Vietnam Plant-based Seafood Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Vietnam Plant-based Seafood Market Summary:

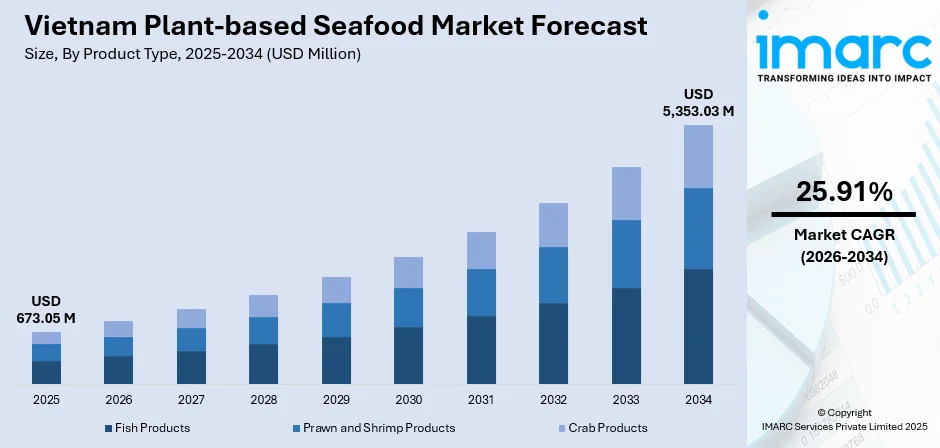

The Vietnam plant-based seafood market size was valued at USD 673.05 Million in 2025 and is projected to reach USD 5,353.03 Million by 2034, growing at a compound annual growth rate of 25.91% from 2026-2034.

The Vietnam plant-based seafood market is expanding steadily as consumers shift toward healthier, sustainable protein alternatives. Growing concerns over overfishing, rising vegan lifestyles, and increasing interest in clean-label ingredients are driving adoption. Local producers and global brands are introducing innovative products that mimic traditional seafood textures and flavors, supporting wider acceptance across retail and foodservice channels.

Key Takeaways and Insights:

- By Product Type: Fish products dominate the market with a share of 50% in 2025, significantly influenced by driven by strong consumer familiarity, versatile culinary applications, and rising preference for sustainable fish alternatives that replicate traditional flavors and textures.

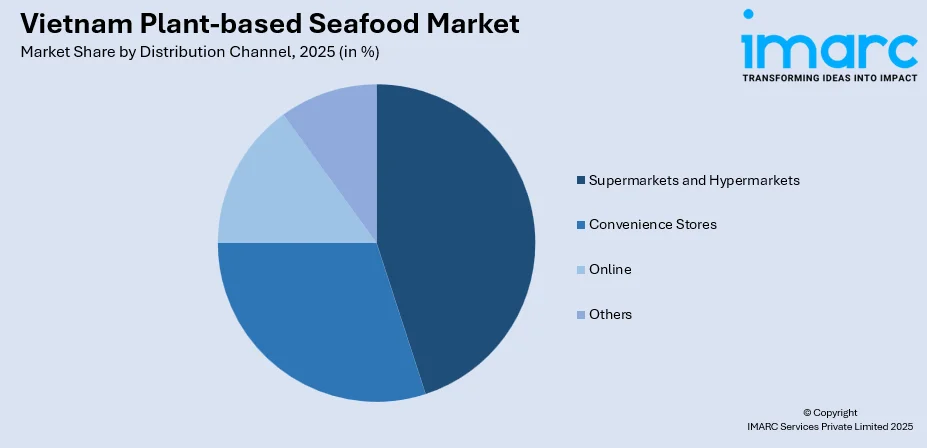

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 50% in 2025, supported by wide product availability, better brand visibility, and growing shopper trust in organized retail for new plant-based seafood options.

- Key Players: The Vietnam plant-based seafood market exhibits emerging competitive dynamics, with international plant-based food innovators competing alongside regional manufacturers and local startups across various price segments and product categories targeting diverse consumer preferences.

To get more information on this market, Request Sample

The Vietnam plant-based seafood market is propelled by a confluence of powerful demand drivers reshaping the country's food landscape. Rising health awareness among Vietnamese consumers, particularly younger urban demographics, is fueling interest in plant-based alternatives perceived as healthier options with lower saturated fats and no cholesterol. Environmental consciousness regarding overfishing, marine ecosystem degradation, and the carbon footprint associated with traditional fishing practices is encouraging consumers to seek sustainable substitutes. This shift is further reinforced by recent national efforts to address illegal, unreported, and unregulated (IUU) fishing, as in November 2025, Vietnam intensified its campaign to lift the EU’s yellow card through legal reforms and stronger enforcement, spotlighting the economic and environmental urgency of sustainable seafood choices. The expansion of modern retail channels, including supermarkets, convenience stores, and e-commerce platforms, is enhancing product accessibility nationwide. Additionally, government initiatives promoting sustainable food systems and nutrition campaigns are creating a supportive regulatory environment for market growth.

Vietnam Plant-based Seafood Market Trends:

Increasing Consumer Interest in Sustainable and Eco-Friendly Food Alternatives

Vietnamese consumers are showing stronger interest in environmentally responsible eating habits as awareness of issues like overfishing, illegal fishing, and marine habitat loss grows. This shift is driving demand for plant-based seafood, which is viewed as a sustainable, ocean-friendly choice that aligns with the country’s rising focus on ecological preservation and responsible consumption. This momentum is further supported by the broader plant-based movement, reflected in the Vietnam vegan food market, which was valued at USD 111.6 Million in 2025 and is projected to reach USD 223.4 Million by 2034, reinforcing growing nationwide acceptance of meat-free alternatives.

Rising Demand for Health-Conscious Diets and Meat-Free Protein Sources

Growing health awareness is reshaping consumption patterns, particularly among younger urban residents. As of November 27, 2025, Vietnam’s population reached 101,845,300, with 41.38% living in urban areas. This young, city-based demographic is increasingly adopting cleaner, cholesterol-free protein options, supporting strong interest in plant-based seafood as a healthier alternative.

Expansion of Retail Distribution and Foodservice Channels

Plant-based seafood is becoming more accessible as supermarkets, convenience stores, cafés, and quick-service restaurants expand their product offerings. This broader distribution network enhances visibility, encourages trial among mainstream shoppers, and supports rising adoption. The growing presence of plant-based menu items in foodservice outlets further accelerates consumer exposure and market penetration across Vietnam. This trend aligns with the rapid expansion of the national foodservice sector, as the Vietnam food service market reached USD 21.92 Billion in 2024 and is projected to grow to USD 54.27 Billion by 2033, creating stronger opportunities for plant-based innovations to enter mainstream dining formats.

Market Outlook 2026-2034:

As innovation in food technology enhances product quality, taste profiles, and textural authenticity to closely mimic traditional seafood experiences. Strategic partnerships between international brands and local distributors are expected to accelerate market penetration across both metropolitan and emerging provincial markets. Continued government support for sustainable food initiatives combined with expanding e-commerce infrastructure will further democratize product accessibility, positioning the Vietnam plant-based seafood market for sustained revenue growth through the end of the forecast period. The market generated a revenue of USD 673.05 Million in 2025 and is projected to reach a revenue of USD 5,353.03 Million by 2034, growing at a compound annual growth rate of 25.91% from 2026-2034.

Vietnam Plant-based Seafood Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Fish Products |

50% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

50% |

Product Type Insights:

- Fish Products

- Prawn and Shrimp Products

- Crab Products

The fish products dominates with a market share of 50% of the total Vietnam plant-based seafood market in 2025.

The fish products segment dominates the market due to strong consumer preference for familiar textures and flavors that closely resemble traditional seafood. Companies are prioritizing plant-based fish alternatives such as fillets, sticks, and canned-style options, which appeal to both vegan consumers and flexitarians seeking healthier, sustainable protein choices.

This segment also benefits from continuous innovation in product formulation and processing techniques that improve taste, appearance, and nutritional value. Wider retail availability and increased visibility in quick-service restaurants further strengthen its lead. As environmental concerns and overfishing issues gain attention, plant-based fish products continue to secure a stronger position in the overall market.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

The supermarkets and hypermarkets leads with a share of 50% of the total Vietnam plant-based seafood market in 2025.

The supermarkets and hypermarkets segment leads the market as these retail formats offer broad product visibility, extensive shelf space, and a wide assortment of brands. Consumers prefer these outlets because they can compare options, access competitive pricing, and rely on consistent product availability, which strengthens their purchasing confidence and convenience. This trend is reinforced by the rapid expansion of the national retail sector, with the Vietnam retail market reaching USD 298.2 Billion in 2024 and projected to grow significantly by 2033, creating a wider platform for plant-based products.

This dominance is further supported by strong distribution networks and strategic partnerships with leading plant-based seafood manufacturers. Promotional campaigns, in-store sampling, and private-label offerings also drive higher footfall and repeat purchases. As consumers increasingly seek sustainable and healthier alternatives, supermarkets and hypermarkets remain the primary channel for mainstream adoption and market expansion.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam shows steady demand for plant-based seafood, driven by rising health awareness and growing urban populations. Expanding retail networks and increasing exposure to global food trends support market uptake, especially in major cities where consumers are more open to sustainable alternatives.

Central Vietnam experiences moderate adoption, influenced by tourism-led food innovation and expanding modern retail formats. Consumers in coastal cities are gradually shifting toward healthier protein choices. Growing interest in eco-friendly products and improved supply chain access support broader market visibility and acceptance across the region.

Southern Vietnam leads market growth due to its strong urbanization, higher purchasing power, and dynamic foodservice sector. Ho Chi Minh City acts as the hub for new product launches and diversified plant-based seafood offerings, driven by changing dietary preferences and broadened retail availability.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Plant-based Seafood Market Growing?

Government Push for Sustainable Food Systems

Vietnam’s regulatory focus on environmental protection and responsible fishing is creating strong momentum for plant-based seafood adoption. Policies encouraging reduced pressure on marine resources, improved nutrition standards, and sustainable consumption are shaping a supportive business environment. This commitment was reinforced in November 2025 when Viet Nam joined the Alliance of Champions for Food Systems Transformation at COP30 in Brazil, a move that expands agricultural innovation and international cooperation. The alliance aims to improve global food systems with an emphasis on sustainability and resilience, aligning closely with Vietnam’s national strategies for sustainable agriculture and strengthening its role in global food security.

Growing Penetration of E-Commerce and Food Delivery Platforms

The rapid expansion of e-commerce and delivery platforms is significantly boosting the visibility and accessibility of plant-based seafood across Vietnam. This trend is reinforced by the strong performance of the Vietnam e-commerce market, which reached USD 24.9 Billion in 2024 and is expected to grow to USD 239.3 Billion by 2033. Digital-native consumers, especially in major cities, increasingly rely on online grocery shopping for convenience, promotions, and wider product variety.The ability to compare brands, access niche products, and receive quick home deliveries is encouraging trial and repeat purchases. As online retail ecosystems mature and scale at a rapid pace, plant-based seafood brands benefit from stronger exposure, improved product discovery, and deeper market penetration nationwide.

Advancements in Food Technology and Product Innovation

Technological progress is reshaping the quality and appeal of plant-based seafood in Vietnam. Manufacturers are improving texture, flavor authenticity, and nutritional profiles to better replicate traditional seafood while maintaining clean-label standards. This innovation momentum is reinforced by industry collaboration, such as the August 2025 Food Innovation Seminar in Ho Chi Minh City, where Roquette and Nam Viet Do showcased advanced plant-based ingredients to over 160 attendees, highlighting solutions tailored to evolving Vietnamese consumer preferences. Investments in R&D, the use of advanced plant proteins, and innovative processing methods are making plant-based seafood more competitive and affordable. These enhancements are attracting not only health-conscious consumers but also flexitarian and mainstream buyers, strengthening market expansion across diverse retail and foodservice channels.

Market Restraints:

What Challenges the Vietnam Plant-based Seafood Market is Facing?

Limited Consumer Familiarity and Taste Acceptance

Many Vietnamese consumers are still new to plant-based seafood, creating uncertainty about flavor authenticity, texture, and overall eating experience. Strong cultural preferences for fresh, locally sourced seafood further slow acceptance, especially in regions where traditional seafood dishes remain central to daily diets and family culinary habits.

Higher Price Compared to Conventional Seafood

Plant-based seafood often carries a higher price tag due to specialized processing, premium ingredients, and technology-driven production. This makes it less attractive to price-sensitive consumers who can easily access affordable traditional seafood, limiting mainstream adoption and creating a perception that plant-based options offer lower value for money.

Limited Product Availability Beyond Major Cities

Access to plant-based seafood remains concentrated in major urban centers with modern retail infrastructure. Rural and semi-urban areas have fewer distribution channels and lower product visibility, restricting consumer exposure and slowing overall penetration. Supply chain limitations also reduce the ability of brands to expand nationwide effectively.

Competitive Landscape:

The competitive landscape of the Vietnam plant-based seafood market features a mix of global innovators, regional manufacturers, and local startups competing on product authenticity, texture innovation, and price. Retailers and foodservice operators play a pivotal role in shaping demand through shelf placement and menu trials. Competition focuses on R&D for superior mouthfeel, clean-label formulations, and localized flavor profiles that suit Vietnamese cuisine. Distribution strength, cold-chain reliability, and retail partnerships determine market reach, while brands differentiate via sustainability credentials, cost competitiveness, and collaborations with chefs or foodservice chains. Early movers that scale production and adapt to local tastes will likely capture lasting market share.

Vietnam Plant-based Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fish Products, Prawn and Shrimp Products, Crab Products |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam plant-based seafood market size was valued at USD 673.05 Million in 2025

The Vietnam plant-based seafood market is expected to grow at a compound annual growth rate of 25.91% from 2026-2034 to reach USD 5,353.03 Million by 2034.

Fish products dominated the market with the share of 50%, supported by high consumer familiarity, versatile usage in Vietnamese cuisine, and growing preference for sustainable alternatives that closely replicate traditional fish textures and flavors.

Key factors driving the Vietnam plant-based seafood market include rising health consciousness, environmental concerns related to overfishing, government initiatives promoting sustainable food systems, rapid expansion of e-commerce, and advancements in plant-based food technology that enhance taste, texture, and nutritional quality.

Major challenges include limited consumer familiarity in some regions, higher prices compared to conventional seafood, and restricted availability outside major urban areas. These factors slow nationwide adoption and require stronger awareness-building and distribution expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)