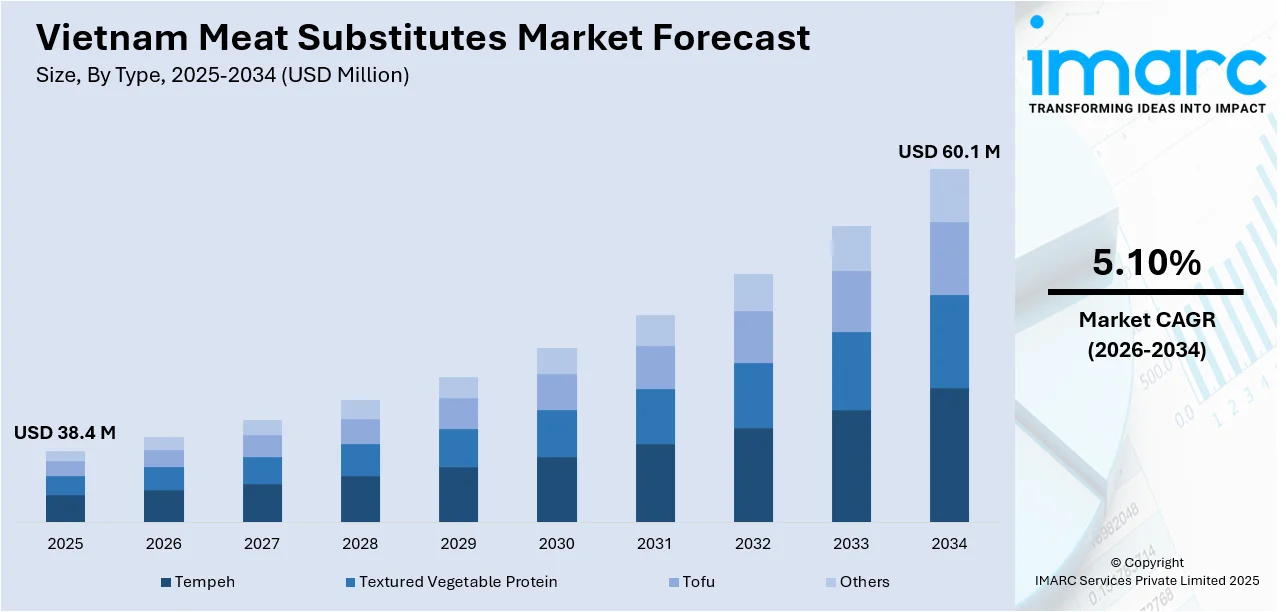

The Vietnam meat substitutes market size reached USD 38.4 Million in 2025. The market is projected to reach USD 60.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.10% during 2026-2034. The market is fueled by increasing health awareness and popularity of plant-based diets, Buddhist culture and traditional vegetarian habits which are driving demand for sustainably sourced proteins, as well as the government fostering sustainable food systems and healthy eating guidelines. Furthermore, the growing middle class, rapid urbanization, and demand for awareness in environmental sustainability are expected to increase demand in the Vietnam meat substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 38.4 Million |

| Market Forecast in 2034 | USD 60.1 Million |

| Market Growth Rate 2026-2034 | 5.10% |

Vietnam Meat Substitutes Market Trends:

Rising Health Consciousness and Adoption of Plant-Based Diets Among Vietnamese Consumers

Vietnam is experiencing a significant shift in dietary preferences as consumers increasingly prioritize health, wellness, and nutritional awareness in their food choices. The growing middle class, which is expected to add thirty-six million people by 2030 according to McKinsey research, demonstrates enhanced purchasing power and heightened health consciousness, driving demand for healthier protein alternatives to traditional meat products. Urban populations, particularly in major cities like Ho Chi Minh City and Hanoi, are becoming more aware of the health risks associated with excessive meat consumption, including cardiovascular diseases, obesity, diabetes, and certain types of cancer. The younger generation, including university students and recent graduates, is particularly receptive to plant-based diets, viewing them as aligned with modern wellness trends and sustainable lifestyle choices. Many consumers are adopting flexitarian approaches, reducing meat intake without completely eliminating animal products from their diets, creating consistent demand for meat substitutes that can seamlessly integrate into traditional Vietnamese cuisine. The perception that plant-based foods are cleaner, lower in cholesterol, and more heart-friendly than animal-based counterparts makes them attractive dietary choices for health-conscious consumers. Additionally, rising concerns about food safety, antibiotic use in livestock farming, and hormones in meat production are motivating consumers to seek safer alternatives, further supporting the Vietnam meat substitutes market growth.

To get more information on this market Request Sample

Buddhist Cultural Influence and Traditional Vegetarian Practices Driving Sustainable Demand

Vietnam's unique cultural and religious landscape creates an inherent foundation for meat substitute consumption that distinguishes the market from other Southeast Asian nations. The country's Buddhist population practices temporary vegetarianism on preassigned dates as a rite of abstinence or purification, typically falling on the first and fifteenth day of each lunar month. This deeply rooted cultural practice creates consistent, predictable demand cycles for meat substitutes including tofu, tempeh, textured vegetable protein, and other traditional vegetarian options, particularly concentrated in central and southern Vietnam where there are higher concentrations of devout followers of vegetarian Buddhist practices. Beyond Buddhism, followers of Cao Dai, a homegrown Vietnamese religion that amalgamates Buddhism, Taoism, and Confucianism, also practice vegetarianism on certain sacred days, further expanding the consumer base. Vietnamese cuisine has historically incorporated abundant vegetables, tofu, and plant-based ingredients as core components of meals, making the transition to meat substitutes culturally familiar and culinarily accessible. Traditional vegetarian restaurants, known as "com chay," have long been fixtures near pagodas and temples throughout Vietnam, serving meat-free versions of popular Vietnamese dishes using tofu, mushrooms, and other plant-based proteins. Street food vendors in central and southern Vietnam routinely switch to vegetarian versions of their meat or seafood-based dishes on days of the new and full moon, demonstrating the cultural normalization of periodic vegetarianism. This established infrastructure of vegetarian food preparation, distribution channels concentrated near religious sites, and culinary expertise in creating flavorful plant-based Vietnamese dishes provides a strong foundation for the meat substitutes market to expand beyond religious observance into mainstream consumer adoption.

Government Initiatives Promoting Sustainable Food Systems and Healthy Dietary Guidelines

The Vietnamese government has implemented comprehensive policy frameworks aimed at transforming the nation's food systems toward greater sustainability, transparency, and health promotion, creating favorable conditions for the meat substitutes market to flourish. In October 2024, Vietnam's Ministry of Agriculture and Rural Development, in collaboration with the Ministry of Health, Ministry of Industry and Trade, and Ministry of Natural Resources and Environment, along with over thirty national and international partners, signed the Partnership Agreement for Transparent, Responsible and Sustainable Food Systems Transformation in Vietnam. This landmark partnership aims to create a multi-sectoral connectivity mechanism that leverages partner strengths in transforming the food system, enhance capacity and share experiences in policy and investment, mobilize resources to develop sustainable production and distribution networks, and promote responsible consumption practices to ensure healthy diets and contribute to food and nutrition security across the nation. New regulations on nutritional labeling mandate that producers, traders, and importers must include nutritional composition on food labels for prepackaged foods, representing a significant step forward in Vietnam's food labeling regulations and enabling consumers to make more informed dietary choices. Government promotion of sustainable and healthy eating habits, combined with increased awareness campaigns about the environmental impact of meat consumption, greenhouse gas emissions from livestock farming, deforestation, and water usage associated with animal agriculture, are encouraging consumers to consider plant-based alternatives as viable options for reducing their environmental footprint.

Vietnam Meat Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Tempeh

- Textured Vegetable Protein

- Tofu

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes tempeh, textured vegetable protein, tofu, and others.

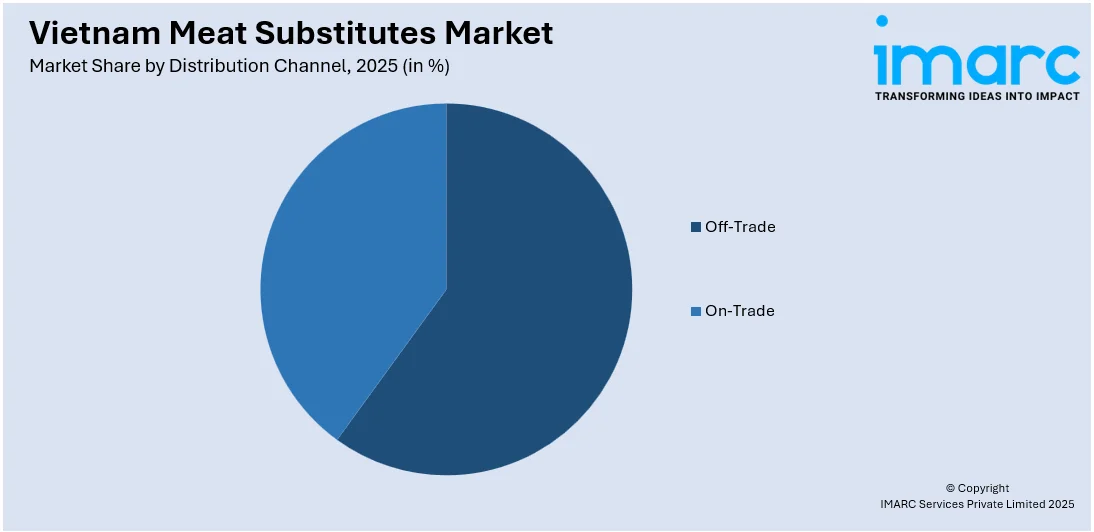

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- Convenience Stores

- Online Channels

- Supermarkets and Hypermarkets

- Others

- On-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes off-trade (convenience stores, online channels, supermarkets and hypermarkets, and others) and on-trade.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Meat Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tempeh, Textured Vegetable Protein, Tofu, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam meat substitutes market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam meat substitutes market on the basis of type?

- What is the breakup of the Vietnam meat substitutes market on the basis of distribution channel?

- What is the breakup of the Vietnam meat substitutes market on the basis of region?

- What are the various stages in the value chain of the Vietnam meat substitutes market?

- What are the key driving factors and challenges in the Vietnam meat substitutes market?

- What is the structure of the Vietnam meat substitutes market and who are the key players?

- What is the degree of competition in the Vietnam meat substitutes market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam meat substitutes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam meat substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam meat substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)