Vietnam Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2025-2033

Vietnam Photonic Integrated Circuit Market Overview:

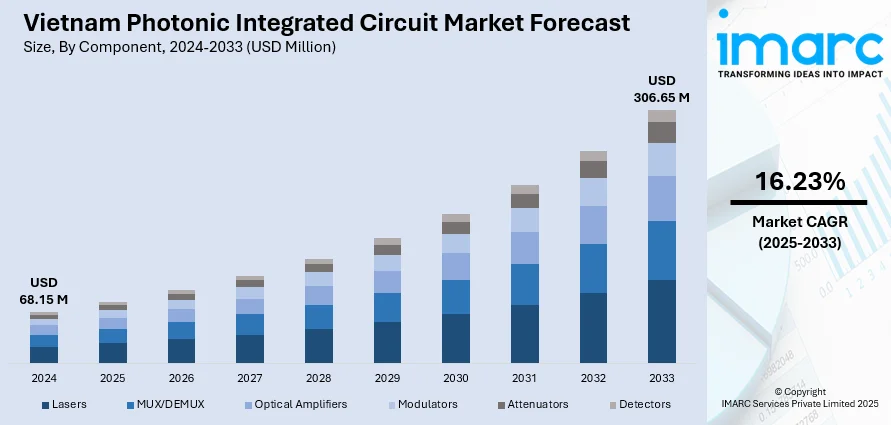

The Vietnam photonic integrated circuit market size reached USD 68.15 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 306.65 Million by 2033, exhibiting a growth rate (CAGR) of 16.23% during 2025-2033. The market growth is driven by rising electronics manufacturing, expanding telecom networks, and increasing foreign direct investments. Government policies promoting technology innovation and infrastructure development further catalyze market expansion. These factors collectively improve Vietnam photonic integrated circuit market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 68.15 Million |

| Market Forecast in 2033 | USD 306.65 Million |

| Market Growth Rate 2025-2033 | 16.23% |

Vietnam Photonic Integrated Circuit Market Trends:

Expansion of Electronics Manufacturing Sector

Vietnam’s booming electronics manufacturing sector serves as a critical driver for the photonic integrated circuit market. Increasing production of consumer electronics and communication devices demands advanced photonic components. The establishment of high-tech industrial zones attracts foreign companies specializing in PIC fabrication and assembly. This manufacturing growth enhances local supply chain capabilities and accelerates technology adoption. Vietnam’s electronics exports hit $134.5 Billion in 2024 and $60.8 Billion by May 2025 (↑39% YoY), ranking 5th globally. It's 2nd in mobile phone exports, but 90% of tier-1 suppliers and 80% of components are foreign-owned. US accounts for 29% of exports; $41.7 Billion in 2024. Global tech giants like Samsung, Apple, LG, Qualcomm, and NVIDIA are expanding. Consequently, the electronics sector expansion underpins Vietnam photonic integrated circuit market growth by fostering ecosystem development and capacity building.

To get more information on this market, Request Sample

Telecom Infrastructure Development and 5G Rollout

Vietnam’s telecom infrastructure is rapidly evolving with nationwide 5G rollout and fiber optic network expansion. These advancements require sophisticated PIC solutions to improve network efficiency and data handling capabilities. Domestic and international telecom operators invest heavily in upgrading equipment to support higher bandwidth demands. The focus on digital transformation across industries further stimulates PIC integration. This infrastructure development is a key contributor to Vietnam photonic integrated circuit market growth by driving consistent demand for photonics-based network components. For instance, in April 2025, Coherent Corp. launched the 2x400G-FR4 Lite, a silicon photonics-based optical transceiver designed for AI-driven data centers and high-speed Ethernet. The module supports 500-meter reach with lower power consumption, complementing their existing 800G-DR8. It integrates a silicon photonic integrated circuit (PIC) with CW lasers and photodetectors, eliminating the need for thermoelectric coolers.

Vietnam Photonic Integrated Circuit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, raw material, integration, and application.

Component Insights:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

The report has provided a detailed breakup and analysis of the market based on the component. This includes lasers, MUX/DEMUX, optical amplifiers, modulators, attenuators, and detectors.

Raw Material Insights:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes indium phosphide (InP), gallium arsenide (GaAs), lithium niobate (LiNbO3), silicon, and silica-on-silicon.

Integration Insights:

- Monolithic Integration

- Hybrid Integration

- Module Integration

The report has provided a detailed breakup and analysis of the market based on the integration. This includes monolithic integration, hybrid integration, and module integration.

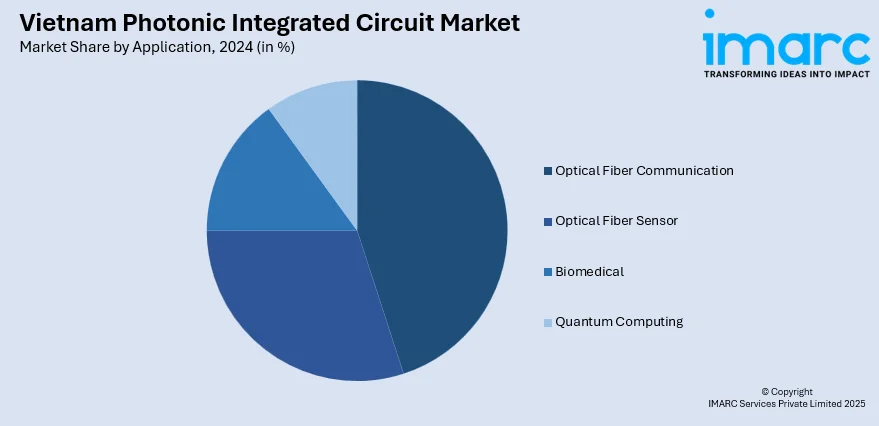

Application Insights:

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes optical fiber communication, optical fiber sensor, biomedical, and quantum computing.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Photonic Integrated Circuit Market News:

- In June 2024, Intel unveiled the first fully integrated Optical Compute Interconnect (OCI) chiplet using advanced integrated photonics technology, co-packaged with a CPU and running live data. Designed for AI and HPC infrastructure, it delivers 4 Tbps bidirectional data over 64 channels at 32 Gbps each across 100 meters. Leveraging on-chip lasers and optical amplifiers, it achieves ultra-low power use (5 pJ/bit), boosting bandwidth, efficiency, and scalability. This milestone marks a major leap in integrated photonics, enabling future high-performance, energy-efficient compute systems.

Vietnam Photonic Integrated Circuit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam photonic integrated circuit market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam photonic integrated circuit market on the basis of component?

- What is the breakup of the Vietnam photonic integrated circuit market on the basis of raw material?

- What is the breakup of the Vietnam photonic integrated circuit market on the basis of integration?

- What is the breakup of the Vietnam photonic integrated circuit market on the basis of application?

- What is the breakup of the Vietnam photonic integrated circuit market on the basis of region?

- What are the various stages in the value chain of the Vietnam photonic integrated circuit market?

- What are the key driving factors and challenges in the Vietnam photonic integrated circuit market?

- What is the structure of the Vietnam photonic integrated circuit market and who are the key players?

- What is the degree of competition in the Vietnam photonic integrated circuit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam photonic integrated circuit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam photonic integrated circuit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam photonic integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)