Vietnam Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2025-2033

Vietnam Online Education Market Overview:

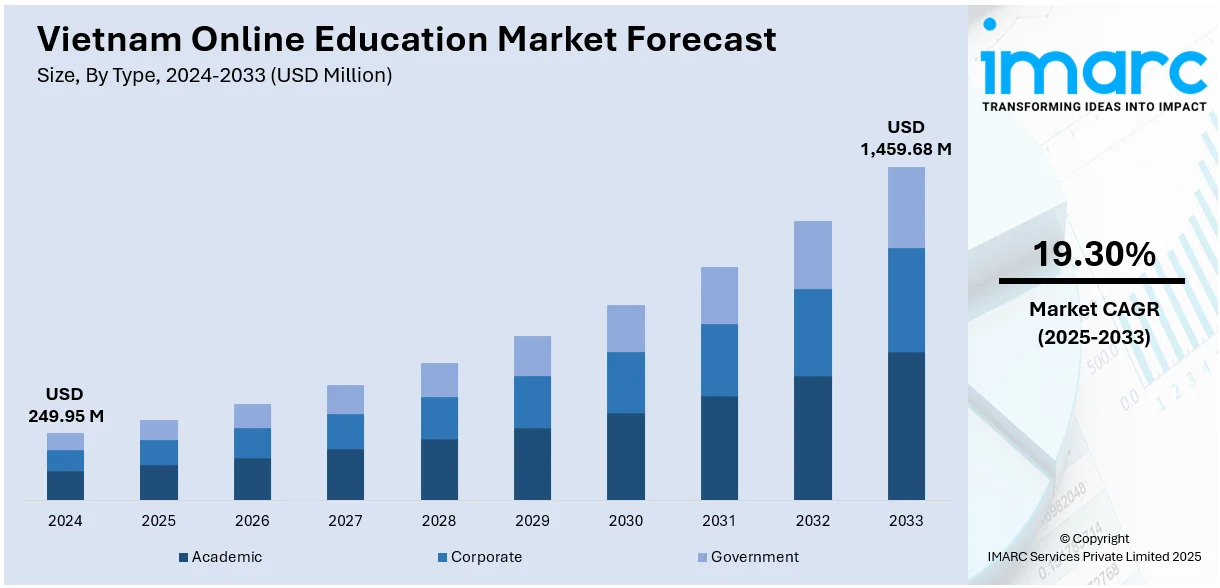

The Vietnam online education market size reached USD 249.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,459.68 Million by 2033, exhibiting a growth rate (CAGR) of 19.30% during 2025-2033. The market is driven by increased internet access and smartphone proliferation, making virtual education accessible to a wider audience across urban and rural areas. Government-led digitalization initiatives, including strategic education sector reforms, are accelerating online curriculum development and infrastructure improvements. A rising emphasis on practical, career-oriented learning programs tailored to Vietnam’s evolving job market is further augmenting the Vietnam online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 249.95 Million |

| Market Forecast in 2033 | USD 1,459.68 Million |

| Market Growth Rate 2025-2033 | 19.30% |

Vietnam Online Education Market Trends:

Growing Preference for Skill-Based Learning

There is a marked shift among Vietnamese learners toward online programs focused on skill acquisition and professional development, driven by changing labor market dynamics. As Vietnam becomes an increasingly important player in regional supply chains and global services, industries are placing greater emphasis on specialized technical and soft skills. Online education providers now offer targeted programs in fields such as information technology, digital marketing, finance, and foreign languages to meet employer expectations. Employers increasingly prefer candidates with recognized certifications and demonstrable skills, encouraging individuals to pursue short-term, modular courses alongside formal education. International collaborations between Vietnamese institutions and foreign universities have further diversified the availability of globally recognized qualifications online. On July 15, 2024, Australia-based edtech company HEX expanded its online learning programs to Vietnam, offering USD 1,200 scholarships to the first 100 students. Coordinated from Ho Chi Minh City, the program features academic credit pathways with Australia’s Group of Eight universities and local module facilitation by Draper Startup House Vietnam. HEX also introduced a bilateral “Entrepreneur Exchange” with the City of Melbourne, granting scholarships for Vietnamese entrepreneurs to engage with Melbourne’s startup ecosystem. Moreover, the growing startup ecosystem in Vietnam encourages entrepreneurial learning through specialized online mentorship and accelerator programs. This shift toward career-oriented education, supported by rising technological accessibility, forms a foundational pillar for Vietnam online education market growth.

To get more information on this market, Request Sample

Government Initiatives Supporting E-Learning Expansion

Vietnam’s government has implemented several initiatives to promote the adoption of online education, further strengthening the sector’s potential. The Ministry of Education and Training (MOET) has prioritized digital education integration through policies focused on enhancing ICT infrastructure in schools and promoting teacher training in digital pedagogy. Programs such as “Digital Transformation of the Education Sector by 2025” emphasize developing high-quality online curricula aligned with national educational standards. Public-private partnerships are encouraged to foster innovation, enabling local and international edtech companies to collaborate in creating customized platforms for Vietnamese learners. Additionally, national universities are increasingly offering online degrees, diploma programs, and skill certification courses to cater to a growing demand for flexible learning pathways. Efforts to bridge digital divides and improve broadband connectivity across provinces ensure broader access to digital education tools. Vietnam’s online learning platforms market is projected to reach USD 247.47 million in 2025, growing at a 14.78% CAGR to hit USD 429.49 million by 2029. The number of users is expected to reach 9.7 million by 2029, with user penetration rising from 7.8% in 2025 to 9.5%. The average revenue per user (ARPU) is estimated at USD 31.78 in 2025. These proactive policies and systemic support measures have reinforced market momentum, making regulatory backing a key contributor to sustained development in Vietnam’s online education sector.

Vietnam Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

The report has provided a detailed breakup and analysis of the market based on the provider. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

End-User Insights:

- Higher Education Institutions

- K-12 Schools

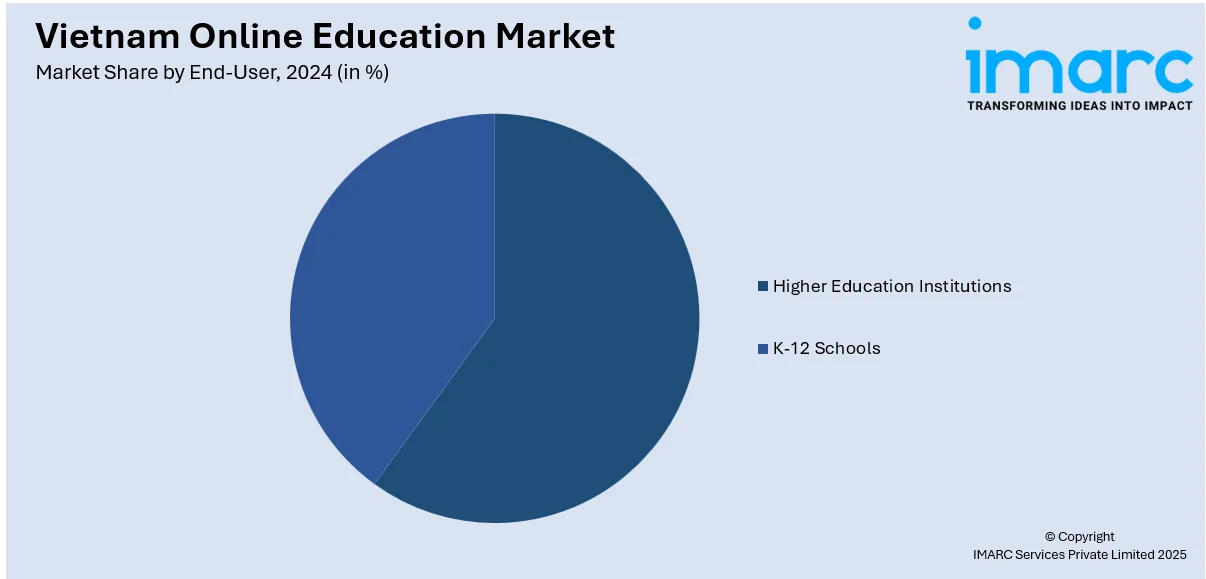

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes higher education institutions and K-12 schools.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Online Education Market News:

- On June 4, 2025, Aventis Learning Group inaugurated the Aventis Vietnam Institute in Ho Chi Minh City, emphasizing flexible online and hybrid executive education. The institute will offer fully online Master’s degrees, graduate diplomas, and part-time Executive MBAs delivered through blended formats combining virtual and on-campus learning. Leveraging advanced technologies like VR and AI, Aventis aims to equip Vietnam’s professionals with globally recognized, future-ready qualifications tailored to the demands of a digital economy.

Vietnam Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam online education market on the basis of type?

- What is the breakup of the Vietnam online education market on the basis of provider?

- What is the breakup of the Vietnam online education market on the basis of technology?

- What is the breakup of the Vietnam online education market on the basis of end-user?

- What is the breakup of the Vietnam online education market on the basis of region?

- What are the various stages in the value chain of the Vietnam online education market?

- What are the key driving factors and challenges in the Vietnam online education market?

- What is the structure of the Vietnam online education market and who are the key players?

- What is the degree of competition in the Vietnam online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)